The recent Indo-China border pact between India and China marks a historic turning point in their strained bilateral relationship. Tensions over disputed territories have shadowed economic cooperation and investment flows for years. However, this landmark agreement offers a glimmer of hope for a new era of collaboration.

While the pact signals a positive development, it’s essential to acknowledge that the road ahead will likely be complex. Several factors, including geopolitical considerations, economic conditions, and regulatory hurdles, will continue to shape the trajectory of investments between the two countries.

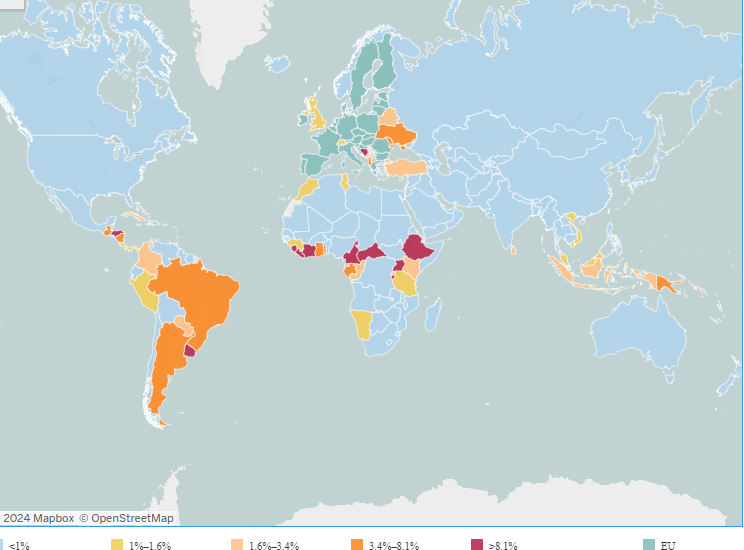

The global geopolitical context, including the ongoing Russia-Ukraine conflict and the broader competition between the United States and China, may also indirectly affect bilateral investments.

Indo-China Pact –A Historic Breakthrough

The announcement of the border pact came as a significant surprise, given the tense relations between the two countries following the 2020 border clash. This breakthrough has opened the door for improved political and economic ties, which could have far-reaching investment implications.

Addressing Investor Concerns

One of the major concerns that has hindered investments between India and China has been the government’s stringent vetting process for companies from neighboring countries. The introduction of Press Note 3 in 2020 effectively restricted investments from Chinese firms, leading to a significant decline in bilateral flows.

While the Indo-China border pact may alleviate some of these concerns, it’s important to note that India will continue to maintain investment curbs on bordering nations. The government will focus on the place of origin of investments rather than the identity of the investors. This suggests that scrutiny will remain in place to safeguard national interests.

The Growing Economic Ties

Despite the political tensions that have characterized the India-China relationship in recent years, economic ties between the two countries have strengthened. This is evident in the steady growth of bilateral trade.

In FY24, India-China trade reached a new milestone, surpassing $118.4 billion. Notably, China overtook the United States as India’s largest trading partner during this period. This signifies a significant shift in India’s trade landscape and underscores the growing economic interdependence between the two nations.

While Chinese investments in India have been relatively modest compared to trade flows, China’s substantial exports to India highlight the complementary nature of their economies. India’s demand for Chinese goods, ranging from electronics and machinery to raw materials, has been a major driver of bilateral trade.

The Role of FDI

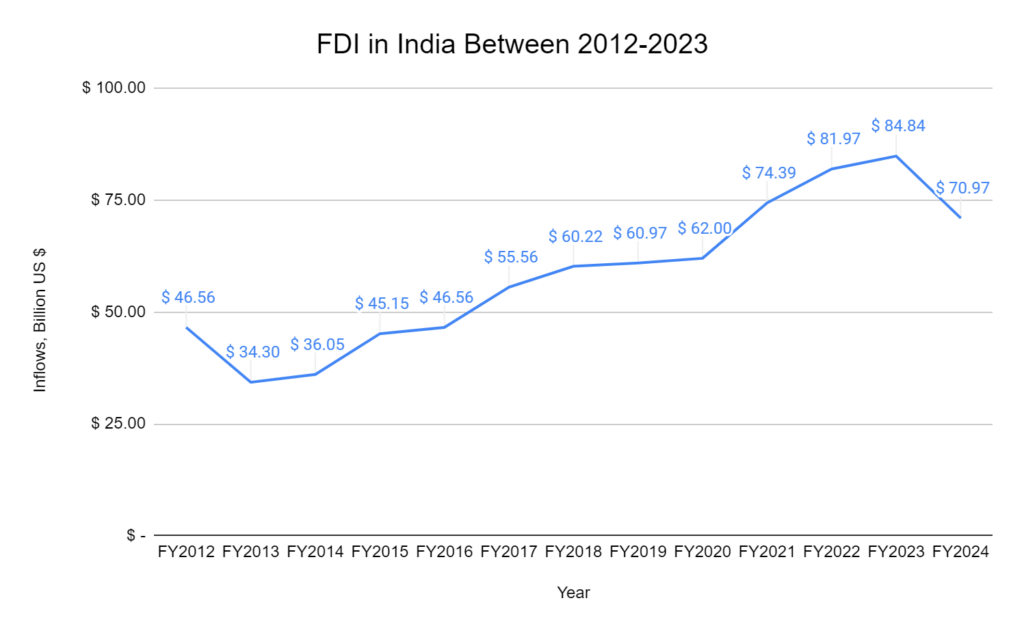

The Indian government has increasingly recognized the importance of foreign direct investment (FDI) as a catalyst for economic growth and development. FDI brings in capital, technology, and expertise, which can contribute to job creation, industrial development, and technological advancement.

While FDI from China has not been a significant source of inflows to India, the recent Economic Survey has advocated for a more open and welcoming approach towards such investments. The argument is that attracting Chinese FDI can be advantageous for several reasons:

- Technology Transfer: Chinese companies often possess advanced technologies and manufacturing capabilities that can benefit India’s industrial development.

- Job Creation: FDI can lead to the creation of new jobs and boost employment opportunities.

- Domestic Manufacturing: By attracting Chinese FDI, India can encourage the domestic manufacturing of goods previously imported from China. This can reduce import dependency, improve trade balances, and promote self-sufficiency.

- Global Value Chains: Participating in global value chains through FDI can help Indian companies enhance their competitiveness and access new markets.

While the Economic Survey has made a strong case for attracting Chinese FDI, it’s important to note that the government will continue to exercise due diligence to safeguard national interests. Any FDI proposal from China will be carefully evaluated to ensure that it aligns with India’s economic and strategic objectives. Source: Livemint

Challenges and Opportunities of the Border Pact

Despite the positive developments, several challenges remain that could impact the flow of investments between India and China:

- Geopolitical Factors: The ongoing geopolitical tensions between the two countries, including border disputes and technology rivalry issues, could continue to influence investment decisions.

- Regulatory Hurdles: Even with the relaxation of some restrictions, navigating the regulatory landscape in India can be complex for foreign investors.

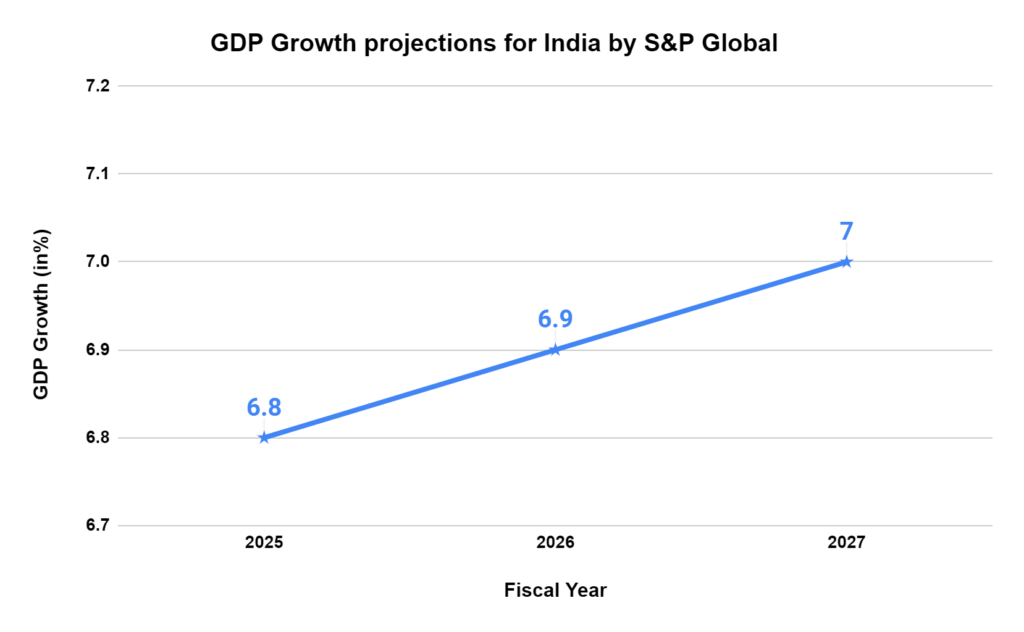

- Economic Conditions: The economic conditions in both countries, including growth rates, interest rates, and exchange rates, will play a crucial role in determining the attractiveness of investments.

The Way Forward

To fully realize the potential for increased investments between India and China, addressing these challenges and creating a conducive environment for businesses will be essential. This includes:

- Further Policy Reforms: The Indian government could consider further easing restrictions on FDI from China and other neighboring countries.

- Enhanced Dialogue: Regular dialogue and cooperation between the two countries can help build trust and confidence, essential for fostering long-term economic partnerships.

- Focus on Mutual Benefits: Investments should be driven by a focus on mutual benefits and the creation of shared value.

Conclusion

The border pact between India and China marks a significant step towards improving bilateral relations. While challenges can be overcome, the potential for increased investments and economic cooperation is substantial. By addressing the concerns and creating a favorable environment, the two countries can unlock the full potential of their partnership and contribute to the global economy.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.