Are you one of the investors who eagerly subscribed to Waaree Energies’ IPO? If so, you’re not alone. The initial public offering of Waaree Energies Ltd, a leading solar PV modules manufacturer, has received an overwhelming response, breaking records with the highest-ever number of applications for an IPO. Following this remarkable demand, Waaree Energies has finalized its IPO allotment, and shares are set to list at a significant premium in the grey market.

Here’s a closer look at the key details, including the IPO’s record-breaking subscriptions, the premium in the grey market, and how you can check your allotment status.

Record-Breaking Waaree Energies IPO Subscription

The Waaree Energies IPO saw stellar demand from investors across categories. The IPO was open for subscription from October 21 to October 23, during which it received bids totaling an impressive 160.91 crore equity shares, significantly higher than the 2.10 crore shares available. This demand resulted in a total oversubscription of 76.34 times, amounting to approximately ₹2.41 lakh crore in bids.

| Qualified institutional buyers | 208.63 times |

| Non-institutional investors | 62.49 times |

| Retail investors | 10.79 times |

| Employees | 7.33 times |

This huge response was primarily driven by institutional investors, with the Qualified Institutional Buyers (QIBs) portion being oversubscribed 208.63 times. Non-institutional investors (NII) also showed strong interest, with their category subscribed 62.49 times.

Retail investors, too, demonstrated substantial participation, with a 10.79 times subscription in the retail category. This high subscription reflects the strong interest in the renewable energy sector and Waaree Energies’ established presence in the Indian solar market.

Waaree Energies IPO GMP Today

In the grey market, Waaree Energies shares are trading at a substantial premium, indicating positive investor sentiment. Today’s grey market premium (GMP) stands at ₹1,590 per share, suggesting that the shares are trading at approximately ₹3,061 apiece—about 106% above the IPO price of ₹1,503 per share. This surge in GMP signals a strong debut for Waaree Energies shares in the unlisted market and reflects high expectations for the company’s performance post-listing.

Checking Waaree Energies IPO Allotment Status

With the allotment finalized, investors can now check if they have secured shares in the IPO. The shares are expected to be credited into the demat accounts of successful applicants on October 25, and refunds for unsuccessful bids will be initiated on the same day. To check your allotment status online, you can use the BSE website, the NSE website, or the IPO registrar’s portal, Link Intime India Private Ltd. Here’s how:

Checking Allotment Status on the BSE

1. Visit the BSE website.

2. Select ‘Equity’ under Issue Type.

3. In the dropdown menu for Issue Name, choose ‘Waaree Energies Limited.’

4. Enter your Application Number or PAN.

5. Verify by selecting ‘I am not a robot’ and click ‘Search.’

Your allotment status will then be displayed on the screen.

Checking Allotment Status on Link Intime

1. Visit the Link Intime India website: [Link Intime IPO Page](https://linkintime.co.in/initial_offer/public-issues.html).

2. Select ‘Waaree Energies Limited’ in the dropdown for Select Company.

3. Choose from PAN, Application Number, DP ID, or Account Number.

4. Enter the necessary details based on your selection.

5. Click on ‘Search’ to view your allotment status.

Details of Waaree Energies IPO

Waaree Energies Ltd launched its IPO with a price band of ₹1,427 to ₹1,503 per share, aiming to raise ₹4,321.44 crore at the upper end. The company’s goal for the funds includes establishing a 6 GW facility for ingot wafer, solar cell, and PV module manufacturing in Odisha, alongside general corporate purposes.

The IPO consists of a fresh issue of 2.4 crore equity shares, which raised ₹3,600 crore, and an offer for sale (OFS) of 48 lakh shares, contributing ₹721.44 crore. With a market valuation projected at over ₹4,300 crore post-issue, Waaree Energies is set to solidify its footprint in India’s renewable energy sector. Source: SEBI

Company Background and Financial Performance

Waaree Energies, one of India’s prominent solar PV module manufacturers, operates five manufacturing facilities in Surat, Tumb, Nandigram, and Chikhli in Gujarat and the IndoSolar Facility in Noida, Uttar Pradesh. As of June 30, 2023, the company’s production capacity stood at 12 GW, underscoring its extensive scale in the PV module industry.

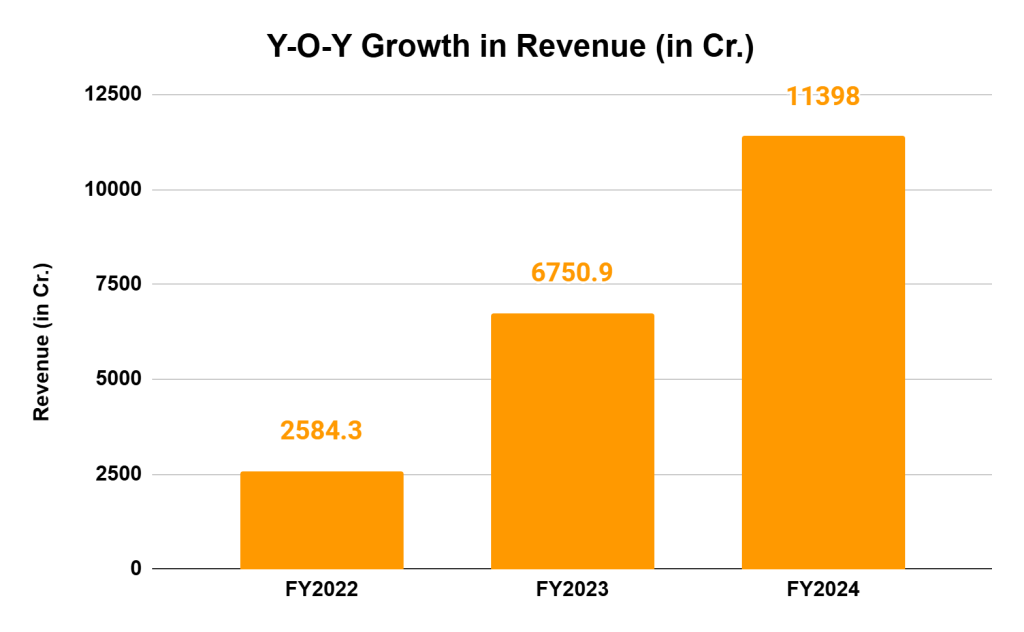

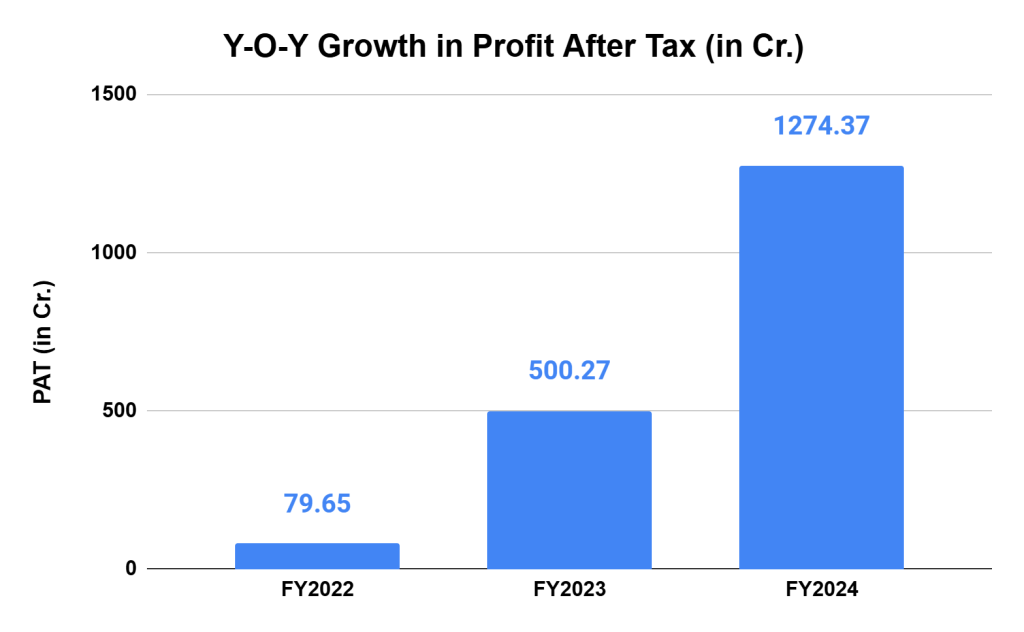

Financially, Waaree Energies has demonstrated good performance. For FY24, the company’s revenue grew by 69% year-on-year to ₹11,398 crore, while its profit after tax surged to ₹1,274 crore, more than double compared to the previous fiscal year. This financial strength likely contributed to the strong response to the IPO.

Waaree Energies IPO Allotment and Next Steps

Following the finalization of the IPO allotment, Waaree Energies shares are set to list on both the BSE and NSE, with a likely listing date of October 28. Investors who receive allotments can anticipate their shares to be credited to their demat accounts on October 25. Given the high GMP and the IPO’s substantial oversubscription, analysts believe Waaree Energies may have a strong debut on the stock exchange.

With its significant market presence, ambitious expansion plans, and positive reception in the grey market, Waaree Energies is positioned as a key player in India’s renewable energy landscape. Investors can eagerly await the official listing and watch for further developments as the company scales its operations to meet India’s growing demand for clean energy.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.