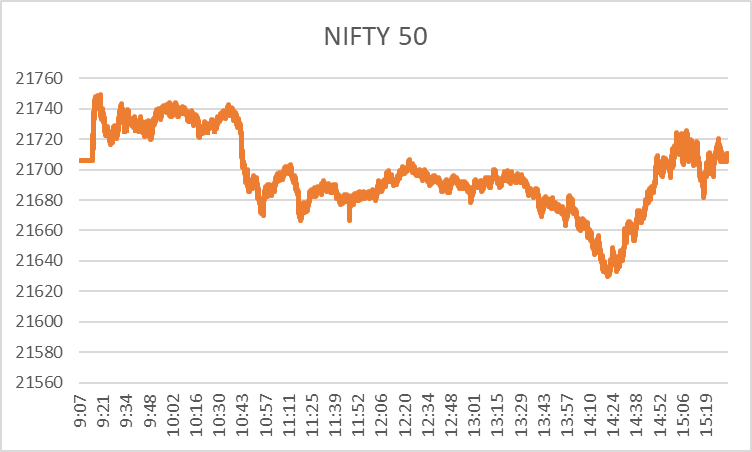

On the last day of this first week of 2024, the domestic stock market ended in the green even though it was a close cut. The broad market index Nifty 50 closed at 21710.80, gaining 0.24% during the market session.

As the market was flat today, the sectoral indices remained flat with marginal gains and losses. However, the IT sector, which dragged the market for the entire week today, was the primary sector pushing the market higher.

Let’s look at today’s top nifty gainers and losers.

Top 5 Nifty Gainer Stocks Today

| Stocks | Previous day’s Closing Price | LTP | Change (%) |

| ADANIPORTS | 1,123.20 | 1,153.00 | 2.65 |

| LT | 3,458.70 | 3,548.60 | 2.6 |

| TCS | 3,666.80 | 3,738.60 | 1.96 |

| SBILIFE | 1,431.60 | 1,454.50 | 1.6 |

| LTIM | 5,866.40 | 5,946.95 | 1.37 |

- Adani Ports: The stocks of Adani Port have been on a roll since the onset of this year’s trading session. The stock today zoomed 2.65% and closed at 1153, up from its previous day’s close at 1123.20.

- LT: This infrastructure company has had all the attention of the investors for the past few market sessions as the elections are nearing, and the multiple infrastructure projects probability is going up. The stock gained 2.60% today and closed at a price of 3548.60.

- TCS: As the It sector was in full upswing today after many sessions of sell-off, this IT giant gained 1.96% and went up to 3738.60 during the closing of today’s session.

- SBI Life: This insurance company came under the top nifty gainers list after a long time. Today’s stock zoomed 1.60% in a sluggish and flat financial services market.

- LTIM: This IT stock rose 1.37% today following the upsurge in the IT sector. The stock closed at a price of 5946.95 up from yesterday’s 5866.40.

Top 5 Loser Stocks Today

| Stocks | Previous day’s Closing Price | LTP | Change (%) |

| BRITANNIA | 5,361.30 | 5,274.50 | -1.62 |

| NESTLEIND | 27,116.40 | 2,668.10 | -1.61 |

| JSWSTEEL | 837.1 | 828.4 | -1.04 |

| KOTAKBANK | 1,863.60 | 1,844.80 | -1.01 |

| UPL | 587.65 | 581.85 | -0.99 |

Source: NSE

- Britannia: This FMCG stock is today’s top Nifty loser, dropping 1.62% from the previous closing price. The stock’s last closing price yesterday was 5361.30, while today it came down to 5274.50 at the closing.

- Nestle India: FMCG stocks tend to lose the charm as all the festivities are over now. Nestle India lost 1.61% today.

- JSW Steel: The steel manufacturing giant’s name was also added to the list of nifty losers today as this stock lost 1.04%. The stock was at 837.10 yesterday while it came down to 828.40 today.

- Kotak Bank: As the financial services market was sluggish today, this private sector bank ended up in the red with a loss of 1.01%.

- UPL: This agrochemical stock lost 0.99% today as the market was highly volatile and sluggish. The stock closed at 581.85 during today’s closing, while yesterday, it was at 587.65 during the close of the market.

Wrapping up

The geopolitical issues leading to adverse global cues are mainly affecting the stock markets across the globe, and the Indian stock market is no exception. You can also learn more about gift nifty with our blog. With highly volatile oil prices, all the sectors are getting affected and this is why the market had been sluggish for the entire week and even closing on the same note.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.