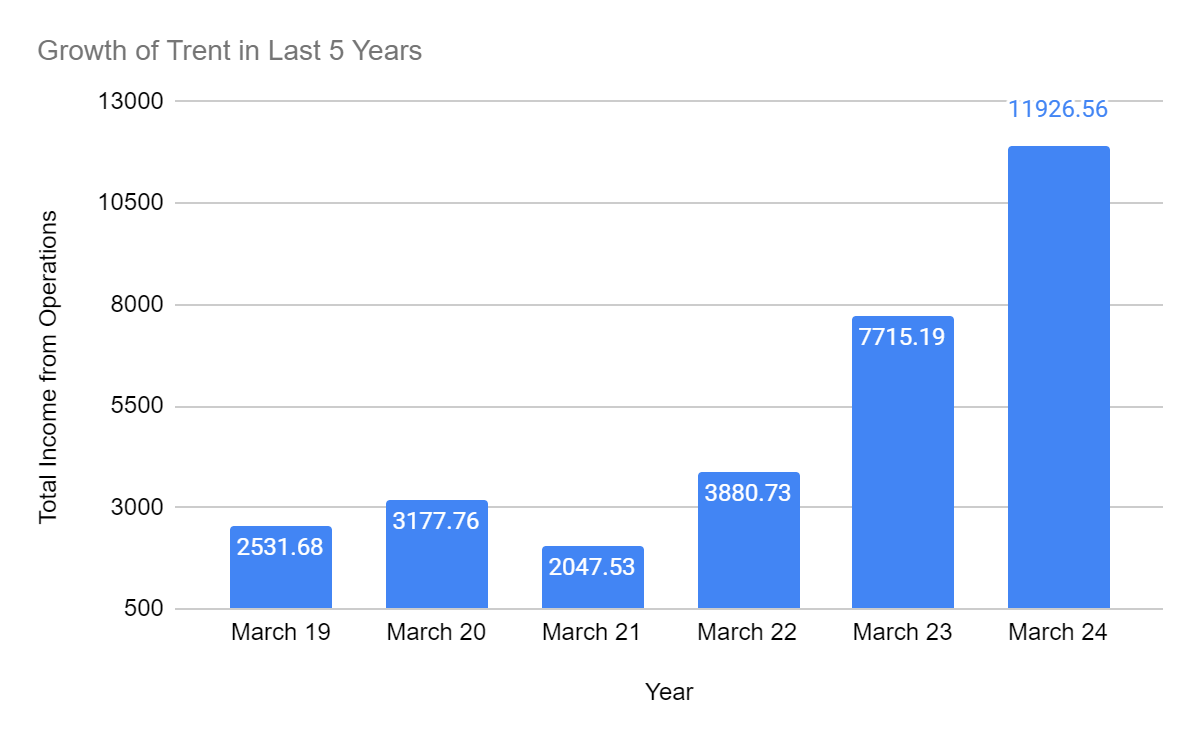

The Tata Group, one of the biggest conglomerates in India, has an incredible growth story to share over the last five years. One of its companies, Trent, has experienced a whopping fivefold increase in income, a remarkable achievement for a company of its size.

This impressive growth, especially considering the challenges of such a large organization, highlights the firm’s smart strategies, ability to adapt to the market, and operational efficiency. Let’s dive into how this Tata firm achieved record income and keep that momentum going!

Surge in Trent Share Price

Tata Firm Trent ranks among the top three fastest-growing companies across all sectors in the last five years. In 2019, Trent’s total income was Rs. 2,671 crore, which surged to Rs. 12,664 crore by 2024—marking a 5x increase or an impressive annual growth rate of 36%. Even more remarkable is the company’s profit growth, which soared at an astounding 73% annually over the same period. Trent’s shares skyrocketed by an incredible 1,490% between 2019 and 2024. Source: Economic Times

Zudio: Major Growth Driver

One primary driver of this impressive growth is Zudio, Trent’s value-fashion chain. Launched a decade ago, Zudio has evolved significantly. It started as a clothing section within Star Bazaar, but its success led to dedicated stores nationwide.

Zudio began as an apparel brand within Star Bazaar, and at some point, it was officially named Zudio. According to industry experts, Trent has significantly outpaced the industry, delivering a leading LFL growth (LFL stands for “Like for Like” and is a measure of sales growth that adjusts for new or closed stores and newly acquired companies) of +10%, gaining market share in the apparel segment, particularly in the value format.

Despite an aggressive store expansion strategy, Trent has maintained a strong balance sheet with no operational weaknesses.

Here is a list of 15 fast-growing companies over the last five years. While several matched Trent’s growth rate, they were relatively smaller. Many attribute this success to timing—being in the right market at the right time. Trent capitalized on the post-COVID-19 “revenge spending” wave, as consumers with disposable incomes in urban and semi-urban areas were eager to spend.

| Company | Total Income (In crores) | Sales Growth from FY19 (x) | PAT (In Crores) | PATM (%) | ROCE (%) | PE (x) | 1Y (%) |

| Indus Towers | 30,171.0 | 4.0 | 6036.2 | 21.1 | 34.9 | 15.3 | 100.3 |

| Dixon Tech. | 17,713.5 | 5.9 | 374.9 | 2.1 | 34.7 | 196.4 | 168.4 |

| Trent | 12,664.4 | 4.7 | 1477.5 | 11.1 | 59.8 | 158.6 | 286.9 |

| Adani Green Energy | 10,460.0 | 4.8 | 1260.0 | 13.7 | 10.0 | 243.9 | 90.0 |

| Delhivery | 8594.2 | 5.1 | -249.2 | -3.1 | -1.7 | 0.0 | 1.6 |

| Bajaj Housing Finance | 7617.7 | 6.6 | 1731.2 | 22.7 | 9.4 | 73.6 | NA |

| FSN E-commerce Ventures | 6415.6 | 5.5 | 43.7 | 0.7 | 8.1 | 0.0 | 28.8 |

| CreditAccess Grameen | 5172.7 | 4.0 | 1445.9 | 27.9 | 14.8 | 12.8 | -9.0 |

| Swan Energy | 5100.1 | 5.6 | 585.9 | 11.7 | 9.8 | 48.7 | 97.3 |

| Angel One | 4279.8 | 5.4 | 1125.6 | 26.4 | 38.8 | 19.6 | 40.5 |

| Route Mobile | 4063.8 | 4.8 | 388.8 | 9.7 | 21.9 | 27.5 | -0.7 |

| RHI Magnesita India | 3792.1 | 4.9 | -100.1 | -2.7 | 1.2 | 0.0 | -16.5 |

| GMM Pfaudler | 3469.9 | 6.8 | 174.1 | 5.0 | 21.4 | 40.3 | -23.5 |

| JITF Infralogistics | 3336.6 | 5.7 | 90.8 | 2.8 | 16.6 | 38.2 | 114.8 |

| Sona BLW Precision Forgings | 3208.8 | 4.6 | 517.8 | 16.3 | 25.9 | 83.0 | 25.3 |

Trent is currently the fastest-growing Indian company, boasting an impressive return on capital employed (ROCE) of about 60%. This figure has surged from 16% in FY22 to 60% in FY24. Fund managers who overlooked the company in 2022 due to its high PE multiple of 429x are now reconsidering their stance, questioning whether they should invest at a PE multiple of 160x.

Companies like Route Mobile and Sona BLW Precision Forgings have experienced similar growth rates, but their starting points were smaller than Trent’s. In FY24, Route Mobile reported sales of INR 4,000 crore, while Sona BLW posted INR 3,200 crore.

Aditya Birla Fashions Ltd (ABFL), which operates in a similar segment as Trent, achieved a top-line growth of 11.6% annually over the five years ending in 2024. During this period, ABFL’s stock rose by 70%, whereas Trent shares skyrocketed by an astounding 1,490%. The most rapid growth for Trent occurred within the past year, with its stock jumping 262%, while ABFL saw a 60% increase. The Nifty 50 index grew 2.3x over the last five years.

Understanding the Growth Story

Over the past five years, Trent has consistently delivered strong financial performance, recording an almost fivefold increase in income. This growth is not just impressive; it’s extraordinary, given the challenges of managing a large-scale operation.

With its diverse operations and extensive market footprint, the firm faced multiple challenges, such as increasing competition, fluctuating market demand, and operational complexities. However, by focusing on innovation, digital transformation, and strategic acquisitions, the company has overcome these obstacles and achieved record-breaking success.

5 Key Factors Behind the Trent’s Success

Digital Transformation

One of the company’s most significant growth drivers has been its focus on digital transformation. The firm has invested heavily in digital technologies to enhance operational efficiency, streamline processes, and deliver better customer experiences. The company has embraced technology to stay competitive in a rapidly evolving market, from automating backend operations to utilizing data analytics for informed decision-making.

Diversification

Diversification has always been a cornerstone of Tata Group’s strategy, and this firm is no exception. Over the years, it has expanded its operations into new markets and industries, reducing its reliance on any single revenue stream. This diversification strategy has helped the firm mitigate risks associated with market volatility and capitalize on emerging opportunities in different sectors.

Cost Optimization

Despite its large size, the firm has focused on cost optimization to maintain profitability. Adopting lean manufacturing practices, renegotiating supplier contracts, and improving operational efficiency have kept costs under control while growing the firm’s top line. This disciplined approach to cost management has allowed the firm to scale operations without compromising profitability.

Strategic Acquisitions

Acquisitions have played a pivotal role in the firm’s growth. Over the past five years, the company has made several strategic acquisitions that have allowed it to expand its market presence, acquire new technologies, and tap into new customer segments. These acquisitions have helped the firm grow and strengthened its competitive position in the market.

Focus on Innovation

Innovation has been at the heart of the Tata Group’s success, and this firm is no different. By continuously investing in research and development (R&D), the company has introduced new products and services that cater to its customers’ changing needs. This focus on innovation has helped the firm stay ahead of the competition and contributed to its revenue growth.

The Challenges of Managing a ‘Plus Size’ Firm

Managing a large-scale operation comes with challenges, and this Tata firm is no exception. One of the biggest challenges is maintaining operational efficiency across its diverse operations. Ensuring smooth operations can be daunting, with multiple business units, supply chains, and markets. However, the firm has been able to address these challenges through robust systems and processes, enabling it to operate efficiently at scale.

The Impact of External Factors

External factors such as economic conditions, government policies, and global market trends have also shaped the firm’s growth trajectory. For instance, the government’s push for digitalization and infrastructure development has created new opportunities for the company. Similarly, favorable economic conditions and rising consumer demand have supported the firm’s growth.

However, external factors have also posed challenges. The firm has had to navigate through regulatory changes, trade tensions, and geopolitical uncertainties, all of which have impacted its operations.

Record-Breaking Income: The Numbers Speak

The firm’s financial performance over the past five years has been remarkable. Its income has risen nearly fivefold, reaching record levels despite the challenges posed by its size and external factors. This growth has been driven by digital transformation, diversification, cost optimization, strategic acquisitions, and innovation.

According to the company’s financial reports, revenue from its core business segments has consistently grown, contributing significantly to the overall income. Additionally, the firm’s focus on expanding into new markets has opened up new revenue streams, further boosting its financial performance. The firm’s profitability has also improved, with margins expanding due to cost-saving initiatives and operational efficiencies.

What Lies Ahead for the Firm?

The company is poised to capitalize on emerging market opportunities with a strong foundation built on digital transformation, diversification, cost optimization, and innovation. However, the firm must continue adapting to changing market dynamics and external factors to sustain its growth trajectory.

One of the critical areas of focus for the firm in the coming years will be sustainability. As global attention shifts towards environmental, social, and governance (ESG) factors, the company must integrate sustainability into its business practices to stay competitive. By adopting sustainable practices and reducing its environmental footprint, the firm can contribute to a better future and enhance its long-term competitiveness.

Additionally, the firm must continue investing in technology and innovation to stay ahead of the competition. The rapid pace of technological advancements means that companies must constantly innovate to remain relevant. By staying at the forefront of technology and innovation, the firm can maintain its competitive edge and continue its growth journey.

Conclusion

The nearly fivefold increase in income over the past five years shows how well the firm has handled challenges, seized opportunities, and executed its strategy. Despite its size, the company has demonstrated innovation and growth.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

What is the reason behind the surge in Tata Trent shares?

The company’s remarkable financial performance is the primary reason for the substantial increase in Tata Trent’s share price. In the past five years, Tata Trent has achieved a staggering 1,490% growth in its share value. This surge can be attributed to the company’s record-breaking income, consistently outperforming expectations. Tata Trent’s robust financial health has instilled confidence in investors, leading to a significant rise in demand for its shares.

How has Tata Trent managed to achieve such impressive financial growth?

Tata Trent’s success can be attributed to several strategic factors. The company has focused on expanding its retail network through acquisitions and organic growth, increasing its market reach. Additionally, Tata Trent has implemented effective inventory management and pricing strategies to optimize profitability. Moreover, the company’s strong brand recognition and association with the reputable Tata Group have been crucial in attracting customers and driving sales.

Should I invest in Tata Trent shares?

Investing in Tata Trent shares depends on individual risk tolerance and investment goals. While the company’s performance has been impressive, conducting thorough research and considering various factors before making investment decisions is essential. Investors should evaluate the company’s financial statements, industry trends, and potential risks associated with the investment. It’s also advisable to consult with a financial advisor for personalized guidance.

How useful was this post?

Click on a star to rate it!

Average rating 5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan