Every year, the Indian stock market holds a special Diwali Muhurat Trading session during Laxmi Pujan, marking the start of the Hindu accounting year, Vikram Samvat. This session holds cultural and religious significance, especially among business communities such as the Marwaris and Gujaratis, who are looking to initiate new ventures or investments during auspicious times. Muhurat Trading is a symbolic event and has become an exciting indicator of market trends.

Let’s examine the stock market’s performance during Diwali over the past four years, covering 2020 to 2023.

| Diwali | 30 Days Before Diwali | Close on Muhurat Trading Day | 30 Days After Diwali | 1-Year Return |

| 14th November 2020 | 11971.05 | 12780.25 | 13558.1(▲6.1%) | ▲9.9% |

| 4th November 2021 | 17691.25 | 17916.8 | 17196.5(▼4%) | ▲40.2% |

| 24th October 2022 | 17327.35 | 17730.75 | 18484.1(▲4.3%) | ▼1.0% |

| 12th November 2023 | 19,794.00 | 19525.55 | 20906.4 (▲7.1%) | ▲10.12% |

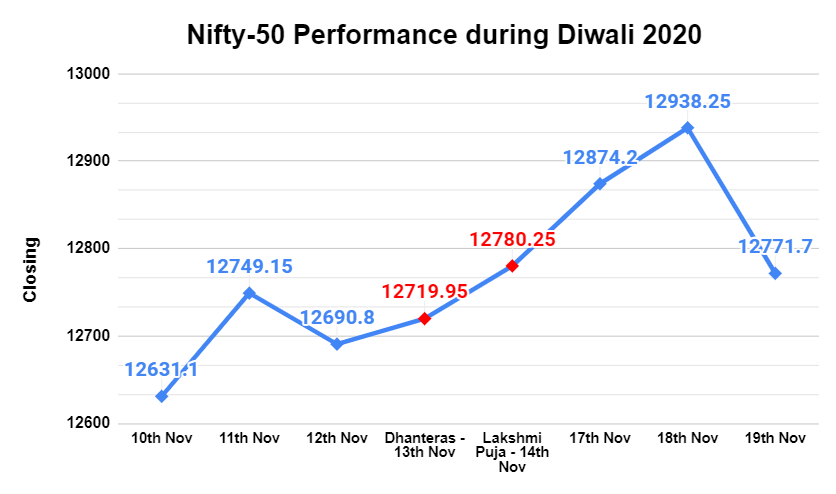

Stock Market during Diwali 2020: A Year of Recovery and Strong Gains

During Diwali of 2020, the stock market was marked by an unusual combination of factors, primarily driven by the pandemic. Despite an initial decline on Muhurat Trading Day, with the Sensex down 0.96% and the Nifty 50 falling by 1.48%, the overall year was highly rewarding for

investors.

During Samvat 2077, which began with Diwali 2020, the Indian stock market posted its best gains in 13 years. The Sensex and Nifty gained around 40%, with both indices touching record highs during the year. The Nifty 50 crossed 18,000 points, and the Sensex breached the 60,000 mark for the first time.

Some sectors posted massive gains:

– Metals: Up by 128%

– Realty: Surged 113%

– PSU Banks: Rose 93%

In contrast, sectors like pharma (23%), FMCG (29%), and private banks (30%) saw relatively modest gains. The BSE Midcap index jumped by 61%, and the BSE SmallCap index surged by 79% during this period. In other words, the stock market during Diwali ushered in widespread market optimism.

Source: Livemint

Stock Market during Diwali 2021: The First Year of Negative Returns Since 2014

The stock market during Diwali 2021 marked a shift, as the Indian stock market posted negative returns for the first time since 2014. While the Nifty 50 ended the year down by less than 2%, the domestic market still outperformed global indices.

Global equity markets experienced severe turbulence, with the MSCI Emerging Markets Index falling by 33%, the Dow Jones down by 13%, and the MSCI All Country World Index dropping by 23%. Several global challenges, including inflation, disruptions in commodity prices, and lockdowns in China, contributed to this bearish trend.

Although Indian equities posted minor declines, the overall sentiment of the stock market during Diwali was more subdued, as the previous year’s sharp gains limited further upside.

Stock Market during Diwali 2022: Resilience and Recovery

The share market in Diwali 2022 was a positive event for traders. The Sensex rose by 0.88% on Muhurat Trading Day, setting the tone for the following months.

Over the next 12 months, the BSE Sensex rallied 6.5%, and the Nifty 50 climbed 7.1%. The Small and Midcap indices were real winners, soaring 31% and 26%, respectively. The broader stock market during Diwali outperformed, buoyed by strong fundamentals and a surge in investor sentiment.

During Diwali of 2022, the stock market faced several headwinds, including rising interest rates, bond yields, and concerns around the Union Budget. But in the latter half, the market staged a remarkable recovery. Factors such as FII inflows, strong corporate earnings, and positive macroeconomic indicators contributed to this rebound.

Stock Market during Diwali 2023: A Positive Start

The Muhurat Trading session of the stock market during Diwali 2023 saw a continuation of the market’s positive momentum, with the Sensex closing up 0.55% and the Nifty50 rising by 0.52%. This marked the sixth consecutive year of gains on the Muhurat day, marking an auspicious day for the stock market during Diwali.

One of the session’s highlights was the record turnover surge, with trades across 2,431 companies reaching a new all-time high. This high trading activity showcased investor confidence and strong participation in the stock market during Diwali.

Some standout performers on Muhurat day were Infosys and Wipro, with Infosys gaining 1.4% and Wipro rising 0.9%. HDFC Bank, Infosys, and Reliance Industries were key contributors to the index gains.

This promising start to Samvat 2080 has set an optimistic tone for the upcoming year, signaling continued interest from retail and institutional investors.

10 Key Learnings from Past Performance

Volatility Around Diwali:

- Despite the cultural and symbolic importance of Diwali Muhurat Trading, the stock market has shown mixed results. While some years saw gains, others posted losses, emphasizing the inherent volatility in the market during this period.

Significant Gains After Economic Shocks:

- Diwali 2020 marked a strong recovery year after the pandemic’s economic shocks. The Sensex and Nifty posted their best gains in over a decade, driven by stimulus measures and market optimism. The market can bounce back sharply even after major disruptions.

Global Factors Play a Big Role:

- Diwali 2021 highlighted how global factors such as inflation, supply chain disruptions, and China’s lockdowns can overshadow local market trends. Even with strong domestic fundamentals, external pressures can lead to negative performance.

Outperformance of Small and Midcap Stocks:

- In years like 2022, Small and Midcap stocks significantly outperformed the large-cap indices, with the Nifty Smallcap 100 gaining 35% and the Nifty Midcap 100 rising 29.5%. Broader market segments often outperform benchmarks during positive market cycles.

Sector-Specific Trends Are Crucial:

- Different sectors perform at varying levels during Diwali periods. For example, in 2022, PSU Banks and Realty surged, while Oil and Gas underperformed. Monitoring sector-specific trends can provide better insights into potential opportunities.

Recovery from Weak Starts:

- The year following Diwali 2022 showed that the market could recover after a weak phase, as seen with the rally after March 2023. Factors like foreign fund inflows, strong earnings, and macroeconomic recovery played a crucial role in this rebound.

Muhurat Trading Performance Not Always a Predictor:

- Positive gains during Muhurat Trading don’t always indicate the market’s long-term direction. For instance, Diwali 2021 started with minor declines but was a year marked by subdued global equity markets.

Investor Sentiment Remains High:

- Despite fluctuations, investor sentiment during Diwali remains strong, as evidenced by the record-high turnover in Diwali 2023 Muhurat Trading. This consistent participation underscores the symbolic importance investors place on this period.

Domestic Market Strength:

- Even in years of global weakness, like 2021, the Indian stock market showed resilience, outperforming many global peers. This suggests that while external factors affect short-term performance, India’s domestic market fundamentals remain strong.

Turnaround Potential:

- Diwali 2022 and beyond highlighted the market’s capacity to turn around even after initial headwinds. Positive sentiment, foreign inflows, and macroeconomic improvements can drive recoveries, especially in the latter part of the year.

Conclusion

Over the last four years, the Indian stock market’s performance during Diwali has been mixed and influenced by global and domestic factors. While Diwali 2020 was a year of strong recovery, Diwali 2021 saw the first negative returns in nearly seven years. Diwali 2022 brought resilience and recovery, and Diwali 2023 began with optimism.

The tradition of Muhurat Trading continues to play a key role in India’s market culture, symbolizing a fresh start and setting the tone for the upcoming financial year. Whether the market has been on an upward trajectory or faced temporary headwinds, Muhurat Trading always draws attention from investors eager to begin the new Samvat on a positive note. Many investors rely on investment advisor services to help navigate market trends and make informed decisions during this auspicious period.

FAQ

What is Muhurat Trading, and why is it significant?

Muhurat Trading is a special session during Diwali to mark the beginning of the new Hindu accounting year, Vikram Samvat. It is considered an auspicious time for investments. Many investors consult a SEBI-registered investment advisory to strategize for this critical event in the Diwali and share market cycles.

How has the stock market performed during Diwali in recent years?

The Diwali and stock market performance over the last four years has been mixed. While 2020 saw strong gains due to recovery from the pandemic, 2021 slightly declined. For more informed decisions, understanding the impact of what is compounding on long-term gains is often recommended, which investors focus on during this period.

Which sectors performed well during recent Diwali periods?

Sectors like PSU Banks, Real Estate, and Small—and mid-cap stocks performed strongly during Diwali. Seeking SEBI-registered investment advisory services can help identify such trends and guide you through the Diwali and stock market season.

How useful was this post?

Click on a star to rate it!

Average rating 4 / 5. Vote count: 1

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan