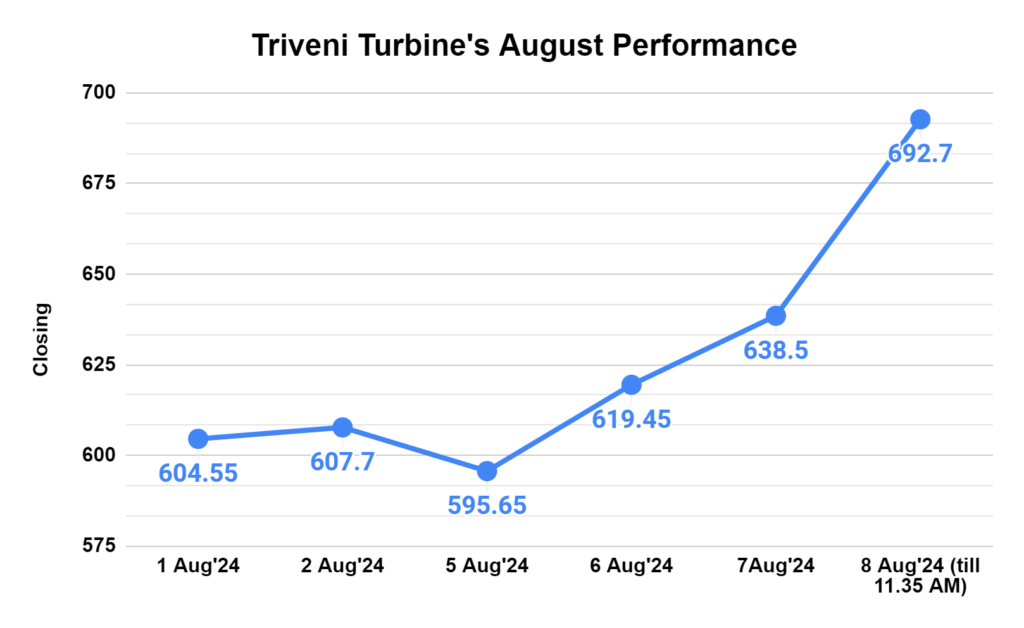

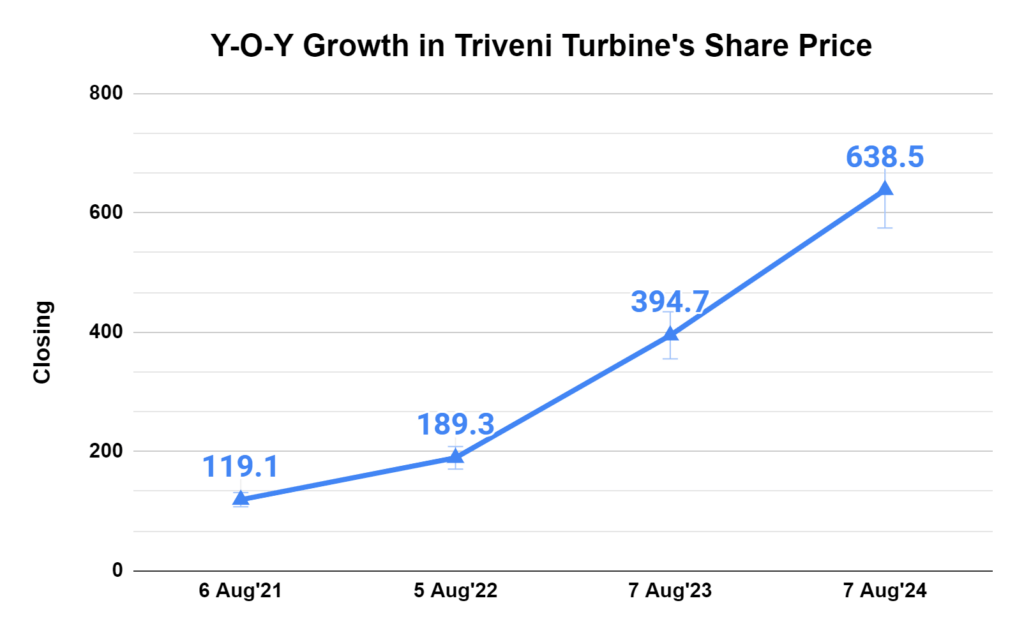

Have you ever wondered how a stock can go from ₹119 to ₹668 in just three years? That’s the story of Triveni Turbine. Shares of the power equipment maker touched a new high yesterday, on August 7, after the company announced its quarterly earnings.

The stock kicked off the day with a strong opening at ₹640, surging 7.84% to hit ₹668, a departure from the previous close of ₹619.4. Investors were keenly interested, with 1.02 lakh shares exchanging hands, amassing a turnover of ₹6.63 crore. The company’s market cap surged to ₹20,410 crore.

Q1 Performance

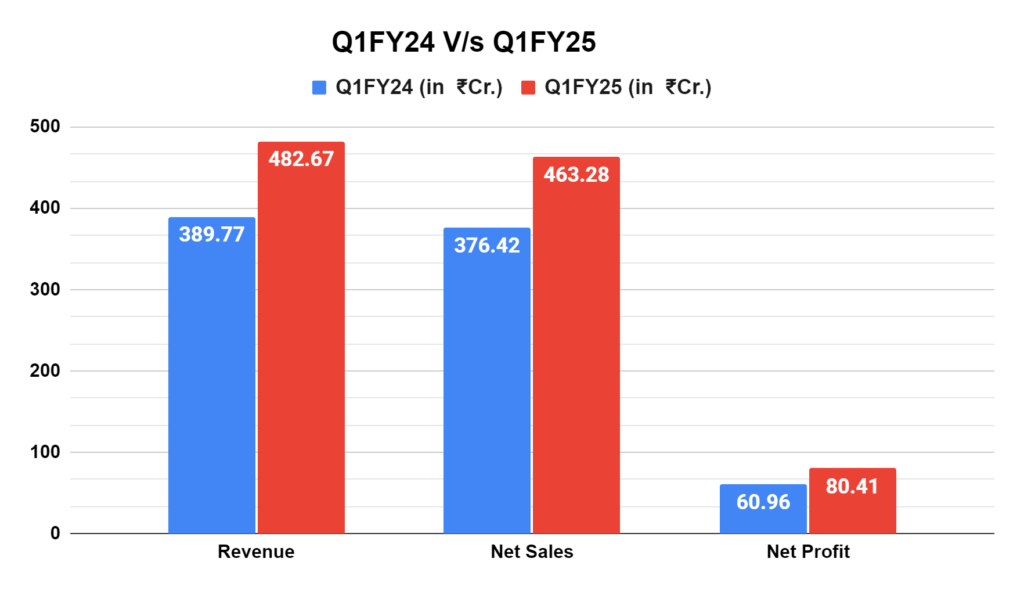

The June 2024 quarter saw revenue climb to ₹482.67 crore, outpacing the ₹389.77 crore recorded in the same period last year. A deeper dive reveals that June 2024 alone witnessed net sales of ₹463.28 crore, a robust 23.08% year-on-year growth. During the quarter, they also delivered a record-breaking net profit of ₹80.41 crore, up 32% from the same period in 2023’s ₹60.96 crore.

EBITDA, a crucial measure of profitability, climbed 36.47% to ₹114.99 crore in June 2024. This growth translates to an impressive EBITDA margin of 24.8%, an improvement over the previous year’s 22.4%. The company registered its highest-ever quarterly revenue, EBITDA, and order bookings, coupled with a record closing order book.

Growth Amidst Challenges

While the general elections dampened domestic order bookings, the company anticipates a rebound in the coming quarters. Triveni Turbine’s strategic expansion into the 120 MW turbine segment positions it to capitalize on the growing demand from sectors like steel, cement, and renewable energy. Driven by its technological prowess, the company’s ambitions extend to capturing a larger share of the API turbine market.

Impressive Returns over the Years

The stock has surged 48.29% in the past six months (since February 2024) and 59.35% over the last year (from August 2023). Looking back, the two-year return (August 2022 to 2024) stands at an impressive 233.86%, whereas the three-year performance (from August 2021 to 2024) is a whopping 460% gain.

Triveni Turbines has been busy building momentum in industrial power solutions. Here’s a look at some key moves that have fueled their growth over the past few years.

Top 8 Factors Fueling the Growth Story

1. Gearing Up for Global Markets: Triveni Turbines is no longer a domestic player. They’ve set up shop in South Africa and Dubai, strategically positioning themselves to cater to the aftermarket needs of these regions. This strengthens their presence and opens doors to new customer segments.

2. Acquisitions Fueling Expansion: The company has been actively acquiring businesses to broaden its reach and capabilities. In 2021, they fully acquired a joint venture, Triveni Energy Solutions Limited (TESL), and in 2022, they bought a majority stake in TSE Engineering Pvt. Ltd. (TSE). These acquisitions allow Triveni Turbines to be closer to customers in South Africa and expand its multi-brand aftermarket business.

3. Innovation is Key: Triveni Turbines isn’t afraid to get its hands dirty in research and development. It constantly works on improving its existing steam turbine solutions, like developing high-speed applications for colder regions. It’s also exploring new areas like floating brush seals and abradable seals that enhance turbine efficiency and robustness.

4. Diversification is the Name of the Game: Triveni Turbines is looking beyond traditional power generation. They’re making inroads into exciting new sectors like Waste-to-Energy and Geothermal. In 2022, they commissioned the first Waste-to-Energy steam turbine generator in Germany, showcasing their commitment to sustainability. Additionally, they’ve secured repeat orders for geothermal projects in Southeast Asia and East Africa, proving their expertise in this growing renewable energy space.

5. Adapting to Customer Needs: The company isn’t a one-size-fits-all solution provider. They understand that different industries have different needs. For example, they’re offering solutions to convert condensing turbines to back-pressure turbines for sugar co-generation applications, demonstrating their ability to adapt and deliver value to customers.

6. Keeping Up with the Big Leagues: Winning orders against international giants is no easy feat. But Triveni Turbines has done just that. In 2022, they secured a prestigious order for three steam turbines from a renowned steel manufacturer in South Korea, proving their ability to compete on the global stage.

7. Building Strong Relationships: Triveni Turbines understands the importance of fostering long-term partnerships. They’ve secured repeat orders from customers in Southeast Asia and East Africa for steam turbine refurbishments, demonstrating their commitment to providing reliable and efficient after-sales service.

8. Supporting National Efforts: The company actively participates in India’s indigenization efforts. They’ve developed and supplied various sub-systems to support the Indian Navy, showcasing their commitment to national development.

Conclusion

These factors have collectively contributed to Triveni Turbine’s exceptional performance. However, it’s essential to remember that past performance does not indicate future results. The stock market is dynamic, and various factors can influence a company’s trajectory.

While Triveni Turbine has undoubtedly delivered impressive returns, potential investors should conduct thorough due diligence before making investment decisions. Understanding the company’s business model, competitive landscape, and valuation is crucial. As always, consult a financial advisor to assess your investment goals and risk tolerance.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.6 / 5. Vote count: 7

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.