Are you ready for another round of wild swings in the stock market? GameStop (GME), the video game retailer at the center of the meme stock frenzy in early 2021, is experiencing a resurgence again.

A meme stock is a stock that becomes popular due to a meme and might be influenced by it. In pre-market trading on May 14th, 2024, its stock price climbed over 146%. This dramatic rise rekindles memories of the online investor fervor that sent GameStop’s stock on a rollercoaster ride three years ago. The stock’s value reached $64.31. Previously, it had ended the day at $30.45 on Monday, a substantial rise of 74.4%.

| GameStop Corp | ||

| Date | Open Price | Percentage Change |

| May 15, 2024 | 40.31 | -38 |

| May 14, 2024 | 64.83 | 146 |

| May 13, 2024 | 26.34 | 47 |

| May 10, 2024 | 17.93 | 13 |

| May 9, 2024 | 15.9 | -1 |

| May 8, 2024 | 16.05 | 1 |

| May 7, 2024 | 15.85 | 6 |

| May 6, 2024 | 14.99 | 21 |

| May 3, 2024 | 12.42 | 12 |

| May 2, 2024 | 11.11 | |

In a similar trend, AMC Entertainment, known for its cinema chain, experienced a surge of 238%, with the opening price of the 13th and 14th of May climbing to $11.88. This follows a significant jump of 78.35% from its closing price of $5.19 on May 13.

| AMC Entertainment Holdings | ||

| Date | Open | Percentage Change |

| May 15, 2024 | 6.1 | -49 |

| May 14, 2024 | 11.88 | 238 |

| May 13, 2024 | 3.52 | 15 |

| May 10, 2024 | 3.06 | 1 |

| May 9, 2024 | 3.02 | -4 |

| May 8, 2024 | 3.15 | -4 |

| May 7, 2024 | 3.27 | 0 |

| May 6, 2024 | 3.26 | 3 |

| May 3, 2024 | 3.15 | 4 |

| May 2, 2024 | 3.04 | |

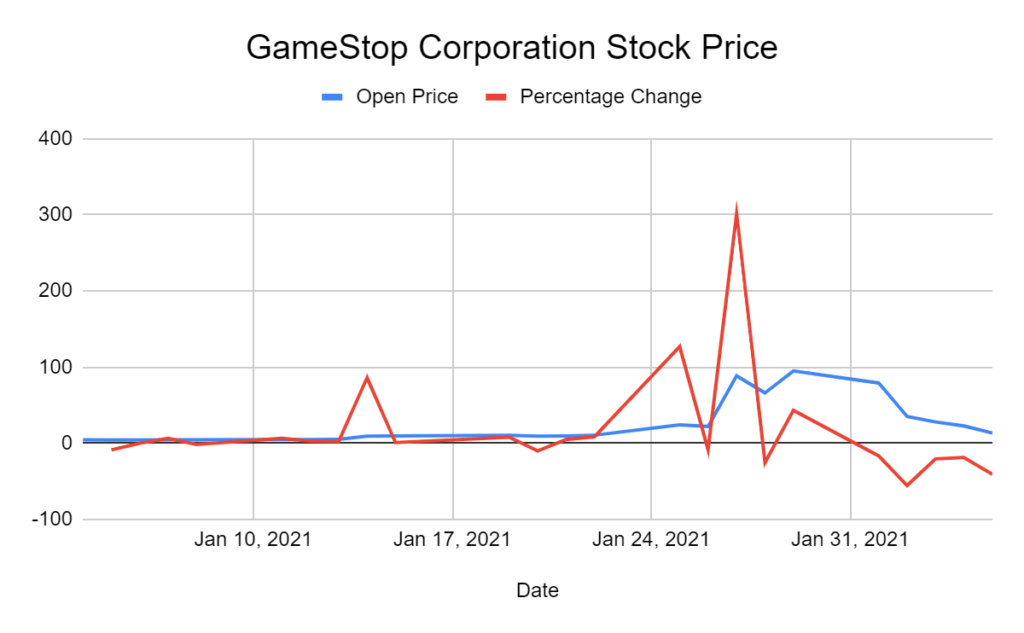

A Look Back at the 2021 Frenzy

The 2021 meme stock frenzy was a truly remarkable event. Here’s a quick recap by the numbers:

- GameStop’s Rise: In January 2021, GameStop’s stock price skyrocketed from around $ 4.34 per share to a high of $94.93. That’s an increase of over 1899% in a matter of weeks!

- Short Squeeze Pain: The rapid surge caused massive losses for short sellers who were forced to buy back shares at inflated prices to cover their positions. Estimates suggest short sellers lost tens of billions of dollars during this period.

- The Fallout: While the initial surge was dramatic, the price of GameStop eventually fell back down. Within five days, the stock fell from $94.93 to just $13.51 per share, a drop of 86%.

This current surge in GameStop’s price undeniably evokes memories of 2021. Whether it’s a short-lived echo of that earlier frenzy or the beginning of a new chapter remains to be seen.

However, one thing is sure: the meme stock phenomenon continues to challenge the status quo. It compels us to consider the evolving dynamics between retail investors, social media, and traditional financial institutions.

Retail Investors Back in the Driver’s Seat

The surge appears to be fueled by renewed interest from retail investors, those individual investors outside of Wall Street institutions. Their buying pressure is squeezing short sellers, hedge funds, and other investors who had bet on declining stock prices. As the price keeps increasing, short sellers are forced to buy back shares to cover their positions, pushing the price up—a phenomenon known as a short squeeze.

Short Sellers Feeling the Burn

A short seller in the stock market is an investor who borrows shares and sells them on the open market to repurchase them later at a lower price. With GameStop’s stock price soaring, short sellers stand to lose billions of dollars if they’re not careful. It can be seen in the stock price as well. While the stock price soared high on 14th May, it fell by 38% on 15th.

Is This for the Long Haul?

While the current frenzy is exciting, investors should be cautious and conduct thorough research before jumping on the trend. It’s important to remember that the fundamentals of GameStop’s business haven’t necessarily changed. This could be a short-term squeeze play, not a reflection of the company’s long-term prospects.

Only time will tell if this is the beginning of a new trend or just a nostalgic echo of 2021. But one thing’s certain: the meme stock saga is back in the headlines.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What are meme stocks?

Meme stocks gain significant attention and price increases due to hype and social media buzz, often fueled by online communities. These stocks may not necessarily have strong underlying fundamentals to justify their price surge.

What happened in the 2021 meme stock frenzy?

In early 2021, retail investors coordinated online to buy heavily shorted stocks like GameStop, AMC Entertainment, etc. This unexpected buying pressure caused short squeezes, sending the stock prices soaring and inflicting heavy losses on short sellers.

What are the risks of investing in meme stocks?

Meme stocks are highly volatile and prone to sudden price swings. They may not be suitable for all investors, especially those with a low-risk tolerance. It’s crucial to conduct thorough research before investing in any stock, including meme stocks.

Is the current GameStop surge a repeat of 2021?

It’s too early to say for sure. While similarities exist, the specific factors driving the current surge are still unfolding.

What should I do if I’m considering investing in GameStop or other meme stocks?

Do your research! Understand the risks involved and only invest what you can afford to lose. Don’t get caught up in the hype without a solid understanding of the underlying company and market conditions.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan