The busy IPO season continues! As mainboard and SME profiles both buzz with activity, another name is all set to enter Dalal Street with its IPO in the latter category: Hari Om Atta & Spices (HOAC). This IPO spiced up the market, opening on 16 May 2024, with more than 19 times subscriptions on Day 1. HOAC Foods’ fixed price issue is worth ₹5.54 crore.

As always, thorough research is crucial before making any investment decisions. Delve deeper into Hari Om Atta & Spices’ financials, growth strategy, and future prospects to determine if this IPO aligns with your investment goals. Stay tuned as we explore the details of this upcoming spice route to potentially high returns!

HOAC Foods IPO Details

| IPO Date | 16 May 2024 to 21 May 2024 |

| Face Value | ₹10 per share |

| Price | ₹48 per share |

| Lot Size | 3,000 Shares |

| Issue Size | Fresh Issue of 1,155,000 shares (aggregating up to ₹5.54 Cr) |

| Issue Type | Fixed Price Issue |

The IPO offers the following:

- Entirely Fresh Issue: HOAC Foods’ upcoming IPO is a fixed-price offering of ₹5.54 crore, consisting entirely of 11.55 lakh new equity shares, so there is no Offer for Sale (OFS).

- The IPO’s Objective: HOAC Foods intends to use the money raised to fund the company’s working capital requirements and general corporate purposes.

- Category-wise Subscription: So far, the IPO has been subscribed 34.29 times in the retail category, while the Non-Institutional Investors (NII) category registered 5.21 times subscription.

HOAC Foods IPO GMP:

As of this morning (17 May 2024), HOAC Foods’ Gray Market Premium (GMP) IPO was ₹100. This has been consistent since the opening’s Day 1 and shot up from ₹75 the previous day. However, note that the GMP only unofficially indicates investor interest in the unlisted market. It’s not a guaranteed future price.

Company Overview:

Founded in 2018, HOAC Foods manufactures flour, spices, and other food products. It offers a range of products such as chakki atta (flour), herbs and spices, unpolished pulses, grains, and yellow mustard oil. Primarily catering to Delhi-NCR through a network of 10 exclusive brand outlets, it comprises a mix of company-owned and franchised locations.

The company operates a production facility in Gurugram and has a product line of 153 SKUs (Stock Keeping Units) encompassing ground and blended spices. As of December 31, 2023, HOAC Foods employs 50 individuals across various departments, contributing to its operations and growth.

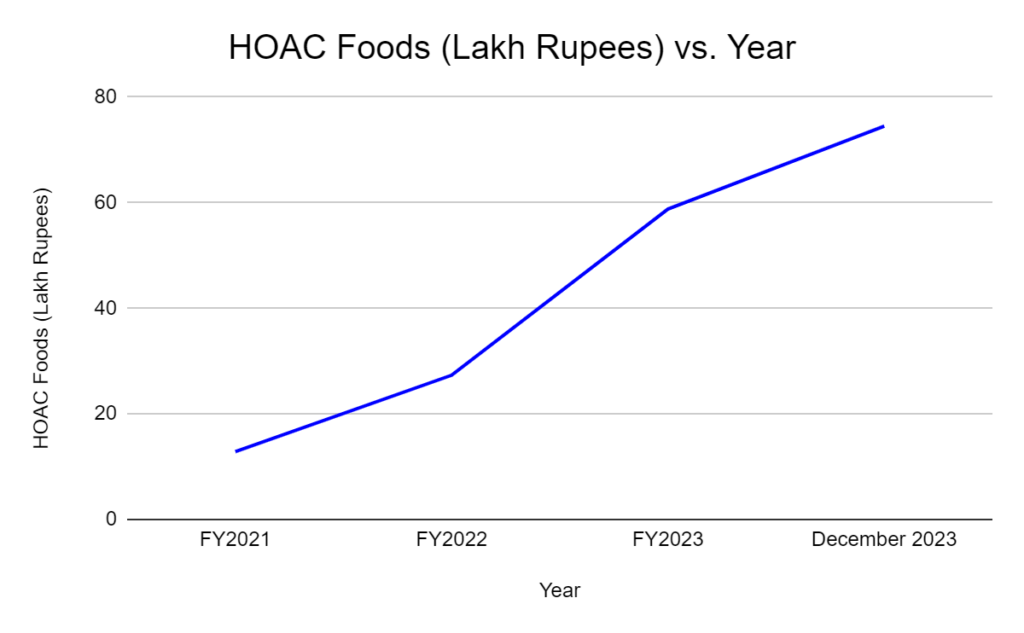

Financial Performance in Three Years

Hariom Atta & Spices has consistently shown positive financial growth in the past three financial years and the latest quarter that ended 31 December 203. Its revenue from operations has shot up from ₹7.42 crores in FY2021 to ₹10.87 crores in FY2022 to ₹12.09 crores in FY2023.

The total revenue in December 2023 stood at ₹11.49 crores. As for its Profit After Tax (PAT) has doubled yearly, from ₹12.85 lakhs in FY2021 to ₹27.33 lakhs in FY2022 to ₹58.79 lakhs in FY2023. The PAT recorded in December 2023 was ₹74.50 lakhs

SWOT Analysis Of HOAC Foods

| STRENGTHS | WEAKNESSES |

| Strong Brand Recognition: HOAC Foods has established a strong brand presence in the Delhi-NCR region with exclusive networks. The localized focus caters to specific customer preferences and builds brand loyalty. Diverse Product Portfolio: The company’s product line includes staples like chakki atta, spices, pulses, and mustard oil, offering a one-stop shop for essential food items. Growth Potential: The company’s operational revenue has grown consistently over the past three years, indicating a promising trajectory. Manufacturing Facility: Their production facility in Gurugram allows for quality control and potentially quicker turnaround times. Franchise Model: Utilizing a franchise model can expedite expansion and reduce upfront investment costs for additional outlets. | Limited Geographic Reach: Since it operates solely in the Delhi-NCR region, the company’s overall market share and growth potential compared to national competitors is restricted. Dependence on Franchisees: Though franchising offers advantages, maintaining brand consistency and quality control across all outlets becomes challenging. Relatively New Company: Founded in 2018, HOAC Foods is relatively young compared to established market players. Limited Marketing Reach: Being a new business in the market limits its brand awareness and consumer trust nationwide. Besides, with a dedicated sales and marketing team of only 12 people, it may struggle to compete with established players with bigger marketing budgets and reach. |

| OPPORTUNITIES | THREATS |

| Expansion into New Markets: The existing brand recognition and product diversification can enable the company to expand beyond Delhi-NCR. This could mean new outlets or franchises in other regions. E-commerce Presence: HOAC sells products online, but partnering with online retailers could increase its customer reach and build a wider user base. Product Line Extension: New products, like ready-to-eat mixes or organic options, could attract new customer segments and boost sales. Strategic Partnerships: Collaborating with other food companies, distributors, or ingredient suppliers could provide HOAC Foods access to more resources and lower production costs. | Stiff Competition: The Indian food market is highly competitive, with established national and regional players. HOAC Foods will need continued innovation and differentiation to maintain an edge. Fluctuations in Raw Material Costs: Rising prices of spices, pulses, and other agricultural commodities could affect profit margins. Consumer Preferences: Changing consumer preferences towards organic or healthier food options may necessitate product adjustments or marketing strategies to remain relevant. Economic Downturn: Economic fluctuations could impact consumer spending and potentially decrease demand for their products. |

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan