The long-awaited IPO of Bajaj Housing Finance will hit the market on September 9th, 2024. This IPO will also be the most closely watched on the street in terms of subscription rate and listing gains. After all, it carries the legacy of Bajaj Finance and will be one of the biggest IPOs in the Indian market in 2024.

In this article, we will review Bajaj Housing Finance IPO and provide key insight to help you make an investment decision about whether to subscribe to it.

Bajaj Housing Finance IPO Details

The Bajaj Housing Finance IPO is being launched following the revised RBI regulatory framework, which requires upper-layer NBFCs to be listed on the stock market. It has an issue size of ₹6,560 crore, consisting of a fresh issue of equity shares totaling ₹3,560 crore and an offer for sale, which means the promoter entity is selling shares worth approximately ₹3,000 crores. For more details, check the DRHP here.

| IPO Status | Approved by SEBI |

| IPO Date | 9th to 11th September 2024 |

| Total IPO Size | ₹6,560 (₹3,560 cr fresh issue and ₹3,000 cr OFS) |

| Issue Type | Book Built |

| Issue Price Band | ₹66 to ₹70 |

| Lot Size | 214 |

| IPO listing at | NSE & BSE |

| Listing Date | 16th September 2024 |

| Face Value per Equity Shares | ₹10 |

Bajaj Housing Finance Business Overview

Bajaj Housing Finance was initially incorporated as Bajaj Financial Solutions Limited on June 13th, 2008, as a subsidiary of Bajaj Finserv Limited. Later, on November 1st, 2014, the company became a wholly-owned subsidiary of Bajaj Finance Limited to start a housing finance business in India.

With its aggressive growth model, it became India’s second-largest housing finance company, with a total loan book size exceeding Rs 97,000 crores and the most diversified mortgage lending products. It offers mortgage lending products, including home loans, Loan Against Property, Lease Rental Discounting, and Developer Financing.

Leadership Team

Atul Jain is the Managing Director of Bajaj Housing Finance. He has been with the Company for over a decade and has held numerous senior management roles, including Chief Collection Officer and Enterprise Risk Officer.

Jasminder Singh Chahal is the President of the Home Loan division and joined the company on August 19th, 2024. Earlier, he was associated with ICICI Personal Financial Services Company Limited.

Kumar Gaurav is the Executive Vice President of debt Management Services, managing the company’s debt profile. Earlier, he was in charge of the Personal and Business Loan vertical at Bajaj Finance Limited.

CA Gaurav Kalani has been the Chief Financial Officer of Bajaj Housing Finance since 2018 and has spent nearly 15 years with the Bajaj Group of companies. In the company’s early phase, he played a significant role in driving key strategies, including capital raising, AOPs, LRS planning and execution, and investor relations.

Gagandeep Malhotra is the Chief of the Credit and Operations department. He manages a Residential and Commercial Real Estate Portfolio that involves lending to Developers and HNIs. He also oversees Construction Finance, Lease Rental Discounting, and Loans Against Property. Earlier, he held top leadership positions at Citibank.

Financials of Bajaj Housing Finance

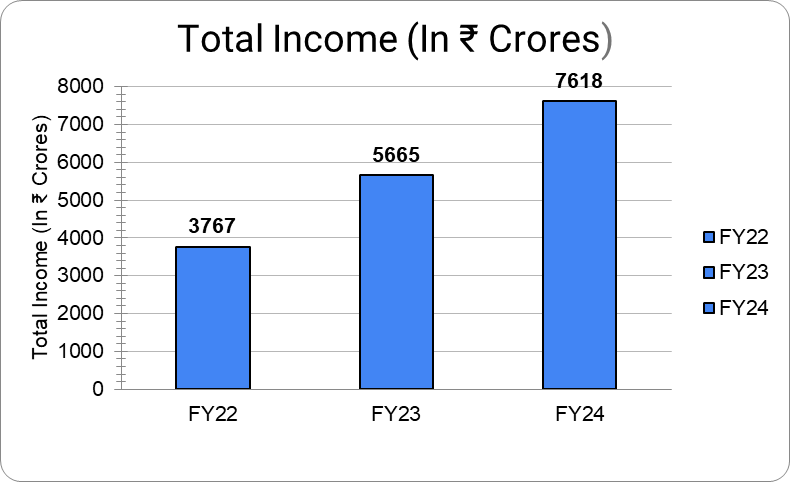

Total Income

The company’s total income has increased by 26.5% annually over the last three fiscal years. According to Screener data, LIC Housing Finance reported 11%, and Can Fin Homes reported 20% annualized growth during the same period.

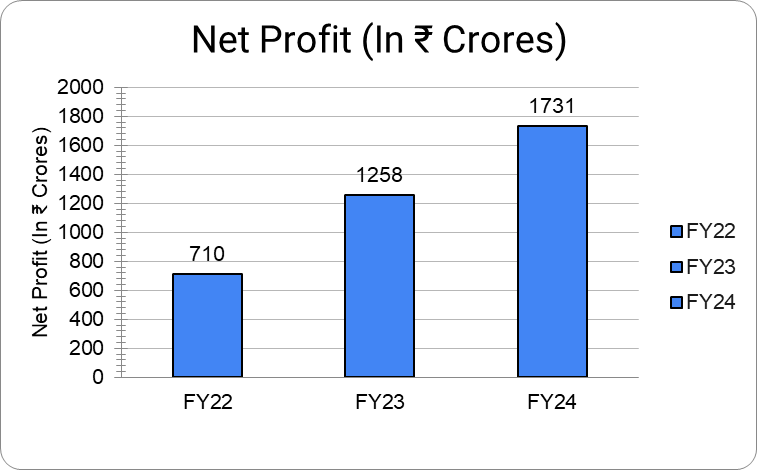

Net Profit

The company’s net profit has increased by nearly 35% annually over the last three financial years, among the best in the industry.

According to screener data, LIC Housing Finance reported 20% annualized growth, and Can Fin Homes reported 18%.

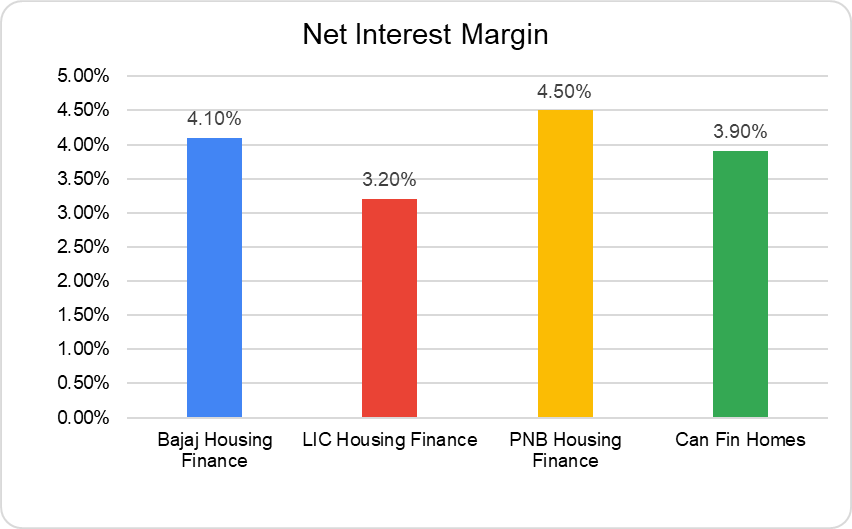

Net Interest Margin

Speaking about the Net Interest Margin, which is like the operating margin for banks and NBFCs, Bajaj Housing Finance reported a net interest margin of 4.1% in FY24, slightly lower than the 4.5% recorded for FY23.

While LIC Housing Finance reported a Net Interest Margin of 3.2% in FY24, PNB Housing Finance reported 4.5%, and Can Fin Homes reported 3.9% during the same period.

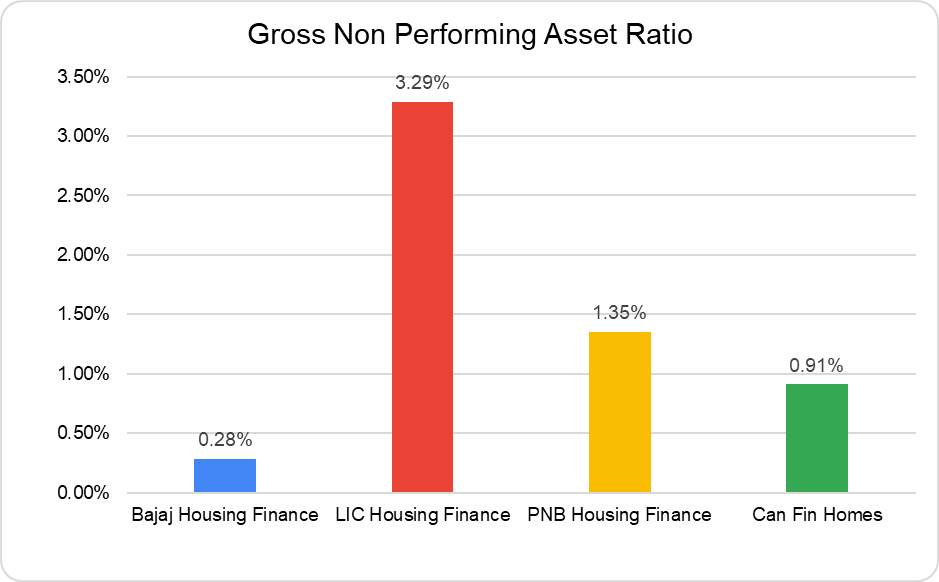

Asset Quality

Among peers, Bajaj Housing Finance has the best asset quality metrics. In FY24, its Gross Non-Performing Asset (GNPA) ratio was 0.28% of the total loan book, and its Net Non-Performing Asset (NNPA) ratio was 0.11%.

While the industry leader, LIC Housing Finance, has the highest nonperforming asset in its book, with a GNPA ratio of 3.29%.

What will Bajaj Housing Finance Do with IPO Money?

Out of the total proceeds of ₹6560 crores, the promoter entity is selling shares worth ₹3,000 crores to comply with regulatory guidelines.

The remaining funds are coming through fresh share issuances, augmenting the capital base to meet the company’s future business requirements and expand lending activities.

Valuations

Now, let’s look at the most crucial aspect of this IPO- the valuations.

The price band of this IPO is ₹66-70. The book value per share at the end of June 30th, 2024, is ₹18.8. This makes the Price-to-Book ratio 3.7 times.

LIC Housing Finance has a P/B ratio of 1.2 times, and Can Fin Homes has a P/B ratio of 2.7 times, so Bajaj Housing Finance is somewhat expensive compared to its peers.

Pros & Cons of Bajaj Housing

In a short span, Bajaj Housing Finance has emerged as India’s second-largest housing finance company, beating established players like PNB Housing, Can Fin Homes, GIC Housing Finance, and many more.

The company’s strengths include industry-best revenue and profitability growth metrics, strong asset quality, the use of technology to identify customers with good credit behavior, cross-channel sales, and experienced leadership, all of which drive business growth.

Also, the current government policies and initiatives towards the housing mission for all drive the growth of housing finance companies in India. The company’s loan book is concentrated in just five states: New Delhi, Maharashtra, Karnataka, Telangana, and Gujarat. Any adverse development in these regions or failure to expand to smaller cities may adversely impact the company’s growth and financials.

Know more about:

IPOs | Current IPOs | Upcoming IPOs | Listed IPOs | Closed IPOs | IPO Performers

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Is Bajaj Housing Finance part of Bajaj Group?

Yes, Bajaj Housing Finance is a wholly-owned subsidiary of Bajaj Finance Limited.

When will the Bajaj Housing Finance IPO come?

Bajaj Housing Finance’s IPO issue opens on September 9, 2024, and closes on September 11, 2024. It is expected to be listed on September 16, 2024.

Is Bajaj Housing Finance profitable?

Yes, Bajaj Housing Finance is a profitable company. In the last three years, revenue and profitability have increased at a CAGR of 26.5% and 35%, respectively.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan