Ever wonder how companies fuel their growth? By raising capital, of course! And that’s precisely what Adani Energy Solutions Ltd (AESL) is setting out to do. The company recently announced a potential fundraising of a whopping ₹12,500 crore ($1.50 billion). That’s a significant amount of cash, and it begs the question: where will it come from, and how will it be used?

A Look at the Fundraiser

AESL plans to raise this capital through several methods. They’re considering issuing new equity shares (think company ownership certificates) with a face value of Rs 10 each. Additionally, they will likely use a Qualified Institutional Placement (QIP) or might explore “other permissible modes” for the fundraiser. This could involve issuing different types of securities or debt instruments. The exact details, like the price of the securities and the chosen method, are yet to be finalized.

Here’s the catch: this fundraiser isn’t a done deal yet. AESL needs approval from its shareholders and potentially some regulatory bodies at its annual meeting in June. But the intent is clear—AESL is looking to raise serious cash.

The Adani Group’s flagship firm, Adani Enterprises, will also go for a fundraiser today. The two Adani companies — Adani Energy and Adani Enterprises — will collectively approve a $3.5-4 billion fundraising plan.

Financial Snapshot

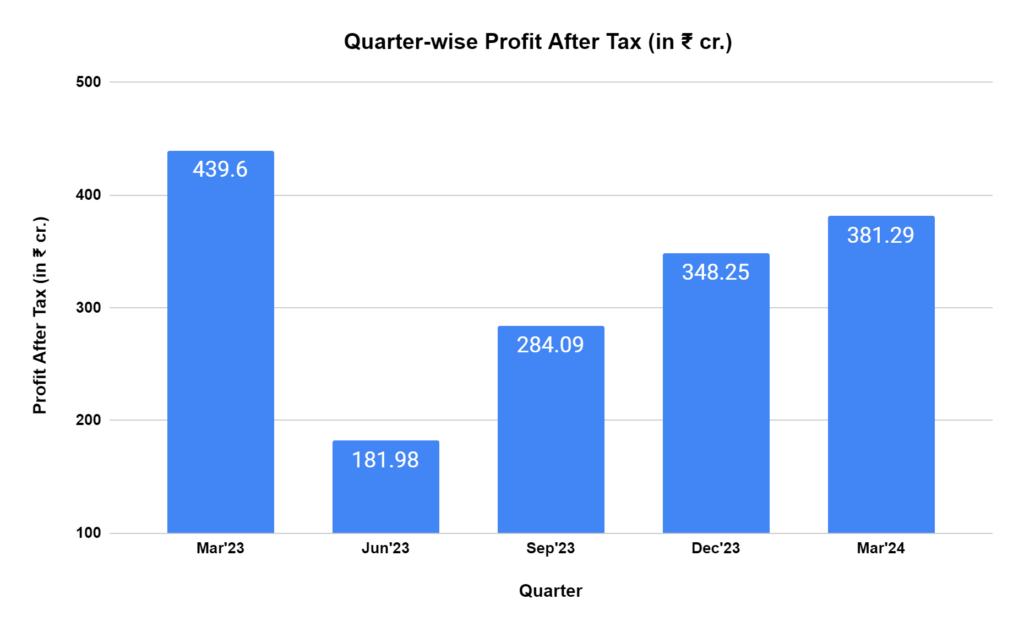

A closer look at AESL’s recent financials reveals a different story. The company’s consolidated net profit for the January-March 2024 quarter dipped 13.26% compared to the same period last year. Its net profit after tax was at ₹439.60 crore in the January-March period of the preceding 2022-23 financial year. For the whole financial year (FY24), the company’s net profit stood at ₹1,195.61 crore, down from ₹1,280.60 crore registered in FY23.

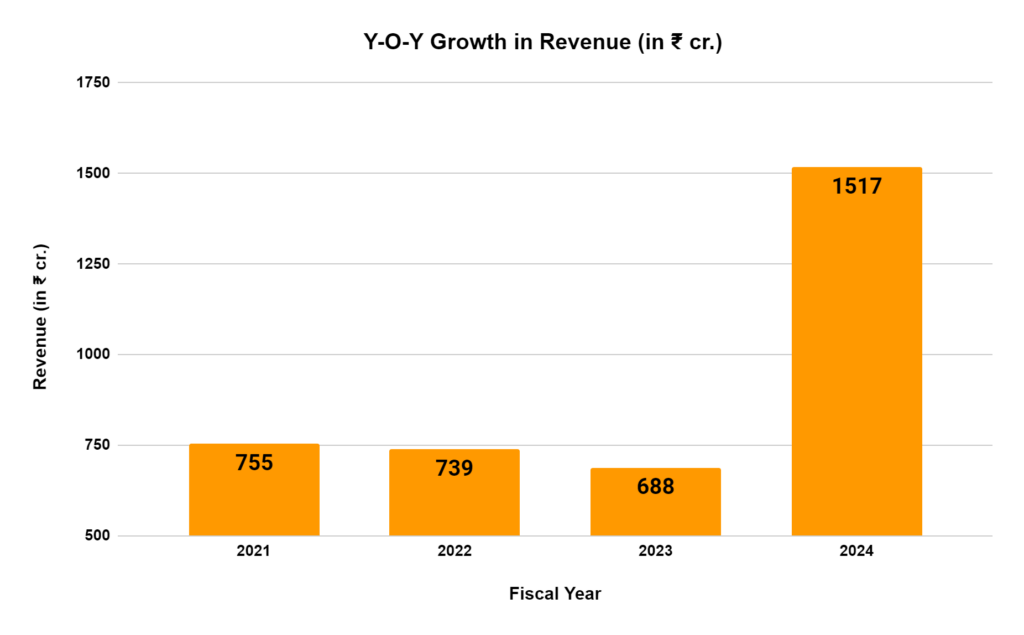

The company’s income was ₹17,218.31 crore in FY24 against ₹13,840.46 crore in FY23. The expenses stood at ₹4,358.83 crore in the period under review, as against ₹3,200.50 crore in the year-ago period. While revenue witnessed a double-digit jump, expenses surged as well.

Interestingly,

AESL’s standalone borrowings nearly doubled at ₹5,165 crore at the end of FY24 compared to the previous year. This financial picture raises another possibility. Could the fundraiser be intended to address existing debt or strengthen the company’s overall financial health?

Growth Aspirations

While the specific use of the funds hasn’t been revealed, AESL is an ambitious company. It aims to establish a vast network of 30,000 circuit kilometers of transmission lines by 2030 and is surely expanding its service offerings and geographical reach.

The company said its revenues witnessed a double-digit growth on account of the contribution from the newly operationalized transmission assets, commissioning of elements at North Karanpura and MP-II package lines, and an increase in the units sold because of higher energy consumption in the distribution business at Mumbai and Mundra.

This growth strategy likely requires significant investment, and the potential fundraiser could fuel their expansion plans.

Market Reaction

The news of the fundraiser didn’t cause a significant swing in Adani Energy Solutions’ share price. It closed marginally lower on Monday at ₹1,104.05, down by Rs 2 or 0.18% compared to Friday’s closing price. This muted response suggests investors might be waiting for more details about the fundraiser and its purpose before making any significant moves in the stock.

Adani Enterprises, the Adani Group’s flagship company, saw a more volatile response. During intraday trading on Friday, their share price temporarily climbed back to pre-Hindenburg levels, making it the fourth Adani Group company to achieve this feat. However, those gains proved temporary, and the price ended Monday down 4.4% compared to pre-controversy levels.

The significant difference in Adani Energy’s overall share price is worth noting. It sits at ₹1,104.05, a hefty 60% lower than its price on January 24th, 2023. This highlights the ongoing impact of past events on investor sentiment towards Adani Energy compared to the partial recovery seen in Adani Enterprises’ stock price.

Questions remain about the road ahead

While the potential fundraiser is a significant development for AESL, several questions linger. How will the company utilize the capital? Will the fundraising be enough to fuel their ambitious growth plans? Only time will tell. But one thing’s for sure: investors and industry observers will closely watch AESL’s upcoming moves.

*Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as recommendation or investment advice by Research & Ranking. We will not be liable for any losses that may occur. Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL, and certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 4.5 / 5. Vote count: 2

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan