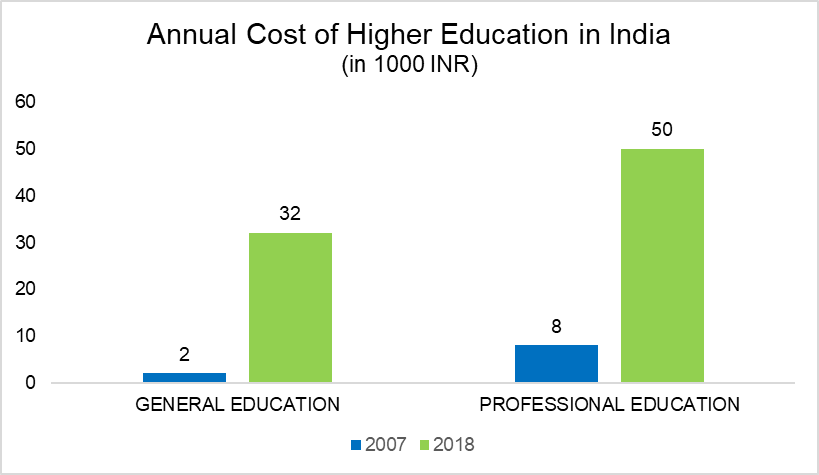

Saving for your child’s higher education is a significant financial goal for many parents. You have an investment in your child’s future and path to success. However, considering education abroad, the financial side will be more challenging to deal with the rupee depreciation.

In this article, we will explore ten practical ways to budget to ensure that your child’s educational dreams are not hindered by the challenges posed by a devalued rupee.

1. Start early:

When saving for your child’s education abroad, time can be your best friend. Starting early allows you to benefit from accumulated interest. Your money can grow substantially the longer it lasts. Start a dedicated education fund as soon as or shortly after your child is born.

2. Set clear goals:

Set specific goals for your child’s education. Know which universities or colleges you are targeting and the likely cost. Having a clear financial goal will help you plan effectively.

3. Diversify your investments:

Diversification is key in a volatile economic environment with a depreciating rupee. Don’t put all your money into one type of investment. To reduce risk, spread your investments across asset classes such as stocks, bonds, mutual funds, and real estate.

4. Investigate education loans:

Many banks and financial institutions offer education loans with reasonable interest rates. Consider using such a loan to reduce the financial burden. While this can increase your child’s expenses, it can also provide a structured payment method.

5. Regularly review and adjust your portfolio:

Be careful with your investments. Market conditions change, and rupee depreciation may affect your international investments. With regular monitoring, you can adjust as needed to stay productive.

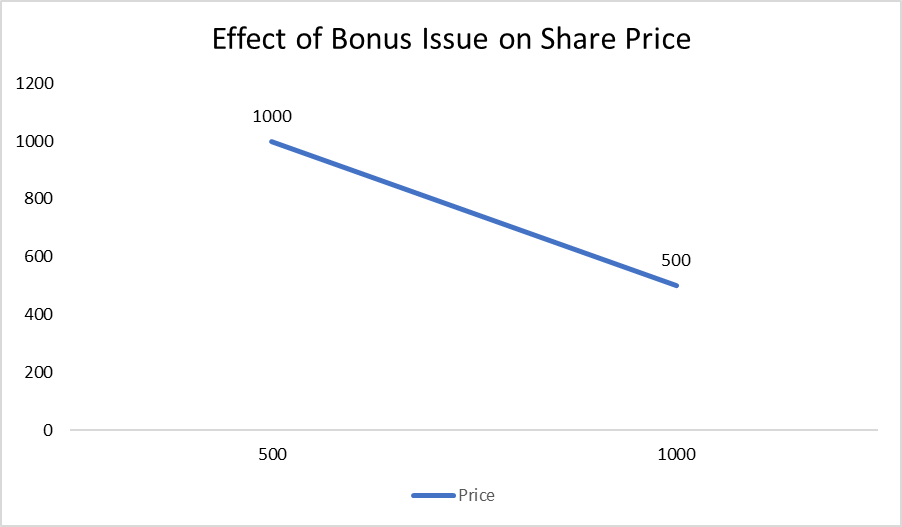

6. Select the rupee-cost average:

You can use the rupee-cost-average formula to reduce the impact of rupee depreciation. Periodically insert a fixed amount. This strategy allows you to buy more units when the price is high and fewer units when the price is high, thus averaging the cost.

7. Consider investments with cash:

Investing can be a valuable tool when saving for education abroad. They protect your investments from adverse currency movements and ensure that your returns are not severely affected by a decline in the dollar’s value.

8. Use tax benefits:

Find out about the tax benefits offered for educational programs in your state. Governments often provide incentives for people to save money in education, such as tax breaks or reduced interest rates on specific financial products

9. Select structured investment plans (SIPs):

SIPs allow you to regularly invest small amounts in mutual funds. These can be a great way to accumulate capital over time. They also offer the opportunity to increase your savings as your income increases. You can also try using our SIP calculator for more details.

10. Provide professional guidance:

Managing money for your child’s education abroad can be difficult. Consider consulting with a financial advisor who specializes in educational programming. They can help you create the right plan based on your budget and goals.

Things To Consider While Saving for Child’s Education Abroad

| Aspect | Details |

| 1. Education Cost | Explore different savings options: traditional accounts, fixed deposits, mutual funds, or education-specific investment plans. |

| 2. Currency Exchange Rate Trends | Research the cost of higher education abroad for your child. Consider tuition, accommodation, living expenses, and other associated costs. |

| 3. Savings Options | Regularly review your savings plan and adjust based on changing circumstances, including exchange rate fluctuations. |

| 4. Rupee Exchange Rate | Monitor the value of the Indian Rupee (INR) against the foreign currency. |

| 5. Start Early | The sooner you start saving, the more time your investments have to grow. Compound interest can significantly boost your savings. |

| 6. Monthly Savings Goal | Calculate how much you must save monthly to reach your education savings goal. Adjust this amount based on changing exchange rates. |

| 7. Emergency Fund | Maintain an emergency fund for unexpected expenses to avoid dipping into your child’s education savings. |

| 8. Diversify Investments | Diversify your investments to manage risk. A mix of equity, fixed income, and other assets can provide a more balanced approach. |

| 9. Consult Financial Advisor | Seek advice from a financial advisor to make informed decisions about your investment strategy. |

| 10. Monitor and Adjust | Regularly review your savings plan and make adjustments based on changing circumstances, including exchange rate fluctuations. |

| 11. Tax Benefits | Check for any tax benefits or deductions available for education savings under Indian tax laws. |

| 12. Stay Informed | Stay updated on global economic news and geopolitical events that can impact currency exchange rates. |

Also Read: Paid Up Capital Explained

Conclusion:

In your quest to provide the best education to your child abroad, rupee depreciation can pose challenges. However, with proper budgeting and the right strategy, these challenges can be successfully addressed. It’s essential to start early, diversify your investments, and stay abreast of market conditions. Don’t forget to explore the benefits of a rupee-cost-average currency-hedged investment. Remember, every penny you save today is an investment in your child’s future. So, plan wisely and safeguard your child’s educational dreams no matter where he chooses to study.

FAQs

Is it better to save for my child’s education in a foreign currency account?

While saving in a foreign currency account can protect your investments from rupee depreciation, it may not be the best choice for everyone. It’s essential to assess your financial goals, risk tolerance, and investment horizon before making this decision.

Are there any specific government schemes that support education savings in India?

Yes, the Indian government offers various schemes and tax benefits to support education savings. The most popular is the Section 80C deduction, which allows you to claim a deduction for tuition fees paid for your children’s education.

What should I consider when choosing an education loan for my child’s studies abroad?

When selecting an education loan, consider the interest rate, repayment terms, collateral requirements, and any additional benefits offered by the lending institution. It’s advisable to compare multiple loan options to make an informed decision.