The EV market in India is expected to reach $47 billion by 2026, reducing our reliance on fossil fuels significantly over time. This advancement will increase energy efficiency and lower carbon emissions in the coming years. Government initiatives and eco-consciousness among buyers have opened doors to boundless opportunities for the emerging electric vehicles hub India.

Wondering why EV? What prompted India to be so bullish on the EV industry?

India currently has the fifth-largest automotive industry in the world, and it wants to move up to the third position. India’s transport sector is the largest fossil fuel user, accounting for 33% of our crude oil consumption. Consequently, it is the country’s second-largest source of CO2 emissions, accounting for almost 11% of total CO2 emissions from fuel combustion.

Catalyzing India EV potential to increase energy security and mitigate the negative environmental impacts of ICE (Internal Combustion Engine) vehicles is a must. Furthermore, focusing on the EV sector can open up new opportunities in EV battery and charging infrastructure while relieving the pressure on oil imports.

Electric Vehicle Hub India Future

With looming oil crisis, growing global warming, and increasing ailments due to poor air quality have triggered the demand for EVs in India.

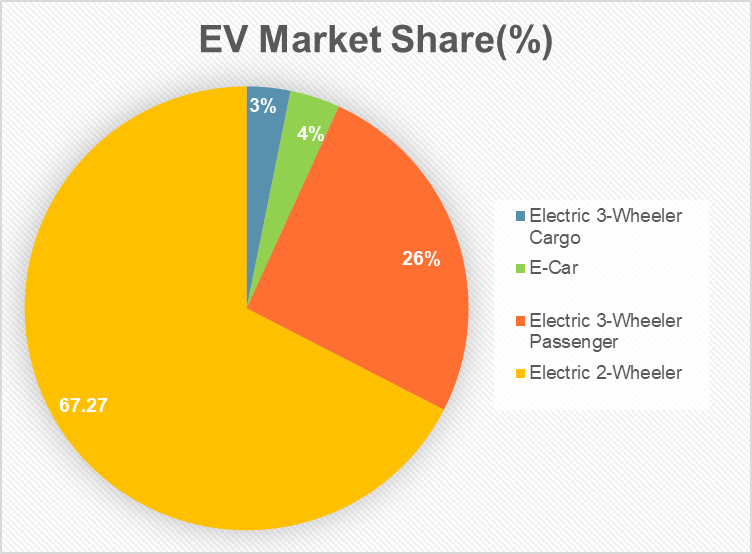

Vehicle Category-wise market share

More than 10 million EV vehicles are expected to be sold in India by 2030, with the two-wheeler category driving most of the growth. In India, the two-wheeler segment currently dominates the EV industry.

Among other measures, proper collaborative actions, reliable charging infrastructure, direct subsidies, further tax incentives, and easier norms for PLI eligibility undoubtedly unlock India EV potential.

5 Reasons Why Electric Vehicles Hub India is Possible

Governments worldwide are providing subsidies to encourage more consumers to choose electric vehicles over fossil-fuel-powered vehicles.

Lower Operating and Maintenance cost

The decision to purchase any vehicle is primarily influenced by two factors: maintenance costs and operating costs. Unlike gasoline vehicles, electric cars have very few moving parts that break or need to be replaced. Furthermore, you spend less on fuel/energy, making it a very cost-effective option.

Eco-Friendly

Electric Vehicles have zero tailpipe emissions, allowing you to reduce your carbon footprint significantly. It can help save our environment from climate change and reduce the health issues caused by pollution.

Less Driving Fatigue

With electric vehicles, you can enjoy a stress-free and noise-free drive as these vehicles are gearless. In addition, the motors are less noisy than combustion engines and their exhaust systems. Therefore, less noise can help to reduce noise pollution.

Hassle-Free Charging

With 1800 electric vehicle battery charging stations already in place and many more on the way, charging your battery will be simpler than standing in queue for petrol/CNG refills. Using charging equipment, you can recharge your vehicle from the comfort of your home.

Tax Benefits

If you take a car loan to buy an electric vehicle, you can claim a deduction of Rs. 1 lac under Section 80 EEB on the interest paid. The government has reduced the GST on electric vehicles from 12% to 5%. The new Green Tax Policy requires you to pay road tax only when you renew your registration certificate after 15 years.

India’s Challenges in the transition to electric vehicles

Lack of Charging Infrastructure

Availability of land for charging infrastructure building and electricity grid readiness are two critical bottlenecks to deep electric vehicle penetration in India.

Supply Chain Challenges

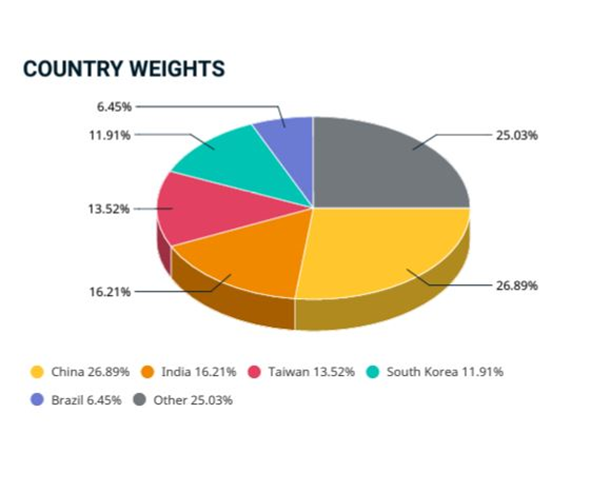

The reliance on imported automobile components such as lithium-ion batteries and semiconductors discourages companies interested in investing in the electric vehicles industry. Moreover, according to experts, battery shortages will reduce global production capacity by more than 20 million between 2020 and 29.

Battery Life

EV batteries are designed to last for a maximum of 6-8 years. As a result, when the battery’s life expires, the user is forced to purchase a new battery, which costs nearly 75% of the total vehicle cost. In the long run, such high battery costs could affect buyer psychology.

Government policies to become a global EV hub

One of the key factors impeding the market penetration of EVs in India is the low acceptance rate.

FAME- I & II

These schemes were launched in 2015 and 2019 to encourage the adoption of EVs in India and to reduce the use of gasoline and diesel in automobiles. It focused on supporting 5,00,000 e-3Wheelers, 7000 e-Buses, 55,000 e-passenger vehicles, and over a million 2-Wheelers with a budget of Rs. 10,000 crores.

PLI Scheme

Launched in June 2021 under the flagship mission “Atmanirbhar Bharat,” the PLI scheme was designed to entice domestic and international investors to invest in India’s Giga Scale ACC manufacturing facilities. Total Rs. 18,100 crores to be paid out over five years after the production facility becomes operational.

Special E-Mobility Zone

Allocating mobility zones for electric vehicles will aid in preventing overcrowding caused by private cars. This, in turn, will help to increase the EV market share by encouraging more consumers to buy or rent one.

Lowering of Custom Duty

The government has lowered import duty on vital raw materials to give a competitive edge to domestic production of EV batteries. Custom duty on Nickel Ore has been reduced from 5% to 0%, Nickel Oxide from 10% to 0%, Ferro Nickel from 15% to 2.5%

Key Takeaways

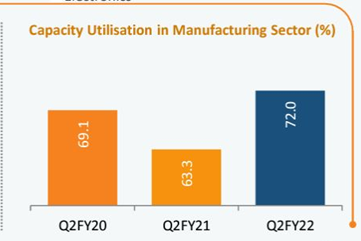

India has become one of the most alluring destinations for investment in the manufacturing sector. Legacy players are catching speed, and many enthusiastic start-ups are ready to jump on the EV bandwagon. In the next decade, India can become the electric vehicle hub with a well-connected roadmap to build a sustainable and intelligent e-mobility landscape.

FAQs

What are Electric Vehicles?

Vehicles that deploy electric motors instead of ICE for power generation are called EVs.

What are the types of Electric Vehicles?

EVs can be Plug-in, Space Rover, Off-and On, Airborne Powered, Range-extended, Railborne, or Seaborne. And Electrically Powered Spacecraft types.

Read more: How Long-term investing helps create life-changing wealth – TOI.