Talking about politics, did you know that the general elections impact the Indian stock markets in the short and long term? If not, we have detailed how voting results can move the stock markets here in this article.

While the short-term effects are temporary, the long-term effects are everlasting. So before we understand the impact of the polls on Nifty and Sensex, if you are an adult with a valid voting card, please VOTE! It’s imperative to exercise your right to vote.

Different stages of elections & how it affects the stock market

The Indian stock market reacts dynamically to different stages of elections, reflecting investor sentiment, economic expectations, and political developments. Here’s an overview:

1. Pre-Election Phase

Markets typically show increased volatility due to uncertainty about election outcomes. Speculation regarding policy continuity or changes leads to fluctuations, especially in sectors sensitive to government policies.

Increased foreign portfolio investor (FPI) activity, cautious corporate strategies, and currency fluctuations are common.

2. Campaigning Period

As parties announce manifestos and policies, markets react to proposals, especially on reforms, fiscal policies, and infrastructure spending. Poll predictions and surveys further add to market swings.

Sectors like banking, infrastructure, and energy see heightened activity if promised reforms directly benefit them.

3. Election Results

Result day often witnesses extreme market movements. A stable, business-friendly government triggers rallies, while fractured mandates or unexpected outcomes can lead to sharp sell-offs.

For instance, in May 2019, after Narendra Modi’s government was re-elected, markets rallied, with the Sensex surging over 1,400 points.

4. Post-Election Phase

Once the government is in place, markets focus on actual policy implementations, the Budget, and economic reforms. Promises during campaigns are scrutinized for delivery.

Stable governments tend to attract more FPIs, ensuring growth in key sectors.

Long-Term Effects of Elections on the Stock Market

In India, general elections every five years are crucial for stock markets, which often become volatile due to political developments and changing expectations around economic policies. However, the government’s long-term actions after elections largely influence market trends.

1. Policy Continuity and Stability

When a government with a strong mandate continues or builds upon previous economic policies, it provides stability and reduces market uncertainty. Under stable governments, long-term reforms in areas like infrastructure, taxation, and industrial policies gain traction, leading to steady growth.

2. Economic Reforms and Growth Policies

Governments with significant support can introduce growth-oriented banking, technology, and infrastructure reforms, directly impacting markets over time. Structural changes like GST and the Insolvency and Bankruptcy Code (IBC) have historically boosted long-term investor confidence, especially from foreign investors.

3. Investor Sentiment and Foreign Investment

Elections affect both domestic and foreign investor sentiment. Foreign investors, in particular, seek stable policies and transparent governance. A pro-business government often attracts more foreign portfolio investment (FPI) and foreign direct investment (FDI), leading to increased liquidity and higher market valuations over the long run.

4. Sector-Specific Impacts

Elections shape the growth trajectory of specific sectors. For example, governments focused on infrastructure or manufacturing drive growth in construction and industrial stocks, while those prioritizing rural development may boost agricultural and allied sectors. These sectoral gains contribute significantly to long-term market growth.

5. Fiscal Policy and Deficit Management

The way a government manages its fiscal deficit affects the economy and markets in the long term. Excessive borrowing may drive up interest rates, impacting business costs, while a focus on reducing deficits can enhance economic stability and instill investor confidence.

6. Monetary Policy and Inflation Control

A stable government can better coordinate with the Reserve Bank of India (RBI) on monetary policy, effectively managing inflation and interest rates. This balance helps keep the economy healthy and supports steady growth in stock markets over time.

7. Political Stability and Global Perception

A politically stable government often improves India’s image globally, making it more attractive to international investors. Effective management of geopolitical relations and trade agreements can result in a stable inflow of foreign capital, boosting markets in the long term.

8. Reforms in Corporate and Financial Governance

Governments can strengthen regulatory frameworks to improve market transparency and corporate governance. Regulatory bodies like SEBI benefit from government support to implement reforms that foster a healthier investment environment, attracting domestic and foreign investors.

A visionary and stable government is crucial to a country’s growth. To understand how this plays a role, look at two countries—India and Sri Lanka. Both countries experienced the worst Coronavirus pandemic. However, the latter dipped into recession and is now experiencing the worst economic crisis since independence. India, on the other hand, managed to steer clear of financial adversities.

