India has emerged as a global frontrunner in adopting Agentic Artificial Intelligence (AI), a transformative technology shifting businesses’ operations. According to Deloitte’s “State of Generative AI in the Enterprise” report (2024), over 80% of Indian enterprises have deployed or are exploring the integration of Agentic AI in their business processes—significantly outpacing global counterparts.

This development underscores India’s openness to emerging tech and marks a critical inflection point in the country’s journey towards a $7 trillion economy by 2030.

What is Agentic AI?

Agentic AI refers to autonomous AI systems capable of independently executing tasks, making decisions, and learning from their environment with minimal human intervention. Unlike basic generative AI, Agentic AI can plan, adapt, and take initiative—essentially acting as “agents” on behalf of users or systems.

Examples include intelligent customer service bots that resolve issues without escalation, AI agents that independently trade stocks based on predictive models, or even smart supply chain systems that reroute logistics based on weather and demand shifts.

Why India Is Leading in Agentic AI

Deloitte’s findings reflect a strong inclination among Indian companies to experiment, pilot, and deploy AI-based systems at scale. Some of the key highlights from the report include:

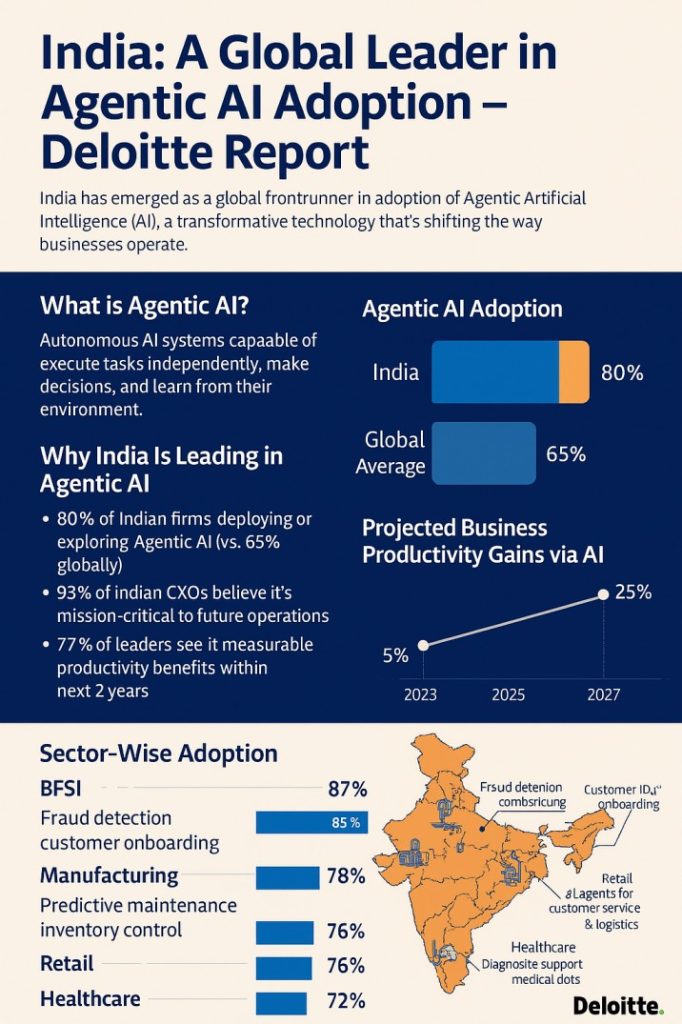

- 80% of Indian firms have deployed or are exploring Agentic AI (vs. 65% globally).

- 93% of Indian CXOs believe Agentic AI will be mission-critical to future operations.

- 77% of leaders said Agentic AI will bring measurable productivity benefits within the next 2 years.

India’s vibrant digital ecosystem drives this widespread adoption, government-backed initiatives like Digital India and IndiaAI, and a thriving tech talent pool—the second-largest globally after the U.S.

Economic Impact of Agentic AI on India

1. Boosting Business Productivity

Agentic AI enables the automation of complex, high-cognition tasks across finance, manufacturing, retail, and logistics. According to Statista, the average Indian firm could see 20–25% productivity gains by 2027 due to AI-driven automation.

Graph: Projected Business Productivity Gains via AI (India vs. Global, 2023–2027)

2. New Job Creation and Reskilling Demand

While automation will phase out some repetitive roles, the demand for AI specialists, data scientists, and prompt engineers is skyrocketing. Nasscom estimates India will need over 1 million AI-related professionals by 2026, creating a parallel economy around AI education, training, and tools.

3. Startup Ecosystem Acceleration

India has seen a surge in Agentic AI startups, especially in SaaS, FinTech, and HealthTech. Bengaluru, Hyderabad, and Pune are now emerging as global AI innovation hubs. The total funding into AI-focused Indian startups crossed $1.7 billion in 2023, up 39% YoY. (Source: IBEF, Inc42)

Policy and Infrastructure Support

India’s AI wave is not just corporate-led—it has strong policy underpinnings:

- IndiaAI Mission: With a proposed ₹10,000 crore investment, this national strategy aims to scale compute infrastructure, datasets, and AI R&D.

- Digital Public Infrastructure (DPI): UPI, Aadhaar, and ONDC create fertile ground for Agentic AI to scale rapidly across sectors.

- Collaboration with global tech firms: Indian enterprises are co-developing AI solutions with Microsoft, Google, and OpenAI, accelerating enterprise-grade AI applications.

India’s Global Edge

India’s early-mover advantage in Agentic AI could position it as a global provider of AI services and solutions, akin to its historic dominance in IT services. Deloitte notes that Indian companies are now exporting AI capabilities and building Agentic systems for clients in Europe, Southeast Asia, and the Middle East.

Moreover, with lower cost structures and high digital readiness, India is uniquely positioned to serve as a global testing ground for Agentic AI solutions before broader deployment.

Challenges Ahead

Despite rapid progress, several roadblocks remain:

- Data privacy and cybersecurity concerns: As Agentic AI systems take on sensitive and decision-critical roles, the risk of data breaches, unauthorized actions, and compliance violations grows. India lacks a robust legal framework akin to GDPR to regulate these dimensions effectively.

- Leadership and organizational readiness: While technical talent is abundant, many Indian enterprises still face a leadership gap in understanding how to align AI strategy with business objectives. This slows down cross-functional integration and enterprise-wide implementation.

- Infrastructure asymmetry: While metro cities have the ecosystem needed for AI development and deployment, Tier-2 and Tier-3 cities struggle with poor computing infrastructure, unreliable connectivity, and a lack of skilled mentors.

- Ethical and algorithmic transparency issues: There is increasing concern over decision bias embedded in AI systems. Agentic AI’s ability to operate autonomously raises red flags about explainability, accountability, and ethical guardrails, especially in critical sectors like finance and healthcare.

Overcoming these challenges will require stronger regulatory frameworks, capacity building at scale, and a national AI ethics council to govern long-term deployment.

Conclusion

India’s rapid adoption of Agentic AI is not a passing tech trend—it’s a structural shift that could transform the country’s economic trajectory. By embracing autonomous AI at scale, India is improving business performance and building the foundation for a more intelligent, adaptive, and globally competitive economy.

As the world looks to the next frontier of AI, India has already staked its claim—not just as a participant, but as a leader.

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan