Once a dominant player, Vodafone Idea is now struggling to stay afloat. With mounting debt, falling subscriber numbers, and weak financial position, the telecom company is in a dire state.

However, with the support of the promoter and the government, will Vodafone Idea be able to make a turnaround? What does the future of Vodafone Idea share price hold?

We will do a deep dive analysis of the company. Stay tuned till the end.

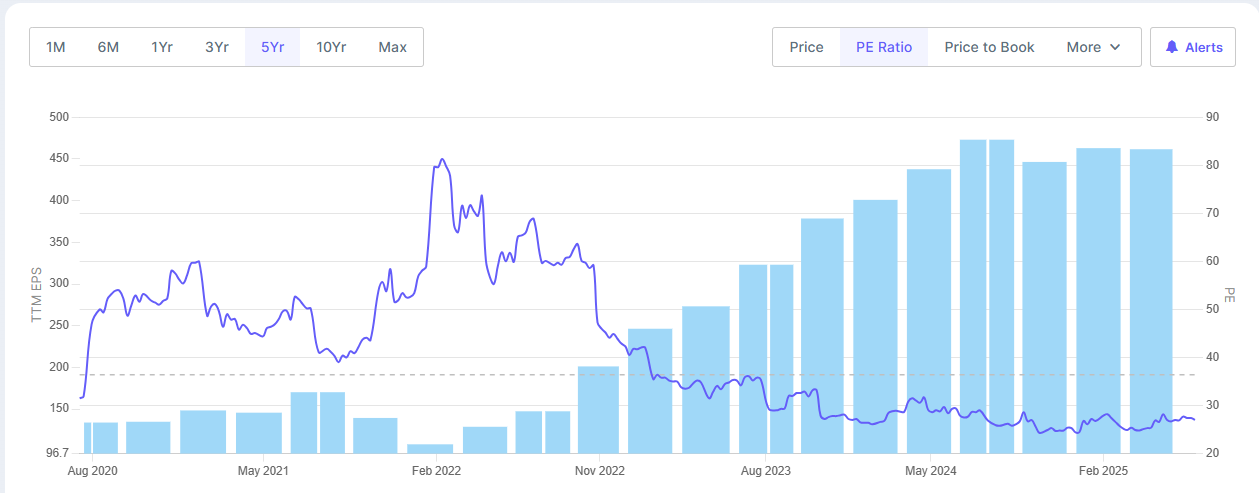

Performance of Vodafone Idea Share Price

Over the last year, Vodafone Idea share price has largely remained range-bound, trading below the ₹10 level. The company has a market capitalization of nearly ₹78,000 crore, as of 25th July 2025.

The 52-week high and low for Vodafone Idea are ₹16.6 and ₹6.29, respectively.

News flows like fundraising plans, tariff hike talks, and government intervention are the major causes of volatility in Vodafone Idea share price. Further, due to poor financials, institutional investors avoid the stock, leaving retail investors and traders as the dominant participants.

Fundamental Challenges for Vodafone Idea

Subscriber Loss

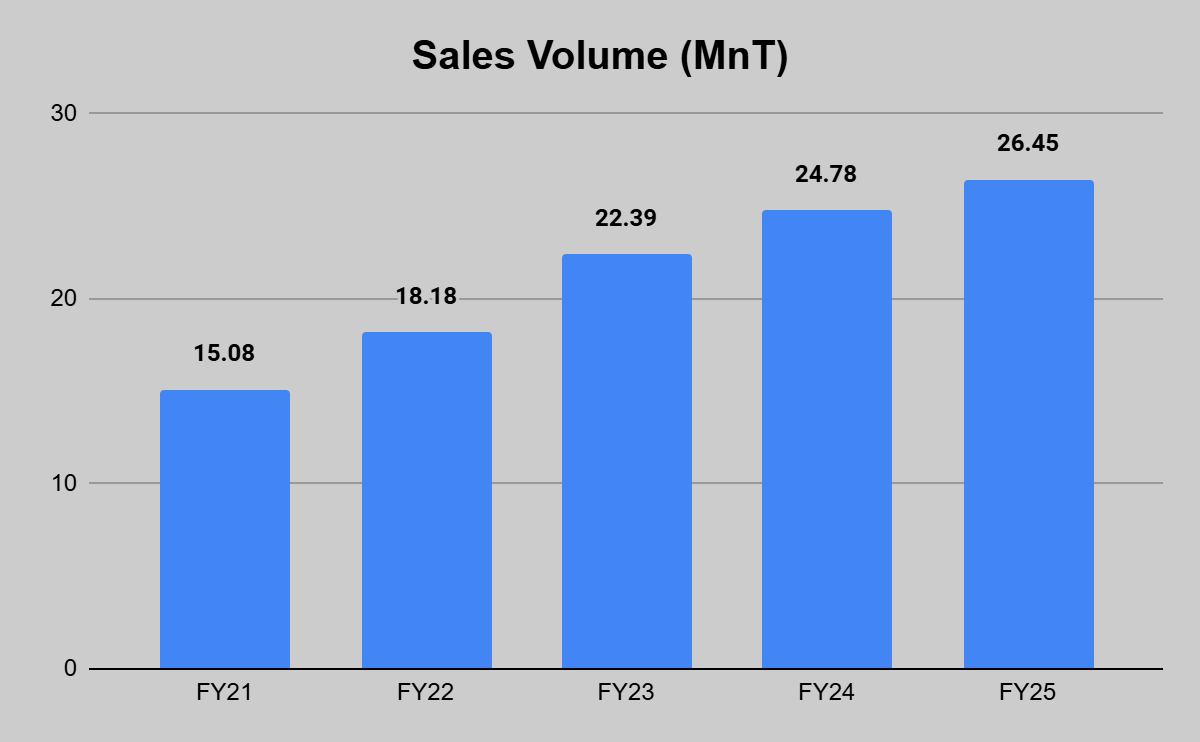

While Bharti Airtel and Reliance Jio have increased their subscriber base, Vodafone Idea’s subscriber base is not improving. Its market share has slipped below 15%, raising concern about its long-term viability and competitive edge.

At the end of June 2025, Vodafone Idea had a total subscriber base of 198 million, while Reliance Jio and Bharti Airtel had 494.47 million and 302.15 million subscribers, respectively.

Huge Debt Burden

Vodafone Idea is one of the most indebted telecom companies globally.

As of 31st March 2025, the outstanding debt from the bank stood at ₹2,345 crores. In FY26, dues related to spectrum are ₹2,538 crores, and the AGR instalment is ₹16,428 crores.

The annual interest cost exceeded ₹25,530 crores in FY25, leaving little room for capex and spending on network expansion.

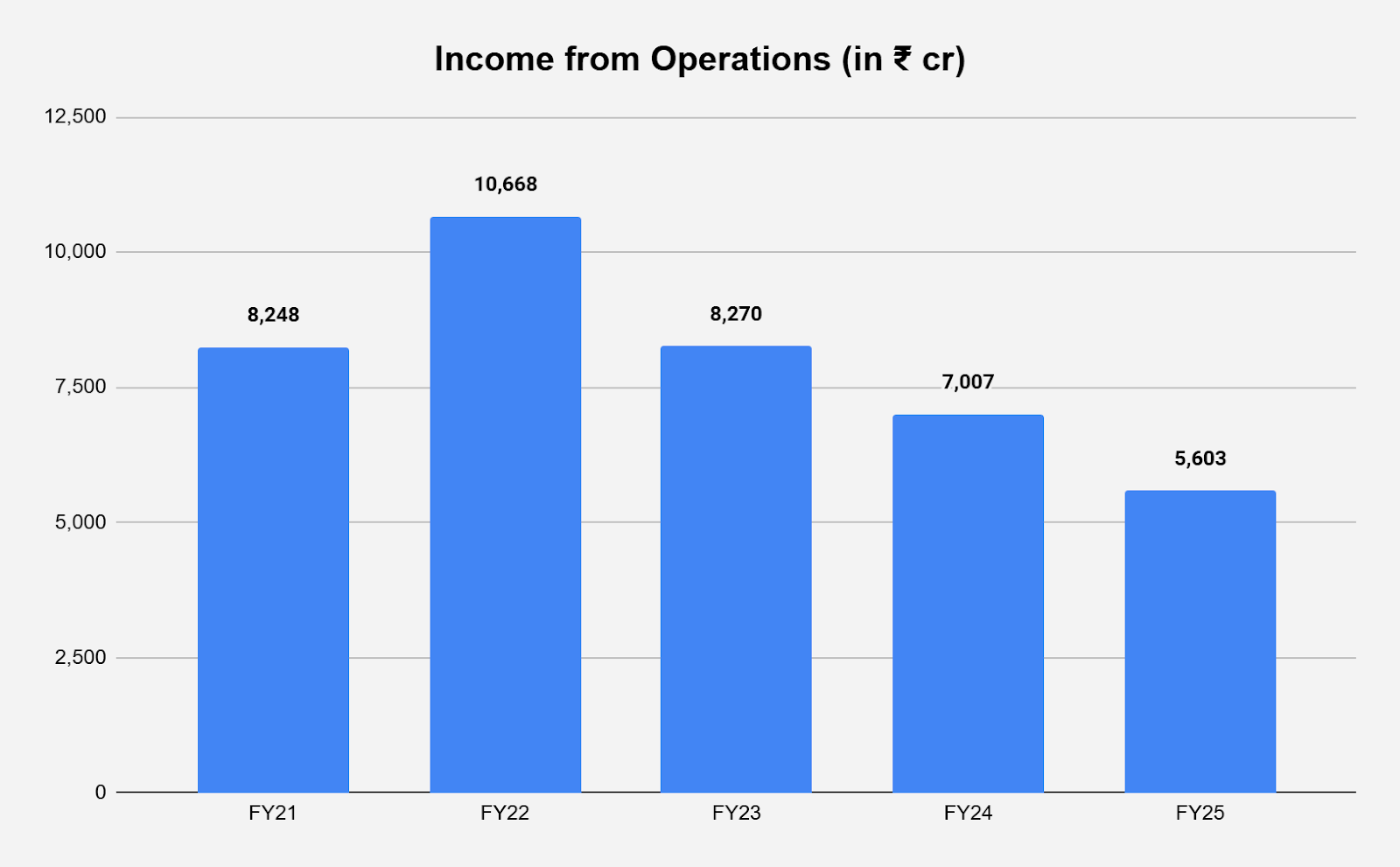

Weak ARPU and Revenue Growth

Vodafone Idea’s Average Revenue Per User (ARPU) is well below its peers. At the end of Q4FY25, customer ARPU stood at ₹175, while Airtel and Jio’s ARPU were ₹245 and ₹209, respectively.

The primary causes of lower ARPU are the lower monetization of the user base, reliance on low-paying prepaid users, and the inability to retain premium customers.

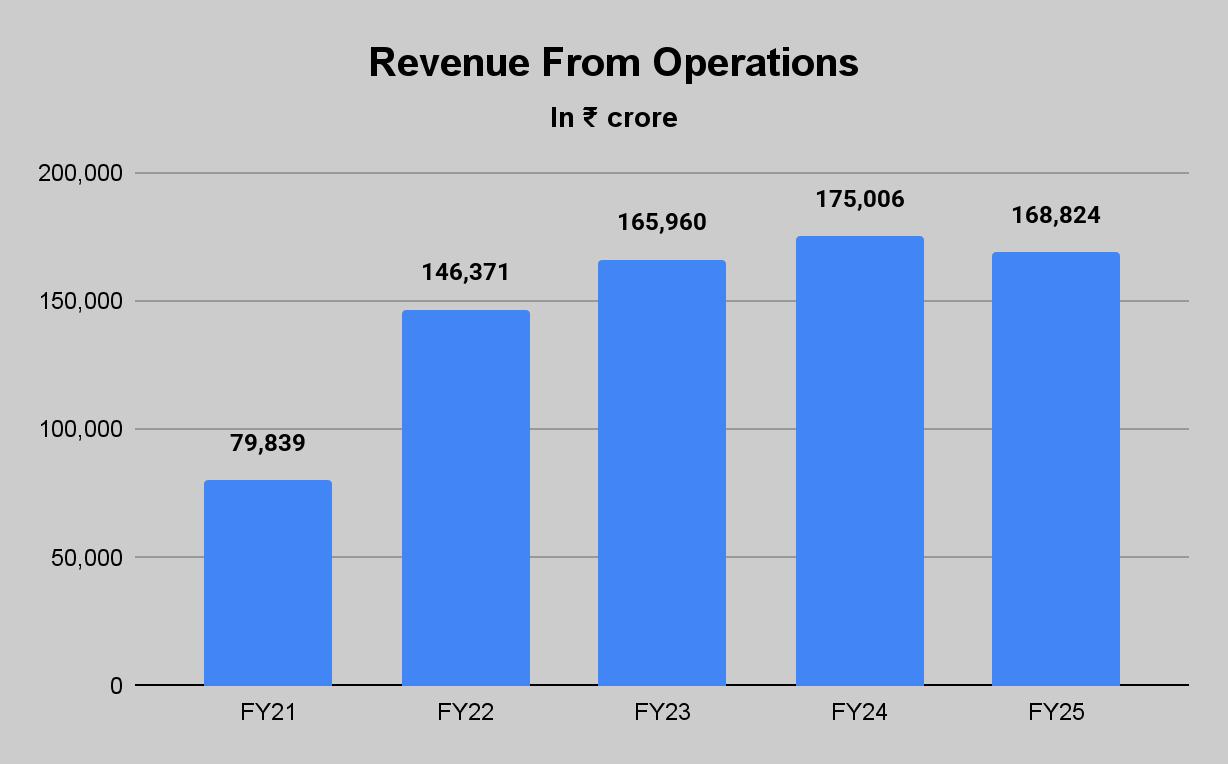

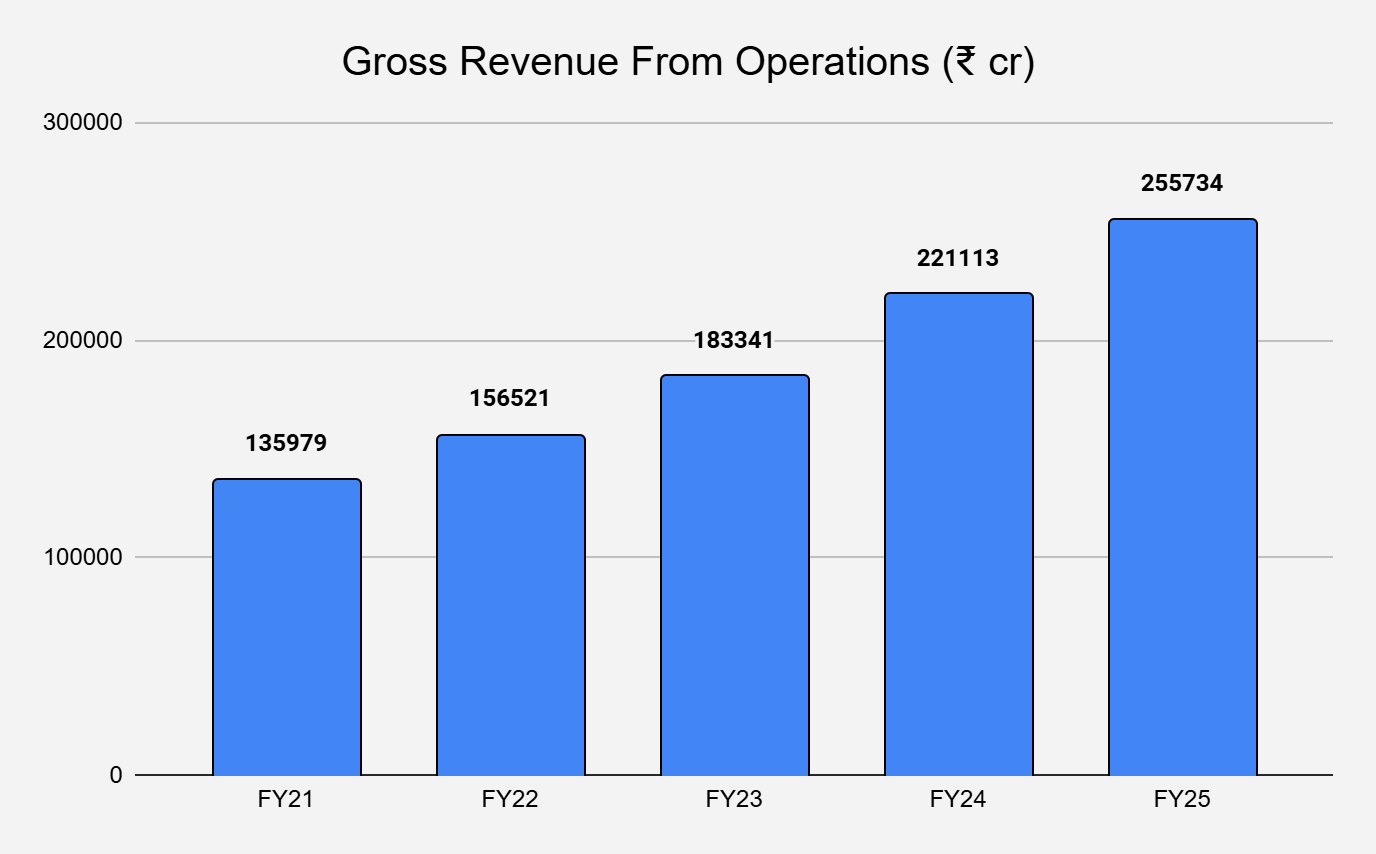

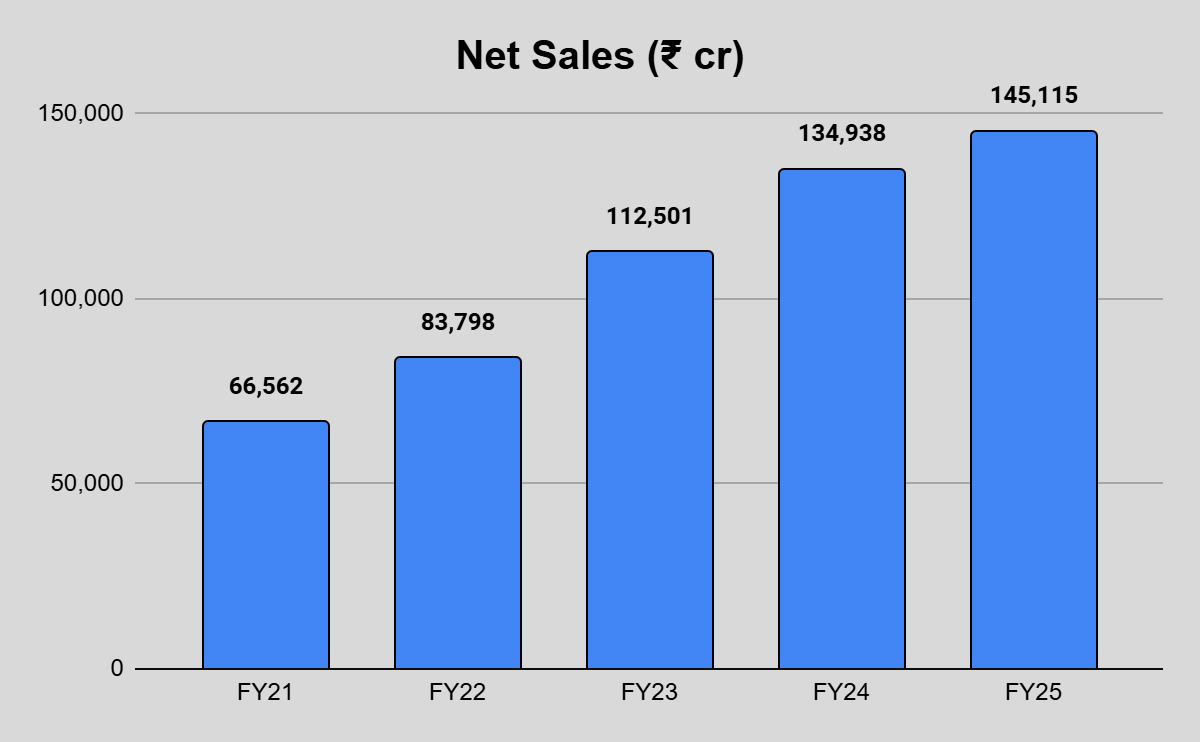

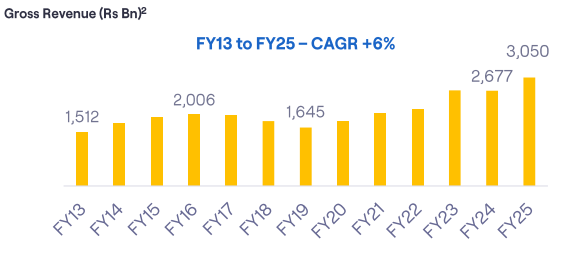

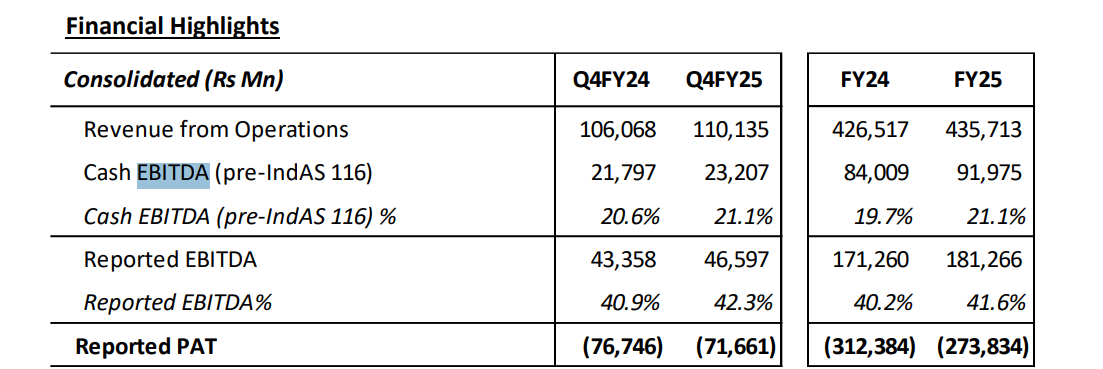

In FY25, the company’s revenue from operations stood at ₹43,571 crore, reporting a slight growth of 2.1% from ₹42,652 crore in FY24.

Limited Capex and Network Investment

Telecom is a capex-heavy business. A telecom operator’s strength lies in its network, and Vodafone Idea is significantly underinvested compared to peers.

The following are the capex figures of all three telecom operators in FY25:

- Reliance Jio: ₹41,600 crores

- Bharti Airtel: ₹30,300 crores

- Vodafone Idea: ₹9,570 crores

Additionally, both Reliance Jio and Bharti Airtel have nearly completed the nationwide rollout of 5G services. While Vodafone Idea’s 5G services are limited to a few cities. Work is underway to roll out the services in 17 circles by August 2025. India currently has 22 telecom circles.

The company has missed an opportunity to retain or regain premium customers. Now, both Reliance Jio and Bharti Airtel will reduce their 5G-related capex spending in FY26.

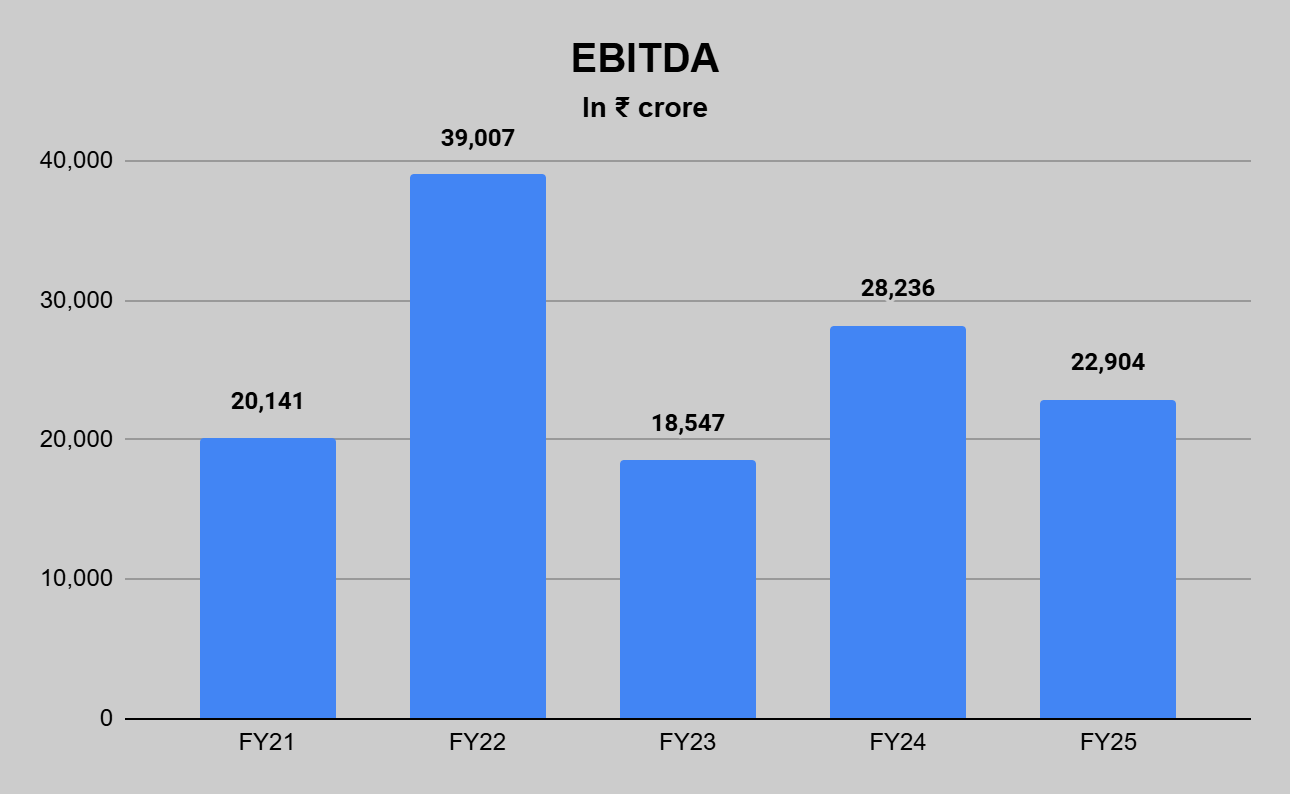

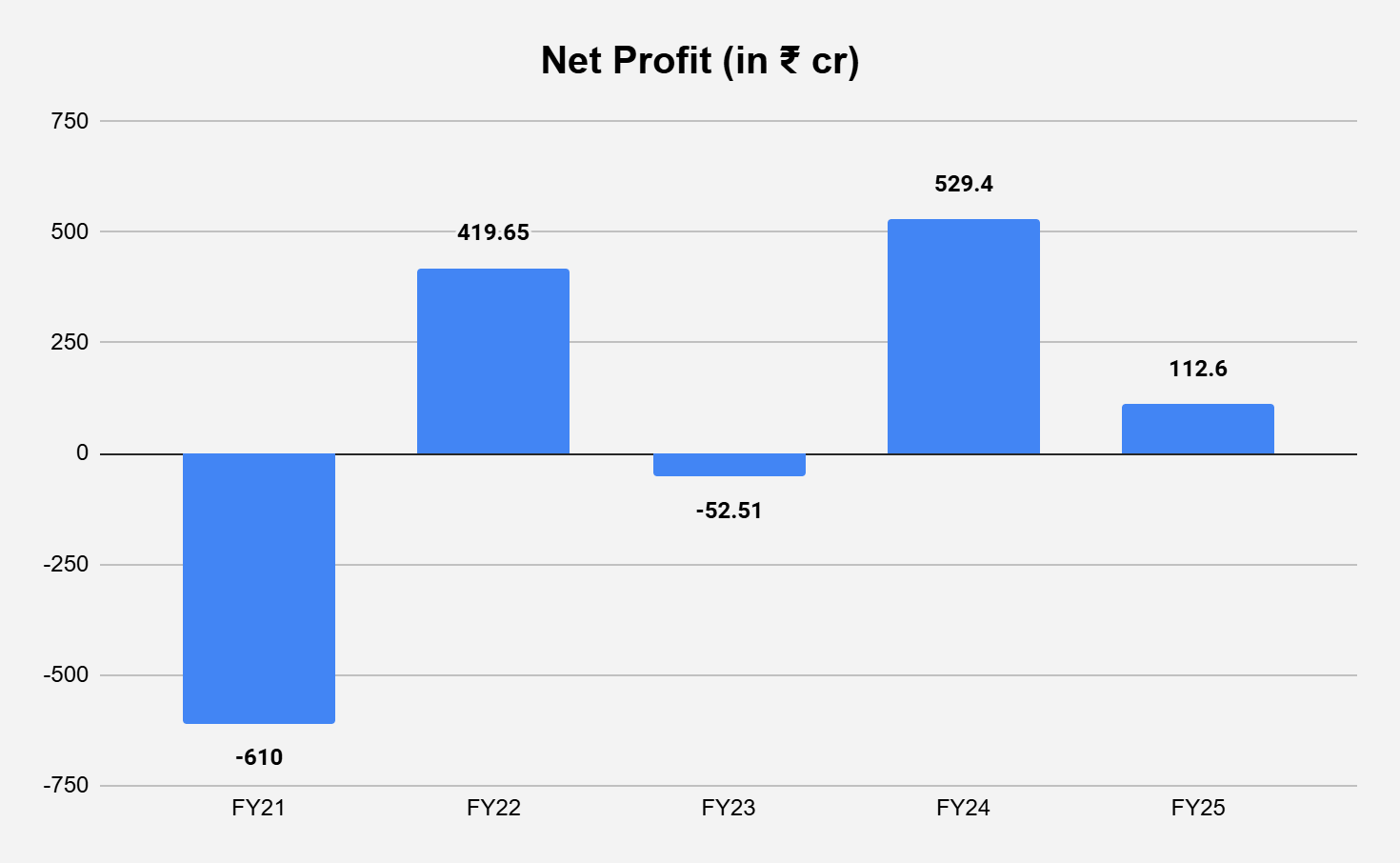

Negative Cash Flow and Operational Stress

While the company has been successful in improving its operational profit and margin, the huge interest expense, license fee, and capex outgoes still result in negative cash flow.

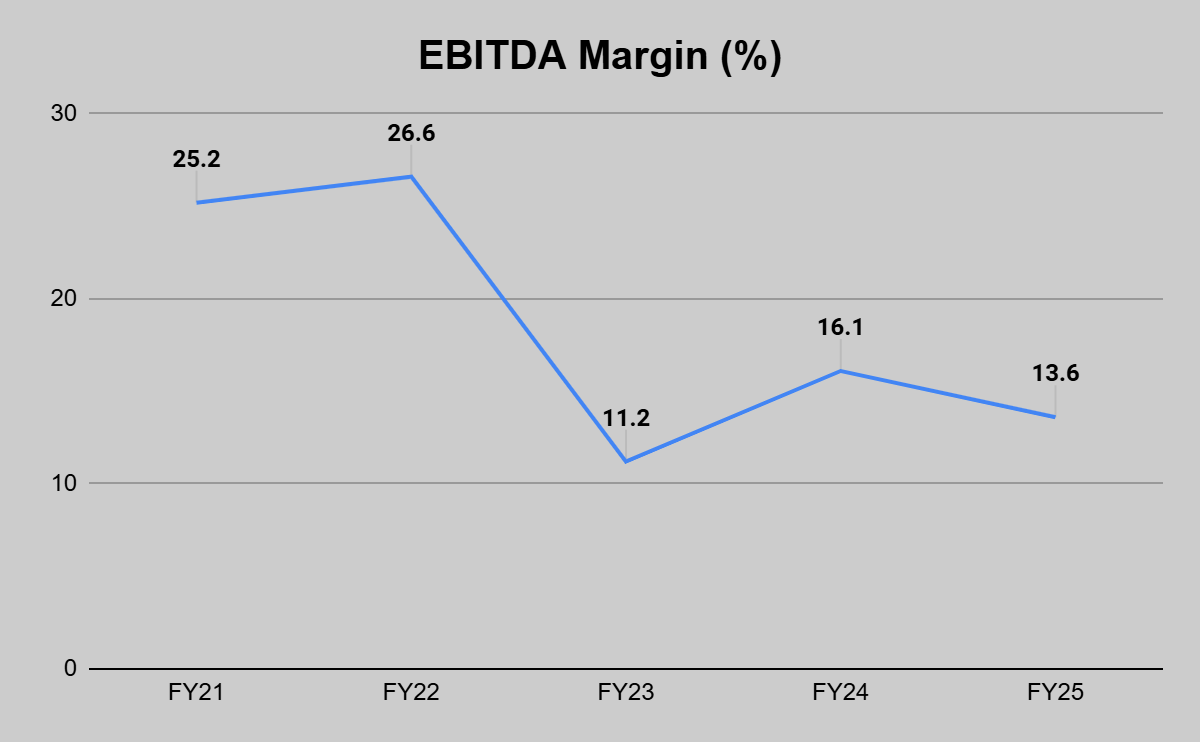

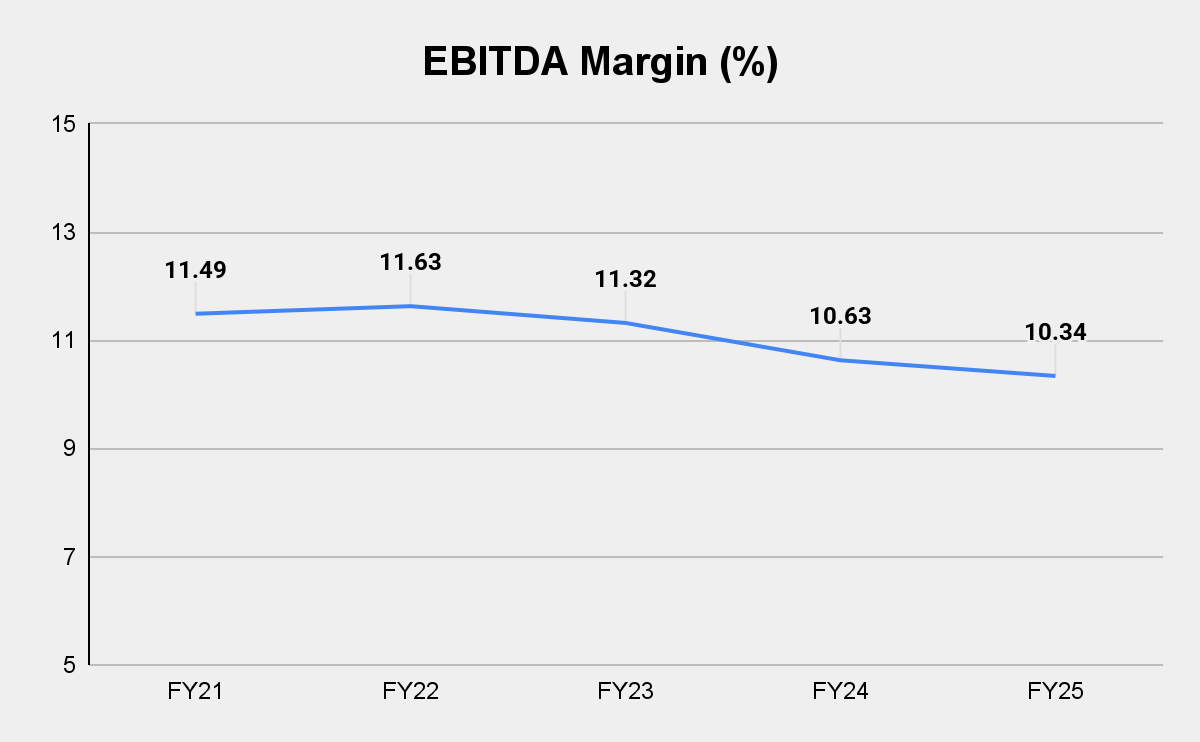

Compared to peers, Vodafone Idea has much lower operating margin. In FY25, the EBITDA margin of Bharti Airtel and Reliance Jio are 57.8% and 50% respectively. The number indicates operational stress or due to outflow of subscribers, Vodafone Idea is struggling.

Vendors, such as Indus Towers, have on multiple occasions also flagged delays in payments.

Corporate Governance & Promoter Support Issues

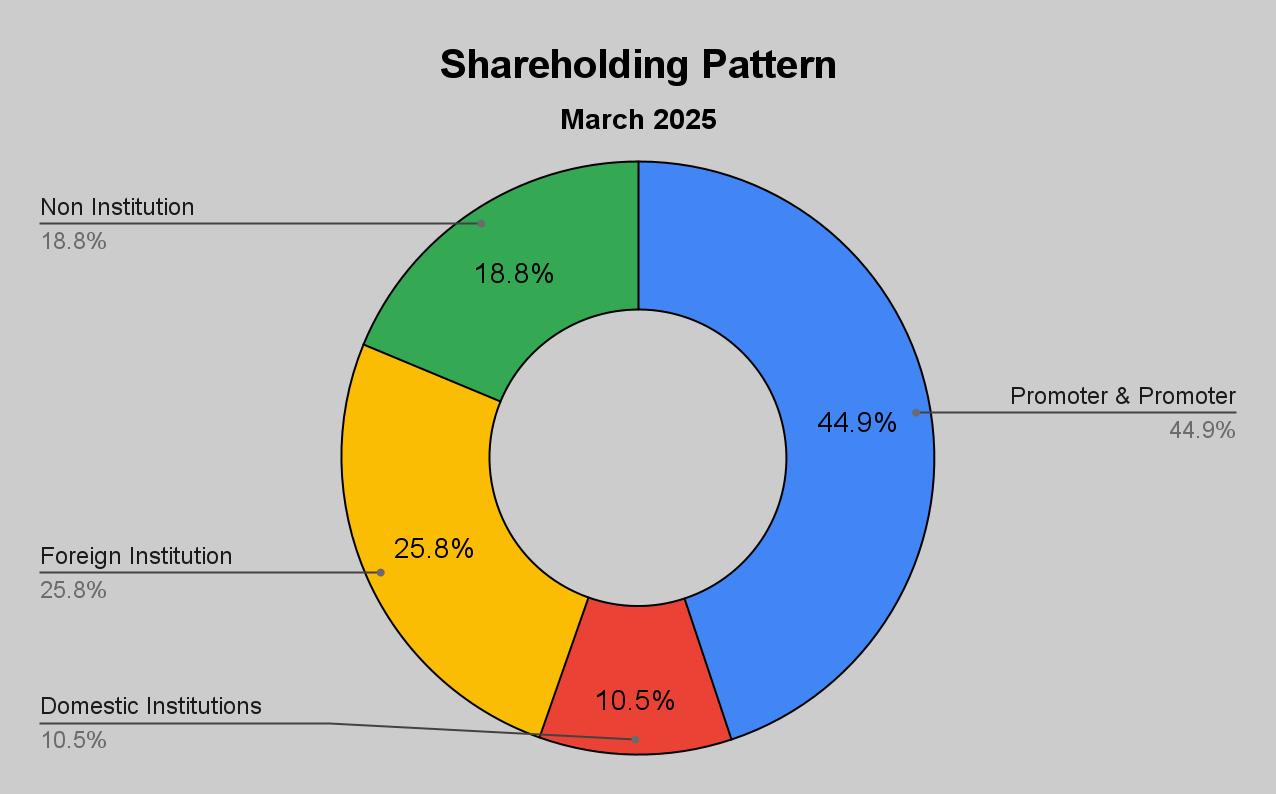

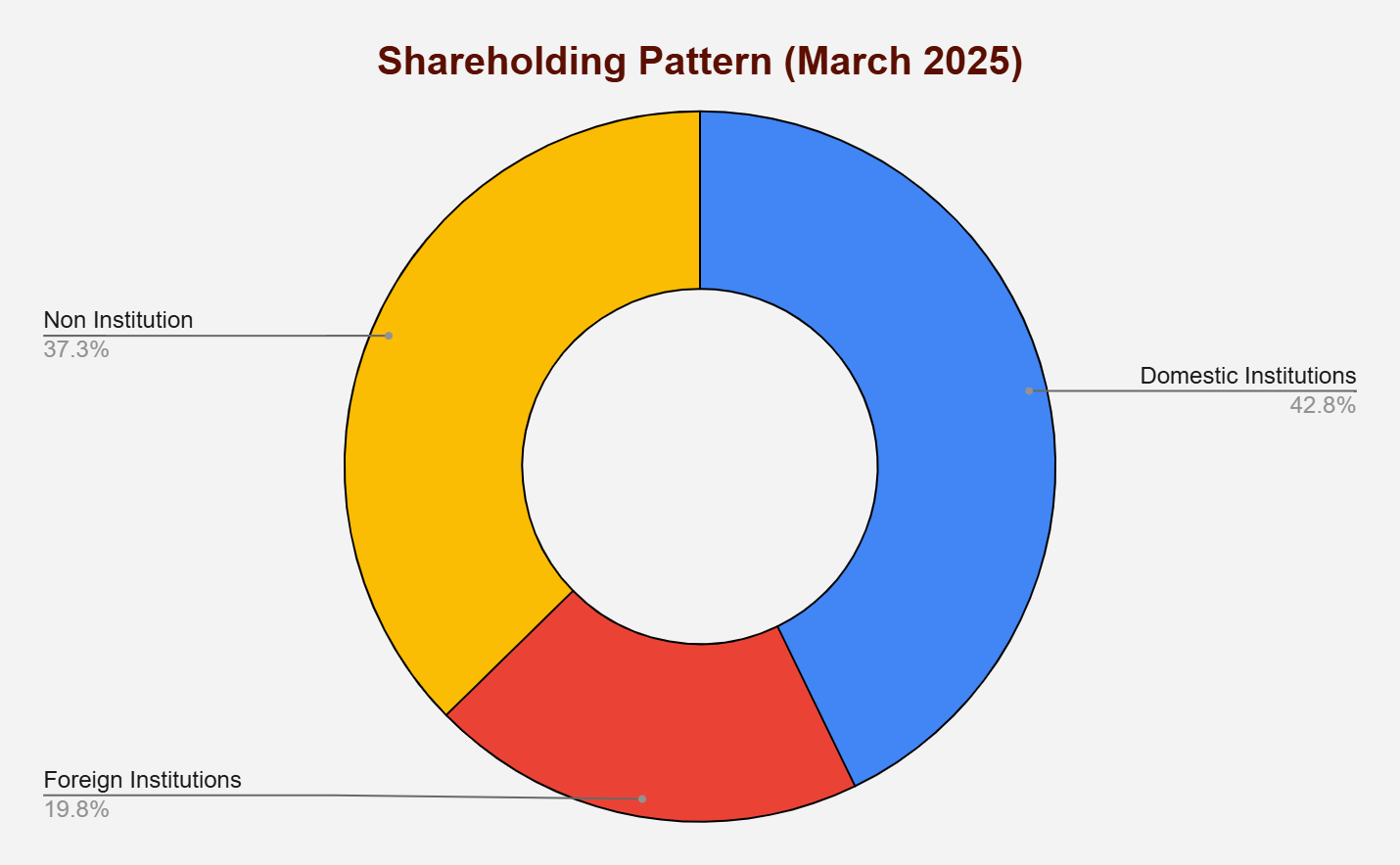

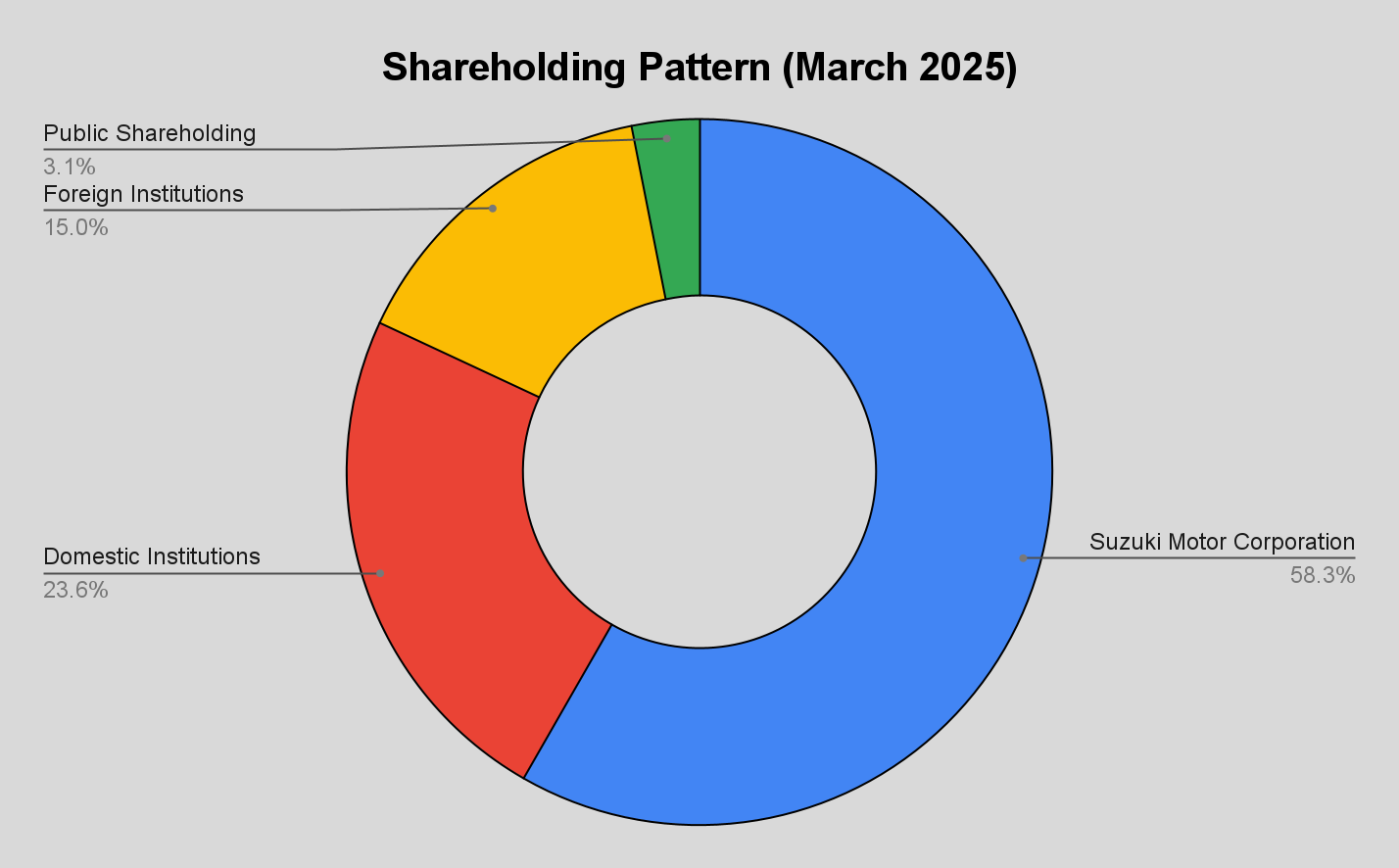

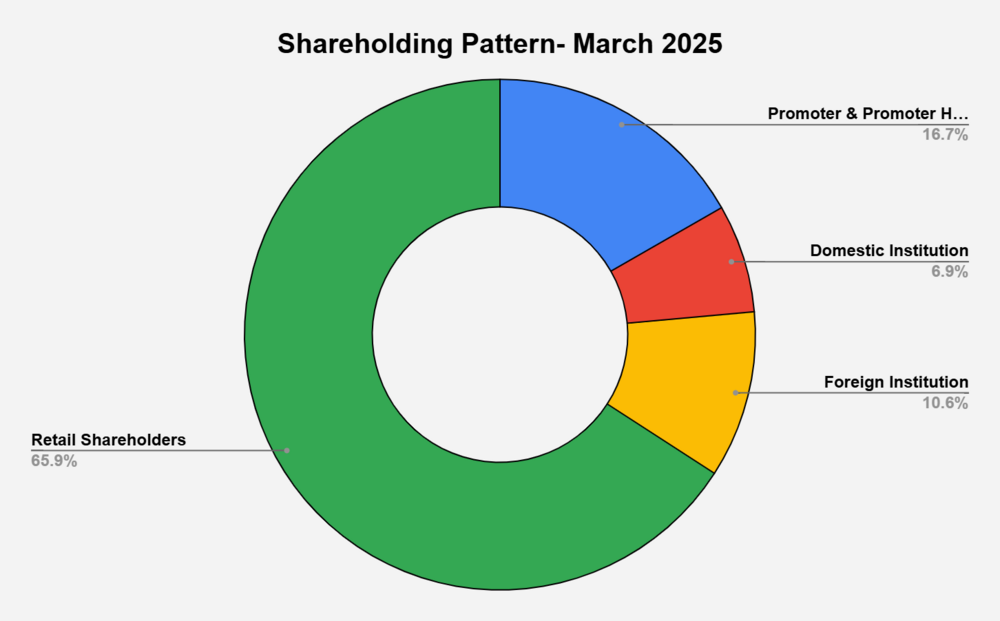

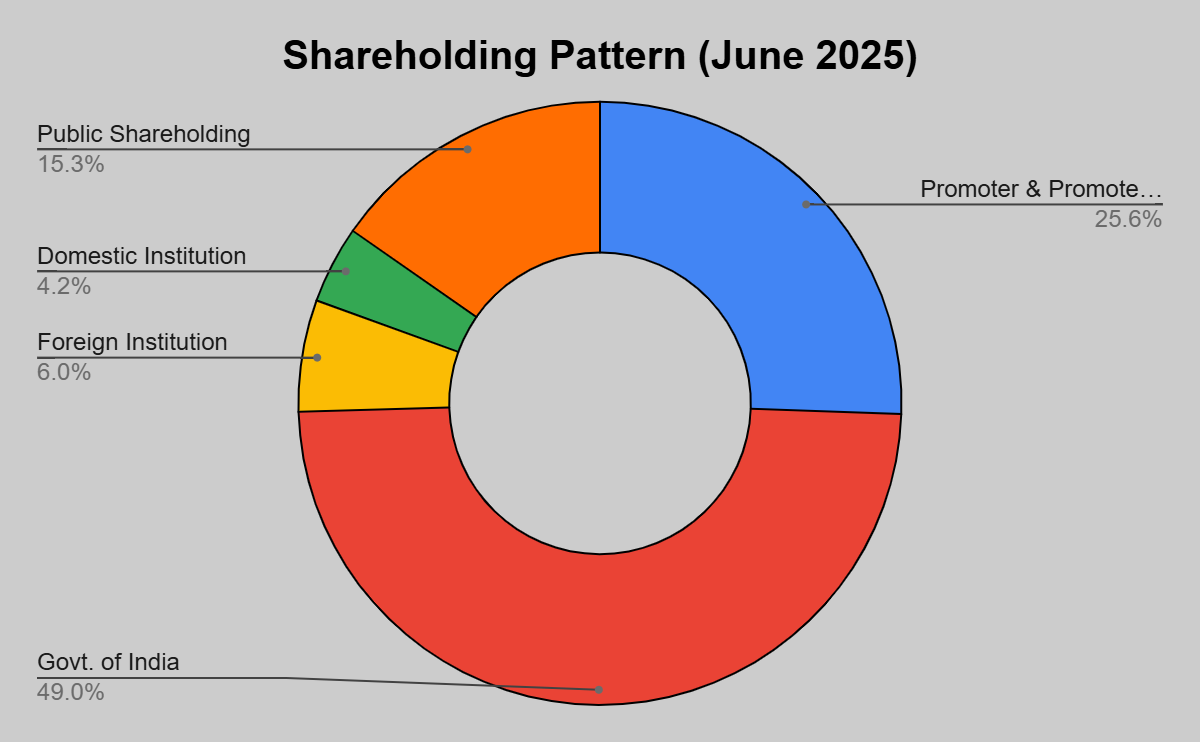

After converting AGR dues to equity, the Government of India has become a majority shareholder in Vodafone Idea. Although, Government of India is the largest shareholder, it is not a proactive investor.

This has led to promoters’ reduced commitment towards the organisation. While Aditya Birla Group has infused more than ₹2,000 crores in the company, it came after much hesitation.

The fundraising has failed multiple times, and Vodafone Idea has to depend on external sources and borrowings to meet its capex spend.

Vodafone Idea is facing a deep structural crisis, and it requires serious investors with long-term commitments.

Investor Takeaway: Should You Invest in Vodafone Idea?

Vodafone Idea remains a financially fragile company, operationally behind its peers, and strategically vulnerable. The company has to depend on constant government relief packages, borrower, and promoter support to keep it operationally afloat.

The recent quarterly performance has indicated some positive developments, like improvement in EBITDA, improved 4G performance by adding network base stations, and starting of 5G deployment. This has resulted in reduced subscriber loss.

Currently, the company lacks revenue and profit growth visibility, with no major catalyst like mergers, major fundraising, or technical collaboration.

While a successful turnaround could lead to multibagger returns from current levels, the probability remains low without credible capital infusion from promoters and clear strategy.

FAQ

Is Vodafone Idea a profitable company?

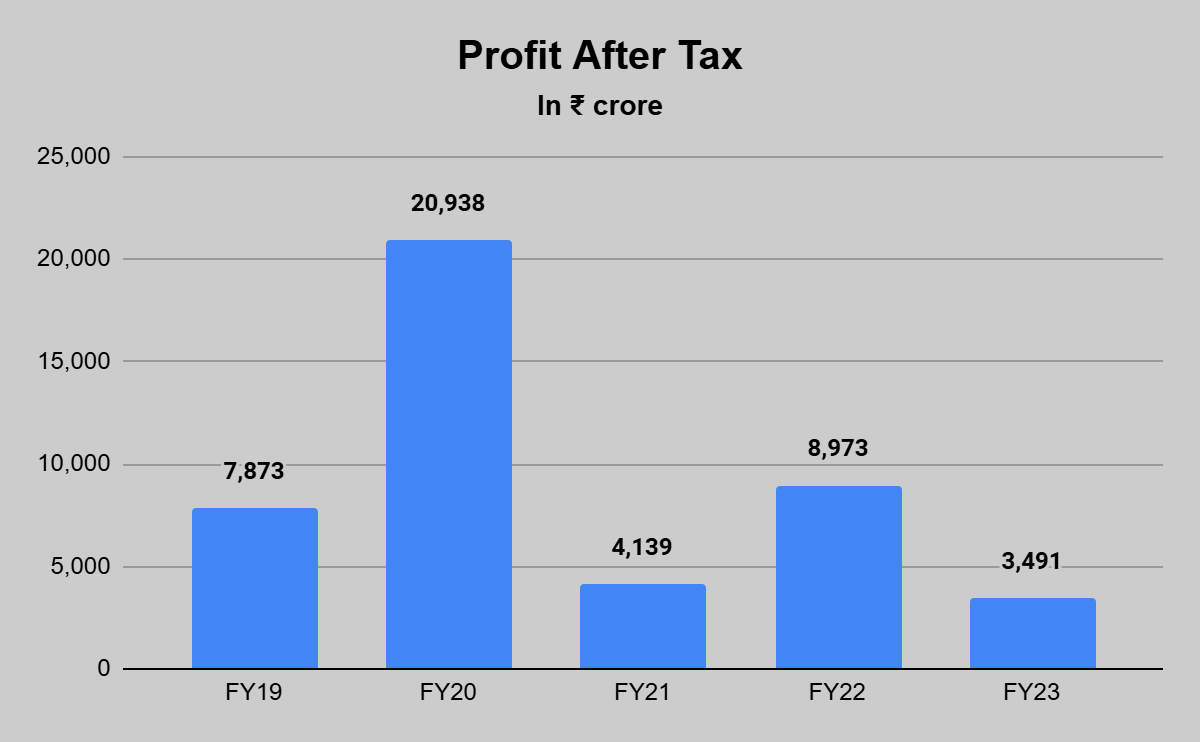

No, Vodafone Idea is not a profitable company. However, it is making profits on an operational level.

Why does the Vodafone Idea share price fluctuate so much?

Vodafone Idea share price is highly sensitive to news such as funding announcements, tariff hikes, and government decisions. Since the company has weak fundamentals, it is often driven by sentiment, making it volatile and speculative.

How much stake does the Government of India hold in Vodafone Idea?

As of June 2025, the Government of India has 49% stake in Vodafone Idea, making it the largest shareholder. Despite having the highest stake, it is not the promoter of the company.

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.