If you are a stock market investor, you will agree that picking the right index for your investments is critical. Also, how your investment decision can have a major impact on your returns as well as your chances of fulfilling your investment goals.

Two popular options are often talked about: Smart Beta and Large Caps. Both have unique pros and cons. Stuck on what to pick? Feeling perplexed?

You can just take a back seat now that we’ve come to your rescue. In this guide, we’ll go over the basics of each, comparing their advantages and disadvantages.

By the end, you’ll know which index best fits your investment objectives. Are you ready to dive in? Let’s get started.

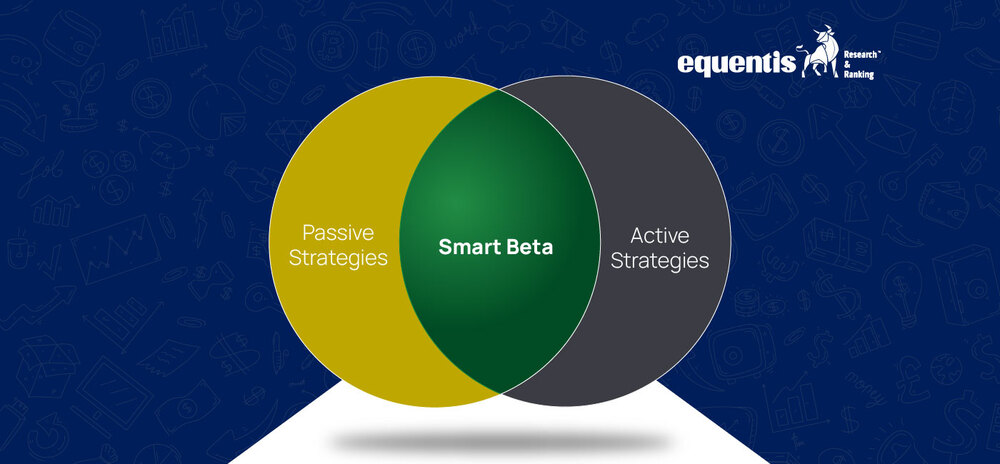

Understanding Smart Beta

Can you get better returns in the stock market without owning the high risk of active investing? Yes, with Smart Beta.

The smart Beta model is a blend of passive and active strategies, to outperform traditional market-cap-weighted indexes (like Nifty 50, Bank Nifty, BSE Sensex etc).

Smart Beta uses a weighing methodology different to traditional market-cap-weighted indexes, known as factor investing. In simpler terms, instead of just following the market capitalization, it focuses on factors like value, momentum, or low volatility.

Smart Beta aims to capture market inefficiencies and provide better risk-adjusted returns.

Smart Beta: Real Life Examples

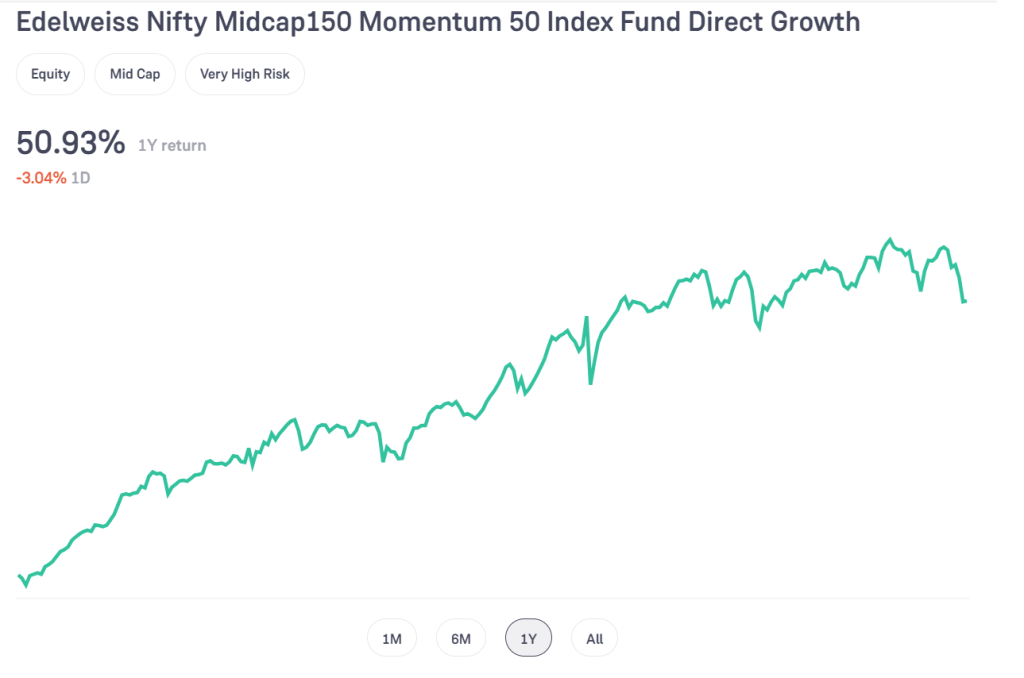

Edelweiss Nifty Midcap 150 Momentum 50 Index Fund (ENM50): This Smart Beta fund focuses on momentum, investing in 50 stocks from the Nifty Midcap 150 index

It has shown an average annual return of around 57.5% over the past 1 years.

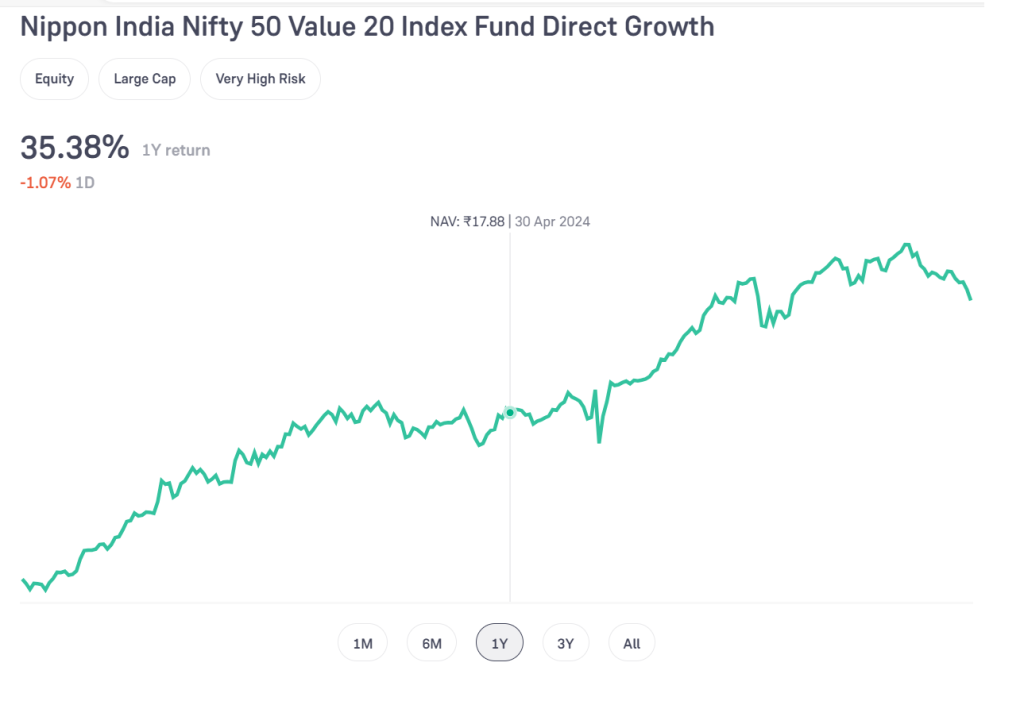

Nifty 50 Value 20 Index: This index filters the top 50 stocks by market cap based on value factors like return on capital employed (ROCE) and dividend yield.

It has delivered an average annual return of 17.1% over the past 3 years.

Why Choose Smart Beta?

Smart Beta offers a middle ground between passive and active investing-

- It provides the diversification benefits of passive investing while targeting specific factors that can lead to better performance

- It is more cost-effective than traditional active management.

Understanding Traditional Large Caps

Large-caps are well-established, financially sound companies with a market capitalisation of $10 billion or more that dominate their industries. These firms are often leaders in their sectors, offering stability and steady growth.

Investing in Large Caps is generally seen as a safer bet, making them a popular choice for conservative investors.

Traditional Large-Caps: Real-Life Examples

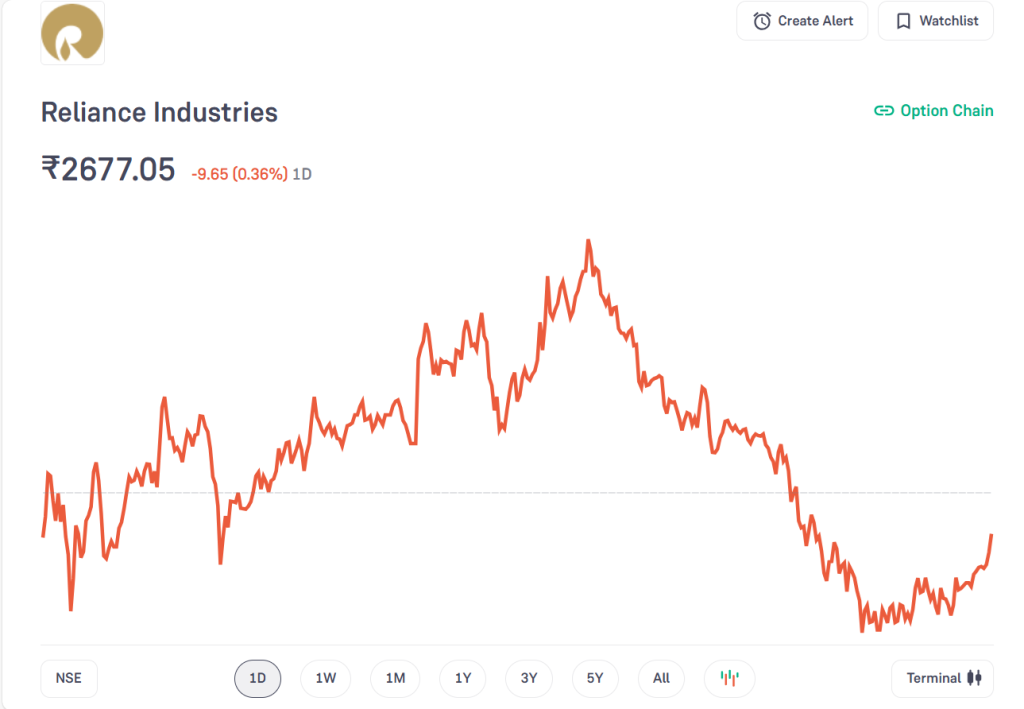

Reliance Industries: As India’s largest company by market cap, Reliance Industries has consistently delivered robust performance. Over the past 5 years, it has provided an average annual return of 18.33%.

HDFC Bank: This leading private sector bank in India is renowned for its solid financial foundation and growth. It has offered investors an average annual return of 14.92 % over the last 5 years.

What makes large caps a reliable choice for investors?

Large Caps are the backbone of any well-rounded investment portfolio, let’s see why-

- They tend to be more resilient during economic downturns, providing a safety net for investors.

- Their strong market presence and consistent performance make them a reliable choice.

- Large caps often pay dividends, offering an additional income stream.

Comparison: Smart Beta vs Traditional Large Caps

| Feature | Smart Beta | Traditional Large Caps |

| Strategy | Alternative index structure based on factors like value, momentum, or low volatility, PE ratio, PB ratio, etc. | Market-cap-weighted, focusing on top companies by market capitalization |

| Risk | Medium – depends on the chosen factors | Low to Medium – generally stable |

| Performance Goal | Outperform traditional indexes and provide better risk-adjusted returns | Steady growth and stability |

| Diversification | Varies based on the factor strategy | High – includes top companies across industries |

| Cost | Generally lower than active management | Lower than active management but can vary |

| Investment Style | A mix of passive and active | Passive |

| Investor Suitability | Investors seeking better risk-adjusted returns or specific factor exposure | Conservative investors seeking steady, long-term growth |

Factors to Consider When Choosing an Index

Investment Goals: Understand what you aim to achieve, whether it’s growth, income, or stability. Your goals will guide you toward the most suitable index.

Smart Beta strategies often seek to outperform traditional market-cap-weighted indexes while maintaining a similar level of risk. While Large-cap stocks are typically sought for their stability, growth potential, and dividends.

Risk Tolerance: Identify the level of investment risk you’re comfortable with. Some indexes are more volatile than others, so choose one that aligns with your comfort level.

Smart beta strategies prioritise low volatility, quality, and value, resulting in more stable performance. Large-cap stocks, on the contrary, can still experience significant price fluctuations as a result of market conditions.

Time Horizon: Think about the length of time you intend to keep your investment.expense Longer time horizons might allow for more aggressive indexes, while shorter ones might benefit from safer, more stable options.

Smart beta strategies can be suitable for both short-term and long-term investment horizons, depending on the specific factors targeted. For example, a low-volatility smart beta strategy might be more appropriate for a shorter time horizon, while a value-focused strategy might be better suited for a longer-term investment.

Large-cap stocks are generally considered suitable for medium to long-term investment horizons due to their stability and growth potential, making them a good choice for investors looking to build wealth over time.

Expense Ratios: Check the costs associated with the index funds or ETFs you’re considering. Keeping expense ratios low can greatly enhance your returns over time.

Smart beta strategies often have higher expense ratios compared to traditional index funds and Large-cap funds due to their active management and factor-based approach.

Tax Considerations: Understand the tax implications of investing in certain indexes, especially if they involve international companies or high turnover rates.

Smart beta strategies can be less tax-efficient due to their active management and frequent trading, which can generate higher capital gains taxes. Large-cap stock funds are generally more tax-efficient due to lower turnover and fewer capital gains distributions.

Key Takeaways

Whether you prefer Smart Beta for its innovative strategies or Traditional Large Caps for their stability, understanding the differences is critical.

Consider your risk tolerance, investment horizon, and desired diversification before making a decision. By weighing these factors, you can choose an index that aligns with your financial goals and allows you to ride the market with confidence.

FAQs

Can market conditions affect the performance of Smart Beta and Large Caps differently?

Yes, Smart Beta strategies might perform better in specific market conditions due to their focus on certain factors. Large Caps, however, tend to be more resilient during market downturns due to their stability.

Is it possible to customize a Smart Beta index to fit my investment preferences?

Some fund providers offer customizable Smart Beta options, allowing you to focus on the factors that align with your investment strategy, such as low volatility or high dividend yield.

How can I balance my portfolio with both Smart Beta and Large Caps?

Combining Smart Beta and large-cap investments can help you diversify your portfolio by balancing higher return potential with the stability of larger, established companies. Consider allocating a percentage to each, depending on your risk tolerance and investment objectives.

What role do dividends play in the returns of large-cap indexes?

Many Large-cap companies pay regular dividends, contributing to the overall returns. This can be a significant advantage for investors seeking a steady income stream in addition to capital appreciation.

How frequently are Smart Beta indexes rebalanced compared to Traditional Large Caps?

Smart Beta indexes are often rebalanced more frequently to maintain their factor-based strategy, while Traditional Large Caps might be rebalanced less often, reflecting changes in market capitalization.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan