Have you checked your stock market app this morning? The Indian market awoke to a new reality after a dramatic night of global events.

Let’s closely examine what happened overnight and how it might impact your investments. Did the surprise Bank of England (BoE) rate cut trigger a domino effect? Did the Wall Street sell-off cast a shadow over Indian markets? Let’s unpack 10 key factors that have reshaped the investment landscape.

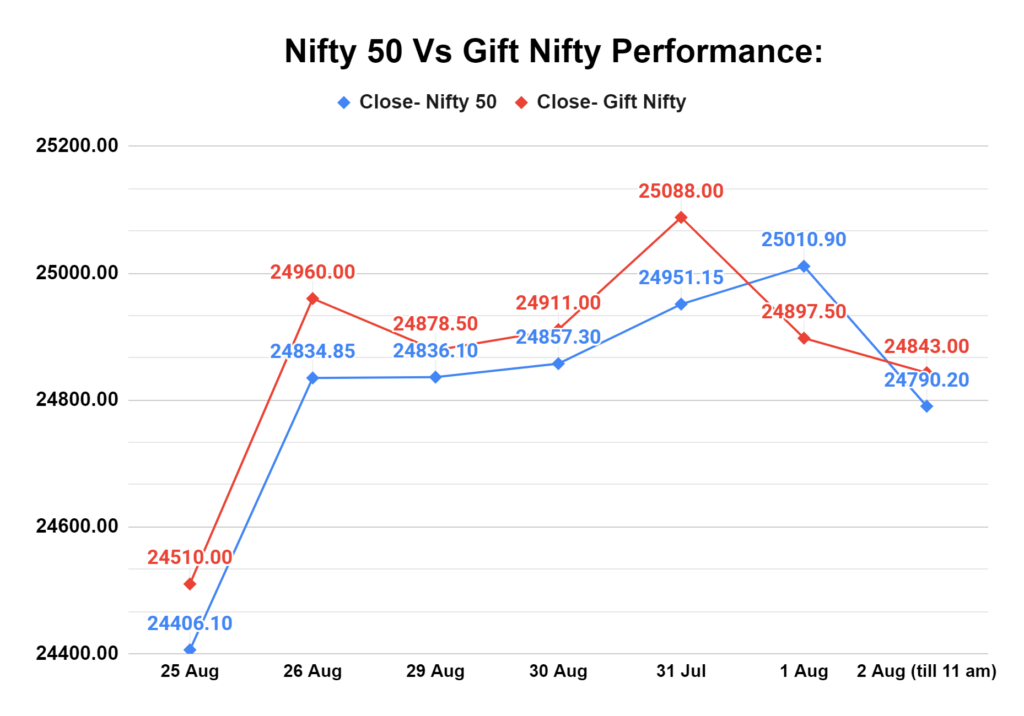

The Gift Nifty Surprise

The Gift Nifty is an index that tracks the performance of stocks listed on the International Financial Services Centre (IFSC) in Gujarat. This new index is aimed at attracting global investors to the Indian market.

Gift Nifty was trading around the 24,820 level, nearly 215 points lower than the previous close of the Nifty futures. This significant discount indicated a potential gap-down opening for the Indian stock market indices.

The performance of the Gift Nifty is closely linked to the overall sentiment in the global financial markets. A rise in the Gift Nifty index could signal a positive outlook for Indian equities, potentially attracting foreign investment and driving up domestic stock prices.

Conversely, a decline in the Gift Nifty might indicate a bearish sentiment and could lead to a sell-off in the Indian market. Monitoring the Gift Nifty’s performance closely is crucial, as it could provide early indications of trends in the Indian stock market.

Wall Street’s Wobble: Dow Jones & S&P 500

The US stock market experienced a significant sell-off overnight. The Dow Jones Industrial Average closed by 0.24%, while the broader S&P 500 witnessed a steeper decline of 1.58%. Several factors likely contributed to this dip, including concerns about inflation and potential economic slowdown.

