Fewer job openings and concerns of an economic slowdown battered the US stock market last week, resulting in the S&P 500’s worst weekly drop in 18 months. The Fed’s lack of clear timelines regarding rate cuts also affected investors’ sentiment.

The oil market is currently experiencing a strong sell-off. Brent Crude is trading below $70, nearing a three-year low due to weak oil demand. However, there were a few gainers and losers in the market.

Top Gainers and Losers in the US Stock Market

Top Gainers

The following are the top gainers in the last one week.

| Stocks | Last 7 Days Gains (in %) |

| Oracle | 10.99 |

| American Tower Corporation | 8.97 |

| Tesla | 5.07 |

| Verizon Corporation | 4.03 |

| Mondelez International | 4.44 |

Top Losers

The following are the top losers in the last one week across various sectors

| Stocks | Last 7 Days Loss (in %) |

| ASML | 15.82 |

| KLA Corporation | 11.44 |

| 8.08 | |

| Conocophillips | 7.06 |

| Nvidia | 6.06 |

In the last week, weakness in the market was led by Electronic Technology, Technology Services, Producer Manufacturing, Energy Minerals, and Consumer Services. While Retail Trade, Consumer non-durables, Commercial Services, Utilities, and Health Technology.

Due to falling crude oil prices, the S & P 500 Energy Index has dropped 4.57% in the last five trading sessions.

Let’s check out how the major US stock market indexes stand out during the week.

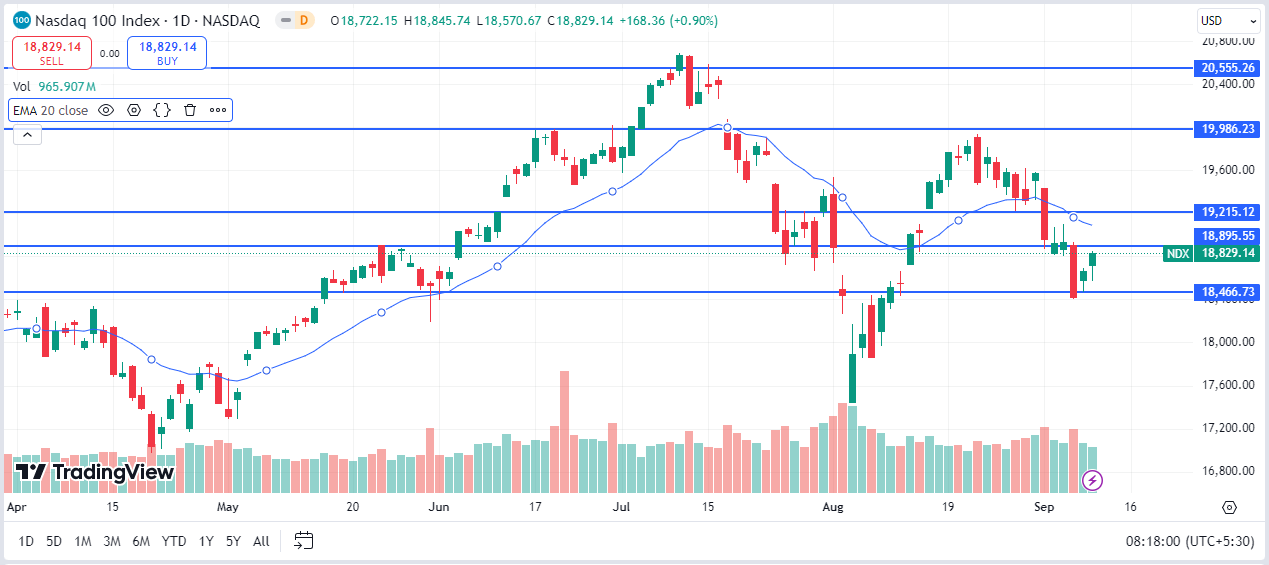

Nasdaq 100

After last week’s sell-off, Nasdaq gained ground as the rebound continued. Broadcom, the key hardware supplier for iPhone 16, has gained upside momentum and is up by more than 5% in the last 24 hours.

Nvidia, a semiconductor chip manufacturer, is trading with a positive bias this week after falling nearly 14% the previous week.

On Tuesday (September 10, 2024), the Nasdaq 100 continued to trade with a positive bias and slowly gained momentum. At the end of the day, it gained nearly 1%.

S&P 500

S&P 500 stocks gained ground as traders and investors reacted to a strong sell-off in the oil markets. Lower energy prices may provide additional support to many struggling industries and boost the labor market.

On Tuesday (September 10, 2024), the S&P 500 gained 0.45%, trying to go past the psychologically important 5,500 level. If the index manages to break above the 20 EMA slope, we may see additional buying in the market, which can propel the index toward its all-time high.

Conclusion

In the short term, markets will likely remain volatile, and future directions will depend on the Consumer Price Index and Producer Price Index reports. A lower-than-expected inflation number can boost growth sectors like technology and consumer discretionary, as lower inflation reinforces expectations of more than one Fed rate cut. However, if inflation exceeds expectations, the market may fall as chances of rate cuts diminish, and more aggressive monetary tightening may resurface.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.