Paytm, a leading fintech company, has witnessed a significant rise in its stock price, climbing over 8% in the last two trading sessions. On September 10, 2024, the stock continued its positive streak, rising more than 8% for the second consecutive day due to strong buying interest.

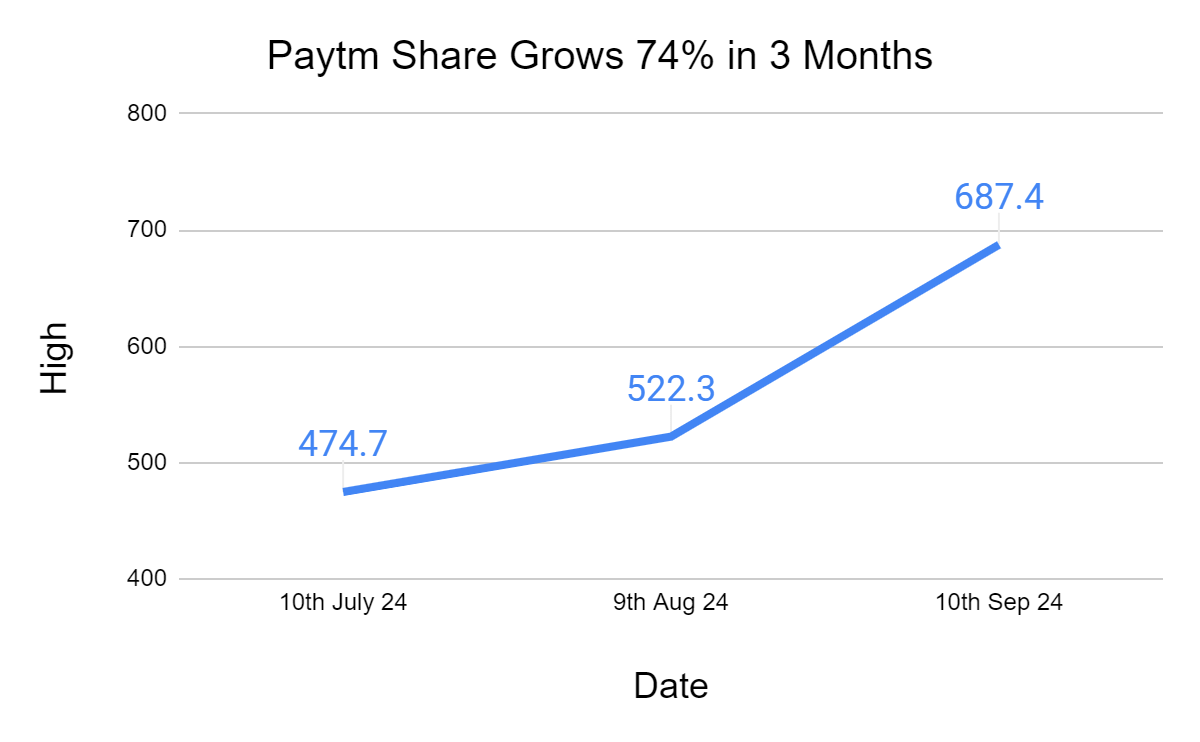

In the last week, Paytm’s stock has risen over 13%, surging more than 33% in a month. Over the past three months, the stock price has seen an impressive jump of over 74%.

Additionally, Paytm’s share price has surged nearly 120% from its 52-week low of ₹310 per share, recorded on May 9, 2024.

You can read more about Paytm share price with the help of our screener.

On August 28, Paytm revealed that it had secured approval from the Ministry of Finance to invest in its payment services division. Following this approval, Paytm Payments Services Ltd (PPSL) plans to resubmit its payment aggregator application. In the meantime, PPSL will continue to offer online payment aggregation services to its existing partners, as stated in a regulatory filing.

Key Highlights of Paytm Share Price’s Recent Rally

- Stock Surge: Paytm’s shares have rallied over 8% across two consecutive trading sessions.

- Positive Sentiment: Investors show optimism towards the company, leading to an increased buying trend.

- Market Confidence: The stock market’s response reflects growing faith in Paytm’s business model and growth trajectory.

4 Key Factors Behind the Rally

- Strong Quarterly Performance: Recent financial reports indicate that Paytm has steadily improved its revenue and reduced losses.

- Increased Adoption of Digital Payments: Paytm’s services are becoming indispensable as more businesses and consumers adopt digital transactions.

- Investor Confidence: Analysts have upgraded their outlook on the stock, contributing to renewed interest from both retail and institutional investors.

- Focus on Profitability: Paytm has clearly focused on achieving profitability in the near future, which has further boosted market sentiment.

How Paytm’s Business Model Supports Growth

Paytm’s ecosystem includes mobile payments, financial services, and e-commerce. Its diverse revenue streams make it more resilient to market fluctuations. With India’s digital economy growing rapidly, Paytm is well-positioned to benefit from this growth.

- Mobile Payments: At the core of Paytm’s business, mobile payments continue to grow as digital transactions become the norm in India.

- Financial Services: Paytm is expanding into lending, insurance, and other financial services, providing multiple avenues for future growth.

- Merchant Services: Paytm’s platform caters to millions of small and medium businesses, offering them tools to manage their payments and financial needs.

What’s Next for Investors?

Paytm’s recent stock performance could be a sign of things to come. Here are some key points to consider for those looking to invest:

- Long-Term Potential: With digital payments expected to grow in India, Paytm may benefit from this trend.

- Focus on Profitability: The company’s aim to achieve profitability by 2024 could provide a substantial upside for the stock.

- Market Conditions: Investors should monitor overall market conditions, as external factors like interest rates and economic policies may impact the stock’s future trajectory.

Conclusion

Paytm’s recent rally, gaining over 8% across two days, indicates growing investor confidence and market optimism about the company’s future. With a focus on profitability and the digital economy booming in India, Paytm seems poised for further growth. However, investors should remain cautious of market fluctuations and consider the stock’s long-term potential.

FAQs

What has caused the recent surge in Paytm’s share price?

The recent surge in Paytm’s share price can be attributed to several factors. Firstly, the company has reported strong financial performance, with significant growth in key metrics. Secondly, Paytm’s expansion into new business areas, such as insurance and mutual funds, has been well-received by investors. Positive market sentiment and overall bullish trends in the Indian stock market have also contributed to the rally.

Is this a sustainable trend for Paytm’s share price?

While the recent rally in Paytm’s share price is encouraging, it’s important to exercise caution. The sustainability of this trend depends on several factors, including the company’s continued financial performance, execution of its growth strategy, and broader market conditions. Investors should conduct thorough research and consider various factors before making investment decisions.

What are the potential risks associated with investing in Paytm?

Like any other stock, investing in Paytm involves certain risks. The company’s business model is subject to regulatory changes, intense competition, and potential technological disruptions. The overall economic climate and market sentiment can also impact the stock’s performance. Investors should carefully assess these risks and diversify their portfolios accordingly.

What are the prospects for Paytm?

Paytm’s prospects appear promising. The company’s strong market position, diversified business model, and focus on innovation can drive continued growth. However, the future is subject to various uncertainties. Investors should stay updated on the company’s developments, industry trends, and market conditions to make informed investment decisions.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan