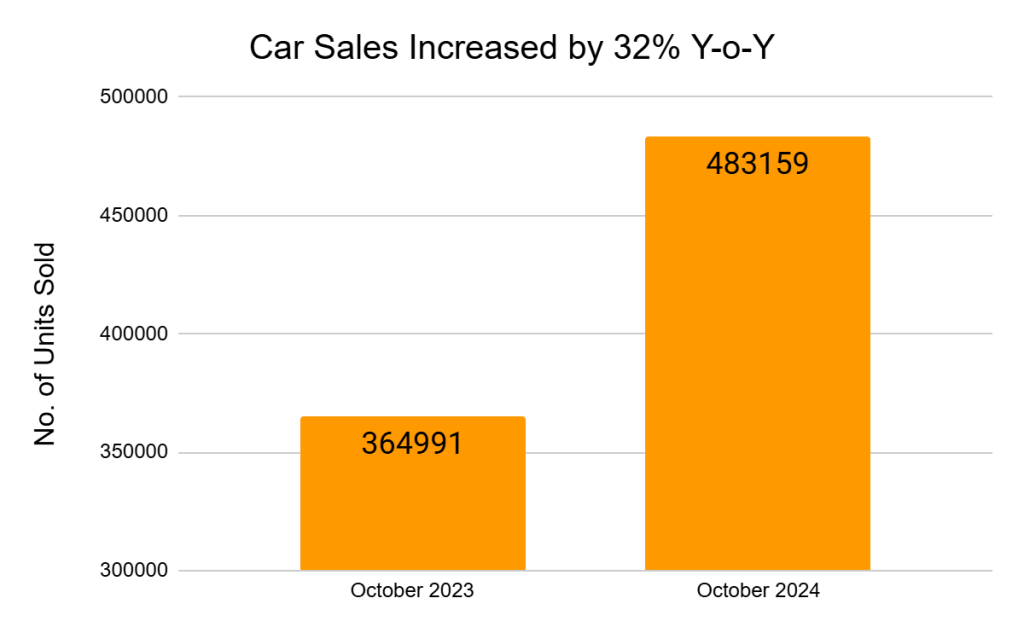

In October, India’s automotive market saw impressive growth, reflecting increased consumer enthusiasm during the festive season. Per the Federation of Automobile Dealers Associations (FADA), the retail car sector reported a remarkable 32% surge in sales, highlighting a strong demand recovery, particularly post-pandemic.

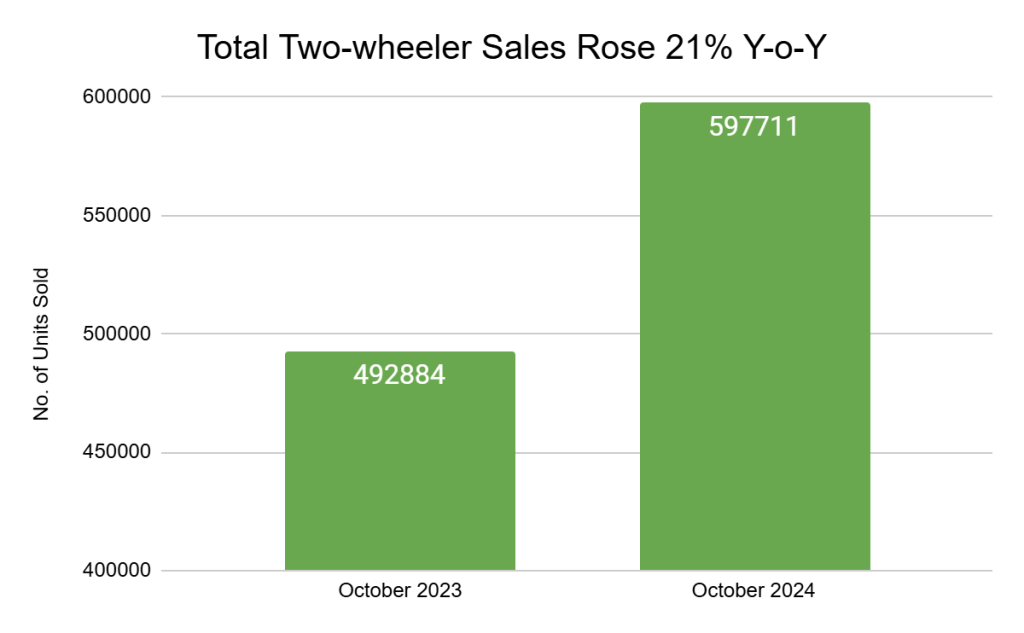

Similarly, Honda Motorcycle and Scooter India ((HMSI) recorded a 21% sales boost, with 5,97,711 units sold. This double-digit rise in two-wheeler and car sales underlines the broader trend of renewed consumer confidence and a preference for quality, affordable options during the celebratory season.

3 Factors For Automobile Sector Car Sales Growth

- Festive Season Impact: The festivals of Diwali and Dussehra spurred consumer interest, resulting in a substantial sales uptick.

- Improved Supply Chains: A smoother supply chain allowed car manufacturers to meet demand, reducing previous backlogs.

- Growing Demand for SUVs: Consumer preference for SUVs continues to dominate, with several brands releasing new models that meet consumer expectations.

Overview of Honda’s October Sales Growth

Honda Motorcycle and Scooter India reported 5,97,711 units sold in October, marking a 21% year-on-year growth. This included a 20% increase in domestic sales, totaling 5,53,120 units, while exports saw a notable 48% rise, with 44,591 units shipped internationally.

Key Factors Behind Honda’s Sales Surge

- Festive Demand: October, featuring festivals like Diwali, saw increased spending, especially on big-ticket items like motorcycles.

- Urban and Rural Demand: Honda benefitted from urban and rural demand, where motorcycles are favored for personal and professional use.

- Diverse Model Range: Honda’s focus on releasing versatile models targeting different consumer needs has paid off, appealing to a broader audience.

Automobile Sector Snapshot: Retail Sales Grow, Wholesales Decline

Retail car sales experienced a substantial uptick in October due to early festival demand, though wholesales to dealers remained flat, with SUVs as the only standout. According to FADA, high showroom inventory days extended to 75–80 days, prompting continued discounts through year-end.

Potential for Extended Discounts

FADA reports that while most unsold inventory consists of small cars, the share of SUVs is gradually increasing. Showroom visits were lower between April and September due to extreme weather, leading many customers to delay their purchases in anticipation of better discounts during the festive season. To clear the excess inventory, discounts may continue through the end of the year.

Implications for the Indian Automotive Market

This spike signals a sustained recovery in the automotive sector. With continued interest in passenger vehicles, especially SUVs, and anticipated improvements in economic conditions, car sales in India may maintain their upward trajectory into the next year.

Honda’s consistent growth reflects a positive trend in India’s two-wheeler market. With continued model innovation and potential expansion into electric two-wheelers, Honda aims to retain and grow its market share in the coming years.

Conclusion

October was a month of significant growth for India’s automotive sector. The festive season, coupled with improved supply chain dynamics and rising consumer confidence, fueled a surge in sales, particularly in the passenger vehicle and two-wheeler segments.

As the industry adapts to evolving consumer preferences and technological advancements, it is poised to drive economic growth and shape the future of mobility in India.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Why did the Indian auto sector witness such significant growth in October 2024?

The robust growth in India’s auto sector in October 2024 can be attributed to several key factors. Firstly, the festive season, a period of heightened consumer spending, boosted sales. Secondly, government initiatives like reduced GST rates on certain vehicles and supportive policies have positively impacted consumer sentiment.

Additionally, the rising middle class and changing consumer preferences, such as the increasing demand for personal mobility, have contributed to the surge in demand.Which segment of the auto industry experienced the most significant growth?

The passenger vehicle segment emerged as the star performer in October 2024, witnessing a remarkable 32% growth in sales. This can be attributed to several factors, including the launch of new models, attractive financing options, and the growing popularity of SUVs and premium cars.

What are the key challenges facing the Indian auto industry?

Despite the strong performance, the Indian auto industry faces several challenges. Rising input costs, including raw materials and components, can erode profitability. The global semiconductor chip shortage has also disrupted supply chains and affected production.

Furthermore, the increasing focus on electric vehicles and stringent emission norms pose significant challenges for traditional internal combustion engine vehicles.What is the outlook for the Indian auto industry in the coming months?

The positive momentum generated by the festive season is expected to continue, driven by sustained consumer demand. However, the industry must navigate challenges such as rising input costs, potential economic uncertainties, and the ongoing transition to electric vehicles. Automakers must invest in new technologies, innovative products, and sustainable practices to sustain growth.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.