Have you been following the Indian stock market lately? If so, you might have noticed a dip in the share price of Central Depository Services (India) Ltd (CDSL) on Wednesday. But what caused this sudden drop? Let’s look closely at what happened and what it might mean for investors.

StanChart Bank Exits CDSL Through Bulk Deal

The primary reason behind the share price decline is Standard Chartered Bank’s decision to exit CDSL completely. On Wednesday, the bank offloaded its 7.1% stake, translating to 75 lakh shares, through bulk deals. This transaction amounted to roughly ₹1,266 crore.

Impact on CDSL Share Price

The news of Standard Chartered Bank’s exit clearly and immediately impacted CDSL’s share price. The stock opened at ₹1,718.55 on the NSE but closed the day significantly lower at ₹1,689, reflecting a 6% drop. This decline can be attributed to several factors, including:

- Increased Supply: The sudden influx of shares from StanChart Bank’s sale increased the overall supply in the market, potentially exceeding demand and pushing the price down.

- Investor Uncertainty: Standard Chartered Bank’s exit might have triggered uncertainty among other investors, causing them to sell their holdings or hold off on buying new shares.

Looking Beyond the Dip: CDSL’s Strong Fundamentals

It’s important to remember that CDSL boasts strong fundamentals. Here are some key points to consider:

- Strong Historical Performance: CDSL’s stock has delivered impressive returns, surging 88% in the past year and a staggering 700% in the last five years.

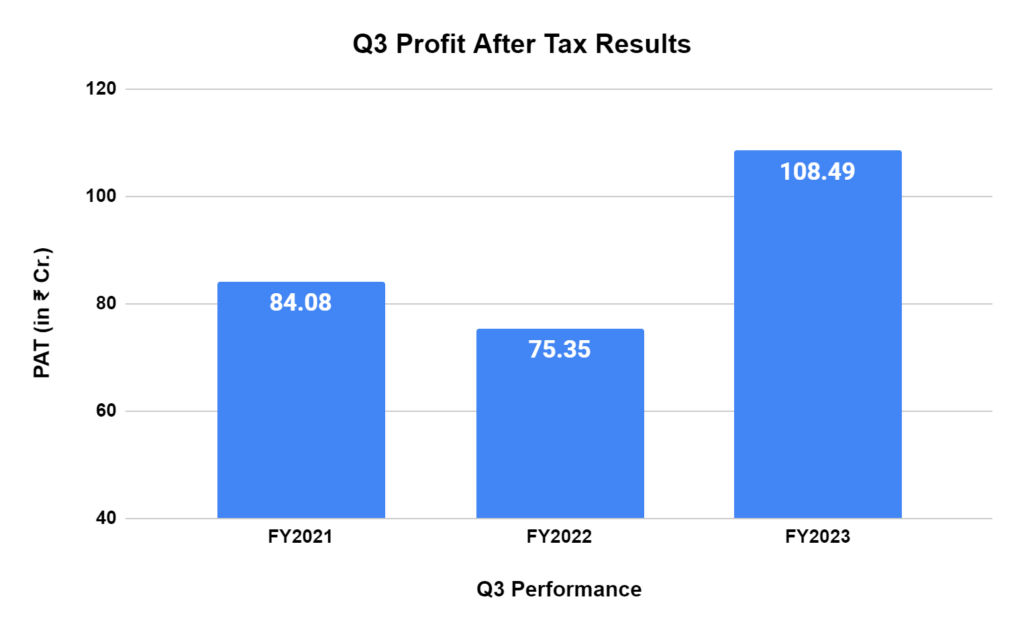

- Profitable Growth: The company reported a consolidated net profit of ₹108 crores for the quarter ended December 2023, reflecting a significant increase compared to ₹75 crores in the previous year.

- Market Leader: CDSL, along with NSDL, is one of only two depositories in India, playing a crucial role in the country’s securities market infrastructure.

First Mover Advantage: Notably, in November 2023, CDSL became the first depository to register a whopping 10 crore demat accounts.

Analyst View:

Financial experts acknowledge the gap-down opening of CDSL’s stock price following the news of StanChart Bank’s exit. However, some analysts believe this might be a short-term reaction. They point towards the high trade volume associated with the bulk deal and suggest that the overall trend for CDSL remains positive.

So, Should You Buy?

Investing ultimately depends on your individual risk tolerance and investment goals. CDSL’s fundamentals appear strong, and the long-term outlook seems promising. However, the recent bank exit has caused a temporary setback. Carefully consider your investment horizon and conduct your research before making any decisions. Remember, past performance is not necessarily indicative of future results.

In Conclusion

CDSL’s share price drop presents an interesting situation for investors. While the short-term impact of Standard Chartered Bank’s exit is undeniable, the company’s growth trajectory and dominant market position are noteworthy. By weighing the potential risks and rewards, you can decide whether this dip offers a valuable buying opportunity or a reason to wait and observe the market further.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.3 / 5. Vote count: 13

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.