Have you been tracking developments in the renewable energy sector? If you’re interested in green energy or the stock market, you may want to know more about NTPC Green Energy Limited’s upcoming IPO.

With an issue size of ₹10,000 crore, it has caught the attention of many industry watchers and market participants. This IPO marks a significant move for NTPC Green Energy, offering investors an opportunity to engage with a company focused on renewable energy solutions. Here’s a detailed breakdown of everything you need to know about this offering.

NTPC Green Energy IPO Details

NTPC Green Energy’s ₹10,000 crore IPO is a fresh issue of 92.59 crore shares, opening for subscription from November 19, 2024, to November 22, 2024. The price band is set at ₹102 to ₹108 per share, with a minimum lot size of 138 shares, requiring a retail investment of at least ₹14,904.

| Offer Price | ₹102 to ₹108 per share |

| Face Value | ₹10 per share |

| Opening Date | 19 November 2024 |

| Closing Date | 22 November 2024 |

| Total Issue Size (in Shares) | 925,925,926 |

| Total Issue Size (in ₹) | ₹10,000.00 Cr |

| Issue Type | Book Built Issue IPO |

| Lot Size | 138 Shares |

| Listing at | BSE, NSE |

Allocation of Shares

For small non-institutional investors (sNII), the minimum investment is 14 lots (1,932 shares), amounting to ₹208,656, while big non-institutional investors (bNII) need to invest in a minimum of 68 lots (9,384 shares), totaling ₹1,013,472. The shares are scheduled to list on the BSE and NSE on November 27, 2024.

| Qualified Institutional Buyers (QIBs) | Not less than 75% of the Net Issue |

| Non-Institutional Investors (HNIs) | Not more than 15.00% of the Net Issue |

| Retail Investors | Not more than 10% of the Net Issue |

Objectives of the IPO

The company intends to use the net proceeds from the IPO for the following purposes:

- Investment in NTPC Renewable Energy Limited (NREL): To fund the repayment or prepayment of certain borrowings availed by NREL.

- General Corporate Purposes: To strengthen the company’s financial position and operational flexibility.

Grey Market Premium (GMP)

The Grey Market Premium (GMP) for NTPC Green Energy’s unlisted shares stood at ₹1, translating to a premium of 0.93% over the upper end of the price band. This is a dip from the ₹3 premium recorded on November 14, 2024, reflecting fluctuating investor sentiment in the grey market. Source: Business Standard

Company Overview

Incorporated in April 2022, NTPC Green Energy Limited is a wholly-owned subsidiary of NTPC Limited, India’s largest power producer. Focused on renewable energy, the company undertakes projects through both organic development and strategic acquisitions. As of August 31, 2024, NTPC Green Energy has an operational capacity of 3,071 MW from solar projects and 100 MW from wind projects across six states.

By June 30, 2024, its portfolio had expanded to 14,696 MW, comprising 2,925 MW of operating projects and 11,771 MW of contracted and awarded projects. The company is currently constructing 31 renewable energy projects across seven states, totaling 11,771 MW. With 15 off-takers engaged across 37 solar and 9 wind projects, NTPC Green Energy has established a strong market presence.

Backed by NTPC Limited’s extensive experience in large-scale project execution and supported by a highly skilled team, NTPC Green Energy is well-positioned to deliver on its vision of advancing renewable energy solutions.

Financial Strength

NTPC Green Energy has demonstrated strong financial growth:

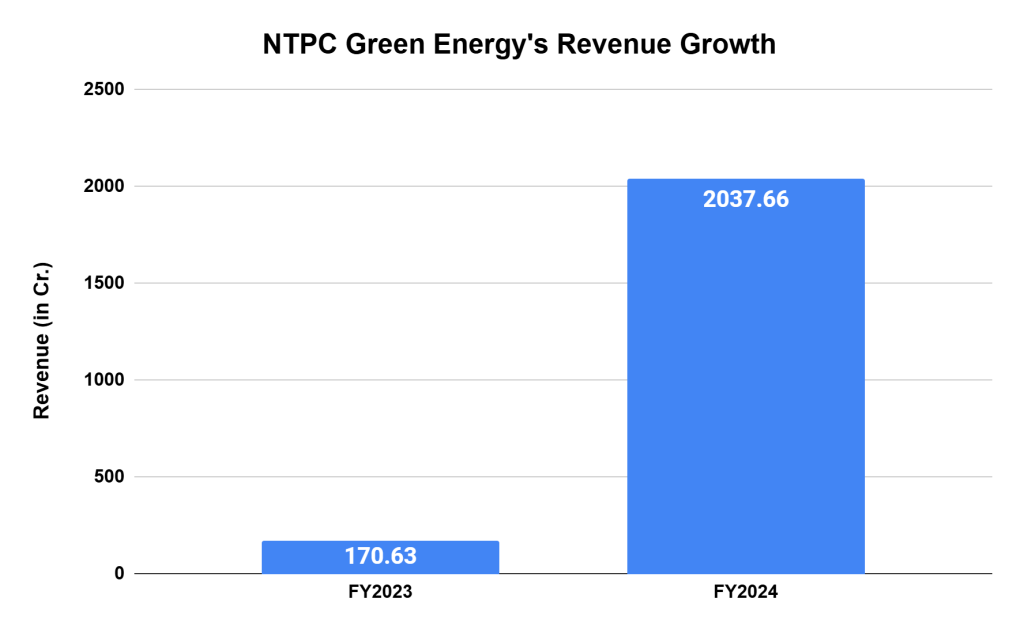

- Revenue Growth: A staggering increase of 1,094.19% between FY23 and FY24.

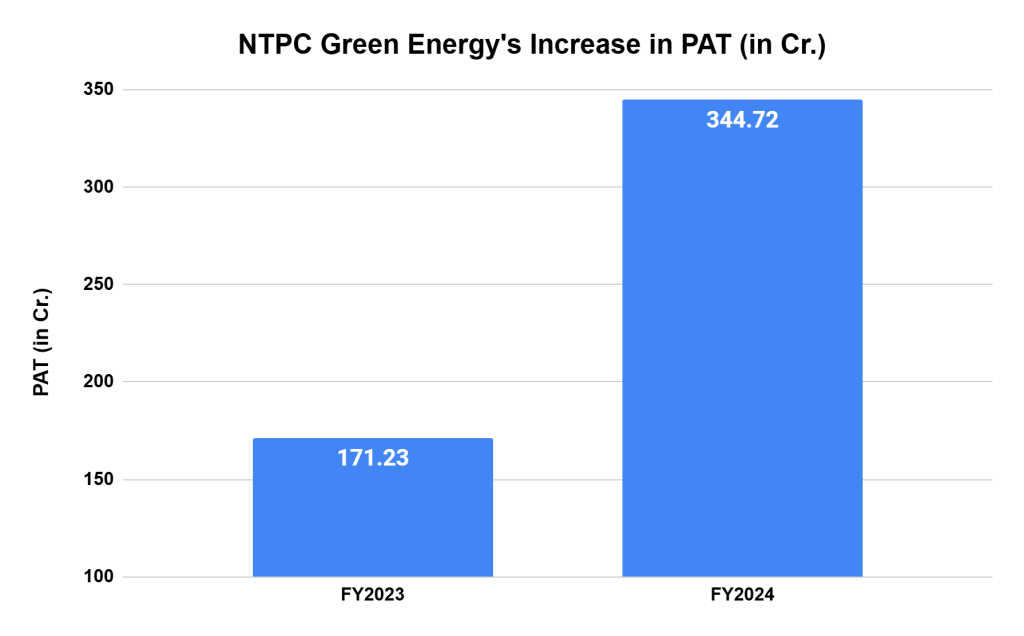

- Profit After Tax (PAT): Grew by 101.32% in the same period.

This growth underscores the company’s capability to scale its operations and generate consistent profits, even in a highly competitive sector.

SWOT Analysis of NTPC Green Energy

| STRENGTHS | WEAKNESSES |

| Strong Backing: Supported by NTPC Limited, ensuring financial and operational reliability. Large Portfolio: A diversified renewable energy portfolio of 14,696 MW across solar and wind projects. Execution Expertise: Proven track record in large-scale renewable energy projects. | Sector Dependency: Heavily reliant on the renewable energy sector, making it vulnerable to sector-specific risks. Revenue Concentration: A significant portion of revenue depends on key off-takers. |

| OPPORTUNITIES | THREATS |

| Rising Demand for Renewable Energy: With increasing global focus on sustainable energy, the company is well-positioned to capitalize on the demand. Government Support: Strong government push towards renewable energy adoption and infrastructure development. | Market Competition: Intense rivalry from established and emerging players in the renewable energy space. Regulatory Risks: Changes in government policies or tariffs could impact revenue streams. |

Conclusion

NTPC Green Energy’s ₹10,000 crore IPO is a significant step for the renewable energy arm of NTPC Limited. With its expansive portfolio and backing from India’s largest power producer, the company is poised to make a mark in the renewable energy sector. However, market conditions and competitive dynamics will play a crucial role in determining the IPO’s success.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.