Are you ready to see Swiggy make its public debut? Swiggy’s highly anticipated IPO opens on November 6, aiming to raise ₹11,327.43 crore from investors. The IPO includes a fresh issue of 11.54 crore equity shares valued at ₹4,499 crore and an offer-for-sale (OFS) component of 17.51 crore shares worth ₹6,828.43 crore.

Priced within a range of ₹371 to ₹390 per share, this IPO places Swiggy’s valuation at around ₹1,130 Cr. (or $11.3 billion), slightly higher than its valuation in its last funding round in 2022. Here, we’ll break down all the essentials of the Swiggy IPO, covering its structure, objectives, GMP trends, company background, financial performance, and a SWOT analysis to help you make an informed decision.

Swiggy IPO Details

| Offer Price | ₹371 to ₹390 per share |

| Face Value | ₹1 per share |

| Opening Date | 6 November 2024 |

| Closing Date | 8 November 2024 |

| Total Issue Size (in Shares) | 290,446,837 |

| Total Issue Size (in ₹) | ₹11,327.43 Cr (Fresh issue ₹4,499.00 Cr & OFS ₹6,828.43 Cr) |

| Issue Type | Book Built Issue IPO |

| Lot Size | 38 Shares |

| Listing at | BSE, NSE |

The Swiggy IPO will be a book-built issue of ₹11,327.43 crore, combining a fresh issue of shares totaling ₹4,499 crore and an OFS component worth ₹6,828.43 crore. With a price band set at ₹371-₹390 per share, the IPO will value Swiggy at around $11.3 billion. Allotments are expected to be finalized on November 11, 2024, with the shares slated for listing on November 13, 2024, on the NSE and BSE.

Allocation of Shares

Swiggy’s IPO offers a 10% reservation for retail investors and allocates 7.5 lakh shares for eligible employees. The minimum investment required for retail investors starts with 38 shares per lot, amounting to a minimum of ₹14,820. High net-worth investors (HNIs) can apply in multiples of 14 lots for a minimum investment of ₹207,480, while large investors can apply for a minimum of 68 lots, amounting to ₹1,007,760.

| Qualified Institutional Buyers (QIBs) | Not less than 75% of the Net Issue |

| Non-Institutional Investors (HNIs) | Not more than 15.00% of the Net Issue |

| Retail Investors | Not more than 10% of the Net Issue |

| Employee Reservation | Up to 750,000 shares with a discount of ₹25 per share |

Objectives of the IPO

Swiggy aims to use the funds raised from this IPO to support various strategic objectives:

- Debt Reduction: A portion of the proceeds will be used to repay or prepay borrowings for Scootsy and its subsidiary.

- Expansion of Dark Stores: Swiggy plans to invest in its Quick Commerce division, mainly to expand its dark store network, which supports Swiggy Instamart’s quick grocery delivery.

- Investment in Technology: Swiggy will fund infrastructure upgrades to improve efficiency and customer experience.

- Marketing and Brand Promotion: A portion of the funds will be used for brand promotion to strengthen Swiggy’s presence in various segments.

- Acquisitions and Growth: Swiggy also intends to explore inorganic growth opportunities through acquisitions and other corporate activities.

Grey Market Premium (GMP)

The IPO has generated notable interest, although the grey market premium (GMP) has fluctuated amid market volatility. The Swiggy IPO is trading at a GMP of ₹20 per share, suggesting a modest 5.13% potential listing gain above the upper price band of ₹390. It’s worth noting that this premium had reached ₹25 per share before the Muhurat trading session, indicating a degree of speculative interest in the unofficial market. Source: Livemint

Company Overview

Founded in 2014, Swiggy has become one of India’s leading on-demand delivery platforms. The company started with food delivery but has since diversified to include grocery delivery (Instamart), restaurant reservations (Dineout), and event bookings (SteppinOut). Swiggy’s platform also supports B2B logistics through services like Swiggy Genie and offers an extensive supply chain network for retailers.

Today, Swiggy operates in five main areas:

- Food Delivery: Core business, connecting customers with thousands of restaurants.

- Out-of-Home Consumption: Restaurant reservations, event booking, and dining-out options.

- Quick Commerce: Fast grocery delivery via Instamart, facilitated by dark stores.

- Supply Chain and Distribution: B2B delivery solutions for retailers and wholesalers.

- Platform Innovation: Services like Swiggy Genie offer hyperlocal deliveries and product pickups.

Financial Highlights

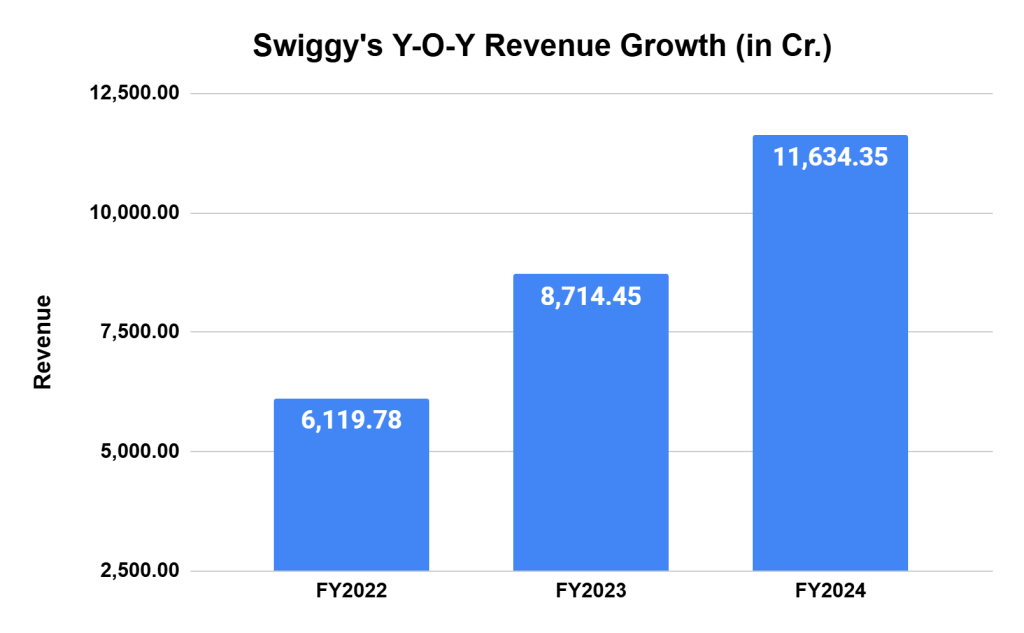

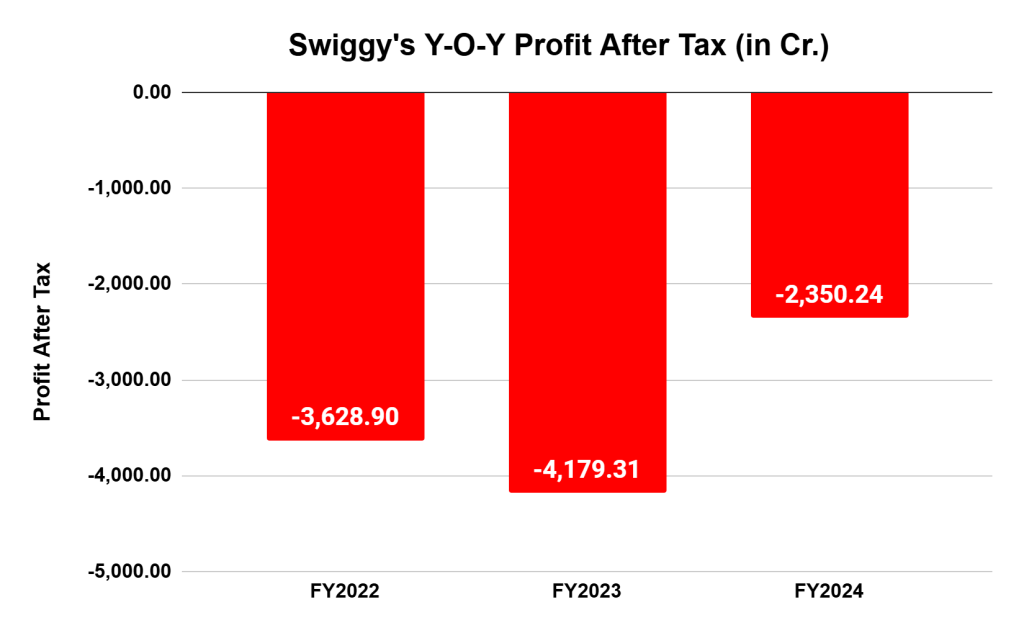

Swiggy’s financial growth has shown strong momentum despite its ongoing efforts to reach profitability.

For the fiscal year ending March 2024, Swiggy’s revenue grew by 34%, while its profit after tax (PAT), though still negative, improved by 44% over the prior fiscal year. Quick commerce and logistics have been key revenue drivers, with both segments showing significant promise as Swiggy works to strengthen its core areas and improve its financial stability.

SWOT Analysis of Swiggy IPO

| STRENGTHS | WEAKNESSES |

| Diverse Service Offering: Swiggy offers more than just food delivery; it also offers grocery, dining-out, and event booking services, appealing to a broad consumer base. Strong Brand Recognition: Swiggy is a household name in urban India, benefiting from its reputation and extensive user base. Solid Partnerships and Investors: With SoftBank and other major investors backing, Swiggy has access to resources for expansion and innovation. | Loss-Making Status: Swiggy continues to report net losses, which could pose concerns for investors focused on profitability. High Dependency on Urban Markets: While Swiggy is prevalent in urban areas, penetration in smaller towns and rural regions remains low, limiting its growth potential in these areas. High Operating Costs: Delivery infrastructure and dark store operations are costly, which may weigh on profitability in the short term. |

| OPPORTUNITIES | THREATS |

| Quick Commerce Growth: India’s quick commerce market is expected to grow at a CAGR of 148-169% from 2018 to 2023, offering significant growth potential for Swiggy Instamart. Untapped Rural Markets: Expanding services to rural and smaller towns could broaden Swiggy’s customer base. Inorganic Growth Potential: The IPO funds will provide capital for acquisitions, giving Swiggy options for growth through strategic acquisitions. | Intense Competition: Competitors like Zomato, Dunzo, and Blinkit continue to vie for market share in the food and quick commerce sectors. Regulatory Risks: Changing regulations in data protection, labor laws, and online services could impact Swiggy’s operations. Volatile Market Conditions: Economic factors, like inflation and consumer spending shifts, may affect demand for Swiggy’s services. |

Conclusion

Swiggy’s upcoming IPO represents a notable event for investors interested in India’s dynamic food tech and quick commerce sectors. With its growing user base, solid financial trajectory, and diverse offerings, Swiggy aims to leverage this public offering to fuel its next growth phase. However, the competitive landscape and Swiggy’s path to profitability will be key factors to monitor as it embarks on this journey.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.