Technical analysis plays a crucial role in the world of financial markets and trading. Traders use various tools and indicators to predict market trends and make informed decisions, and the Super Trend Indicator stands out as a popular choice.

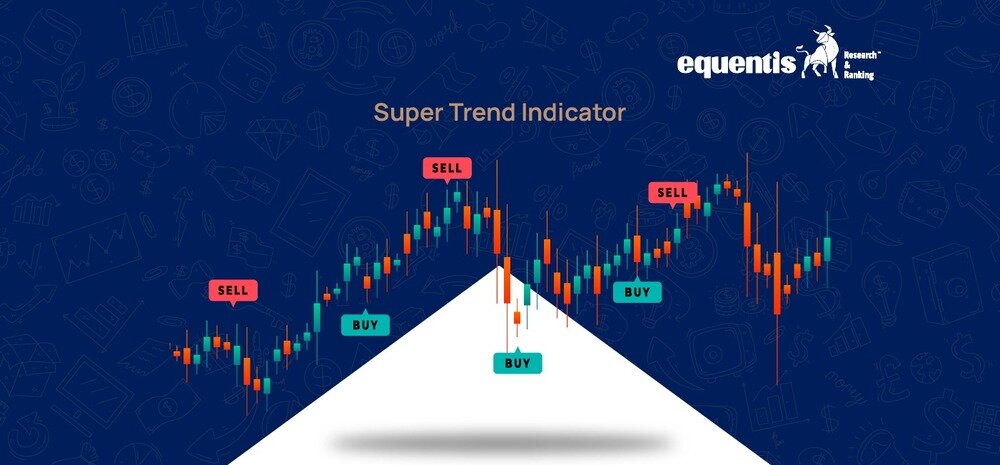

Super Trend Indicator helps traders identify the direction of an asset’s price movement and potential reversals, enhancing their trading strategies. By providing clear buy and sell signals based on price action, the Super Trend Indicator simplifies decision-making and helps traders maximize their profits while minimizing risks.

This article aims to comprehensively understand the Super Trend Indicator, its mechanics, applications, and benefits for traders.

What is Super Trend Indicator: Understanding the Basics

The Super Trend Indicator is a trend-following tool used in technical analysis to identify the market’s direction. It is designed to provide clear buy and sell signals based on the prevailing market trends. Traders can effectively determine the trend direction and potential reversal points using the Super Trend Indicator.

How Does the Super Trend Indicator Work?

The Super Trend Indicator is plotted on a price chart and moves in accordance with the market price. It consists of two main components: the Average True Range (ATR) and a multiplier. The ATR measures market volatility, while the multiplier is a user-defined value that adjusts the indicator’s sensitivity.

How to Use Super Trend Indicator

When using the Super Trend Indicator for intraday trading, start by viewing the chart of the specific stock or index you wish to monitor and select a 10-minute time frame.

Open the chart, insert the Super Trend Indicator, and set the periods and multiplier to 10 and 3, respectively. You can adjust these settings further based on your preferences.

It is crucial to use stop-loss orders when trading with this indicator. For a long trade, place the stop-loss at the green indication line, and for a short position, place it at the red signal line.

Source: Trade brains

Here’s how the Super Trend Indicator is calculated:

- Calculate the ATR: The Average True Range is calculated over several periods. It measures the degree of price volatility by comparing the range between the high and low prices over a given period.

- Determine the Basic Upper and Lower Bands: The upper band is calculated by adding the ATR (multiplied by the multiplier) to the closing price. Conversely, the lower band is determined by subtracting the ATR (multiplied by the multiplier) from the closing price.

- Plot the Super Trend Line: The Super Trend Line is plotted depending on the current market trend. If the price is above the upper band, the indicator signals an uptrend, and the line is plotted below the price. If the price is below the lower band, the indicator signals a downtrend, and the line is plotted above the price.

Super Trend Indicator Formula

The formula for the super trend indicator is as follows:

Upper Band = (High + Low)/2 + multiplier x ATR

Lower Band = (High + Low)/2 – multiplier x ATR

Interpreting the Super Trend Indicator

The Super Trend Indicator provides straightforward buy and sell signals, making it an excellent tool for both novice and experienced traders. Here’s how to interpret these signals:

- Buy Signal: When the price crosses above the Super Trend Line, it indicates a potential uptrend. This is considered a buy signal, suggesting that traders should consider entering long positions.

- Sell Signal: Conversely, when the price crosses below the Super Trend Line, it indicates a potential downtrend. This is considered a sell signal, suggesting that traders should consider exiting long positions or entering short positions.

Advantages of Using the Super Trend Indicator

The Super Trend Indicator offers several benefits that make it a valuable tool for traders:

- Simplicity: One of the Super Trend Indicator’s most significant advantages is its simplicity. It provides clear and unambiguous buy and sell signals, making it easy for traders to make quick decisions.

- Trend Confirmation: The indicator helps confirm the trend’s direction, enabling traders to align their positions with the prevailing market trend.

- Versatility: The Super Trend Indicator can be used across various time frames, making it suitable for different types of traders, including day traders, swing traders, and long-term investors.

- Customizability: Traders can adjust the multiplier and ATR period to suit their trading style and the asset’s volatility. This flexibility allows for fine-tuning the indicator to match specific market conditions.

- Reducing False Signals: The Super Trend Indicator incorporates the ATR to account for market volatility, which reduces false signals and improves trend identification accuracy.

Limitations of the Super Trend Indicator

Despite its many advantages, the Super Trend Indicator is not without its limitations:

- Lagging Nature: As a trend-following indicator, the Super Trend Indicator tends to lag behind the price. It means that buy and sell signals may be delayed, potentially causing traders to miss the optimal entry or exit points.

- Whipsaw Effect: In choppy or sideways markets, the Super Trend Indicator can generate false signals due to frequent price fluctuations around the indicator line. This can lead to a series of losing trades, known as the whipsaw effect.

- Dependency on Parameters: The effectiveness of the Super Trend Indicator largely depends on the chosen ATR period and multiplier. The indicator may not perform optimally if these parameters are not appropriately set.

Practical Applications of the Super Trend Indicator

The Super Trend Indicator can be applied in various trading strategies to enhance decision-making and improve trading outcomes. Here are some practical applications:

- Trend Identification: Traders can use the Super Trend Indicator to identify the prevailing market trend. By aligning their trades with the trend’s direction, traders can increase the likelihood of profitable outcomes.

- Entry and Exit Points: The clear buy and sell signals provided by the Super Trend Indicator can be used to determine optimal entry and exit points. This helps traders to enter trades at the beginning of a trend and exit before a potential reversal.

- Stop-Loss Placement: The Super Trend Line can be a dynamic stop-loss level. For long positions, traders can place a stop-loss order below the Super Trend Line, and for short positions, they can place a stop-loss order above the line. This approach helps manage risk and protect profits.

- Combining with Other Indicators: The Super Trend Indicator can be combined with other technical indicators to enhance its effectiveness. For instance, combining it with moving averages, RSI (Relative Strength Index), or MACD (Moving Average Convergence Divergence) can provide additional confirmation and improve the accuracy of trade signals.

Conclusion

The Super Trend Indicator is a powerful tool for securities advisory, particularly in the realms of equity picks. Its simplicity, effectiveness in identifying trends, and versatility across different time frames make it a popular choice among market participants. However, like any other indicator, it has its limitations and should be used alongside other tools and analysis techniques to maximize its benefits. By understanding the mechanics, advantages, and limitations of the Super Trend Indicator, traders can make more informed decisions and enhance their trading strategies. Whether you are a novice trader looking to get started or an experienced trader seeking to refine your approach, the Super Trend Indicator can provide valuable insights into stock market volume trends and help you navigate the complexities of financial markets with greater confidence.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Which is the best supertrend indicator?

The best Supertrend indicator is subjective and varies based on individual trading strategies. However, many traders prefer versions with customizable settings for multiplier and period, allowing for tailored sensitivity to market conditions. Popular choices include the default Supertrend on platforms like TradingView and the enhanced versions with additional features for risk management and signal clarity.

Is the Supertrend indicator accurate?

The Supertrend indicator is considered accurate for identifying trends and generating buy or sell signals, particularly in trending markets. However, its accuracy diminishes in sideways or highly volatile markets. It should be used with other technical analysis tools to enhance overall trading accuracy and risk management in the stock market.

How to use the supertrend indicator?

To use the Supertrend indicator, apply it to your chart and set the multiplier and period based on your trading strategy. A buy signal occurs when the price moves above the Supertrend line, turning it green. A sell signal occurs when the price falls below the line, turning it red. Use alongside other indicators for confirmation.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.