Porinju Veliyath Portfolio: An Introduction

Looking for Porinju Veliyath’s portfolio? Stock market stalwarts often leave a trail for aspiring investors to follow. Be it Rakesh Jhunjhunwala, Radhakishan Damani, Sunil Singhania, Ramdeo Agarwal, or Ankita Vasistha, every ace investor has a lesson in their portfolio. Some lead with exceptional vision, and some with unconventional strategies.

Also Read: Madhusudan Kela Portfolio

But the seasoned investor we will discuss here has made big wealth and a name with small-cap stocks. Porinju Veliyath is a famous Indian investor known for his unique investing style and success in the stock market. Let’s explore the Porinju Veliyath portfolio to understand Porinju Veliyath stock recommendations in detail.

Also read: Mukul Agrawal Portfolio

Who is Porinju Veliyath?

Porinju Veliyath is a well-known Indian investor and fund manager famous for his value investing approach. Born on June 6, 1962, near Kochi, he grew up in a middle-class family. During his teenage years, his family faced a severe financial crisis, forcing them to sell their house to repay loans. This motivated him to find a job to support his family.

He worked while studying, starting as an accountant and earning Rs. 1000. Later, he worked at Ernakulam Telephone Exchange and earned a law degree from Government Law College, Ernakulam.

Despite his degree, Veliyath couldn’t find a well-paying job. In 1990, he moved to Mumbai and began as a floor trader at Kotak Securities. He then joined Parag Parikh Securities, developing his skills as a fund manager and research analyst.

In 2002, Veliyath returned to Kerala and founded Equity Intelligence India Pvt. Ltd., focusing on value investing in Indian equities. His first significant investment was in Geojit Financial Services, a stock considered a bad penny by many, yet it generated substantial returns. This demonstrates his confident and strategic investing style. He also invested in Shreyas Shipping, which became profitable in the long run.

Veliyath’s personal wealth creation led him to start his own firm. Today, Equity Intelligence manages both its portfolio and those of other investors. His ability to pick undervalued stocks and turn them into valuable investments earned him the title “Small-Cap Czar.”

Also read: Ramesh Damani Portfolio

Porinju Veliyath Portfolio Holdings:

Porinju Veliyath’s portfolio as of the quarter ending March 2024 holds 13 active stocks. Porinju Veliyath’s holdings include the following-

| Sr. No. | Company | Dec 2023 | March 2024 | Value in Crores |

| 1 | Aeonx Digital Technology Ltd. | 3.04 | 3.04 | 1.89 |

| 2 | Ansal Buildwell Ltd. | 2.03 | – | – |

| 3 | Aurum Proptech Ltd. | 4.52 | 4.49 | 50.1 |

| 4 | Duroply Industries Ltd. | 6.45 | 5.54 | 16.50 |

| 5 | Kaya Ltd | 3.02 | 3.02 | 17.52 |

| 6 | Kerala Ayurveda Ltd | 4.82 | 5.18 | 19.55 |

| 7 | Orient Bell Ltd | 3.73 | 3.73 | 21.34 |

| 8 | RPSG Ventures Ltd | 1.56 | 1.39 | 33.12 |

| 9 | Max India Ltd | 1.04 | 1.04 | 13.2 |

| 10 | Centum Electronics Ltd. | 1.01 | 1.01 | 21.39 |

| 11 | Kokuyo Camlin Ltd | 1.01 | 1.01 | 15.35 |

| 12 | Arrow Greentech Ltd | 1.06 | – | 0 |

| 13 | PG Foils Ltd | 1.06 | 1.06 | 2.44 |

| 14 | Mitsu Chem Plast Ltd | – | 1.66 | 3.22 |

| 15 | TAAL Enterprises Ltd | – | 1.08 | 9.56 |

Porinju Veliyath’s current investment portfolio details aren’t publicly available, but his strategy is clear. He selects companies across various sectors, aiming to benefit from India’s economic growth and emerging trends. This approach pays off, as evidenced by the return rate of the investments he made through his PMS firm, Equity Intelligence India Pvt. Ltd.

In FY24, his investments generated an average annual return of 23.60%, compared to the NIFTY50’s 10.74%. Over the past three years, his PMS returned 11.50%, while the NIFTY50 had 20.15%. Additionally, his PMS achieved an 18.30% return in the last five years, outperforming the NIFTY50’s 11.52%.

Porinju Veliyath Portfolio changes and analysis:

- As of the quarter ending March 2024, Porinju Veliyath reduced his share in Duroply Industries Limited (-0.91%), RPSG Ventures Limited (-0.17%) and Aurum Proptech Limited (0.03%).

- During the same tenure (March 2024 quarter), he increased his holdings in Kerala Ayurveda Limited by 0.36%, bringing the total share tally to 5.18%. He also reduced his shareholding in Arrow Greentech Limited.

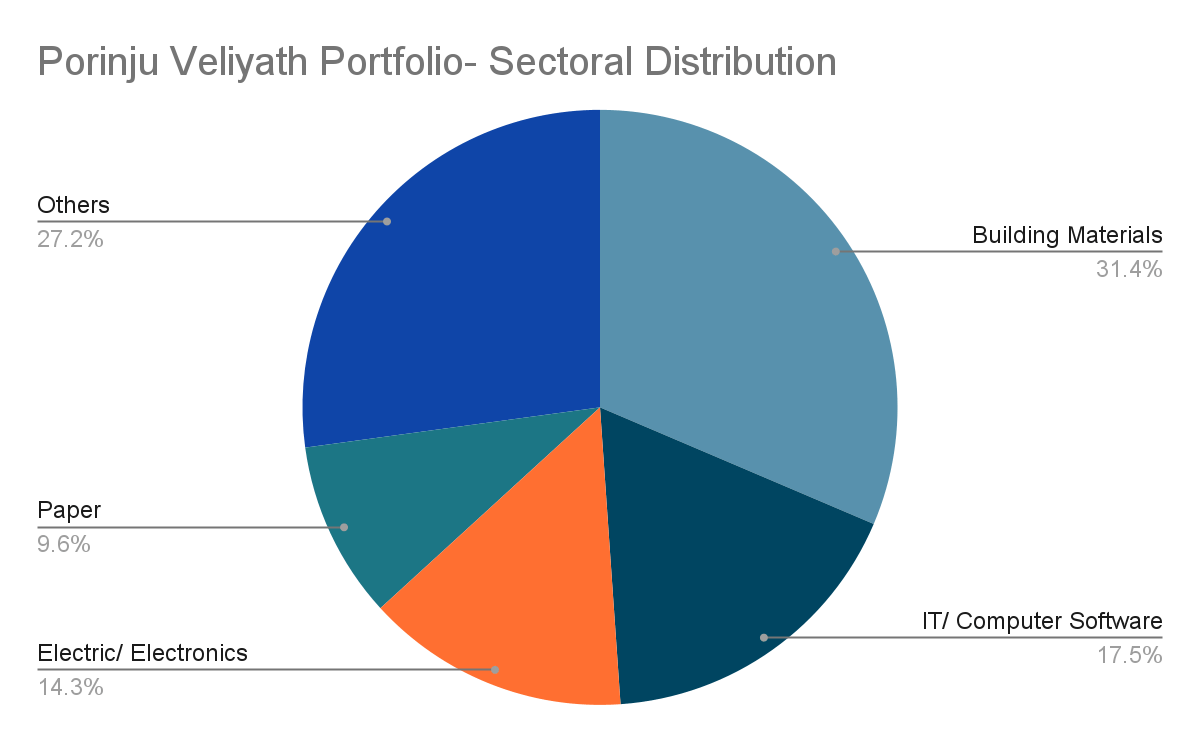

- The portfolio’s sectoral distribution is strategically divided into various industries, including finance, ceramics and granite companies, electricals, pharmaceuticals, transport and logistics, plastics, and computer software. However, the portfolio is concentrated (not limited to) on value small-cap and mid-cap stocks.

- The sectoral breakup of the portfolio is as follows-

Lessons from Porinju Veliyath Portfolio:

Porinju Veliyath’s journey offers valuable lessons and market insights for investors navigating the stock market:

- Embrace Value Investing: Veliyath’s success shows the importance of value investing. This means finding undervalued companies with strong fundamentals and growth potential.

- Conduct Thorough Research: Veliyath is known for his detailed research and due diligence. You should adopt a similar approach, thoroughly analyzing companies and keeping risk analysis at the centre of your decision-making.

- Think Long-Term: Veliyath focuses on finding multi-bagger stocks, highlighting the need for a long-term investment horizon. Patience and discipline are key to realizing the full potential of your investments.

- Embrace Contrarian Thinking: Veliyath’s contrarian approach involves going against the prevailing market sentiment. Be willing to challenge conventional wisdom and seek opportunities others might overlook.

- Guide to Diversification: Even though Veliyath’s portfolio might seem concentrated, it’s important to maintain a diversified portfolio. This helps mitigate risk and allows you to capitalize on opportunities across different sectors and market capitalizations.

In an old interview, Porinju Veliyath advised investors to visualize the selected company’s growth over the coming five to ten years and focus on its different dynamics.

Conclusion:

Porinju Veliyath’s investment journey is a masterclass in strategic thinking, financial acumen, and resilience. He identified undervalued stocks and followed a disciplined approach to significantly shape his wealth. If you are starting your investment journey and looking for a guide in value investing, you can take inspiration from his strategies to achieve financial success.

His story highlights the power of value investing and the importance of a well-researched approach to the stock market. However, before following his trail of investing completely, consult SEBI-registered financial advisory services to understand what is stock portfolio and to analyze the alignment of your goals and investment style.

FAQs on Porinju Veliyath’s Portfolio

What is the net worth of Porinju Veliyath?

As of the quarter ending March 2024, Porinju Veliyath’s net worth amounts to Rs.210.83 crores.

Is it OK to invest in small-cap?

Small-cap stocks are often volatile, but they hold the potential to grow into a multi-bagger over the long term. However, before investing in a small-cap stock, you must thoroughly research the company’s fundamentals. Ensure the company has a strong managerial and financial base and a growth vision. Additionally, ensure you balance the risk of small-cap stocks with other more stable options in your portfolio.

Is small-cap worth investing in?

Small-cap investments have an advantage over large-cap stocks—their potential long-term performance. However, they carry comparatively greater risk, so they are suitable only if you have a high-risk appetite and can take any possible capital loss.

Also Read:

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.