The dust has settled on the Union Budget 2024, and the market’s initial reaction was a shrug and a decline. The Sensex fell 89.85 points on the budget day, adding to the historical trend of markets generally underperforming post-budget announcements. Will these announcements affect your investment portfolio? This time. However, the reasons for the market’s tepid response are more pronounced.

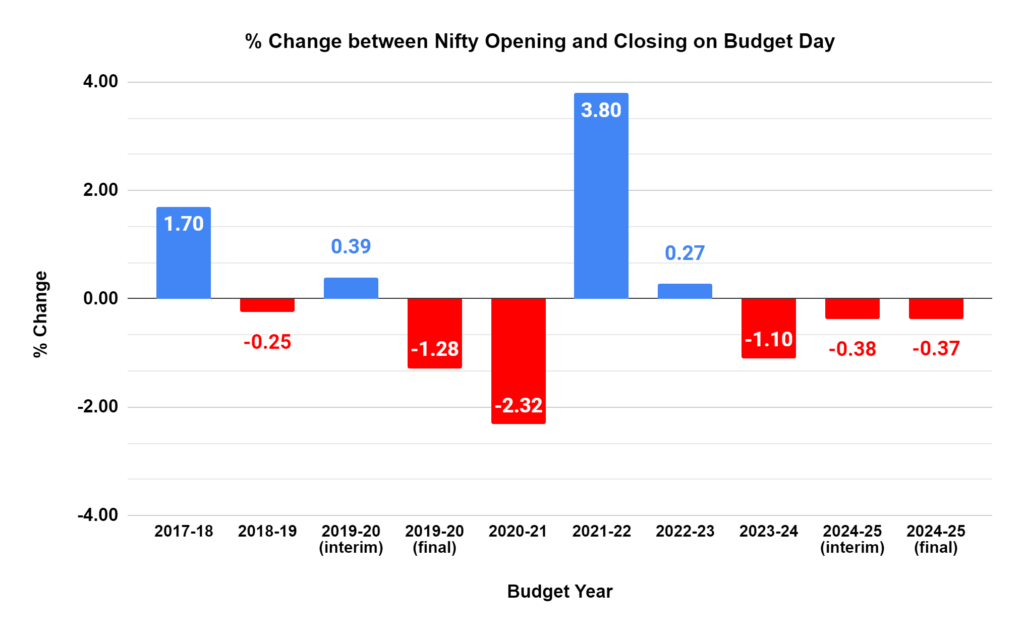

Market’s Historical Performance on Budget Days

Let’s examine the market’s performance on budget days over the years. Historically, the market hasn’t always welcomed budget announcements with open arms. It’s shown a tendency to trend downwards. For instance, the Nifty closed 89.85 points lower at 24,479.05 on July 23rd following the Union Budget presentation.

Markets have dipped after budget announcements on 6 out of 10 occasions. The interim budget in February this year also saw a decline of 83.2 points.

| Budget | Date | Nifty Opening | Nifty Closing | % Change |

| 2017-18 | 1st Feb 2017 | 8570.35 | 8716.40 | 1.70% |

| 2018-19 | 1st Feb 2018 | 11044.55 | 11016.90 | -0.25% |

| 2019-20 (interim) | 1st Feb 2019 | 10851.35 | 10893.65 | 0.39% |

| 2019-20 (final) | 5th July 2019 | 11964.75 | 11811.15 | -1.28% |

| 2020-21 | 1st Feb 2020 | 11939.00 | 11661.85 | -2.32% |

| 2021-22 | 1st Feb 2021 | 13758.60 | 14281.20 | 3.80% |

| 2022-23 | 1st Feb 2022 | 17529.45 | 17576.84 | 0.27% |

| 2023-24 | 1st Feb 2023 | 17811.60 | 17616.30 | -1.10% |

| 2024-25 (interim) | 1st Feb 2024 | 21780.65 | 21697.45 | -0.38% |

| 2024-25 (final) | 23rd July 2024 | 24568.90 | 24479.05 | -0.37% |

Finance Minister Nirmala Sitharaman seems to have adopted a more cautious approach, emphasizing fiscal consolidation and a shift away from government-led growth. The budget’s clear message is that equity investments can no longer be the sole driver of wealth creation. This shift in focus is evident in the increased taxes on both short-term and long-term capital gains and the higher Securities Transaction Tax (STT) on options and futures.

