Remember the pre-election market frenzy? Everyone chased the Nifty 50, hoping to ride that bull to the bank. But what happened post-election? Did those same momentum stocks keep climbing, or did something unexpected happen? Let’s look closely at the data to see which sectors are grabbing investor attention now and why the focus might have shifted toward FMCG companies.

Let’s Talk Numbers

The Nifty 200 Momentum 30 Index, which tracks companies with strong price momentum, has significantly outperformed the broader Nifty 50. Over the past year, the Momentum Index has delivered a whopping 70% return, compared to the Nifty 50’s 25%. This trend has continued in the last six months, with the Momentum Index surging 32% against the Nifty 50’s 12%.

Companies within the Nifty 500 index were analyzed to identify these momentum plays. It was observed that stocks with 20-day short-term simple moving averages (SMA) were consistently higher than the long-term 200-day simple moving average (SMA), indicating an upward price trend. These stocks also delivered higher returns in the last month than their one-year performance.

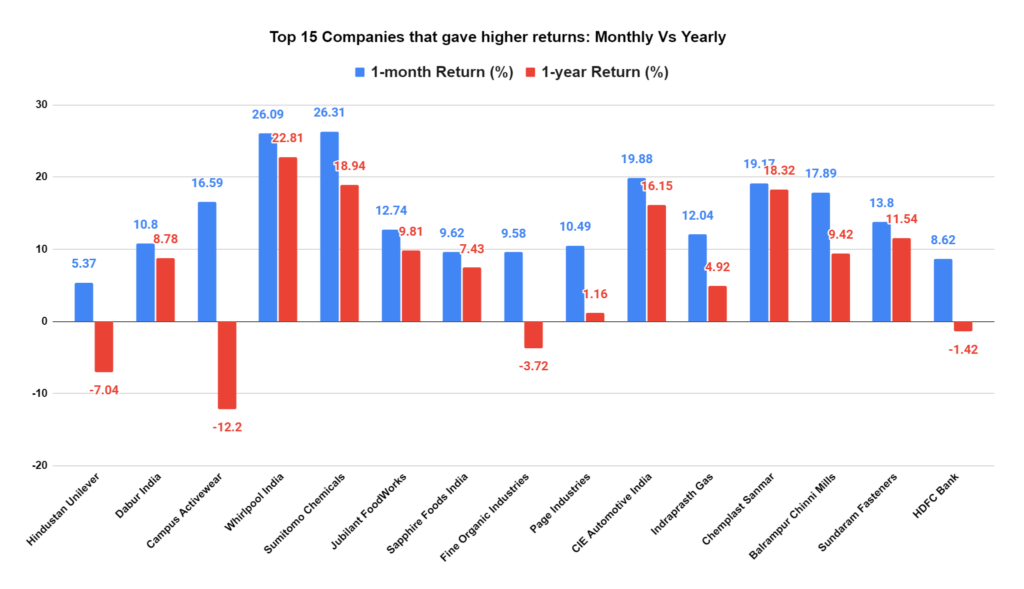

15 Stocks That Delivered Bigger Returns in 20 Days Than 200

| Company | 1-month Return (%) | 1-year Return (%) | Market Cap (INR Crore) | PE (x) | Closing Price (on 14/06/24) |