The Bank of England Rate Cut

Surprisingly, the Bank of England slashed interest rates by 0.25%—this decision aimed to stimulate the UK economy, facing a potential recession. However, the impact can be multifaceted. While lower interest rates could make borrowing more accessible for businesses, it might also lead to the depreciation of the British Pound. This rate cut will influence foreign investment flows into India and currency exchange rates.

US Manufacturing PMI

The release of the US Manufacturing PMI has sent ripples through global markets. The index dropped drastically to 46.8 in July, marking an eight-month low. This significant decline, coupled with a slump in new orders, raises concerns about the overall health of the US economy.

A weakening US manufacturing sector, including India, can have broader implications for the global economy. If the slowdown persists, it could impact India’s export-oriented sectors, such as IT and pharmaceuticals. A weaker US economy might also influence investor sentiment and lead to capital outflows from emerging markets.

Monitoring these economic indicators closely is crucial, as they can provide early warning signs of potential challenges. While India’s domestic demand remains relatively robust, external factors cannot be ignored.

Asian Markets Tumble

Asian stock markets suffered significant losses on Friday, mirroring a sharp decline on Wall Street. Major indices in Japan and South Korea plummeted, while Hong Kong was poised for a steep drop. Growing concerns about a potential global economic slowdown primarily drove this broad-based sell-off. Investors reacted negatively to weak economic data in the US, which fueled fears of a recession and prompted a reassessment of interest rate hike expectations.

GST Collections Surge

India’s GST revenue for July 2024 reached a robust ₹1.82 lakh crore, marking a substantial 10.3% increase compared to last year. This consistent growth underscores a strengthening domestic economy, with increased consumer spending and a widening tax base. The sustained upward trend in GST collections is a positive indicator for overall economic health and government revenue.

US Treasury Yields Decline

US Treasury yields experienced a sharp decline, with benchmark yields hitting multi-month lows. Investors flocked to safe-haven bonds amid growing concerns about a potential economic recession. The rapid drop in yields indicates a shift in market sentiment, as investors anticipate a less aggressive monetary policy stance from the Federal Reserve. This development has significant implications for both the bond and equity markets.

Oil Prices Under Pressure

Crude oil prices struggled to gain traction, with a downward trend persisting. The market remains cautious due to concerns over a potential global economic slowdown, which could dampen fuel demand. Despite a slight uptick on Friday, the overall outlook for oil prices is bearish. Investors adopt a wait-and-see approach as economic uncertainties linger, putting downward pressure on oil prices.

Dollar Loses Ground

The US dollar weakened against major currencies, with the Japanese yen and Swiss franc reaching multi-month highs. The yen strengthened by approximately 0.2% to 149.085 per dollar, while the franc climbed to its highest since early February at 0.8726 per dollar. Conversely, the British pound and euro experienced modest declines, trading at $1.2723 and $1.07845, respectively. This shift in currency dynamics reflects growing investor concerns about global economic prospects and a search for safe-haven assets.

US Jobless Claims Surge

The number of Americans filing for unemployment benefits unexpectedly jumped to a seasonally adjusted 249,000 for the week ending July 27, marking an 11-month high. This significant increase surpasses analysts’ expectations and suggests a potential cooling of the labor market. While the overall job market remains resilient, the uptick in jobless claims raises concerns about economic growth and could influence the Federal Reserve’s monetary policy decisions.

Conclusion

Global financial markets experienced a tough day marked by significant volatility. The sharp decline in Asian equities and a sell-off on Wall Street reflects growing investor concerns about the global economic outlook. The mixed signals from the US economy, as evidenced by rising jobless claims and declining Treasury yields, further contributed to market uncertainty.

Strengthening safe-haven currencies like the Japanese yen and Swiss franc underscored investor anxiety. As these trends unfold, market participants will closely monitor economic indicators and central bank policies for clues on the potential trajectory of global financial markets. Remember, this is a dynamic market, and staying informed is key to making informed investment decisions.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.