Hammer Candlestick: What It Is and How Investors Use It

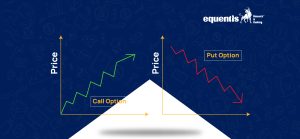

Understanding key patterns is important in investing. Candlestick patterns help predict price changes. First used in Japan, traders worldwide rely on them to track daily price movements using candle-shaped charts. The hammer candlestick is one such pattern that signals potential market shifts.

A candlestick chart hammer forms after prices fall, showing sellers are losing strength and buyers may take over. This article will explain the hammer candlestick pattern, how to spot it, and how a stock market advisor can use it to make better investment decisions.

What is a Hammer Candlestick Pattern?

A hammer candlestick is a simple pattern that hints at a possible trend reversal from falling to rising prices. It shows up on a price chart when a stock or asset drops a lot after opening but bounces to close near its starting price.

This creates a hammer-shaped candle with a small body and a long lower shadow—at least twice the body’s size. The body reflects the difference between the opening and closing prices, while the shadow shows the highest and lowest points reached during that period.

Identifying a Hammer Candlestick

To spot a hammer candlestick pattern, look for the following characteristics:

- Small Real Body: The distance between the opening and closing prices is small, forming the “head” of the hammer.

- Long Lower Shadow: The lower shadow (or wick) is at least twice the length of the real body, indicating that prices dipped significantly during the session but recovered to close near the opening price.

- Little to No Upper Shadow: There’s minimal or no upper shadow, emphasizing the strength of the recovery during the session.

Understanding Hammer Candlesticks

How Does a Hammer Signal a Reversal?

The hammer pattern forms in one trading session, but it doesn’t guarantee a price reversal. A reversal is confirmed if the next candle closes above the hammer’s closing price, ideally with strong buying.

Where Can Hammers Appear?

Hammer candlestick patterns can be found across different time frames—whether on one-minute charts, daily charts, or even weekly charts. This makes them a versatile tool for traders looking to spot potential reversals in any market condition.

The Psychology Behind the Hammer

The hammer candlestick pattern reflects a battle between buyers and sellers. Initially, sellers dominate, pushing the price downward. However, as the session progresses, buyers regain control, driving the price back up. This recovery suggests that the market may be finding a bottom, and an upward reversal could be on the horizon.

Know More: SEBI Registered investment advisory | Stock investment advisory

Using the Hammer Candlestick in Trading

Traders often use the hammer candlestick pattern as a signal to enter long positions, anticipating a price increase. Here’s how it can be applied:

- Confirmation: After identifying a hammer, wait for the next candlestick to close above the hammer’s closing price. This confirmation reduces the risk of a false signal.

- Stop-Loss Placement: Place a stop-loss order below the hammer’s lower shadow to manage potential losses if the anticipated reversal doesn’t occur.

- Profit Targets: Set profit targets based on key resistance levels or use technical indicators to determine exit points.

It’s essential to combine the hammer candlestick pattern with other technical analysis tools and consider the broader market context to make informed trading decisions.

Example of a Bullish Hammer Candle

A bullish hammer candlestick pattern can be red or green, meaning the closing price can be higher or lower than the opening price. However, what truly matters is its shape—a small body with a long lower shadow and little to no upper shadow.

upper wick.

Most traders look for a lower shadow at least twice the length of the body. If the shadow is much longer, like four to five times the body’s size, it may resemble a pin bar instead of a hammer. This pattern often appears after a price decline or a pause in a rise and is sometimes called a pin bar or bottoming tail candle.

Hammer vs. Inverted Hammer

The hammer candlestick has a small body at the top and a long lower shadow, while the inverted hammer has a small body at the bottom and a long upper shadow. Both suggest a possible price rise, but the inverted hammer shows that buyers tried to push prices higher but faced resistance. Even so, if the inverted hammer appears after a price decline, it can still signal a potential upward reversal.

Limitations of the Hammer Candlestick Pattern

While the hammer candlestick pattern can be useful, it’s not foolproof. Some limitations include:

- False Signals: Not all hammers lead to price reversals. It’s crucial to seek confirmation before making trading decisions.

- Market Context: The effectiveness of the hammer can vary depending on the overall market conditions and the specific asset being analyzed.

- Combination with Other Indicators: Relying solely on the hammer pattern without considering other technical indicators or fundamental analysis can lead to suboptimal decisions.

Using the hammer candlestick pattern alongside other analysis tools is wise to get a clearer market picture. Traders often combine it with patterns like the Cup and Handle and Rounding Bottom pattern to make more informed decisions.

The Cup and Handle pattern indicates a possible rise after a period of stability, while the Rounding Bottom Pattern shows a slow shift from a downtrend to an uptrend. Using multiple patterns together helps traders confirm signals and make more accurate decisions.

Conclusion

The hammer candlestick pattern is helpful for investors and stock market advisors looking to spot potential bullish reversals. They can make better-informed decisions by understanding its formation, market psychology, and practical application.

However, it’s important to use this pattern alongside other analysis methods and consider the broader market trends, including NSE trending sectors. While the hammer pattern offers valuable insights, consistent learning and practice are key to successful trading.

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQ

How do I identify a Hammer?

Look for a small real body (the open and close prices are close together) at the top end of the candle. The lower shadow should be at least twice the length of the body. It appears after a price decline. The color of the body can be either bullish (green/white) or bearish (red/black), though bullish is generally considered stronger.

What does a Hammer signal?

A Hammer suggests that despite selling pressure during the day, buyers ultimately pushed the price back up, indicating a potential shift in sentiment from bearish to bullish. It doesn’t guarantee a reversal but acts as a warning sign.

How do investors use the Hammer?

Investors often seek confirmation of the Hammer’s signal in the following trading sessions. This might be a bullish candlestick or a price move above the high of the Hammer. They may consider entering an extended position.

What are the limitations of the Hammer?The Hammer is more reliable when it appears after a well-defined downtrend. It’s crucial to consider other technical indicators and the overall market context. A single Hammer is not enough to base trading decisions on. False signals can occur.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

- Archana Chettiar