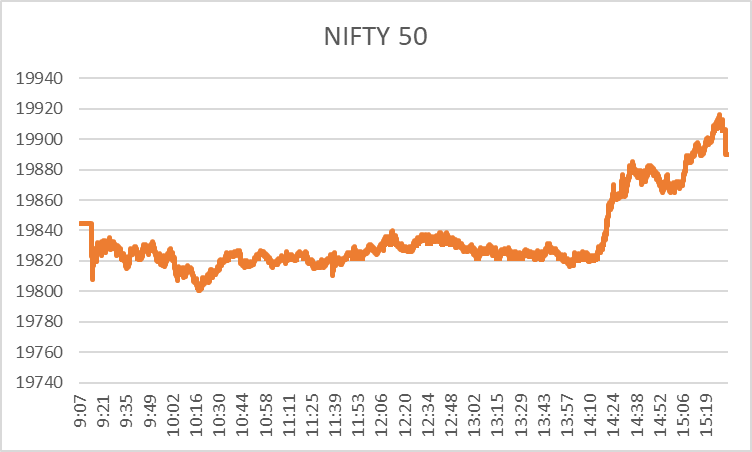

As the market opened today after three days of holidays, Nifty increased by 0.48% due to stable oil prices even before the OPEC meeting; global cues are positive. Most importantly, FIIs are coming back.

The gradual return of FIIs in the month of November post the global selloff during the three months of (August to October) is having a steady positivity in India. However, currently, the Indian market is facing resistance to edge above 19,800 levels,” said Vinod Nair, Head of Research at Geojit Financial Services.

Today, Nifty 50 closed at 19889, above the 19800 level, and made a peak at 19916.85. Of its constituents, 39 stocks advanced, while 11 fell behind and ended in red. Here are the top nifty gainers and losers today.

Top 5 Nifty Gainer Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| ADANIENT | 2,225.45 | 2,430.00 | 9.19 |

| ADANIPORTS | 795.55 | 840.5 | 5.65 |

| TATAMOTORS | 673.7 | 698 | 3.61 |

| BPCL | 410.6 | 422.8 | 2.97 |

| COALINDIA | 332.8 | 342.1 | 2.79 |

- Adani Enterprise: This metals and mining stock rose 9.19% today, one of the highest gains in a single session. The stock price was Rs. 2430 at the end of the session. A significant rise in the metal sector influenced Adani Enterprise’s stock price, and the company announced its investors’ meeting on 1 December.

- Adani Ports: Today, Adani Group has ruled the domestic market. The following nifty gainer is also an Adani stock, Adani Ports. The stock gained 5.65% during the day and closed at 840.50. The price rose due to a surge in the oil & gas industry and the metal industry.

- Tata Motors: As the wedding season arrives, the auto stocks are back in the game. Tata Motors gained 3.61% today and closed at 698.

- BPCL: This stock had to go up today, as the oil prices are stable even when the OPEC meeting is around the corner. It moved up 2.97% during the market session and ended at 422.80.

- Coal India: With a rise of 2.79% in the stock price, Coal India is the fifth nifty gainer today. This is also an oil & gas sector stock, so the price increased primarily due to an upswing.

Top 5 Nifty Loser Stocks Today

| Stocks | Previous Day’s Closing Price | LTP | Change (%) |

| CIPLA | 1,198.65 | 1,191.50 | -0.6 |

| APOLLOHOSP | 5,401.30 | 5,370.05 | -0.58 |

| HINDUNILVR | 2,515.20 | 2,502.55 | -0.5 |

| SUNPHARMA | 1,195.45 | 1,190.10 | -0.45 |

| ITC | 437.8 | 435.9 | -0.43 |

- Cipla: Today, the pharma sector and Cipla are down. The stock dipped 0.60% and closed at 1191.50, down from its Friday closing price of 1195.65, to become a top nifty loser.

- Apollo Hospital: The sluggish healthcare and pharma sectors dragged Apollo Hospitals today, and the stock dipped 0.58%.

- Hindustan Unilever: This FMCG stock declined 0.50% today, as the overall FMCG sector was sluggish during today’s market session.

- Sun Pharma: After Cipla, this pharma stock also plummeted 0.45%, which is also an effect of the sectoral decline.

- ITC: The most extensive FMCG stock in India fell today by 0.43% and became the fifth nifty loser, as the FMCG industry was slow today due to a dip in demand after the festivals and the month’s end.

So, the domestic market today was under the influence of oil prices, FII’s investments, and sluggishness in the pharma and healthcare sectors. However, the overall start to the week had been positive, with Nifty closing in the green.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.