Understanding Capital Gains Tax and STT

The recent Union Budget introduced significant changes to the tax landscape for equity investors. Let’s break down the key alterations.

Capital Gains Tax

Capital gains refer to the profit from selling an asset for more than its purchase price. In the context of equities, capital gains are the difference between a share’s selling price and the purchase price. The tax levied on this profit is termed capital gains tax.

- Short-Term Capital Gains (STCG): Profits from selling equity shares held for less than a year are classified as STCG. The budget increased the tax rate on STCG from 15% to 20%.

- Long-Term Capital Gains (LTCG): Profits from selling equity shares held for more than a year are considered LTCG. The tax rate on LTCG has been increased from 10% to 12.5%.

These changes are aimed at discouraging short-term speculative trading and encouraging long-term investments.

Securities Transaction Tax (STT)

STT is a tax levied on every purchase and sale of shares, derivatives (like futures and options), and mutual fund units. The recent budget increased the STT on options from 0.0625% to 0.1% and on futures from 0.0125% to 0.02%.

This hike is expected to impact the profitability of frequent traders, especially those who engage in high-frequency trading. It’s a move to curb excessive speculation in the derivatives market.

The combined effect of increased capital gains tax and STT makes equity trading, mainly short-term trading and derivatives trading, more expensive. The government intends to promote long-term investments and reduce speculative activity in the market.

What it means for investors?

The most immediate impact is on your wallet. The short-term and long-term capital gains tax hike and increased Securities Transaction Tax (STT) will eat into your returns. While the long-term tax hike might not be a deal-breaker, the short-term could significantly impact traders.

The government’s rationale behind these changes is to curb speculation and encourage long-term investments. While this goal is noble, it might not be the best news for those looking for quick gains.

Another implication of the budget is the potential shift in investment focus. The government seems to be nudging businesses away from the stock market and towards the real economy. This could impact the overall market sentiment, as the influx of easy money from promoters and family offices might slow down.

Impact of Budget 2024 on Your Investment Portfolio

The Union Budget 2024 has introduced several changes likely to impact different sectors and your investment portfolio to varying degrees. Let’s break down the potential implications:

Financial Services

The increased capital gains tax and STT directly impact the financial services sector. Due to lower trading volumes, brokerage houses, mutual fund houses, and other market intermediaries will see a decline in revenues. However, focusing on long-term investments could benefit wealth management and advisory services.

IT and ITES

The IT and ITES sector is expected to remain resilient. While the budget didn’t offer any specific incentives, the sector’s growth trajectory is primarily driven by global trends and digital transformation, which are expected to continue.

Banking and Financial Institutions

Banks and financial institutions stand to benefit from increased government spending and the potential revival of the economy. However, the rise in interest rates and the cautious approach to credit growth might impact profitability.

Real Estate

The real estate sector could see a mixed impact. While increased government spending on infrastructure might boost demand for commercial real estate, the higher interest rates and overall economic uncertainty could dampen residential demand.

Automobiles

Focusing on rural development and infrastructure spending could benefit the automobile sector, especially in the commercial vehicle segment. However, the rising cost of living and uncertainty in the global economy might impact passenger vehicle sales.

Consumer Goods

The budget’s emphasis on rural development is positive for the consumer goods sector. Companies focused on rural markets and affordable products are likely to benefit. However, inflationary pressures and rising interest rates could dampen consumer spending.

Pharmaceuticals

Due to its defensive nature, the pharmaceutical sector is expected to remain resilient. The government’s focus on healthcare could provide some tailwinds, but rising input costs might impact margins.

Oil and Gas

The oil and gas sector is likely to benefit from increased economic activity. However, the government’s focus on renewable energy and electric vehicles could pose long-term challenges. It’s important to note that these are general trends, and the actual impact on specific companies within each sector will depend on their business models, financial performance, and market positioning.

To conclude,

The budget has undoubtedly introduced new challenges for investors. However, with careful planning and a long-term perspective, weathering the storm and emerge stronger is possible.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.8 / 5. Vote count: 4

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan