When it comes to investing in the share market in India, there are plenty of options available with share prices ranging from single digits to five digits.

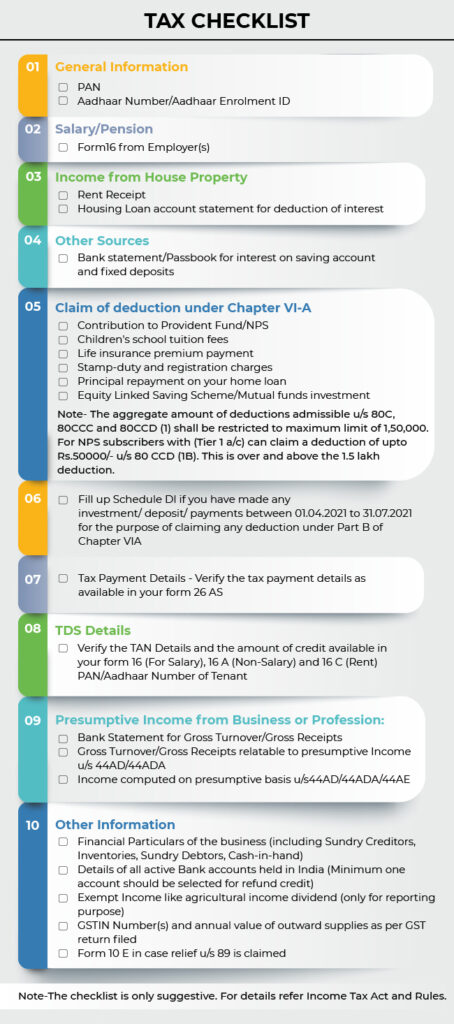

In this article let’s take a detailed look at:

10 companies in India with the highest share price

Does it make sense to invest in companies in India with the highest share price now?

12 companies in India with the highest share price

MRF

Share price on 20/04/22 – Rs.67,766

Headquartered in Chennai, Madras Rubber Factory (MRF) is India’s largest manufacturer of tyres in India, and the sixth-largest tyre manufacturer in the world. MRF also manufactures a variety of rubber products apart from tyres such as Pretreads, tubes, sporting goods, conveyor belts, paints, and coats.

Page Industries

Share price on 20/04/22 – Rs. 45,066

Incorporated in the year 1994, Page Industries is the exclusive licensee of JOCKEY International Inc. in India, Sri Lanka, Bangladesh, Nepal, UAE, Oman, and Qatar. It is also the exclusive licensee of the Speedo brand in India.

With 15 state-of-the-art manufacturing units and a strong distribution network of over 50,000 retail outlets spread across 1,800 cities and towns in India, Page Industries has revolutionized the innerwear market in the country.

Honeywell Automation

Share price on 20/04/22 – Rs. 40,400

Incorporated in the year 1984, Honeywell Automation is a leading provider of integrated automation and software solutions. Honeywell Automation is a Fortune India 500 company and offers a diversified product portfolio that includes sensing and control, environmental and combustion controls, and engineering services in the field of automation and control globally.

Shree Cements

Share price on 20/04/22 – Rs. 25,775

Founded in the year 1979, Shree Cements is one of the largest cement manufacturers in Northern India and caters mainly to markets across India and the Middle East. The company has a consolidated production capacity of 44.4 million tonnes of cement per annum. With operations spanning across India and the UAE, the company was one of the first to use alternate fuel resources in the production of cement.

3M India

Share price on 20/04/22 – Rs. 20,730

Founded in the year 1998 as Birla 3M Ltd., the company was renamed 3M India Ltd. in the year 2002. The company is a diversified player which caters to segments such as mining, health care, railways, telecom, marine services, aerospace, security, and automotive care.

Some of its popular products include fiber cables, high-quality reflective equipment for personal and traffic safety, personal protective kits for medical personnel, and N95 masks.

Nestle India

Share price on 20/04/22 – Rs. 18,273

Nestle India is the Indian subsidiary of Nestle the world’s largest food and beverage company. The company offers a variety of products in the FMCG segment such as dairy products, infant foods, frozen foods, confectionaries, chocolates, breakfast cereals, pet food, nutritional drinks, soups, sauces, and coffee, beverages, and seasonings.

Some of Nestle’s popular brands include Maggi, Milkmaid, Nescafe, Munch, Cerelac, and Everyday Dairy Whitener.

Abbott India

Share price on 20/04/22 – Rs. 16,820

A subsidiary of Abbott Laboratories, Abbott India Limited is one of the fastest-growing pharmaceutical companies in India. Headquartered in Mumbai, Abbott India offers a wide range of medicines across categories such as cardiology, women’s health, gastroenterology, metabolic disorders, and primary care.

Bombay Oxygen

Share price on 20/04/22 – Rs. 14,951

Incorporated in 1960 as Bombay Oxygen Corporation Ltd., the company’s name has been changed to Bombay Oxygen Investments in the year 2018.

Bombay Oxygen Investments discontinued its primary business of manufacturing and supplying industrial gases in the year 2019 and derives a substantial portion of revenue from its financial investments from shares, mutual funds & other financial securities held by the company.

Procter & Gamble Hygiene and Health Care

Share price on 20/04/22 – Rs. 14,400

Procter & Gamble Hygiene and Health Care is a leading player in the healthcare and female care segment in India. Some of the most well-known brands of the company include Tide, Arial Pampers, Head & Shoulders, and Pantene.

Bharat Rasayan

Share price on 20/04/22 – Rs. 13,149

Established in the year 1989, Bharat Rasayan is an R&D-driven chemical manufacturing company that specializes in the production of Grignard reagents, fatty acid anhydrides, solvents, and pharma/drug intermediates. The company is one of the largest manufacturers of cosmetic ingredients used in personal care products.

Bharat Rasayan also provides custom and contract manufacturing services.

Tasty Bite Eatables

Share price on 22/04/22 – Rs. 11,388

Established in the year 1985, Tasty Bite Eatables is a leading player in the food manufacturing industry and a preferred partner to leading Quick Service Restaurants (QSR) and cloud kitchens globally.

The company has a massive store presence of 40,000+ stores in 15 countries across the world and offers a wide range of frozen formed products, patties, gourmet sauces, gravies, curries, and meals. The company also offers a variety of ready-to-eat entrees, organic rice, grains, and ready to cook sauces.

Polson

Share price on 20/04/22 – Rs. 11,200

Incorporated in 1900, Polson is a leading Indian supplier of natural tannin materials and eco-friendly leather chemicals to the leather industry globally. With 3 state-of-art facilities, the company offers a diverse range of products to its high-profile customer base throughout the world.

Does it make sense to invest in companies in India with the highest share price now?

Many investors make the mistake of associating a stock’s value with its price. A high stock price does not necessarily mean a share may be a good buy. Rather than looking at the stock price one should look at the value associated with the company.

Let’s understand this in detail with the example below:

MRF’s share price as of 20th April 2022 was Rs. 67,766, whereas RIL’s share price was Rs. 2717. In terms of market capitalization, with a market cap of Rs. 18.39 Lakh crores, RIL is way ahead of MRF’s market cap of Rs. 28.74 Thousand crores.

When we divide the market cap of a company by its outstanding shares, we get the share price.

In simple words, RIL has issued more shares compared to MRF. Further, there have been splits in RIL shares multiple times. On the other hand, MRF has never undergone a stock split. This explains the high share price of MRF.

Both MRF and RIL have generated outstanding returns for investors. So, a high stock price should never be considered a reason to invest in a stock. Instead of judging a share by its price, it is important to look at the company’s fundamentals to evaluate a stock.

Our team of experts can help you to create a personalized portfolio of fundamentally sound stocks based on your risk profile, which has the potential to grow up to 4-5 times or more in 5 years.

This article was last updated on 20/04/2022

Read more: How Long-term investing helps create life-changing wealth – TOI.