The Indian stock market has really taken off over the past decade, with many people getting into stocks and mutual funds. But there’s a big debate among financial experts. Some say that the real money is in unlisted shares—stocks from companies that haven’t gone public yet. Others strongly disagree, warning investors to stay away because of the high risks.

So, should you think about unlisted shares as a retail investor? Let’s explore this world and see if they’re suitable for your investment portfolio. Let’s begin with an understanding of what unlisted shares are and the risks and rewards awards associated with them.

What are Unlisted Shares

Unlisted shares are company ownership stakes without a listing on a major stock exchange like the National Stock Exchange (NSE) or the Bombay Stock Exchange (BSE). Unlike publicly traded stocks, you won’t find them on any trading platform where you can easily buy or sell them.

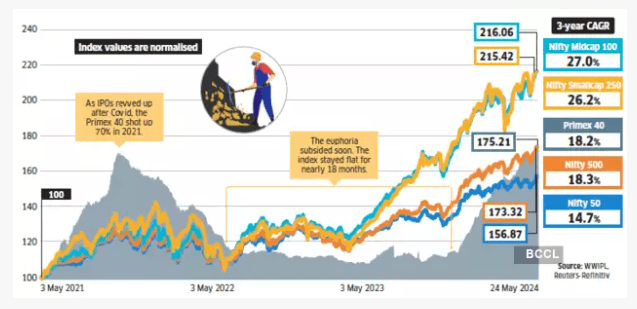

Primex 40 is the index tracking the performance of the top 40 Indian private companies in unlisted and delisted markets. Last month, the Primex 40 index reached an all-time high. This surge is mainly due to the convenience offered by online investment platforms. Anyone with Rs. 5,000-10,000 and a demat account can invest in unlisted stocks.

Over the past three years, Primex 40 has outperformed Nifty 50, but mid-cap and small-cap indices have surged even further ahead.

High Risk, High Reward: The Unlisted Share Game

Unlisted shares are attracting a lot of attention for several reasons. IPOs in the last 2-3 years have delivered substantial returns to investors. However, due to the high demand, only a small portion of IPO shares get allotted compared to the number of applications. Investors are looking to buy stocks before they go public to overcome this issue.

Let’s understand the unlisted share risk and rewards game with an example. Imagine being an early investor in a company like Zomato, a food delivery giant in India. Before its Initial Public Offering (IPO) in July 2021, Zomato’s unlisted shares were available at a much lower price. Investors who bought in early saw significant returns when the stock debuted on the exchange. However, the story isn’t always rosy.

Not all IPOs are created equal. Take Policybazaar, an online insurance aggregator. Similar to Tata Technologies, Policybazaar went public in November 2021. While there were gains, they weren’t as dramatic as Zomato’s. Investors who bought Policybazaar shares in the unlisted market just before the IPO saw a more modest increase in their investment.

Why Unlisted Shares Can Be So Appealing

First things first, why are unlisted shares so appealing? Here’s the lowdown:

- Potential for Higher Growth: Unlisted companies are often young and have the potential for explosive growth. By grabbing shares early, you could see a windfall if the company takes off and eventually goes public (IPO). Imagine buying shares in a little-known tech startup that becomes the next big thing!

- Exciting Ventures: Not all publicly traded companies are created equal. Unlisted shares can open doors to exciting ventures that haven’t hit the mainstream yet. You might discover a diamond in the rough before everyone else catches on.

- Potentially Higher Returns: Since there’s a higher risk involved, unlisted shares have the potential for greater returns compared to established, publicly traded companies. Think of it as a calculated gamble – the risk is high, but the reward could be much bigger.

Unlisted shares can be a good fit for some investors, but not for everyone. Before you take the plunge, consider these factors:

5 Factors to Consider Before Investing in Unlisted Shares

- Limited Liquidity: Unlisted shares are like illiquid assets—there’s no established market for them. Finding a buyer can be challenging, and you might have to wait a long time or even sell at a loss to get out of your investment. This lack of liquidity makes unlisted shares a high-risk proposition.

- Information Asymmetry: Publicly traded companies must disclose a lot of financial information. This transparency allows investors to make informed decisions. Unlisted companies, on the other hand, operate with less scrutiny. You might not have a clear picture of the company’s financial health, its future prospects, or even the true value of its shares. This lack of information makes it difficult to assess the risk involved, potentially leading to high rewards or significant losses.

- Valuation Challenges: Determining the fair value of an unlisted share can be a guessing game. It’s difficult to pinpoint a reliable price without a readily available market for these shares. You might end up overpaying for shares that are actually worth much less. Conversely, you could score a bargain if you manage to find an undervalued company.

- Higher Risk of Fraud: The lack of regulation surrounding unlisted shares can make them more susceptible to fraud. Since there’s less oversight, some companies might use misleading information to entice investors. Without proper due diligence, you could end up investing in a company that doesn’t even exist.

- Long-Term Commitment: Investing in unlisted shares is a marathon, not a sprint. These are often young and unproven companies. It could take years before they succeed or even go public, allowing you to sell your shares. Be prepared to hold onto your investment for a long time, potentially weathering ups and downs along the way.

So, You Want to Invest? Here’s Your Checklist:

- Your Risk Tolerance: Unlisted shares are a high-risk proposition, so make sure you check your risk appetite before investing.

- Investment Goals: Unlisted shares are better suited for long-term investors who can weather any bumps in the road.

- Investment Knowledge: Do you understand the intricacies of the stock market and how to value companies? A solid understanding of financial analysis will help you make informed decisions.

- Professional Advice: Consider seeking guidance from a registered financial advisor specializing in unlisted shares. They can help you navigate the risks and identify potentially good investments.

Invest Wisely

Unlisted shares can be a fascinating investment option, but remember, it’s not for investors with a low-risk appetite. Do your research, understand the risks, and only invest what you can afford to lose. By being cautious and well-informed, you can increase your chances of a successful foray into the world of unlisted shares.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are the advantages of investing in unlisted shares?

Unlisted shares offer the potential for high returns, especially if the company goes public (IPO) and the share price surges. You might also discover promising young companies before they become mainstream successes.

What are the risks of investing in unlisted shares?

Unlisted shares are highly illiquid, meaning it can be difficult to sell them. You might face limited information about the company, making it hard to assess the risk. Additionally, the valuation of unlisted shares can be challenging, and there’s a higher risk of fraud compared to publicly traded companies.

Are unlisted shares a good investment for everyone?

No, unlisted shares are best suited for investors with a high tolerance for risk and a long-term investment horizon. You should have a diversified portfolio and only invest what you can afford to lose.

How can I research unlisted shares before investing?

Research the company thoroughly, including its financials, business plan, and management team. Seek information from reliable sources and consider consulting a financial advisor to understand the risks involved.

How useful was this post?

Click on a star to rate it!

Average rating 2.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.