Paytm investors have been on a rollercoaster ride in 2024. After a rough few months, the company’s stock price surged by over 25% in the past week. But what triggered this sudden jump? Let’s examine the two key factors that experts believe played a major role.

A Week of Dramatic Fluctuations

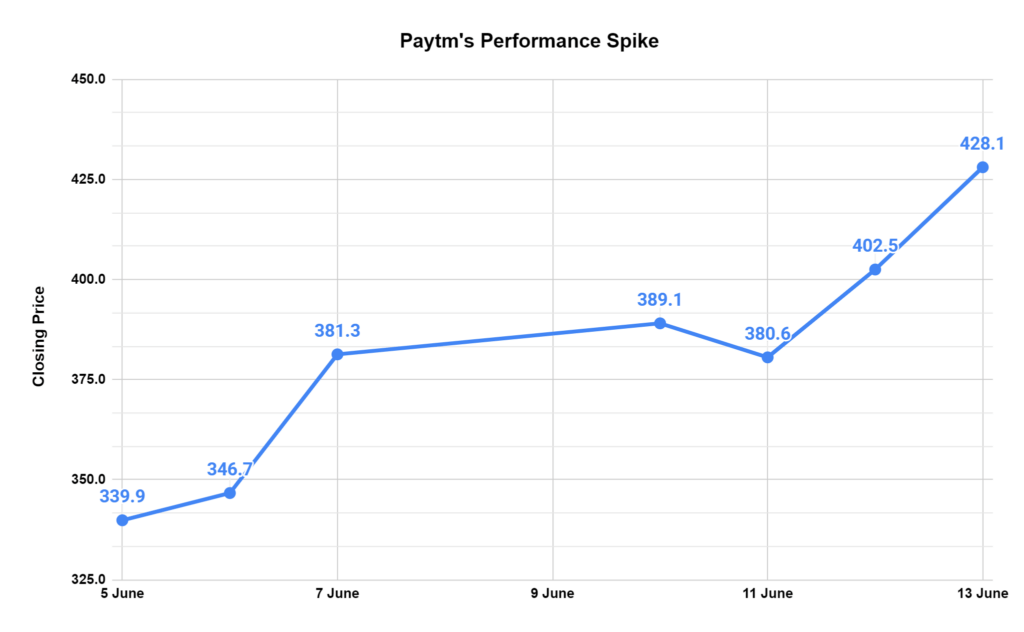

The past week for Paytm wasn’t just about a steady rise – it was a period of dramatic fluctuations. The stock has surged around 26%, up from a nearly 52-week low of ₹339.85 on June 5. It jumped around 5.40% to ₹424.40 on Thursday morning, compared to Wednesday’s closing price of ₹402.65.

That initial jump was followed by an even more significant surge. The share price opened with an upside gap of ₹407 a piece on NSE and touched an intraday high of ₹439 per share, logging an intraday rise of nearly 9%. However, the price settled at a more moderate increase, closing 25.55 points or 6.35% higher at ₹428.05 on the NSE.

Reasons Paytm Share Price Soared

1. Samsung Partnership Expands User Base

The recent partnership with Samsung is one major driver of the stock price increase. This collaboration allows users of Samsung smartphones to access flight, bus, movie, and event ticket bookings directly through the Samsung Wallet app, powered by Paytm’s services. Experts see this as a strategic move that could significantly expand the company’s user base.

Imagine how many people use Samsung phones in India. By integrating the company’s services within the Samsung Wallet, Paytm will gain access to a vast pool of potential new customers without needing to download a separate app. This could potentially translate to a higher transaction volume for Paytm, which could be a positive sign for the company’s future.

2. Regulatory Hurdle Removed, Investor Sentiment Improves

Another factor that likely contributed to the stock price rise is the recent decision by the Insurance Regulatory and Development Authority of India (IRDAI). Previously, Paytm had its own insurance arm but wasn’t performing well financially. Fortunately, IRDAI approved its request to withdraw its application for a general insurance license. This allows Paytm to operate as an insurance agent instead of partnering with other insurance companies.

Experts believe this shift in strategy is a positive move. Selling its own insurance policies was a loss-making venture for Paytm. By becoming an agent, it can still offer insurance products to its customers but avoid the financial burden of managing its own insurance arm, improving its overall financial health, which is something investors are likely looking for.

Looking Back and Moving Forward

It’s important to remember that Paytm’s stock price has faced significant pressure in recent months, primarily due to a regulatory ban imposed by the Reserve Bank of India (RBI) on its payments bank subsidiary in January 2024. This caused the stock to plummet and eroded investor confidence.

However, experts believe the recent developments might indicate a turning point. They suggest that the stock may have bottomed out, and the positive news surrounding the Samsung partnership and IRDAI decision is leading to cautious optimism among investors. They seem more comfortable buying the stock at current levels, which is contributing to the price increase.

The Bottom Line

While the recent surge may be positive news for Paytm, it’s crucial to remember that the stock market can be volatile. Experts advise investors to remain cautious, especially when a company has faced regulatory hurdles like Paytm. Careful research and a clear understanding of the company’s future prospects are essential before making investment decisions.

The next few months will be interesting to watch for Paytm. Will the partnership with Samsung translate into increased business? Will the company leverage its new insurance agent strategy effectively? Only time will tell how these developments will ultimately impact Paytm’s long-term success.

Read More: What is stock market

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.