| Hindustan Unilever | 5.37 | -7.04 | 584,437.33 | 57.78 | 2,479.75 |

| Dabur India | 10.80 | 8.78 | 108,048.96 | 71.59 | 608.65 |

| Campus Activewear | 16.59 | -12.20 | 8,678.29 | 97.03 | 280.55 |

| Whirlpool India | 26.09 | 22.81 | 22,770.96 | 136.05 | 1,784.90 |

| Sumitomo Chemicals | 26.31 | 18.94 | 24,403.24 | 66.01 | 497.55 |

| Jubilant FoodWorks | 12.74 | 9.81 | 35,143.36 | 150.24 | 530.65 |

| Sapphire Foods India | 9.62 | 7.43 | 9,611.94 | 189.33 | 1,503.75 |

| Fine Organic Industries | 9.58 | -3.72 | 14.402.52 | 39.18 | 4,673.45 |

| Page Industries | 10.49 | 1.16 | 43,313.84 | 76.10 | 38,512.70 |

| CIE Automotive India | 19.88 | 16.15 | 22,004.92 | 38.49 | 569.55 |

| Indraprasth Gas | 12.04 | 4.92 | 34,093.54 | 19.50 | 482.60 |

| Chemplast Sanmar | 19.17 | 18.32 | 8,788.52 | – | 621.50 |

| Balrampur Chinni Mills | 17.89 | 9.42 | 8,859.82 | 20.45 | 430.20 |

| Sundaram Fasteners | 13.80 | 11.54 | 27,135.98 | 56.57 | 1,289.05 |

| HDFC Bank | 8.62 | -1.42 | 1,202,263.69 | 19.77 | 1,596.90 |

FMCG Takes Center Stage

HUL justifies Premium Valuation

The data reveals a fascinating trend – many of these momentum stocks belong to the FMCG sector. Take Hindustan Unilever (HUL), for example. While the stock has underperformed in the last year, declining by 7%, the past month has seen a dramatic turnaround with a 5% gain. This shift can be attributed to investor optimism regarding the new government’s focus on welfare schemes and rural spending, which is expected to boost consumption of FMCG products.

However, the high valuation of FMCG stocks like HUL, with a PE ratio of around 60x, creates a debate. Value investors might be hesitant due to the perceived high c. In contrast,ile quality investors recognize the potential for long-term returns from consistent market leaders like HUL, justifying their premium valuations.

Dabur: A Standout Performer

Another notable mention is Dabur, a stock from the expensively valued healthcare sector. Despite a PE ratio of 72x, the stock has climbed 12% in the last month and sits just 7% below its all-time high. Solid financials back these impressive performances—Dabur reported revenue and profit growth exceeding its peers like HUL, Marico, or Britannia. Notably, Dabur stood out as the top performer on the Nifty 500 Index on June 4th, bucking the market trend that saw a 6% drop due to election results.

Campus Activewear Defies Expectations

Following the FMCG giants, Campus Activewear emerges as another interesting contender on the post-election list. While the athletic footwear brand witnessed a lackluster performance over the past year, delivering a negative return of 12.20%, the last month saw a dramatic shift. Campus Activewear defied expectations and surged a remarkable 16.59%. This sudden jump could be attributed to several factors.

Firstly, a stable government often translates to increased consumer spending, potentially benefiting companies like Campus Activewear that cater to the growing demand for athleisure wear.

Secondly, the company’s strong brand presence and established distribution network might position it to capitalize on this potential spending surge. However, it’s important to note that Campus Activewear’s P/E ratio currently sits at 97.03x. It could indicate that the stock may be priced above its current earnings potential.

Beyond FMCG: A Diverse Momentum Play

While FMCG dominates the list, other sectors are also represented. Companies like Whirlpool India and Sumitomo Chemicals, which saw minimal growth in the pre-election year, have witnessed a surge of 26% each in the last month. Even the QSR (Quick Service Restaurant) segment makes an appearance with Jubilant FoodWorks (Domino’s, Dunkin’ Donuts) and Sapphire Foods (KFC, Pizza Hut) experiencing gains of 13% and 8% respectively, despite their already high PE ratios exceeding 150x.

A Look at the Outliers

CIE Automotive India is unique in delivering gains before and after the elections. This auto component manufacturer witnessed a 10% rise in the pre-election year, followed by another 20% post-election. Similarly, Page Industries, another outlier, ended the election day in positive territory despite underperforming the Nifty 50 in the previous year. However, their recent gains of 11% are accompanied by a slowdown in revenue growth.

Institutional Backing

Unlike retail-driven stock surges, these momentum plays have a significant institutional investor presence. Barring Sumitomo Chemical, all the listed companies boast a higher institutional stake than retail investors. It suggests a strong belief in the long-term potential of these companies by institutional heavyweights.

The Takeaway

The post-election market landscape is revealing a clear shift in investor focus. Momentum stocks, particularly those in the FMCG sector, are taking center stage, driven by an optimistic outlook on increased consumer spending under the new government. This trend highlights

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.