Remember that feeling of setting a new personal best? That’s precisely how the S&P 500 and Nasdaq indices felt on Tuesday, June 11th, 2024, as they closed at record highs! But wait a minute before you begin celebrating; the story has a few twists.

This week is packed with potentially market-moving events, and investors are cautiously optimistic. They are keeping a watchful eye on upcoming economic data and the Federal Reserve’s policy decisions. Let’s break down what happened and what’s coming up next.

S&P 500 & Nasdaq: A Look Back

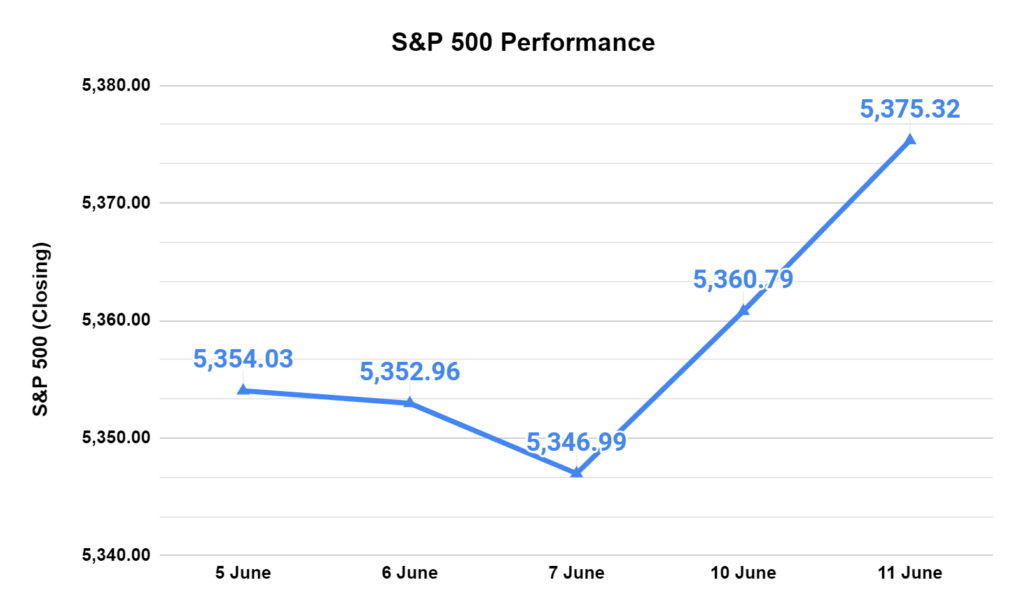

US stocks closed in a mixed bag on Tuesday. The S&P 500, the benchmark index for large-cap US stocks, increased slightly by 0.27%, settling at a record 5,375.32.

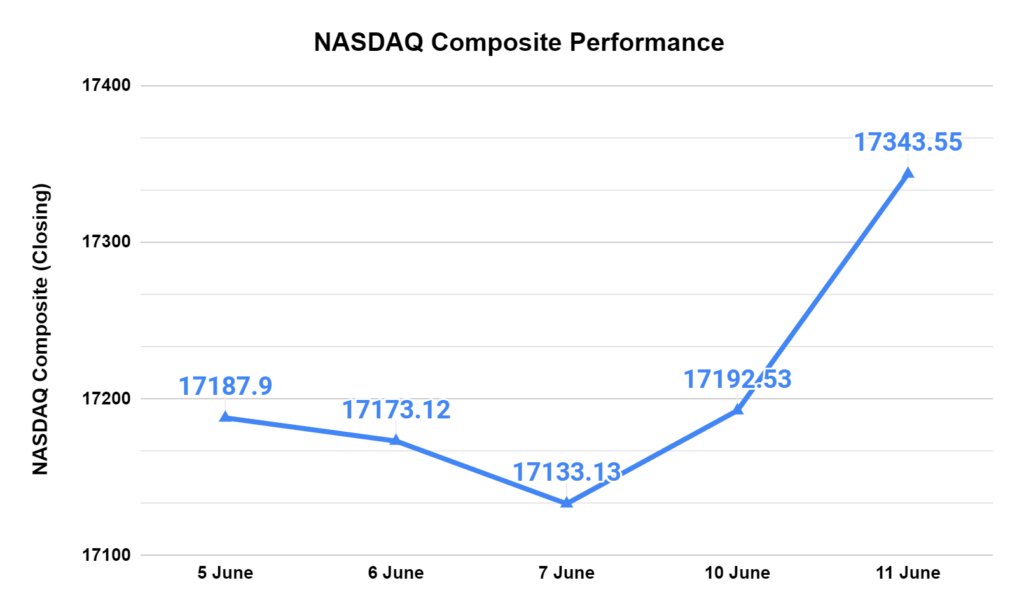

The tech-heavy Nasdaq followed suit, closing at an all-time high of 17,343.55, a gain of 0.88%. However, the Dow Jones Industrial Average, which tracks 30 large blue-chip companies, dipped slightly by 0.31% to close at 38,742.42.

Global Market Performance

While Wall Street saw some key indices reach new highs, the global market story wasn’t entirely rosy. Here’s a quick snapshot:

- European Markets Subdued: Major European markets like the FTSE 100 in London and the CAC 40 in Paris closed primarily flat or with slight declines. This cautious sentiment might reflect investor concerns about the upcoming economic data and central bank decisions.

- Asian Markets Mixed: Asian markets also presented a mixed picture. Japan’s Nikkei 225 closed lower by 0.03%, while China’s Shanghai Composite Index managed a small gain of 0.1%. This regional disparity could be attributed to individual country-specific factors and varying investor outlooks.

Also Read: Top Semiconductor Stocks in India

What Fueled the US Rally?

Despite the global mixed bag, a few factors might have contributed to the positive performance in the US:

- Investor Eye on Upcoming Events: Investors might have adopted a wait-and-see approach with the Federal Reserve meeting and the crucial CPI report looming. This cautious optimism could have contributed to the modest gains in the S&P 500 and Nasdaq.

- Apple Soars: Shares of Apple jumped a significant 7%, buoyed by the excitement surrounding their WWDC event. This positive performance from a major tech giant might have also rippled through the broader market.

Top 10 companies of the S&P 500

The S&P 500 is a stock market index that tracks the performance of 500 large-cap companies listed on stock exchanges in the United States. Here’s a look at the top 10 S&P 500 companies by index weight:

| Company | Index Weight | Market Cap |

| Microsoft | 6.85% | $2.89 trillion |

| Apple | 5.85% | $2.47 trillion |

| Nvidia Corp. | 5.05% | $2.13 trillion |

| Amazon.com Inc. | 3.79% | $1.59 trillion |

| Alphabet Class A | 2.72% | $959 billion |

| Meta Platforms Class A | 2.42% | $946 billion |

| Alphabet Class C | 1.92% | $812 billion |

| Berkshire Hathaway Class B | 1.71% | $721 billion |

| Eli Lilly & Co. (LLY) | 1.47% | $622 billion |

| Broadcom | 1.35% | $572 billion |

- Microsoft (MSFT): A household name in tech, Microsoft is the powerhouse behind the Windows operating system. Its recent success hinges on the strength of its cloud computing services (Azure) and advancements in artificial intelligence.

- Apple (AAPL): Apple revolutionized consumer electronics with its iconic iPhone, iPad, and Mac products. It was the first US company to reach a market cap of $1 trillion (2018) and $2 trillion (2020), exceeding $3 trillion in early 2022.

- Nvidia Corp. (NVDA): A leader in artificial intelligence and graphics processing units (GPUs), Nvidia is at the forefront of technological innovation. They created the world’s first cloud-based AI supercomputer and continue to push boundaries with their advancements in AI technology.

- Amazon.com Inc. (AMZN): The e-commerce giant Amazon has transformed online shopping. Beyond retail, they offer streaming services, consumer electronics (Kindle), smart home devices (Alexa), and cloud computing (Amazon Web Services).

- Alphabet Class A (GOOGL): Alphabet, Google’s parent company, remains a dominant force in search and cloud-based services. Recent revenue growth has translated to strong earnings per share.

- Meta Platforms Class A (META): Formerly known as Facebook, Meta Platforms is moving beyond traditional social media and focusing on virtual reality (Meta Quest VR headsets) and augmented reality technologies.

- Alphabet Class C (GOOG): This is another share class of Alphabet, created to limit outside influence over the company’s direction.

- Berkshire Hathaway Class B (BRK.B): Led by legendary investor Warren Buffett, Berkshire Hathaway is a holding company known for its value investing approach. It boasts some of any US company’s highest revenues and share prices.

- Eli Lilly & Co. (LLY): A major pharmaceutical company recognized for its ethical business practices, Eli Lilly focuses on cancer, diabetes, Alzheimer’s, and pain management.

- Broadcom Inc. (AVGO): Broadcom’s reach extends across various sectors, from semiconductors and wireless technology to data centers and cybersecurity solutions. They play a crucial role in developing smartphones, GPS, Wi-Fi routers, etc.

Key Events on the Horizon

The record highs are impressive, but the market can be quite volatile. Here are two major events that could significantly impact markets in the coming days:

- Federal Reserve Policy Decision: The Federal Reserve’s two-day policy meeting concludes on Wednesday, June 12th. Investors are eagerly awaiting Jerome Powell’s remarks, particularly regarding the future direction of interest rates. While no change in policy is expected, any hints about potential rate cuts later in the year could influence investor sentiment.

- Consumer Price Index (CPI) Report: On Wednesday, the Bureau of Labor Statistics releases the highly anticipated CPI data. This report tracks inflation levels, a key concern for consumers and investors. A cooler-than-expected inflation reading could be seen as positive news, potentially leading to a more dovish stance from the Fed. However, a higher-than-expected inflation number could trigger market jitters.

The Final Word

The record highs achieved by the S&P 500 and Nasdaq might seem like a cause for celebration. However, it’s crucial to remember that upcoming events, particularly the Fed decision and CPI report, could significantly impact market direction. Investors should stay informed, closely monitor these events, and adjust their strategies accordingly.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 3.7 / 5. Vote count: 3

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.