The stock market constantly changes, and investors closely follow the money movement. Recently, Indian markets have faced a big challenge due to a record sell-off by Foreign Institutional Investors (FIIs).

This large-scale exit has raised worries about market stability. In this uncertain situation, a key question arises: can domestic mutual funds (MFs) support the markets? Let’s break down the problem, understand its reasons, and see how mutual funds might help.

Domestic Institutional Investors (DIIs) to the Rescue

To counterbalance the effects of FII selling, Domestic Institutional Investors (DIIs) have stepped up as significant buyers in Indian equities, gaining considerable influence in the market. This growth is largely driven by mutual funds, particularly through the steady inflows from systematic investment plans (SIPs), which have become a driving force behind DII strength.

Mutual Fund SIP Inflows Surge 200%

Mutual Fund SIP inflows have grown significantly, from ₹8,000 crore in January 2021 to a massive ₹25,300 crore by October 2024—an increase of around 200%. This steady inflow has allowed Domestic Institutional Investors (DIIs) to shift from a net negative position of ₹12,000 crore to becoming net buyers with ₹10.41 lakh crore during the same period.

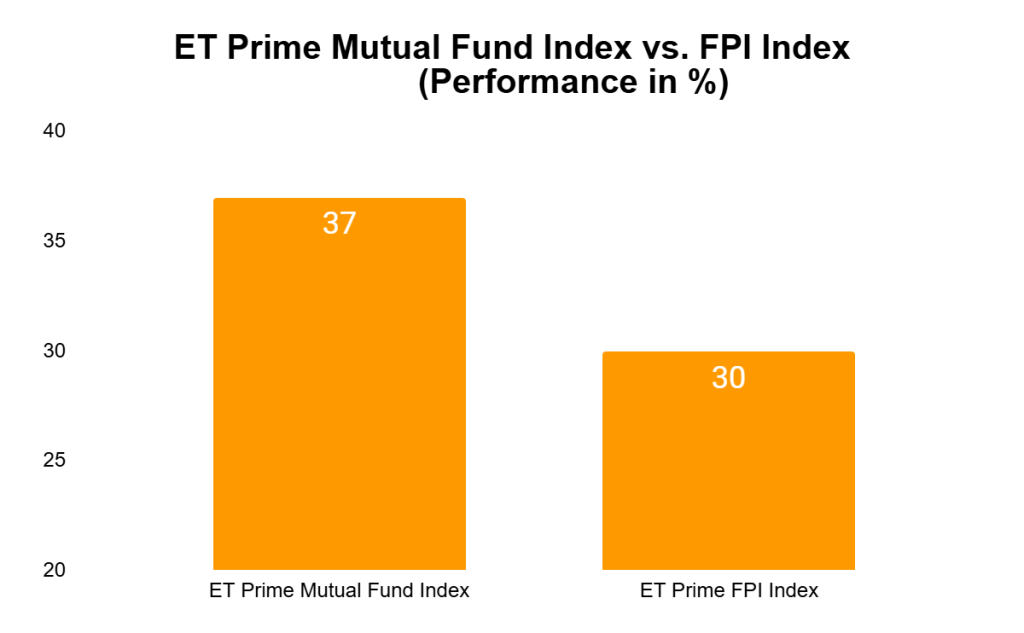

The ET Prime Mutual Fund Index highlights the crucial role of DIIs in stabilizing the market. With impressive returns of 37%, it has outperformed the ET Prime FPI Index, which recorded a return of 30%.

Interestingly, retail investors led the pack two years ago, thanks to their focus on small-cap stocks and niche investments like BSE. However, the tide has turned. Today, DIIs outperform in returns and the volume of funds flowing into Indian markets, making them a critical pillar of market stability.

Impact on the Indian Market

The sustained selling by foreign institutional investors (FIIs) has had a notable impact on the Indian market, leading to significant volatility in the benchmark indices Sensex and Nifty. Mid-cap and small-cap stocks have been particularly affected.

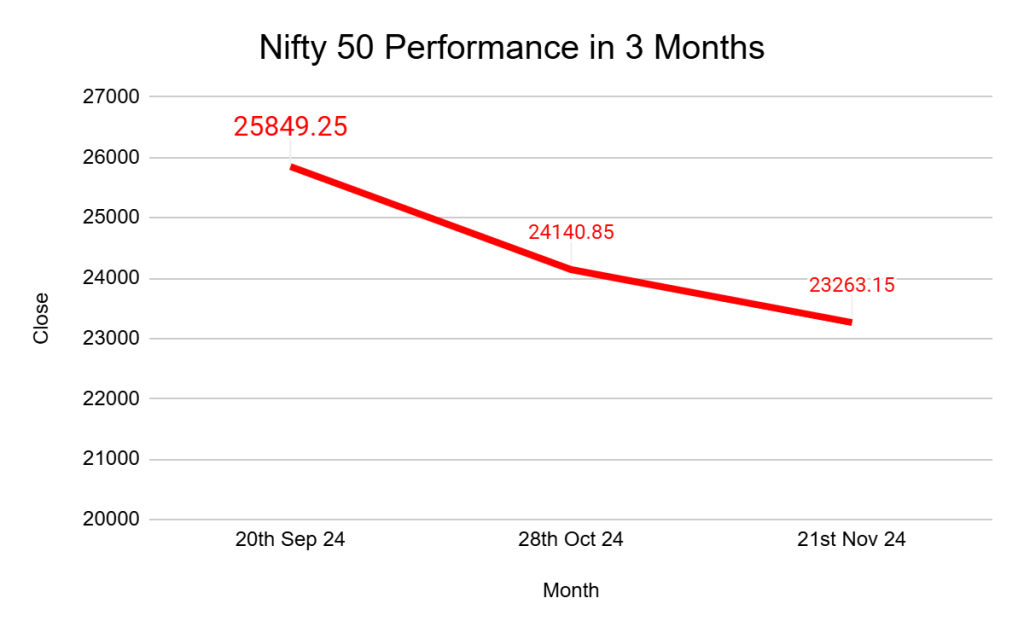

Last month, FIIs offloaded a massive ₹1.14 lakh crore in the cash market, far exceeding the typical monthly average of around ₹12,000 crore. This sharp sell-off dented market sentiment, causing the Nifty 50 to drop nearly 9% over the past two months.

Source: ET Prime

From a high of 25,849 points in September, Nifty tumbled to 24,140 points in October. It slid further to 23,263 points before recovering to 24,221 points on 25 November 2024. The index has faced a bumpy ride, influenced by global and domestic events, including China’s stimulus package, the U.S. elections, and the recent indictment of Gautam Adani in the U.S. The uncertainty has kept investors on edge, reflecting the market volatility. Source: ET Prime

FII & DII Growing Divide

Since March 2023, the gap between FII selling and DII buying has expanded. In January 2022, while FIIs sold a net ₹1.33 lakh crore compared to January 2021, Domestic Institutional Investors (DIIs) stepped in with net purchases of ₹1.16 lakh crore, almost matching the FII outflows. In February 2022,

FIIs increased their net sales to ₹1.79 lakh crore, yet DIIs continued their buying spree with net purchases of ₹1.58 lakh crore, helping to stabilize the market amid the selling pressure.

Sector Composition in Institutional Indices

The MF and FPI indices are predominantly composed of stocks from the financial sector. All financial stocks are performing well in the MF index except Equitas SFB. In the FPI index, most stocks, except AU Small Finance Bank and Five-Star Business Finance, have delivered returns exceeding 14%. Notable performers in the MF index include MCX, Fortis, and Kalpataru Projects, with mutual funds holding almost 42% of Kalpataru’s stake.

In the FPI index, top performers include Zomato, PB Fintech, M&M, and 360 One Wam. According to Axis Securities, Zomato has built a robust business model with solid growth potential, driven by increased market share and greater revenue visibility over the long term.

Source: ET Prime

What Lies Ahead?

The road ahead for Indian markets depends on several factors:

- FII Sentiment: The return of FIIs will largely hinge on stabilizing global economic conditions and making Indian equity valuations more attractive.

- MF Strategy: Mutual funds need to maintain their disciplined investment approach. Expanding their asset base and enhancing retail participation will further strengthen their role.

- Policy Interventions: The government and regulatory bodies can intervene to make Indian markets more appealing to foreign and domestic investors. Measures like incentivizing long-term investments or easing restrictions for FIIs could help.

Why Retail Investors Should Stay Calm

As an individual investor, it’s easy to feel alarmed by headlines of record sell-offs. But here’s why staying invested makes sense:

- Market Cycles Are Normal: Markets go through ups and downs. Historical data shows that staying invested during downturns yields better returns when markets recover.

- Power of SIPs: By continuing your SIPs during market corrections, you effectively buy more units at lower prices, boosting returns in the long term.

- Diversification Is Key: To minimize risk, ensure your portfolio is diversified across asset classes and sectors.

The Bigger Picture

While the current FII sell-off is undoubtedly troubling, it also highlights the growing maturity of Indian markets. The resilience shown by mutual funds and retail investors speaks volumes about the strength of domestic participation. As India continues its economic growth journey, these factors will be crucial in shaping a more robust and self-reliant market.

Record FII sell-offs might shake the markets, but they also test their resilience. Domestic mutual funds, backed by a growing base of confident retail investors, are proving stabilizing. However, challenges persist, and the journey ahead will require strategic policy support, disciplined investment approaches, and sustained investor confidence.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are SIPs?

A Systematic Investment Plan (SIP) is a simple investment strategy where a fixed sum of money is regularly invested in a mutual fund scheme. This disciplined approach helps investors average the cost of investment over time, reducing the impact of market volatility.

Why are SIPs becoming so popular?

SIPs have gained immense popularity due to their numerous benefits. They promote disciplined investing, allow for rupee-cost averaging, and offer flexibility regarding investment amounts and frequencies. Additionally, SIPs are suitable for novice and experienced investors, making them a popular choice for wealth creation.

How do SIPs help in times of market volatility?

During market downturns, SIPs allow investors to buy more units of a mutual fund at a lower cost. This strategy, known as rupee-cost averaging, can help investors accumulate more units over time, potentially leading to higher returns in the long run.

What is the impact of FII outflows on the Indian market?

Foreign Institutional Investors (FIIs) have been significant players in the Indian stock market. However, recent FII outflows have raised concerns about the market’s stability. While this may lead to short-term volatility, the consistent inflow of SIP money has helped mitigate the impact of FII selling. DIIs, powered by SIPs, have emerged as a key support for the Indian market.

How useful was this post?

Click on a star to rate it!

Average rating 3.3 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.