Ever heard of a company splitting into two separate entities? That’s exactly what’s happening with Tata Motors! On March 4th, they announced a demerger, dividing the company into two distinct listed firms.

This move has sparked much interest, leaving people wondering what it means for the company’s future, employees, and investors. Let’s look closer into the details and see what lies ahead.

Key takeaways

- Two new entities: One focused on commercial vehicles (CV) and the other on passenger vehicles (PV), including electric vehicles (EVs) and JLR (Jaguar Land Rover).

- Independent operations: CV and PV businesses have been functioning independently under separate CEOs since 2021.

- Demerger timeline: The process will take 12-15 months to complete.

- Impact on stakeholders: The company assures the demerger will not negatively impact employees, customers, or business partners.

Why the Demerger?

The decision to demerge stems from the inherent differences between commercial and passenger vehicle segments. The CV industry is heavily influenced by the industrial sector and long-term logistics trends, whereas the PV industry caters to individual consumers and experiences quicker shifts in demand.

By separating these businesses, the Tata Motors Demerger aims to:

- Unlock the potential of each segment: Focused management and independent strategies can help each entity tailor its approach to its specific market and customer needs.

- Improve financial performance: Independent operations allow for better resource allocation, potentially leading to improved financial performance for both entities.

- Enhance strategic flexibility: The demerged companies gain greater agility and flexibility to pursue individual growth opportunities and partnerships.

Performance of the Group and Entities

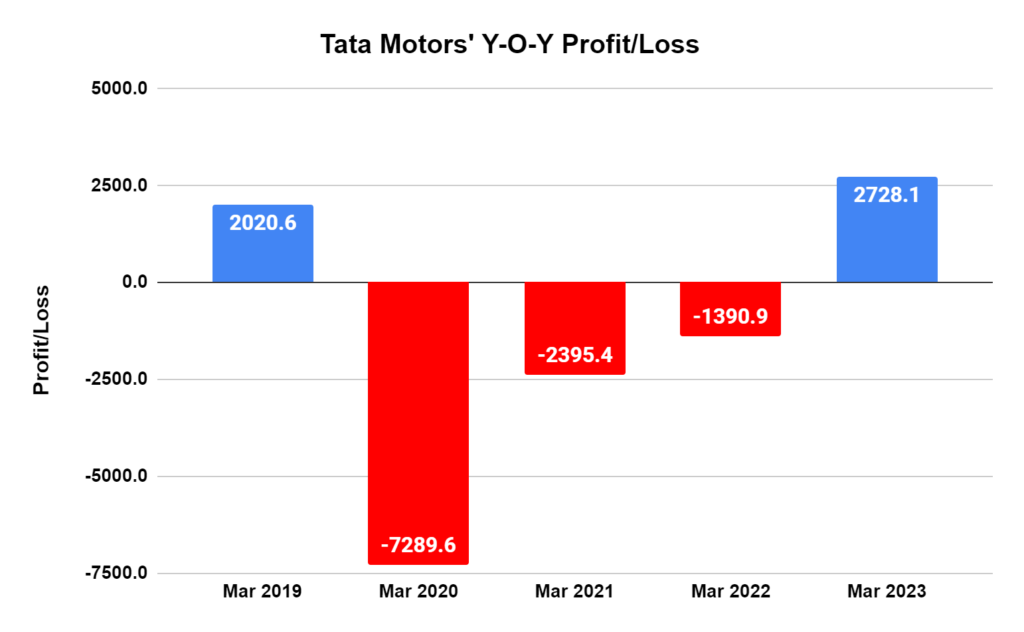

While Tata Motors as a whole has witnessed consistent growth, especially after COVID-19, when the losses incurred were huge, the performance of the CV and PV segments has differed. The CV segment has been facing challenges due to rising input costs and fluctuations in economic activity. On the other hand, the PV segment, particularly the electric vehicle segment, has shown promising growth potential.

The Tata Motors demerger is expected to provide a clearer picture of the CV and PV businesses’ financial performance and growth trajectories. Investors can then make informed decisions based on each entity’s strengths and prospects.

What the Tata Demerger Means for Stakeholders & Employees

- Shareholders: Existing Tata Motors shareholders will receive shares in both the new demerged companies in proportion to their holdings. This exposes them to the independent growth potential of both the CV and PV segments.

- Employees: The company has assured that the demerger will not adversely impact employee jobs or benefits. However, each entity might have internal restructuring as they chart their independent courses.

The Road Ahead

The Tata Motors demerger marks a significant step in the company’s evolution. It presents both challenges and opportunities for the newly formed entities. The success of this move will depend on several factors, including:

- Effective execution of the demerger process: Ensuring a smooth transition and minimizing disruption to operations is crucial.

- Strong leadership and strategic direction: Each entity will require a clear vision, strategic planning, and efficient execution to achieve its full potential.

- Adapting to market dynamics: Both the CV and PV segments are constantly evolving, and the new companies must be agile and responsive to changing market trends.

The Final Word

While the short-term impact of the Tata Motors demerger remains to be seen, it has the potential to unlock significant value for both the new companies and their stakeholders in the long run. As these entities embark on their separate journeys, it will be interesting to see how they navigate the competitive landscape and carve their unique paths to success.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.