India has become the hottest destination for foreign investors, beating China that’s struggling with a slowing economy and a crackdown on its tech sector. A survey by the think tank Official Monetary and Financial Institutions Forum (OMFIF) showed that India was the top choice for 40% of the 100 funds surveyed. At the same time, China got the support of less than a quarter of the managers.

The Numbers Game

Here are some of the reasons why foreign investors are moving their money from China to India:

- Indian Stock Market Performance Increased by 2000% is Better

The stock markets are doing much better in India than in China. The MSCI China Index has given zero returns to investors since it started in October 1995. Still, the MSCI India Index has increased by a whopping 2,000%, and the MSCI Emerging Market Index has risen over 160%. China’s stock market has been hit hard by the government’s actions against some of its most prominent tech companies, like Alibaba, Tencent, and Didi, which have scared away investors and lowered their value.

India, on the other hand, has seen a surge in the share prices of its tech companies, such as like Reliance Industries, Infosys, and TCS, which have gained from the digital transformation and the increased demand for IT services during the pandemic.

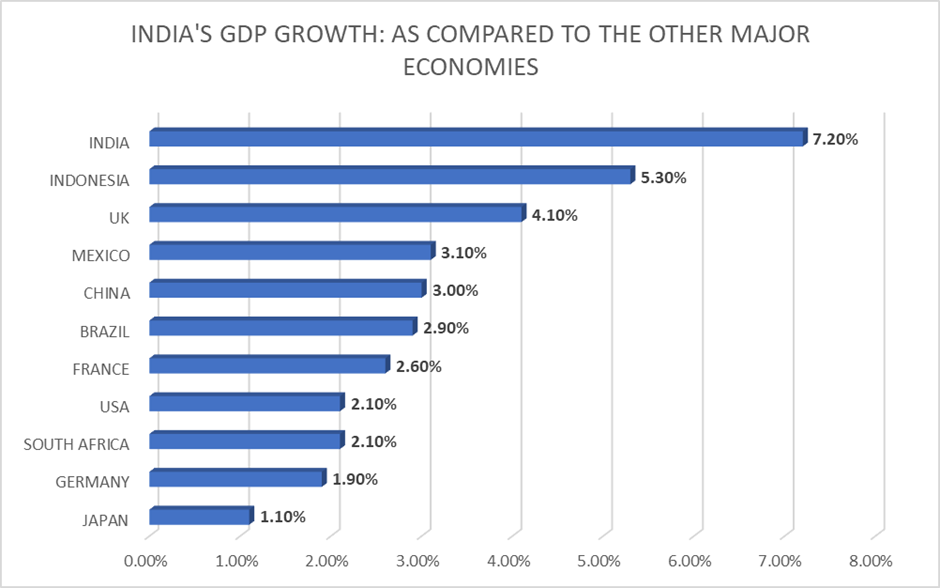

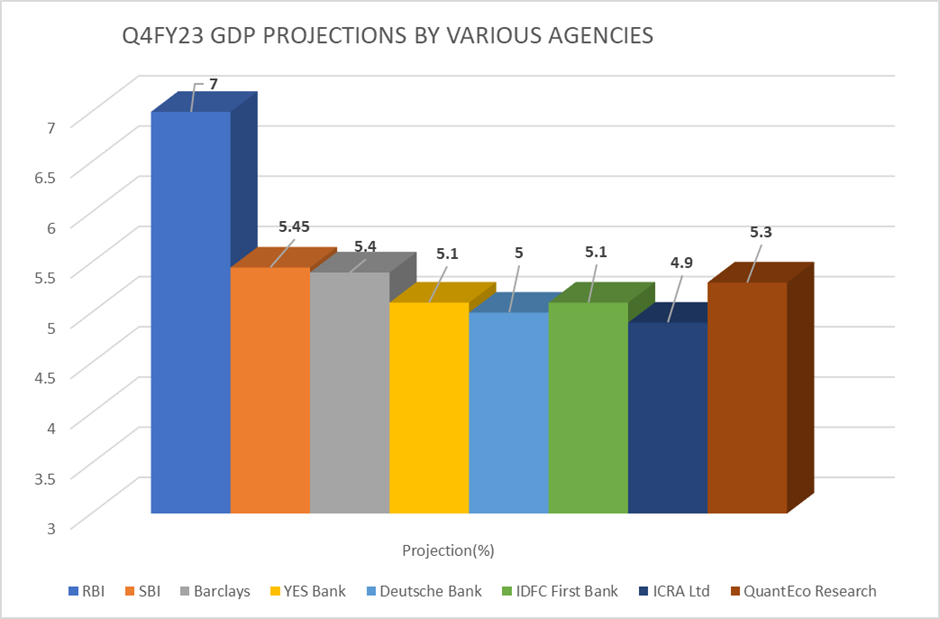

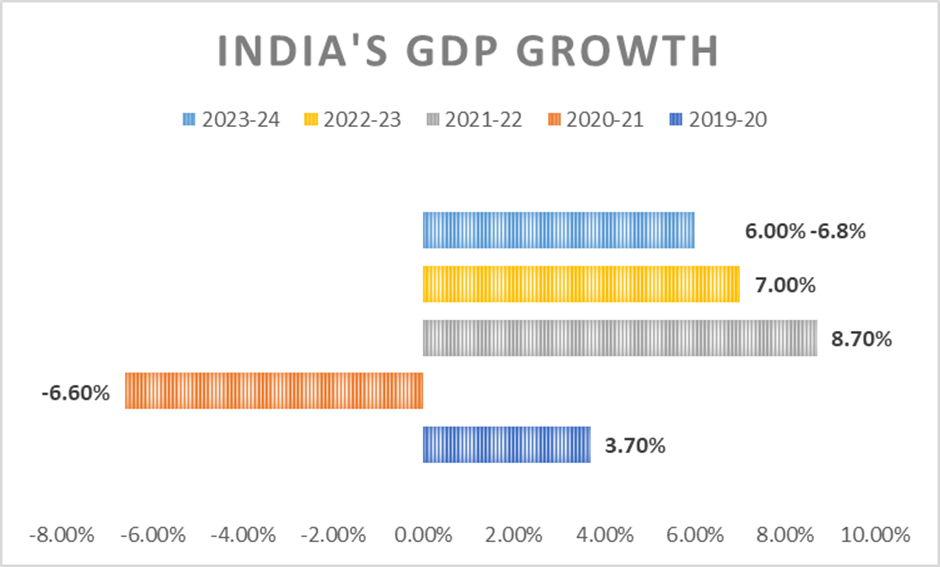

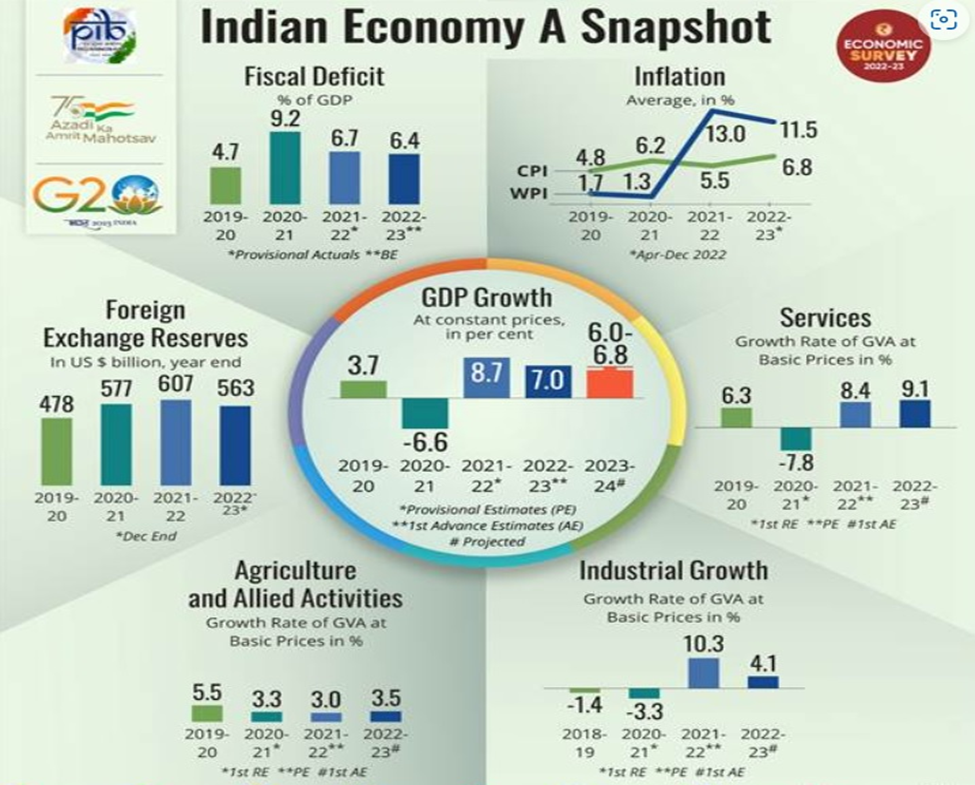

- Indian Economy’s Growing Faster

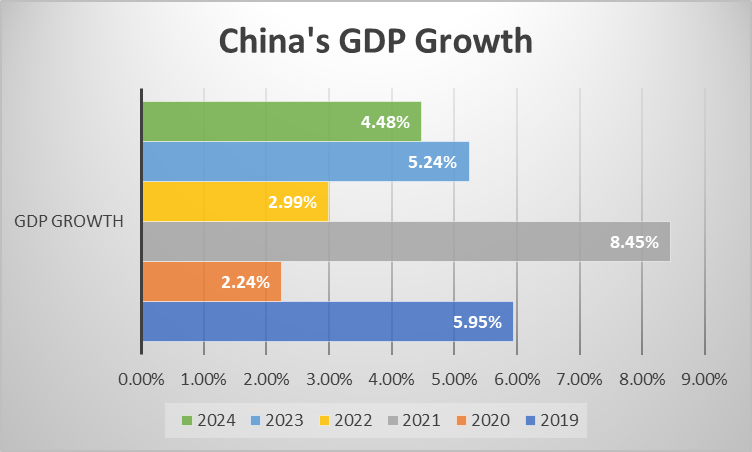

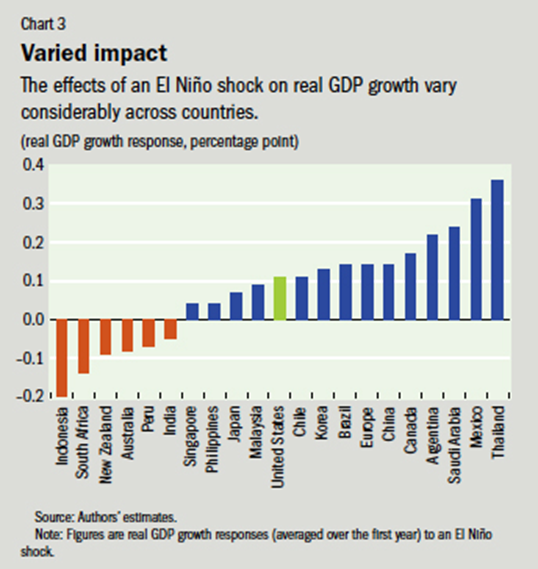

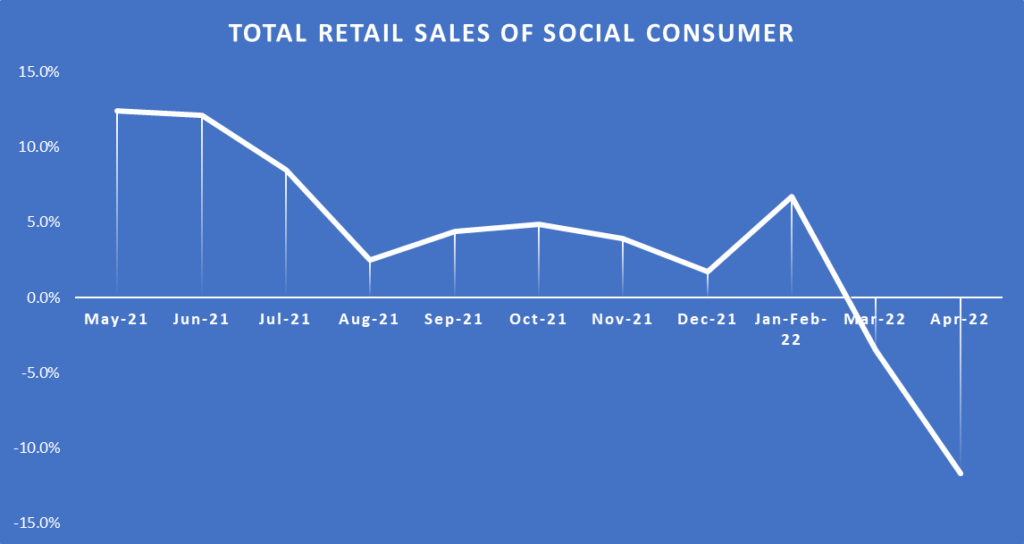

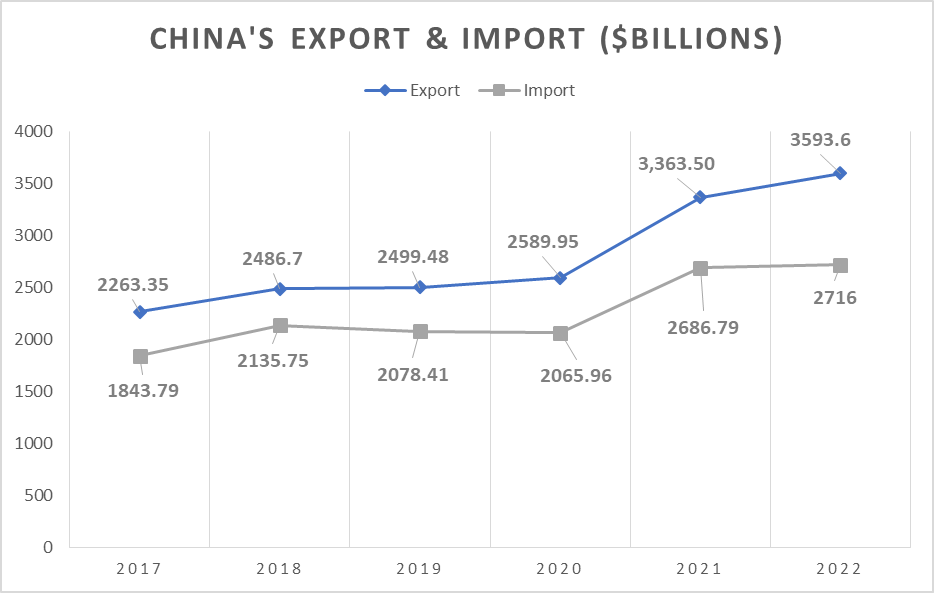

According to the International Monetary Fund (IMF), the Indian economy is growing faster than China. China’s GDP growth slowed down to 3.7% in 2020, the lowest in 44 years, but India’s GDP shrank by 5.9% and has bounce back strongly in 3 years and grown by 39.7% till 2023. Since 2021, China’s economy can be seen falling while India’s India’s GDP is showing an upward trend.

India’s recovery is driven by the easing of lockdown restrictions, the rollout of vaccines, and the government’s spending and lending measures. China’s recovery, however, is facing challenges from the comeback of COVID-19 cases, the tightening of credit conditions, and trade tensions with the US and other countries.

- Indian Market Gives You More Control

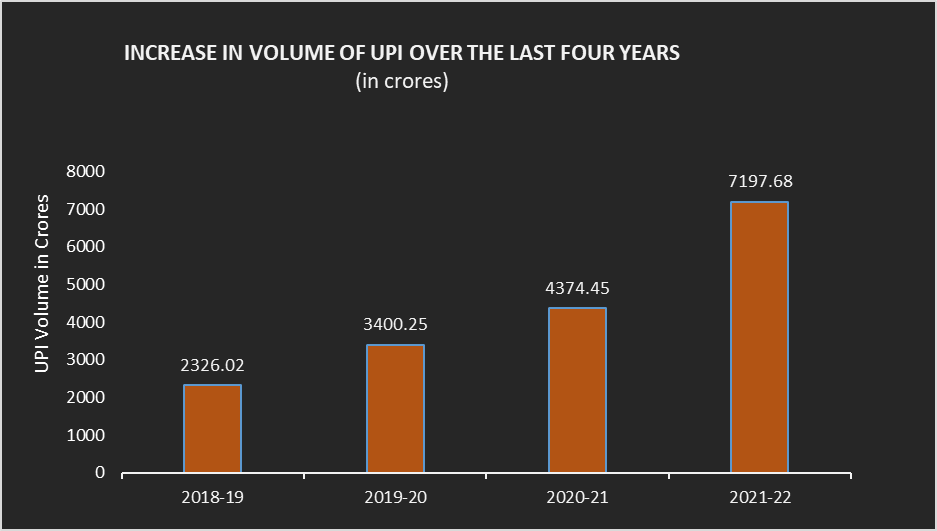

The foreign direct investment (FDI) policy is more open in India than China. India has made it easier for foreign investors to invest in various sectors, such as defence, insurance, and retail. China has made it harder for foreign investors to invest in its market and has banned investments from countries that share a land border with it, such as India. This has affected the flow of FDI into China, which grew by only 4% in 2020, while India’s FDI rose by 13%, reaching $57 billion, the highest among the emerging markets. Most of the FDI into India went to companies active in the digital economy, such as Jio Platforms, Flipkart, and Zomato, which attracted investments from global giants like Facebook, Google, Walmart, and Tiger Global.

Politics is Bigger than We Think

Apart from the economies of the countries, geopolitics also plays a vital role in the change of dynamics:

- India has a more stable and democratic political system than China, which reduces the risk of policy uncertainty and social unrest. India also has a more independent judiciary and a free press, which protect investors’ rights and interests, setting them in a state of ease and giving them a sense of control over their investments.

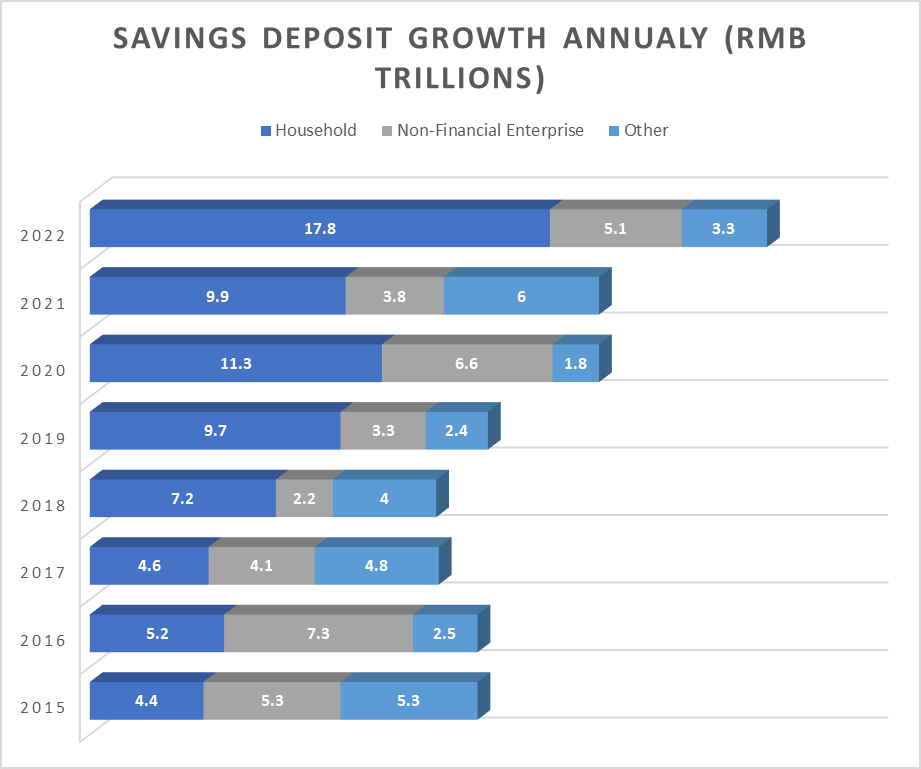

- The demographic profile of India is more favourable than China, with a large and young population that provides a vast market and a skilled workforce that will stay intact for years. India also has a more diverse and vibrant culture, which fosters creativity and innovation. On the other hand, China’s population is growing older, and the decline in population growth makes the economy more vulnerable.

- India has a more strategic and friendly relationship with the US and other major economies than China, which gives it access to trade and investment opportunities. India also has a more balanced and sustainable approach to development than China, which respects the environment and human rights.

Know more about

IPO | Current IPO | Upcoming IPO | Listed IPO

China is facing a significant backlash as the US has banned many big Chinese companies from conducting business in the US. As companies like Huawei Technologies and Jiangxi Hongdu Aviation Industry are not connected to one of the biggest markets in the world, it becomes difficult for investors to stay invested in such a volatile market.

India has become a more attractive destination for foreign investors than China because of better stock market performance, robust economic growth, and a more favorable FDI policy. This edge is likely to last in the coming years as India uses its demographics, innovation potential, and strategic partnerships to achieve its goal of becoming a $5 trillion economy by 2025.

Read More: Grey Market Premium

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.