Here’s a breakdown of key figures comparing the economic impact on India and Sri Lanka after the pandemic:

- Sri Lanka’s Inflation: In 2022, inflation peaked at over 50% due to debt and policy mismanagement. Essential items became scarce, and fuel and medicine were severely affected.

- Foreign Reserves: Sri Lanka’s reserves plummeted, leading to a severe import crisis and dependency on an IMF bailout for $2.9 billion

- India’s GDP Growth: India’s GDP grew by around 7% in 2021-2022 and maintained relatively stable inflation rates compared to Sri Lanka

Short-Term Effects Of Elections On The Stock Markets

News is a primary mover of the stock markets in the short term. An adverse event causes the markets to go down, and a positive event moves them upward.

For example, during the recent US election results, Trump’s victory sparked an immediate rally in Indian markets on November 6, pushing the Nifty above 24,500 and lifting the Sensex by 900 points to close at 80,378.13. Gains were widespread, with sectors like IT, realty, oil & gas, and power leading, each rising over 2%.

As you must have seen, the news flavors change when polls are around the corner. As a result, the stock markets may become volatile, and the election’s impact on the stock market is unpredictable.

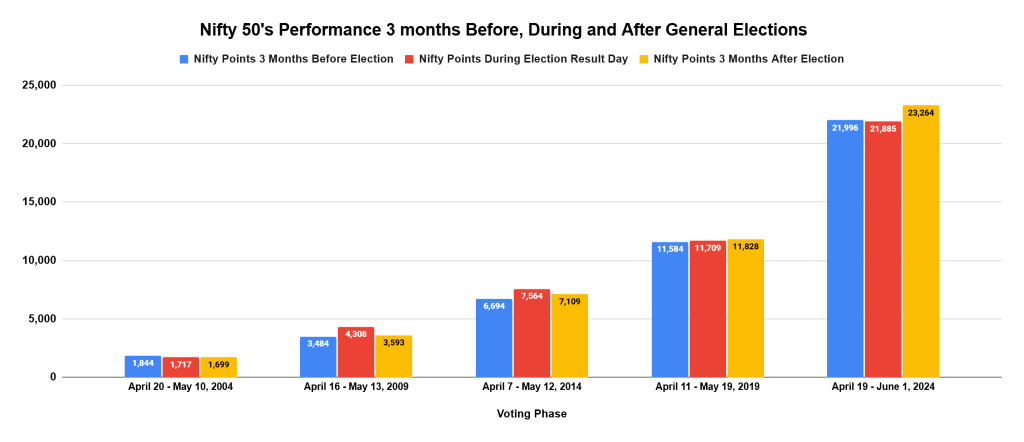

We studied five general poll cycles to understand if Nifty moved in a particular pattern. We considered three-time frames: three months before, during, and after the poll results.

Here are the key takeaways from the graph:

- Pre-Election Volatility:

- 2004, 2009, and 2014: In these elections, the Nifty 50 index exhibited a downward trend in the three months before the voting phase. This suggests a period of uncertainty and potential market correction.

- 2019 and 2024: The index showed a more stable or even upward trend in the pre-election period. This could indicate increased investor confidence and a positive outlook on the economy.

- Election Day Impact:

- 2004, 2009, and 2014: The index typically saw a slight dip on the day of the election result. It could be attributed to market volatility and uncertainty about the new government’s policies.

- 2019 and 2024: In these years, the index remained relatively stable or experienced a minor uptick on election day. It could suggest that markets have become more resilient to election-related volatility.

- Post-Election Recovery:

- 2004, 2009, and 2014: The index generally recovered and experienced growth in the 3 months following the elections. This positive trend can be attributed to increased certainty and potential policy reforms.

- 2019 and 2024: The index continued its upward trajectory after the elections, indicating strong investor sentiment and positive economic expectations.

The graph suggests that the Indian stock market, as represented by the Nifty 50 index, has become more resilient to election-related volatility. Investors increasingly focus on long-term fundamentals and economic indicators rather than short-term political events.

Final Words

Although this article only examined how voting affects the Indian stock markets, it’s a global phenomenon. For example, the US Bank states that US presidential polls impact US stock markets.

Events like general polls, wars, and budget announcements affect the stock markets, but the effects are short-lived for a month or quarter. Long term performance of the stock markets fundamentally depends on how the country’s economy grows over the years.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan