As the Indian market evolves, Small and Medium Enterprises (SMEs) increasingly migrate from SME-specific platforms to main stock exchanges. Over 300 SMEs have already made this move, raising questions about their growth potential and sustainability. Could they transform into major market players like Zomato?

Over the past decade, 295 companies have transitioned from the Small and Medium Enterprises platform to the main index, delivering impressive shareholder gains. More than 110 of these firms have achieved returns exceeding 50%, while the top 50 have yielded returns of 250%, showcasing their potential for significant growth and investor satisfaction.

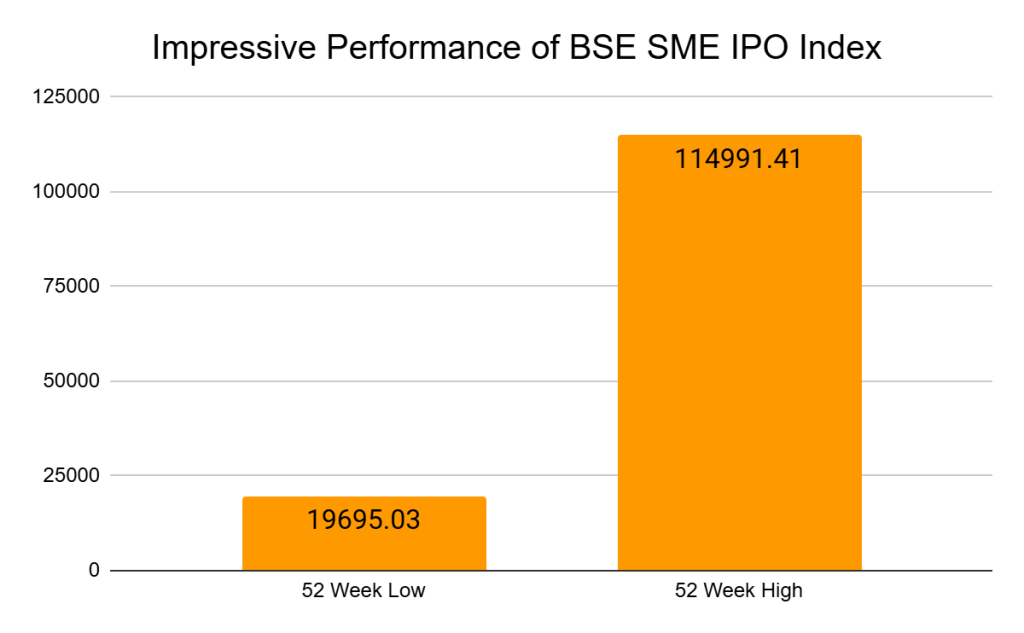

Performance Overview of the SME Index

Small and Medium Enterprises Index has demonstrated impressive annualized gains, reaching 195% over the last decade. These returns highlight the index’s role in attracting investment to SMEs, supporting economic growth, and generating jobs.

Recent Market Movements and Resilience

On August 28, 2024, the BSE SME IPO Index peaked at 1,14,991 before correcting to 93,747 on October 25 amid foreign institutional investor (FII) sell-offs. Despite volatility, the index bounced off its 200-day EMA, signaling resilience and potential upward movement. According to industry experts, this bounce at a key support level shows strong investor confidence.

Why Are Small and Medium Enterprises Migrating to Main Exchanges

1. Access to Capital:

Migrating to a main exchange gives small and medium enterprises access to a broader pool of institutional investors, allowing them to raise capital on more favorable terms. This is essential for SMEs aiming for expansion and market penetration.

2. Increased Visibility and Credibility:

Main exchange listing enhances brand visibility and instills confidence in stakeholders, including customers, suppliers, and partners. This credibility is essential for scaling operations and competing with larger, established firms.

3. Regulatory Rigor and Governance:

Moving to a main exchange often demands stricter compliance, which can improve corporate governance standards and operational transparency. This structure attracts investors who are cautious of Small and Medium Enterprise risks but value accountability.

Top 15 Small and Medium Enterprises That Migrated to the Main Exchange

| Name | Market Cap in crore (as of 08-11-24) | Current Price (in Rs. as of 08-11-24) | 1-YR Return (%) |

| Waree Renewables | 88,196 | 3070 | 544.31 |

| KPI Green Energy | 10,593 | 807 | 182.28 |

| E2E Networks | 8,647 | 5121 | 851.99 |

| Share India Securities | 6,255 | 289 | -1.86 |

| Manorama Industries | 6,347 | 1065 | 132.87 |

| Aditya Vision | 5,451 | 424 | 57.32 |

| Sky Gold | 4,890 | 3337 | 364.84 |

| Sarvotech Power Systems | 4,152 | 186 | 143.12 |

| K P Energy | 4,014 | 602 | 257.2 |

| D P Abhushan | 3,846 | 1701 | 184.68 |

| Hi-Tech Pipes | 3,706 | 182 | 84.82 |

| Raghav Productivity Enhancers | 3,631 | 1582 | 128.51 |

| Gensol Engineering | 3,130 | 826 | 2.91 |

| Marine Electricals India | 3,145 | 228 | 185.74 |

| Jash Engineering | 3,034 | 485 | 72.72 |

Financial Performance of Waaree Renewable Technologies

In the past year, Waaree Renewable Technologies’ share price surged by 544%, making it one of the hottest stocks in the market. In Q2 FY25, the company saw a 160% rise in net profit to INR 53 crore, with sales increasing 250% to Rs. 524 crore, boosting its market cap to Rs. 18,000 crore.

Listed on the BSE SME Index in August 2012, Waaree Renewable moved to the main exchange in 2019 due to market cap and sales growth. Since then, its performance has consistently impressed investors.

Other Successful SME Migrants

Several other companies, including KPI Green Energy, E2E Networks, Jash Engineering, and Gensol Engineering, have shown strong fundamentals. For example, KPI Green Energy’s Q2 revenue rose 70% to INR 361 crore, with profit up 99% to INR 70 crore, indicating solid long-term growth among SMEs transitioning to the main exchange.

Potential Growth Paths for SMEs on Main Exchanges

1. Mimicking Zomato’s Success Story:

Zomato’s rapid scale-up and eventual IPO offer a blueprint for how SMEs might get large-scale investment and user engagement. For a tech-driven SME, for instance, exposure on the main exchange can lead to faster scaling, similar to how Zomato leveraged its online platform to dominate the food delivery market.

2. Sector-Specific Opportunities:

SMEs in technology, pharmaceuticals, and finance have shown significant growth potential. Those strategically positioned in these high-growth sectors can benefit from shifting consumer demands and favorable policies, such as the government’s “Make in India” initiative.

Challenges SMEs Face on the Main Exchange

Intense Competition:

While main exchanges offer growth opportunities, they expose SMEs to intense competition from well-established companies. Many SMEs may struggle to compete due to limited resources or experience.

Cost of Compliance:

Meeting the compliance and reporting standards on a main exchange can be costly and complex. For some SMEs, these requirements might strain their finances, impacting profitability.

Maintaining Consistent Growth:

Investor expectations can be demanding on the main exchange, requiring SMEs to demonstrate growth and profitability consistently. A lack of sustained growth may cause stock volatility and erode investor confidence.

Will All SMEs Succeed?

While many SMEs may strive to replicate Zomato’s success, not all are positioned for such transformative growth. Success depends on their sector, adaptability, and capacity to innovate. The main exchange offers a platform, but scaling requires robust business models and resilience. Some SMEs may achieve high valuations, while others may take years to gain traction.

Risks and Considerations for Investors

Despite high returns, ex-SME stocks require careful consideration. These companies must establish credibility through consistent profit growth, fair valuations, and sound governance. High promoter risk also makes institutional investors cautious. Tracking these stocks closely is essential for retail investors, as only a select few might evolve into small or mid-cap entities.

Conclusion

SMEs’ migration to main exchanges marks a significant development in India’s capital markets, opening avenues for growth and investment. While not every SME will reach Zomato’s scale, those with unique value propositions and effective governance could become vital players in the long run.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What does “300 SMEs leap Main Exchange” mean?

This means 300 small and medium-sized enterprises (SMEs) have decided to list their shares on a main stock exchange, like the NSE or BSE in India. This allows them to raise capital from a wider pool of institutional investors.

Why is this a significant development?

This is a significant development because it indicates growing confidence in the Indian economy and the potential of SMEs. Listing on the main exchange gives these companies credibility and access to a larger investor base, which can fuel their growth and innovation.

What does this mean for the future of the Indian economy?

This development signifies a new era for the Indian economy, where SMEs are increasingly important. As more and more SMEs list on the main exchange, it can increase economic activity, job creation, and overall growth. It also highlights the potential of the Indian startup ecosystem and its ability to produce innovative and high-growth companies.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.