For us, summer is about taking cover from scorching temperatures and sweltering heat and keeping it cool with Nimbu Paani and the blasting air conditioner. But for some businesses, it’s a boom time!

Many sectors of the economy benefit from the rise in mercury levels, and savvy investors capitalize on this seasonal trend. Let’s explore why these “summer stocks” are heating up and how investors potentially benefit from them.

Top Sectors During Summers

The Indian Meteorological Department (IMD) predicts this summer will be unlike any other, as temperatures rise higher than usual, and heat waves grip the entire country between March and May. With that, these sectors may be the hot stuff this summer:

Also Read: Top 10 Solar Energy Stocks in India

Air Conditioning and Cooling Systems

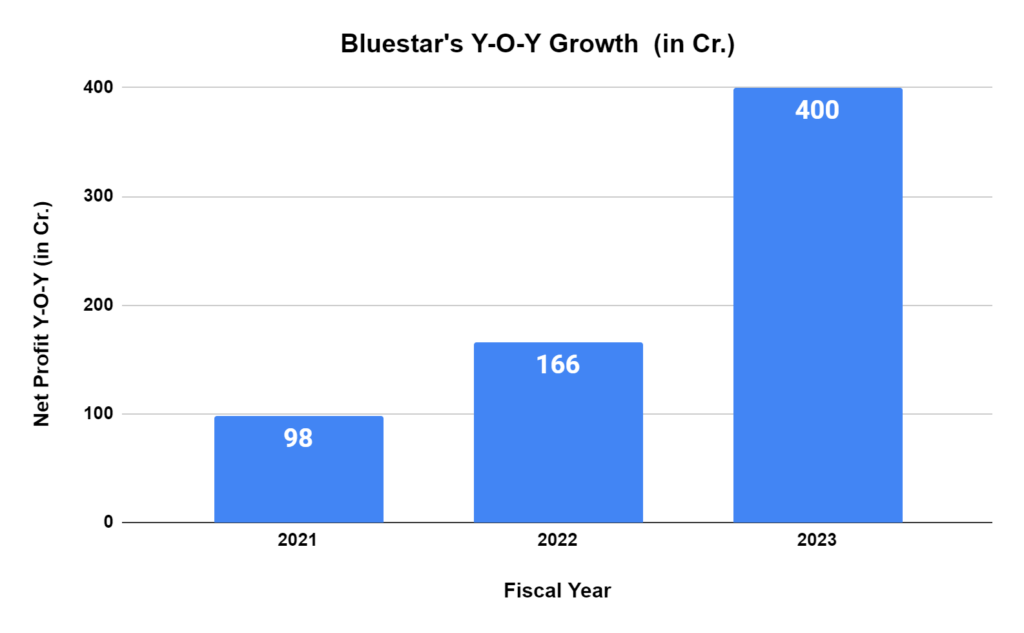

The demand for air conditioners, coolers, and related services will also rise with temperatures. Increasing disposable incomes and urbanization are making the air conditioner market in India grow big-time, too. Stocks of companies that manufacture, sell, and are otherwise involved in the AC industry will surge. These include significant players such as Voltas and Blue Star. Other leading names include Amber Enterprises, Johnson Control, Hitachi, EPAC Durable, etc.

Consumer Goods (FMCG)

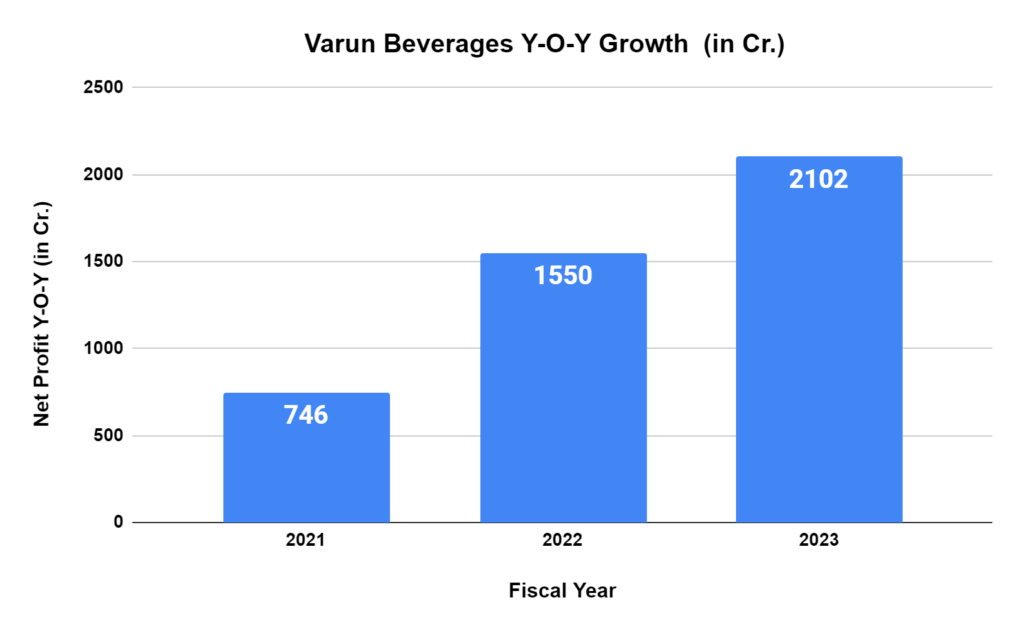

Who doesn’t want to stay calm and hydrated during summer? As we dash for buttermilk, lassi, fruit juices, and packaged drinking water, the demand for these drinks and ice cream increases. Varun Beverages and ice-cream manufacturers like Hindustan Unilever typically benefit from this seasonal surge.

Power

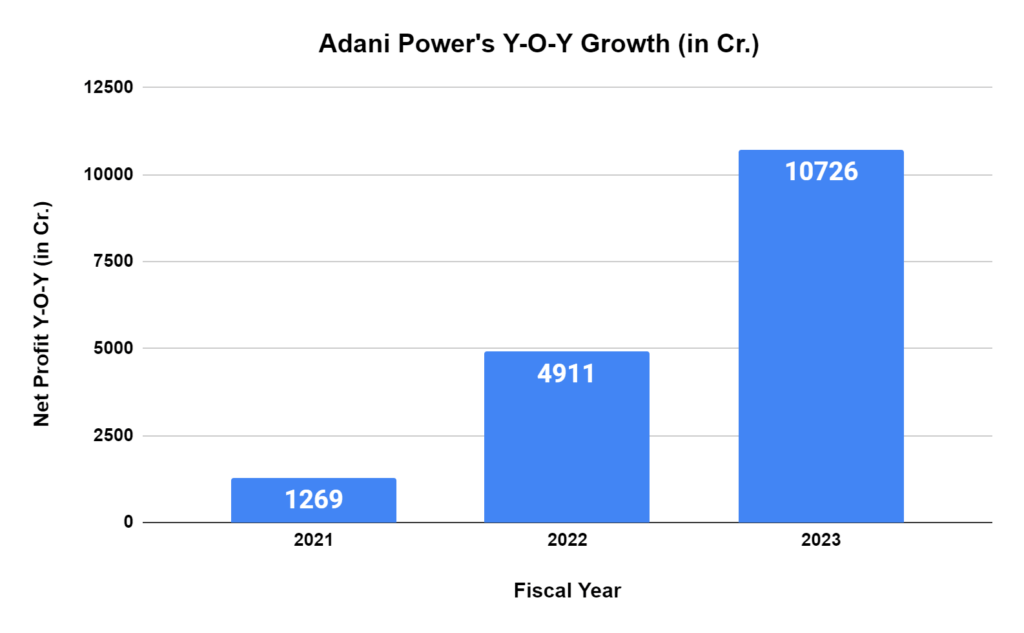

We can’t head to cooler destinations for the entire summer, so we bring home air conditioners, fans, and coolers to cool us down. This translates to a higher revenue potential for power companies like NTPC and Adani Power. Moreover, power plants tend to see better efficiency during summer, leading to increased generation and profitability. Companies moving towards renewable energy sources can benefit from increased solar power generation during peak summer days.

Now that we know why these specific sectors do well during summer, let’s examine why summer stocks are generally attractive.

Capitalizing on Consumer Demand

Summer triggers a predictable shift in consumer behavior. People prioritize staying relaxed and comfortable, increasing demand for specific products and services like air conditioners, coolers, beverages, ice creams, sunscreens, and deodorants. Companies that cater to these seasonal needs see a natural boost in sales, translating to potentially higher profits.

Targeted Growth Potential

Investing in summer stocks also means targeting exposure to sectors that ought to experience growth during the hotter months. This targeted approach has the potential to outperform the broader market during the hot summer months.

Portfolio Diversification

Besides long-term holdings already in your portfolio, summer stocks also add seasonal stocks to the mix. This essentially means an opportunity to diversify your investment portfolio. Include these seasonal companies with your long-term holdings to spread risk and add a layer of potential growth. Doing so will create a more balanced portfolio that benefits from both long-term trends and seasonal fluctuations within the market.

Beyond the Summer: Other Segments That Could Boom

While summer brings a boom to certain sectors, other industries catering to seasonal needs throughout the year cannot be ignored. While the beauty industry sees a rise in sales of sunscreens and deodorants, cosmetic stocks such as Dabur, Emami, and ITC, among others, capitalize on this through innovative products and targeted marketing strategies.

The travel and tourism sector also experiences a peak season during the summer, especially in popular hill stations and tourist destinations. Travel booking, aviation, and hospitality companies typically see a seasonal boost during this period.

The Indian summer may be a reason for big companies to rejoice as their sales boost, but it also means investors can capitalize on seasonal trends. Thorough research and analysis can help investors potentially profit from the summer sizzle!

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.7 / 5. Vote count: 6

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.