The World Bank has recently released its Global Economic Prospects report, offering a glimpse into the projected path of various economies. In this report, India’s economic future paints a promising picture, with an anticipated average growth rate of 6.7% per year between FY25 and FY27.

The global agency stated that India will continue to be the fastest-growing economy among the world’s largest economies, even though its growth rate is anticipated to slow. Following a high growth rate in 2023-24, the agency projects an average annual growth of 6.7% for the three fiscal years starting in 2024-25, as outlined in its Global Economic Prospects report for June 2024.

In April, the World Bank increased its GDP growth forecast for India by 20 basis points to 6.6% for the current financial year.

Also Read: Momentum Investing Strategies

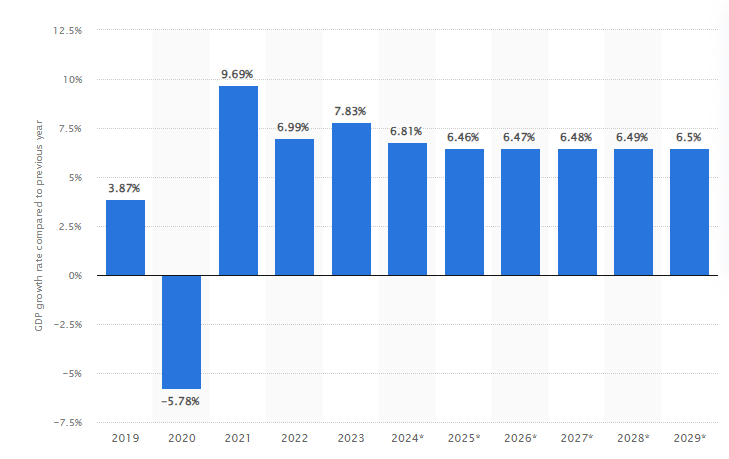

Real GDP Growth Rate from 2019 to 2029

Compared to the Previous Year

India’s GDP growth exceeded expectations, hitting 7.8% in the January-March quarter, showing a slowdown from the previous quarter’s 8.4%. Data released by the Ministry of Statistics and Programme Implementation on May 31st unveiled a revision in the full-year 2023-24 GDP growth to 8.2%, up from the earlier estimate of 7.6%.

Let’s delve deeper into what this World Bank forecast signifies for India and the global economic landscape.

Maintaining Momentum Amidst Global Uncertainties

The World Bank’s projection indicates a continuation of India’s economic expansion at a commendable pace. However, the report also acknowledges a potential moderation in this growth trajectory compared to the current year. In simpler terms, the pace of economic expansion might slow down slightly, although it’s important to emphasize that it will remain positive.

This anticipated slowdown is primarily attributed to a projected decrease in investments. Nevertheless, even with this moderation, the investment scenario is expected to remain robust on a larger scale.

The Ripple Effect of Growth

Economic growth has a significant cascading effect, impacting various aspects of a nation’s well-being. Imagine a company expanding its production capacity. This translates to increased job opportunities, leading to higher disposable income for individuals. This, in turn, fuels consumer spending, benefiting businesses and fostering a vibrant economic cycle.

In essence, India’s projected growth has the potential to elevate the standard of living for a large portion of the population.

The World Bank identifies several key factors contributing to India’s anticipated growth.

3 Key Factors Fueling the GDP Growth

- Strong Domestic Demand: Indian consumers and businesses actively buy and sell goods and services, signifying a healthy internal market that fuels economic activity and growth.

- Increased Investments: Infrastructure development, new factories, and business expansion are expected to rise. This will inject fresh energy into the economy and create opportunities for the future.

- Robust Services Sector: The information technology, tourism, finance, and healthcare sectors are all projected to perform well. This signifies a diversified economy, less reliant on just one or two industries.

Challenges Ahead

While the outlook appears optimistic, the path to sustained growth is rarely without its hurdles. India faces a few potential challenges that could impact the projected figures.

- Global economic challenges, such as a slowdown in international trade, could potentially reduce demand for Indian exports.

- Additionally, inflation, or the rising cost of living, could strain household budgets and impact consumer spending.

- Addressing issues related to inclusive growth and ensuring that the benefits of economic expansion reach all sections of society remains another crucial aspect to consider.

Steering Towards a Brighter Future

The World Bank’s forecast offers a promising outlook for India’s economic future. However, it’s important to acknowledge that this is a prediction, and the actual outcome can be influenced by various domestic and international factors. To ensure the projected growth translates into tangible benefits for its citizens, the Indian government will need to navigate these challenges effectively.

Your Stake in the Growth Story

Whether you’re a seasoned entrepreneur, a student embarking on your career path, or simply someone with a keen interest in India’s economic trajectory, this growth story holds immense significance. A strong Indian economy creates a fertile ground for businesses of all sizes, domestic and foreign, to flourish. It also paves the way for increased investment in critical areas like education, healthcare, and infrastructure, ultimately benefiting all citizens.

A Reason for Optimism

The World Bank’s forecast for India’s economic growth is undoubtedly positive. However, a dose of realism is essential. Challenges exist, and their effective resolution will be key to unlocking the full potential of this growth story. As India navigates the economic landscape in the coming years, one thing remains certain: the nation’s path will be exciting to watch, with the potential to solidify its position as a global economic powerhouse.

Global Growth Prospects

The World Bank forecasts global growth to stabilize at 2.6% in 2024, marking the first time in three years without significant fluctuation, despite geopolitical tensions and high interest rates. Projections suggest a slight uptick to 2.7% by 2025-26, driven by modest improvements in trade and investment.

Regional Outlook for South Asia

In the South Asia region, GDP growth is anticipated to decelerate from 6.6% in 2023 to 6.2% in 2024, mainly due to India’s growth moderating from recent highs. However, with India’s stable growth trajectory, regional growth is expected to maintain at 6.2% in 2025-26.

Bangladesh’s growth is forecasted to remain robust, while Pakistan and Sri Lanka are expected to strengthen. Downside risks include disruptions in commodity markets, fiscal consolidations, financial instability, extreme weather events, and slower growth in China and Europe. Conversely, stronger activity in the United States and global disinflation pose upside risks.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

How fast is India’s economy expected to grow?

The World Bank forecasts India’s economy to grow at an average rate of 6.7% per year between FY25 (financial year 2024-25) and FY27 (2026-27). This would make India the fastest-growing major economy globally during this period.

Is there any chance this growth projection might change?

The World Bank’s forecast is based on current trends and projections. However, global factors like economic slowdowns or inflation could potentially impact this growth rate.

How will this growth benefit India?

A growing economy can lead to several positive outcomes for India. Increased economic activity can create new employment opportunities and improve living standards for many Indians. Increased government investment: A stronger economy allows the government to invest more in education, healthcare, and infrastructure development. India’s position as a major economic power can attract further investments and strengthen its global influence.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.