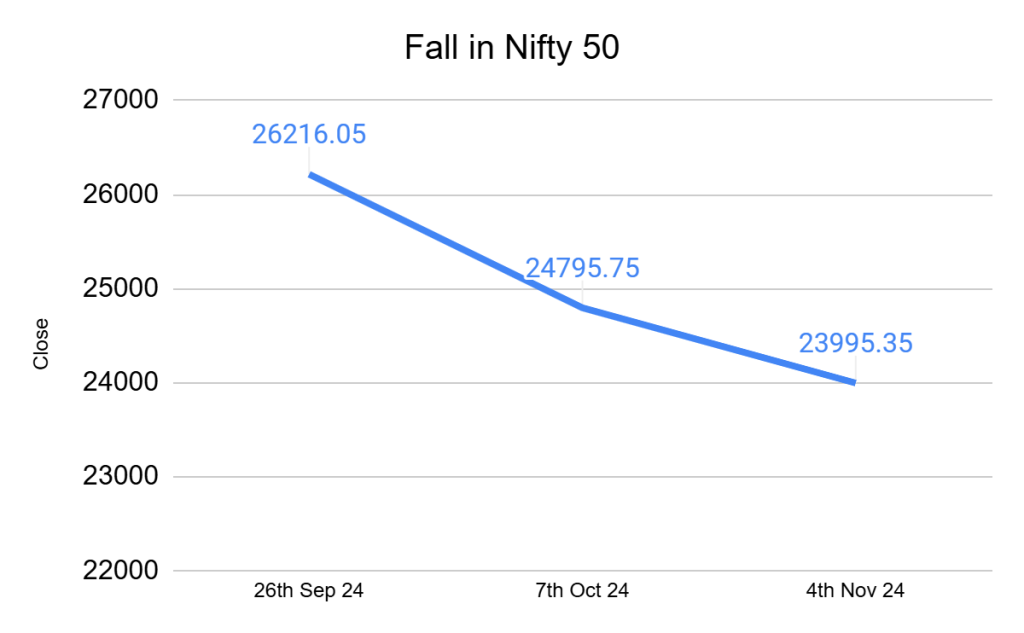

The Indian equity markets have seen heightened volatility, influenced by global and domestic factors. Previously, they had remained strong, driven by robust domestic investments and solid corporate performance. However, benchmark indices dropped by 8% in October amid increased foreign selling.

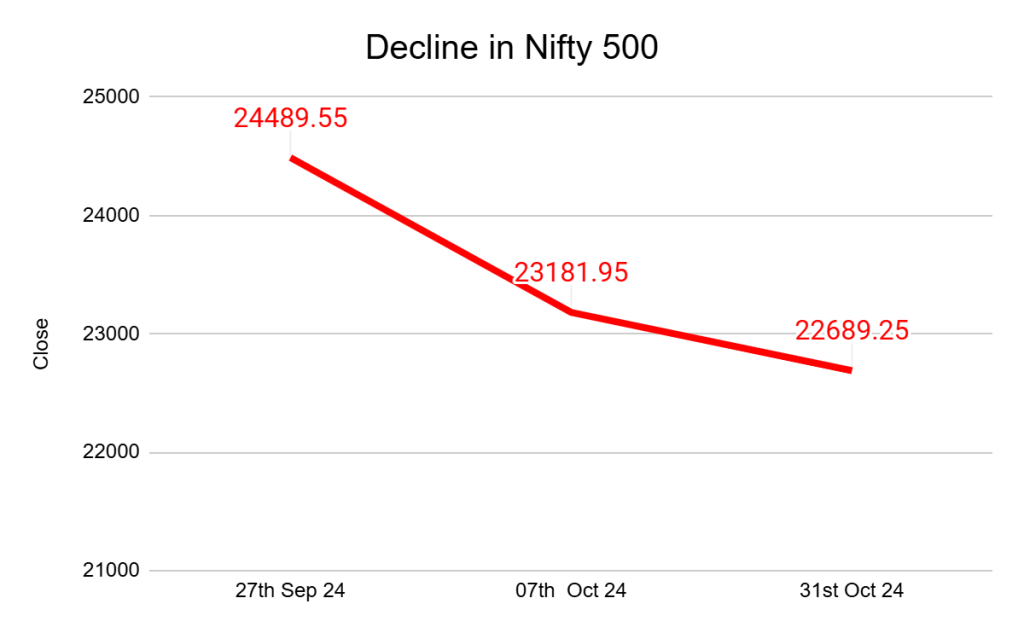

The market correction has been more pronounced, with over 175 stocks in the NSE 500 index dropping by more than 25% from their recent highs.

Despite strong inflows into domestic mutual funds, the market has seen volatility. In September, mutual funds saw ₹344 billion ($4 billion) in inflows, with total inflows for the first half of FY25 reaching $30 billion. SIP investments hit a new high of ₹245 billion ($2.9 billion) in September, continuing into October, and mutual funds have bought a net $9 billion this month.

Understanding these factors is crucial for investors to make informed decisions and manage risks effectively. Here’s a breakdown of the key causes driving the recent turbulence.

3 Reasons for the Volatility in Indian Equity Markets

Foreign Selling Pressure:

October saw record foreign outflows of $10 billion, bringing total Foreign Institutional Investor (FII) flows in FY25 to $150 million.

Factors Impacting Foreign Flows:

- Rising U.S. Yields: U.S. 10-year yields have increased by 65 basis points since mid-September. This reflects investors’ demand for higher returns due to inflationary pressures and the Federal Reserve’s ongoing rate-tightening stance. Higher yields in the U.S. attract global capital, pulling funds away from emerging markets, including India, as returns in U.S. bonds become more appealing with less perceived risk.

- Strengthened Dollar: The dollar index has appreciated by 3.5%. The dollar index measures the dollar’s strength against other major currencies. This strengthened dollar has made investments in U.S. assets more attractive while pressuring emerging market currencies. Foreign investors often reduce exposure to different markets as the dollar strengthens, leading to sell-offs and increased volatility in those regions.

- Shift to Asian Markets: New policies have redirected investments towards Chinese and Japanese markets.

Domestic Investment vs. Foreign Outflows

In FY22 and FY23, strong inflows into mutual funds, totaling $53 billion, effectively countered foreign institutional investor (FII) outflows of $18.5 billion in FY22 and $5 billion in FY23. This influx of domestic capital contributed to an 18% rise in the market during that period.

- Rising Equity Supply: The rapid increase in the issuance of new equity is putting pressure on domestic fund flows. As more companies raise capital through public offerings and private placements, there is greater competition for investment dollars. This situation can dilute funds available for existing investments, making it challenging for domestic mutual funds to maintain their buying momentum. Consequently, the market may experience increased volatility as these dynamics play out.

Increase in Q2 FY25: Supply surged to $21 billion from $15 billion in Q1, surpassing the $18 billion MF inflow comprising $4 billion in IPOs, $6 billion in Qualified Institutional Placements (QIPs), and $11 billion from secondary sales, mainly by private equity (PE) and promoters.

Source: Economic Times

Impact of Equity Supply on Market Direction

- Dependence on Foreign Flows: The substantial equity supply, projected at $55 billion in H2 FY25, is expected to exceed MF inflows, leading to market reliance on foreign capital.

- Shift from Debt to Equity: With $39 billion raised in the past 18 months, more capital is funding corporate expansion and acquisitions, promoting a shift from debt to equity funding.

Implications for the Market

- Volatility Sensitivity: As the pace of equity supply outpaces mutual fund inflows, the Indian equity market will likely remain sensitive to global economic factors and foreign flows.

- Equity-Driven Private Investment: Unlike past cycles driven by debt, the current cycle is expected to be equity-funded, with companies raising significant capital for expansion, acquisitions, and new projects.

Sectors Leading Capital Raises

- Power and Real Estate: The power sector anticipates $4.7 billion and real estate $4.1 billion in capital raises.

- Other Active Sectors: Key sectors such as IT and logistics, retail, healthcare, metals, and auto are also raising significant capital.

This robust equity supply signals the potential for an equity-driven investment cycle as companies across sectors prepare for expansion. Source: Economic Times

Conclusion

A complex interplay of global, domestic, and market-specific factors drives volatility in the Indian equity markets. While short-term fluctuations are common, long-term investors can benefit by staying informed and strategically managing their portfolios.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is this a good time to invest in the Indian equity market?

Market declines can often present buying opportunities for long-term investors. Suppose you have a long-term investment horizon and a strong conviction in the Indian economy’s growth potential. In that case, this may be the time to consider investing in quality stocks at discounted prices. However, it’s crucial to conduct thorough research or consult with a financial advisor before making any investment decisions.

Should I be worried about this decline?

While the 8% decline in October was significant, it’s important to remember that market fluctuations are a normal part of the investment cycle. Short-term volatility should not deter long-term investors with a well-diversified portfolio.

However, staying informed about the underlying factors driving the market’s movement is essential. Investors can make informed decisions about their investment strategy if they understand the reasons behind the decline.How can I protect my investments during such market volatility?

To safeguard your investments during market volatility, consider diversifying your portfolio by investing in different asset classes like stocks, bonds, and real estate. This can help reduce risk.

Regularly rebalancing your portfolio ensures you maintain your target asset allocation and avoid excessive exposure to any area. Implementing a dollar-cost averaging strategy allows you to invest a fixed amount consistently, minimizing the effects of market fluctuations.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.