If you’ve been to the market recently, you might have noticed something unusual: onion prices have surged. The reasons behind the recent price hike are a complex web of factors, ranging from unpredictable weather to global market forces and even government decisions.

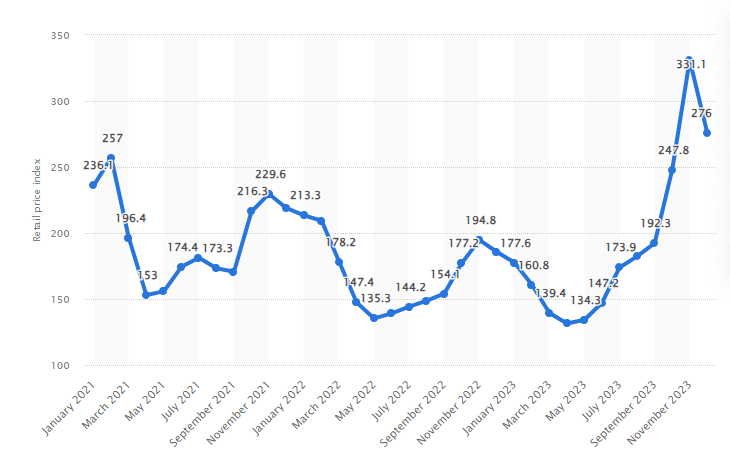

Onion prices climbed over 30% in the past two weeks at the Lasalgaon wholesale market in Maharashtra’s Nashik district. This sudden surge has left many wondering what’s behind this spike. Let’s look at the retail price index of onion in the last two years.

Retail Onion Price Index in India from January 2021 to December 2023

Let’s dive into the details to understand the factors at play.

Usual Trends vs. Unusual Surge

Typically, onion prices follow a predictable pattern. They start to increase gradually from June, peaking around September or October. This trend is largely influenced by stock levels and the amount of monsoon rain. However, this year, the price hike happened a month earlier, and the increase was much steeper than usual. So, what changed?

6 Reasons for the Onion Price Spike

The Immediate Triggers

Two main factors contributed to the early and sharp rise in prices:

- Strong Demand for Bakri Eid: Festivals often drive up the demand for certain foods, and this year, Bakri Eid significantly boosted the demand for onions.

- Lower Arrivals in Nashik: Continuous rainfall in the Nashik region, a major onion-producing area, led to lower arrivals of onions at the market. This reduction in supply naturally pushed prices up.

But, while these factors explain the immediate surge, they don’t tell the whole story.

Contrasting Views on Maharashtra’s Onion Production

The government predicts a 10-13% decrease in national rabi onion production for 2023-24, primarily due to prolonged water shortages for irrigation last year. However, many in the trade believe the government might be wrong about a rabi shortfall in Maharashtra, the largest onion-producing state.

Without reliable official data on total rabi onion production and storage, market behavior is largely driven by sentiment. Some traders believe that despite a production dip in key onion-growing areas of Maharashtra, the overall rabi onion production in the state hasn’t declined significantly. They cite two main reasons for this:

- Better yields: Improved yields have helped offset production losses.

- Crop substitution: Farmers outside the traditional onion belt switched to onions, which require less water than their usual crops.

The anticipated drop in Madhya Pradesh’s onion production is a significant factor influencing market sentiment and prices. The market estimates a 30% shortfall in MP’s rabi crop, with MP traders moving to Nashik for stocking, indicating a shortage.

A Deeper Dive into the Situation

Let’s look at some additional factors that might be contributing to the price rise:

- Monsoon Impact: While necessary for crops, monsoon rains can also disrupt harvesting and transport. This year’s rains have been particularly heavy, affecting not just the quantity of onions reaching the markets but also their quality.

- Stock Levels: Typically, stock from the previous season can help buffer price hikes. However, if the carryover stock is lower than usual, it can exacerbate the impact of reduced new arrivals.

- Market Speculation: In many agricultural markets, speculative buying and hoarding can significantly affect price movements. Traders might hold back supplies in anticipation of further price increases, thereby driving prices up in the short term.

- Government Policies: Export policies, import restrictions, and other regulatory measures can influence onion prices. Any recent changes in these areas could be contributing factors.

Will Onion Prices Continue to Rise?

In the upcoming months, onion prices are expected to increase steadily, possibly reaching INR 35/kg or more by the end of July, up from the current INR 27-28/kg in the wholesale market. Retail prices are typically double those of wholesale. Onion exporters identify two main factors keeping the price rise gradual:

- Low export demand is due to better crops in competing countries like Pakistan and Iran.

- The timely arrival of the southwest monsoon should ensure the Kharif crop reaches the market in August/September.

Mumbai Agricultural Producer Market Committee (APMC), cautions that some traders might try to manipulate prices despite no significant shortage in Maharashtra. Additionally, rainfall during the southern harvest in August/September has historically influenced prices.

The Government’s Role in the Onion Price Hike

While there are options for government intervention, the current political climate and market dynamics make it unlikely for any immediate action to be taken.

Here’s a closer look at the current situation and potential interventions:

- Export Restrictions: Currently, India allows onion exports, but with a 40% duty and a minimum export price of $550 per tonne. This makes Indian onions less competitive in the global market.

- Government Intervention Unlikely in the Short Term: Due to upcoming elections in Maharashtra, a key onion-growing state, the government is unlikely to take actions that could upset farmers, such as reducing export duty or banning exports altogether.

- Building a Buffer Stock: Another potential intervention is for the government to buy onions and create a buffer stock to regulate prices later. However, this has been challenging as farmers are fetching better prices in the open market, making them less willing to sell to the government.

The Broader Economic Impact

High onion prices aren’t just a concern for household budgets—they have broader economic implications:

- Inflation: Onions are a staple in Indian cuisine, so a significant price increase can contribute to overall food inflation, impacting the cost of living.

- Political Ramifications: Given the importance of onions in the Indian diet, sharp price increases can become a political issue, prompting government intervention.

- Supply Chain Strain: Persistent high prices can strain the supply chain, affecting farmers and retailers.

A Watchful Eye on the Market

As onion prices continue to fluctuate, it’s clear that a combination of immediate triggers and deeper systemic issues are at play. While demand spikes and supply disruptions have caused the recent surge, addressing the underlying factors will be key to stabilizing the market.

For now, consumers will need to monitor the market closely, and policymakers will need to stay proactive in managing both short-term shocks and long-term stability. Whether through better storage, timely imports, or improved agricultural practices, a lot can be done to keep onion prices in check and ensure this essential ingredient remains accessible to all.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

When will onion prices go down?

The next onion harvest season is on the horizon, and with a hopefully more regular monsoon and improved storage practices, a more abundant crop is expected. This anticipated increase in supply should eventually lead to a price correction, bringing some relief to consumers.

How does the monsoon season affect onion prices?

The monsoon season can disrupt the harvesting and transport of onions, affecting the quantity and quality of the crop reaching the market and thereby influencing prices.

Are there any external factors contributing to the price rise?

Yes, better crops in competing countries have limited export demand for Indian onions, and anticipated production drops in other states like Madhya Pradesh have also influenced market sentiment and prices.

What can be done to stabilize onion prices in the future?

Improving storage facilities, enhancing irrigation practices, and monitoring market speculation can help stabilize onion prices. Additionally, timely government interventions and import strategies can provide short-term relief.

How useful was this post?

Click on a star to rate it!

Average rating 2.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.