SpiceJet, one of India’s prominent budget airlines, recently announced a return to profitability in the third quarter of the financial year 2024-2025, reporting a net profit of ₹26 crore. This marks a significant turnaround from the ₹300 crore loss recorded during the same period the previous year.

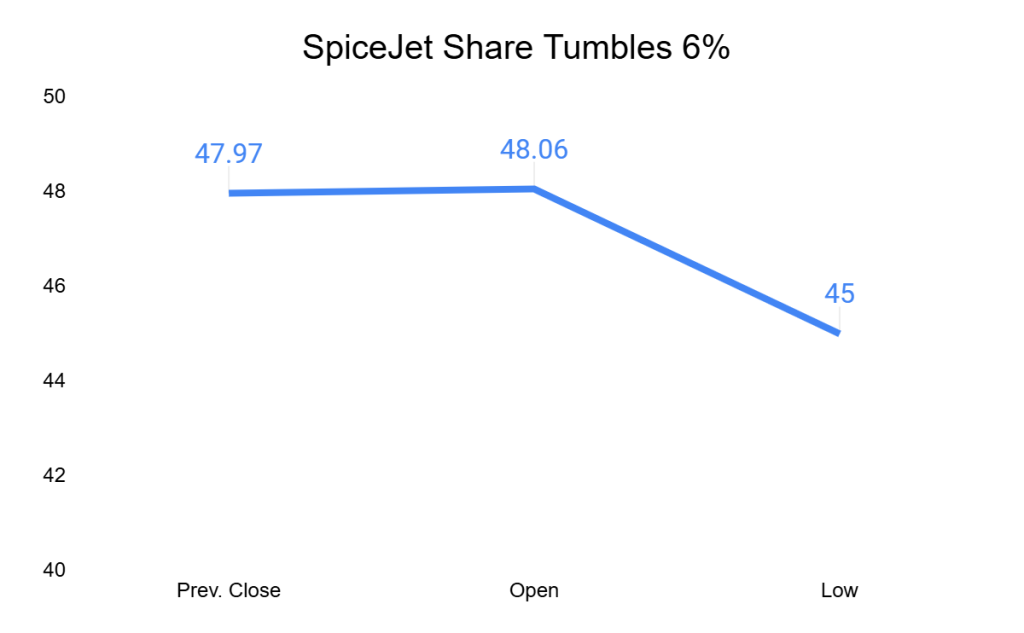

Despite this positive development, the airline’s shares experienced a 6% decline on 27th February 2025, leaving investors puzzled. Let’s delve into the factors contributing to this unexpected market reaction.

Financial Turnaround Amidst Challenges

The December 2024 quarter showcased SpiceJet’s resilience, with total revenue surging by 35% to ₹1,651 crore. This growth was primarily driven by robust passenger demand and enhanced operational efficiency. Notably, for the first time in a decade, the company’s net worth turned positive, underscoring the success of its turnaround strategy. Economic Times

SpiceJet’s Financial Highlights

| Quarterly Comparison | In the previous quarter ending September 2024, SpiceJet had reported a loss of ₹441.7 crore. |

| Revenue Decline | Revenue from operations fell 35% YoY to ₹1,140.7 crore from ₹1,756.6 crore last year. |

| Quarterly Revenue Performance | For Q3FY25, operational revenue stood at ₹817.1 crore. |

| EBITDA Growth | EBITDA surged to ₹210 crore from ₹3 crore; excluding forex impact, it rose to ₹316 crore from ₹30 crore. |

| Net Worth Improvement | The company achieved a net worth of ₹70 crore, turning positive for the first time in a decade. |

Market Reaction: A 6% Share Decline

Despite the encouraging financial results, SpiceJet’s shares fell by 6% following the announcement. Several factors may have contributed to this decline:

- Profit Margins and Sustainability Concerns: While a ₹26 crore profit is a positive sign, it remains modest relative to the airline’s revenue base. Investors might be cautious, questioning whether this profitability is sustainable in the long term, especially given the competitive nature of the aviation industry.

- Historical Financial Instability: SpiceJet has faced financial turbulence, including delayed earnings announcements and significant losses. This history may lead investors to adopt a “wait and see” approach, affecting immediate market confidence. LiveMint

- Operational and Legal Hurdles: The airline has been entangled in various operational challenges and legal disputes. For instance, two former pilots recently approached the National Company Law Tribunal (NCLT), seeking insolvency proceedings against SpiceJet over unpaid dues. Such legal issues can raise concerns about the company’s financial health and management practices.

- Broader Market Sentiments: The overall stock market environment is crucial in individual stock performances. If the broader market is experiencing volatility or bearish trends, even companies reporting positive results might see their share prices decline as part of a wider market movement.

Operational Highlights

In January 2025, SpiceJet reintroduced its first grounded Boeing 737 MAX aircraft into service to enhance operational capacity and cater to high-demand routes such as Jeddah and Riyadh. This move was anticipated to boost revenue and improve market share. LiveMint

However, the airline continues to grapple with challenges, including resolving disputes with lessors and vendors. The airline mentioned that approximately 70% of claims with lessors and vendors have been settled, indicating progress and highlighting ongoing financial obligations. Moneycontrol

Know More: SEBI Registered investment advisory | Stock investment advisory

Investor Considerations

For current and potential investors, it’s essential to weigh both the positive strides and the existing challenges:

- Return to Profitability: The shift from a substantial loss to a profit within a year showcases effective management strategies and operational improvements.

- Positive Net Worth: Achieving a positive net worth after a decade signifies a strengthened financial position.

- Areas of Caution:

- Modest Profit Levels: The relatively small profit margin may raise questions about long-term profitability and growth prospects.

- Ongoing Legal and Financial Issues: Pending disputes and financial obligations could impact future earnings and operational stability.

Conclusion

SpiceJet’s return to profitability in Q3 FY25 is a significant achievement, reflecting the company’s resilience and strategic efforts amidst a challenging environment. However, the subsequent 6% decline in share price underscores the complexities of investor sentiment, influenced by factors such as profit sustainability, historical financial instability, ongoing legal challenges, and broader market conditions.

As the airline navigates these challenges, stakeholders will keenly observe its strategies to maintain and enhance profitability, resolve outstanding disputes, and strengthen its market position in the competitive aviation sector.

Related Posts

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

FAQs

Why did SpiceJet’s shares drop despite a profit?

Despite a ₹26 crore Q3FY25 profit, shares fell due to concerns about the profit’s sustainability, ongoing financial restructuring, heavy debt load, and operational challenges like fleet availability and competitive pressures. Investors are wary of long-term stability amidst these factors.

What are the key reasons for the market’s adverse reaction?

The market reacted adversely due to high debt, uncertain profits, reliance on one-time gains, and operational challenges. Investors worry about SpiceJet’s long-term stability and competitiveness despite its quarterly profit.

Is the profit indicative of a turnaround for SpiceJet?

While the profit is a positive sign, it doesn’t guarantee a full turnaround. Significant debt and operational hurdles remain. Future profitability hinges on successful restructuring, consistent operational efficiency, and addressing financial liabilities, making long-term stability uncertain.

What operational challenges does SpiceJet face?

SpiceJet faces challenges like fleet availability due to maintenance and financial constraints, intense competition impacting yields, and fluctuating fuel prices. These operational hurdles affect profitability and investor confidence. Consistent operational efficiency and cost management are crucial for sustained financial health.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan