India’s pursuit to become a global leader in adopting electric vehicles (EVs) is gaining momentum. With a burgeoning automotive market, the nation aims to electrify 30% of its fleet by 2030.

However, achieving this ambitious target requires more than just manufacturing EVs; it necessitates a holistic approach that includes robust infrastructure development, strategic business opportunities, and policy reforms. Notably, enhancing rail connectivity is pivotal in accelerating EV adoption, drawing lessons from China’s successful integration of high-speed rail and EV proliferation.

Current Landscape of India’s EV Market

As of 2023, electric four-wheelers constitute 1% of India’s automotive market. The government’s Faster Adoption and Manufacturing of (Hybrid &) Electric Vehicles (FAME) scheme, now in its second phase with a budgetary allocation of ₹10,000 crore, aims to bolster this figure.

The scheme supports the deployment of 7,090 electric buses, 500,000 electric three-wheelers, 55,000 electric four-wheelers, and 1 million electric two-wheelers. Despite these initiatives, challenges such as limited charging infrastructure, high upfront costs, and consumer apprehension hinder widespread EV adoption.

The China Paradigm: Railways Fueling EV Growth

China’s rapid EV adoption offers valuable insights. A study analyzing 328 Chinese cities between 2010 and 2023 revealed that cities connected to the high-speed rail (HSR) network experienced a 1.22 percentage point increase in EV market share and a 91.39% surge in sales volume.

The extensive HSR network, covering 96% of areas with populations exceeding 500,000, alleviated range anxiety among consumers and complemented EV usage by providing reliable alternatives for long-distance travel. This symbiotic relationship between rail connectivity and EV adoption underscores the potential benefits for India.

Tesla’s Foray into the Indian Market

Tesla’s strategic entry into the Indian electric vehicle (EV) market parallels its earlier expansion into China. Both ventures involve penetrating populous markets with burgeoning EV potential, yet each presents unique challenges and opportunities.

Tesla’s Entry into China: A Catalyst for Market Transformation

In 2019, Tesla inaugurated its Gigafactory in Shanghai, marking its first manufacturing plant outside the United States. This pivotal move allowed Tesla to circumvent import tariffs, reduce production costs, and cater directly to the world’s largest EV market. The establishment of the Shanghai Gigafactory was unprecedented, being the first wholly foreign-owned car plant in China. This venture solidified Tesla’s presence in Asia and intensified competition within the Chinese EV sector.

Tesla’s presence spurred local manufacturers to elevate their standards, leading to increased innovation and improved product offerings. Studies indicate that Tesla’s market entry significantly boosted demand for EVs in China, benefiting both the company and domestic producers. The “catfish effect” describes how Tesla’s competition prompted Chinese manufacturers to enhance their technological capabilities and cost efficiencies. Consequently, companies like BYD Auto expanded their market share, with BYD capturing 35% of China’s new energy vehicle market in 2023, while Tesla held a 7.8% share. Source: industryweek.com

Anticipated Impact of Tesla’s Entry into India

Tesla’s planned entry into India involves establishing showrooms in New Delhi and Mumbai, aiming to tap into the world’s third-largest automotive market. However, unlike its approach in China, Tesla has not announced plans for local manufacturing in India, which presents distinct challenges.

- Market Dynamics and Consumer Demand: India’s EV market is nascent, with electric vehicles accounting for approximately 2.5% of the 4.3 million cars sold in 2024. Tesla’s entry could elevate consumer interest and set new benchmarks for quality and performance. However, the high import duties on fully built units (ranging from 70% to 100%) could position Tesla’s vehicles at a premium price point, limiting their accessibility to a niche segment.

- Local Manufacturing and Supply Chain Integration: Tesla’s local production facilitated competitive pricing and supply chain efficiencies in China. In contrast, the absence of immediate manufacturing plans in India means Tesla may face higher operational costs and extended delivery timelines. The Indian government’s policies favor local production, offering incentives for manufacturers who commit to domestic manufacturing. Tesla’s decision to import vehicles initially might delay potential benefits from such incentives.

- Competitive Landscape: The Indian EV market is attracting global players, with companies like BYD also making inroads. BYD’s strategy includes local assembly, which could offer cost advantages over Tesla’s imported models. This pressure may compel Tesla to reassess its long-term strategy in India and consider local manufacturing to enhance its market position.

- Regulatory and Political Considerations: favorable policies and government support facilitated Tesla’s expansion into China. In India, negotiations regarding import duties and local manufacturing requirements are ongoing. The Indian government’s stance on promoting domestic production could influence Tesla’s operational strategies and investment decisions.

Economic Implications and Business Opportunities

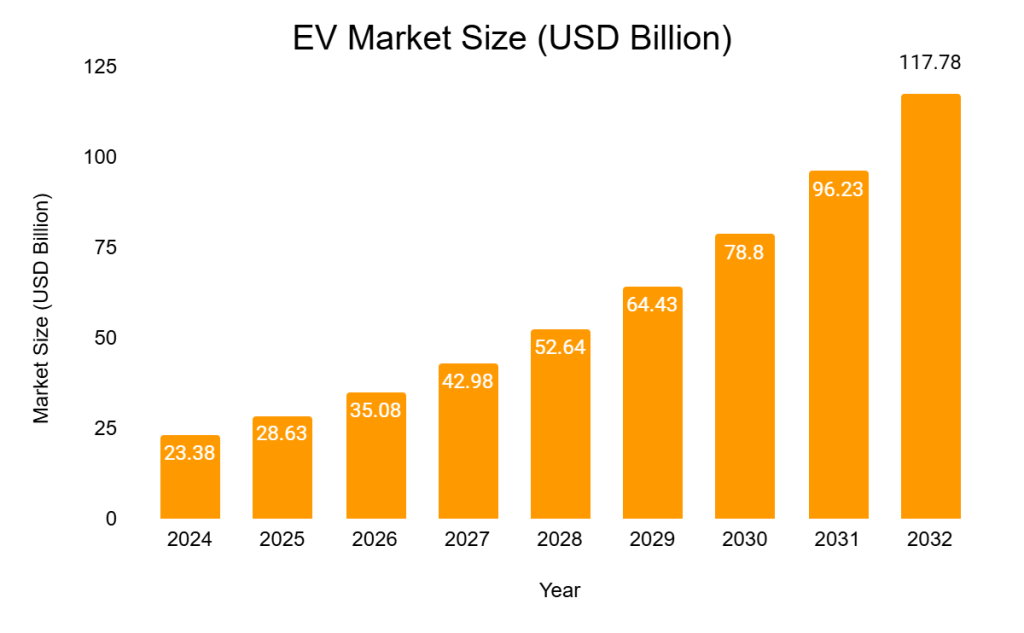

India’s electric vehicle (EV) sector is poised for exponential growth, presenting substantial economic opportunities across various industries. In 2024, the Indian EV market was valued at approximately USD 23.38 billion and is projected to reach USD 117.78 billion by 2032, exhibiting a compound annual growth rate (CAGR) of 22.4%. fortunebusinessinsights.com

Several factors drive this rapid expansion:

- Increased Investments: The sector has witnessed a surge in investments, with EV companies securing significant funding from venture capital, private equity, and commercial investors. In 2024 alone, EV firms in India secured $1 billion in funding, underscoring strong investor confidence in the market’s potential. energy.economictimes.indiatimes.com

- Government Initiatives: The Indian government’s policies, such as the Faster Adoption and Manufacturing of Hybrid and Electric Vehicles (FAME) scheme, have been instrumental in promoting EV adoption. These initiatives offer manufacturers and consumers financial incentives, aiming to make EVs more accessible and affordable.

- Local Manufacturing and Job Creation: Companies like Tata Motors invest heavily in local production facilities, including battery manufacturing plants. Tata Motors plans to increase the proportion of electric models in its lineup from 12% in 2024 to 30% by 2030, reflecting a strategic shift towards electrification. Such investments reduce import dependence and generate employment opportunities, bolstering the domestic economy.

- Market Entry of Global Players: The anticipated entry of global EV manufacturers like Tesla is set to intensify competition, leading to technological advancements and potentially more competitive pricing. Tesla’s plans to establish a presence in India, including scouting for showroom locations in major cities, signify the attractiveness of the Indian market to international players. reuters.com

The economic ripple effect of the burgeoning EV market extends to ancillary industries such as charging infrastructure, battery production, and raw material supply chains. The government’s Production-Linked Incentive (PLI) scheme further encourages domestic manufacturing, aiming to position India as a global hub for EV production.

Projected Growth of India’s EV Market (2024-2032)

This table illustrates the projected expansion of India’s EV market over the next decade, highlighting the significant economic opportunities.

Strategic Role of Rail Infrastructure

Integrating rail and road transport can boost EV adoption by providing a reliable long-distance travel option, addressing range anxiety. This would allow EV use for urban commutes and trains for intercity travel, promoting EV adoption, reducing emissions, and decongesting roads.

Enhanced rail connectivity can boost EV adoption by enabling EVs for urban commutes and trains for long-distance travel. This integrated approach promotes EV usage, reduces road congestion, and lowers emissions.

Policy Interventions for Accelerated EV Penetration

To outpace global competitors like China, India must implement comprehensive policy measures:

- Infrastructure Development: The expansion of charging stations, especially in urban centers and along highways, should be prioritized to alleviate range anxiety and encourage EV adoption.

- Financial Incentives: To make EVs more affordable and stimulate market demand, offer subsidies and tax benefits to both manufacturers and consumers.

- Local Manufacturing Support: To reduce costs and reliance on imports, provide incentives for domestic production of EV components, including batteries.

- Public Awareness Campaigns: Educate consumers about EVs’ environmental and economic benefits to shift public perception and drive adoption.

- Integration of Transport Modes: Develop policies that promote the synergy between rail and road transport, facilitating seamless intermodal travel and enhancing the appeal of EVs for daily commutes.

Conclusion

.India’s journey to becoming a global EV leader depends on infrastructure development, policy reforms, and strategic investments, including enhancing rail connectivity, which can accelerate EV adoption and reduce emissions. While Tesla’s entry into China spurred market transformation, replicating this success in India requires navigating high import duties, nascent infrastructure, and competitive pressures.

Tesla may need to consider local manufacturing, strategic partnerships, and active engagement with government policies to align with India’s vision for sustainable transportation and domestic industry growth to achieve a similar impact.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

Related Posts

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.