Vedanta Limited, a prominent Indian multinational conglomerate, has become a significant force in the global natural resources sector. With diversified operations spanning metals, mining, oil and gas, and power generation, Vedanta has consistently played a pivotal role in India’s industrial landscape. Its aluminium division is the country’s largest producer, contributing approximately 61% to its total revenue. reuters.com

The Demerger Plan: A Breakdown

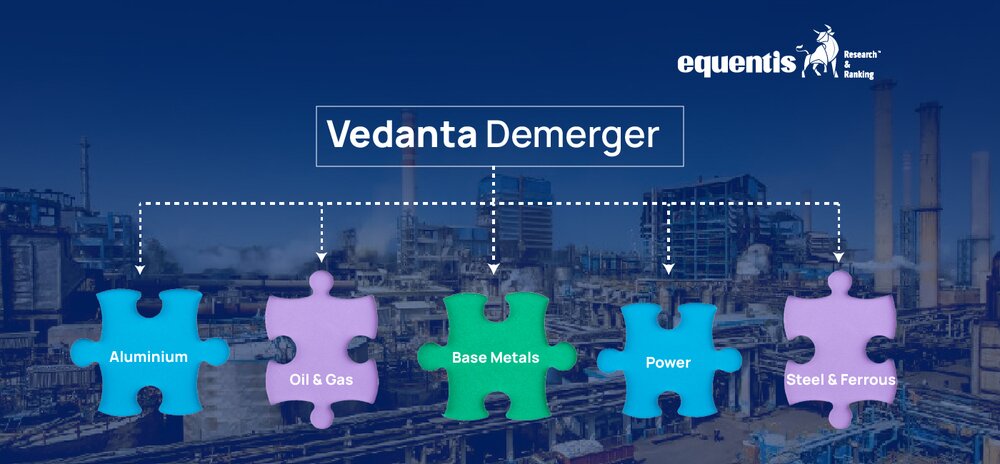

As of February 27, 2025, Vedanta Limited has made significant strides in its strategic demerger plan. The plan will restructure its diverse business portfolio into five independent, sector-focused entities. This move is designed to streamline operations, enhance transparency, and unlock shareholder value.

The approved demerger will result in the formation of five distinct entities, each concentrating on a specific sector:

- Vedanta Aluminium Metal Ltd.: As one of the world’s largest aluminum producers, this entity will focus on producing and supplying aluminum, leveraging its extensive resources and market position.

- Vedanta Oil & Gas Ltd. will oversee the oil and gas operations, maintaining its status as India’s largest private-sector crude oil producer.

- Vedanta Power Ltd.: This entity is dedicated to power generation and aims to contribute significantly to India’s energy sector.

- Vedanta Iron and Steel Ltd.: Focusing on the ferrous products industry, this company will manage the iron and steel operations, catering to both domestic and international markets.

- Vedanta Ltd.: The parent entity will continue to house the base metals business, including operations in zinc and copper, and will act as an incubator for emerging ventures, such as technology initiatives.

Share Allocation

According to the demerger scheme, upon completion, each Vedanta shareholder will receive one additional share in each of the four newly formed entities for every share held in Vedanta Limited.

The Need For Vedanta Demerger

The decision to demerge into five distinct entities is a strategic maneuver aimed at enhancing operational efficiency and unlocking shareholder value. Several key considerations drive this restructuring:

- Focused Management and Operational Agility: By segregating into specialized units—Vedanta Aluminium, Vedanta Oil & Gas, Vedanta Power, Vedanta Iron and Steel, and the parent Vedanta Limited—the company aims to foster dedicated management teams for each sector. This specialization is expected to streamline decision-making processes, tailor strategies to specific market dynamics, and enhance responsiveness to industry-specific challenges.

- Attraction of Sector-Specific Investments: Independent entities can appeal to investors with targeted interests, facilitating strategic partnerships and investments aligned with each sector’s unique growth prospects. This approach allows for more precise capital allocation and the potential to tap into diverse funding sources.

- Enhanced Transparency and Valuation: The demerger will provide clearer financial disclosures for each business unit, enabling more accurate performance and value assessments. This transparency can lead to a re-rating of the individual entities, potentially resulting in a cumulative market capitalization that surpasses the pre-demerger valuation.

- Unlock Hidden Value: Separate listings allow each entity to be valued based on its specific industry metrics, potentially leading to a higher cumulative market capitalization.

Implications for Shareholders

The demerger significantly shifts existing shareholders’ investment portfolios. Upon completion, shareholders will receive proportional shares in each newly formed entity corresponding to their existing holdings in Vedanta Ltd. This allocation allows investors to tailor their exposure based on individual sector performance and risk appetites.

Financial analysts project that this restructuring could lead to a re-rating of Vedanta’s businesses. Vedanta trades at an enterprise value to EBITDA multiple of under 5x. Post-demerger, the individual companies could command higher valuations, ranging from 6x to 7x, depending on industry dynamics.

This potential uplift suggests an optimistic outlook for shareholders, with the sum-of-the-parts valuation possibly exceeding the current enterprise value. livemint.com

Financial Performance Overview

Leading up to the demerger, Vedanta Ltd. reported robust financial metrics:

- Q3 FY2024 Revenue: ₹385.3 billion, a 10% increase year-on-year.

- Net Profit: ₹35.5 billion, marking a 76% surge from the previous year.

- EBITDA: ₹112.8 billion, with margins improving to 34%.

Market and Economic Implications

The demerger is poised to have several significant impacts on the market and broader economy:

- Stock Market Performance: Following the announcement and subsequent approval of the demerger, Vedanta’s share price experienced an upward trajectory. On February 21, 2025, the stock rose by 1.99%, reaching an intraday high of ₹442.2 on the BSE. This marked the fifth consecutive session of gains, with the stock appreciating over 7% year-to-date. zeebiz.com

Vedanta Share Price Performance (Pre & Post Demerger Approval)

| Date | Share Price (₹) | % Change (Intraday) |

| Feb 16, 2025 | 430.2 | 0.009 |

| Feb 17, 2025 | 432.5 | 0.005 |

| Feb 18, 2025 | 436.1 | 0.008 |

| Feb 19, 2025 | 438.3 | 0.006 |

| Feb 20, 2025 | 442.2 | 0.0199 |

Source: Investing.com and EquityPandit

Since the demerger approval, Vedanta’s stock has gained 7% YTD and experienced a 1.99% jump on Feb 21, 2025.

- Debt Management and Financial Health: As of September 2024, Vedanta’s parent company, Vedanta Resources, reported a debt of $11.36 billion. The demerger is expected to facilitate more effective debt management by allocating liabilities appropriately among the new entities, thereby improving financial stability and credit profiles. reuters.com

- Sectoral Growth and Economic Contribution: Each independent entity is positioned to pursue growth strategies tailored to its specific industry. For instance, Vedanta Aluminium, India’s largest aluminium producer, can focus on expanding its market share and innovating within the aluminium sector. Such targeted growth may enhance the company’s contribution to India’s GDP, stimulate job creation, and bolster the country’s position in the global market.

Next Steps

The demerger process is anticipated to conclude within 12 to 15 months, subject to statutory and regulatory approvals, including clearance from the National Company Law Tribunal (NCLT). timesnowhindi.com

This strategic restructuring positions each entity to pursue focused growth trajectories, attract sector-specific investments, and enhance shareholder value.

Conclusion

Vedanta Limited’s strategic demerger into five specialized entities represents a calculated effort to enhance operational efficiency, attract targeted investments, and unlock shareholder value. Vedanta is poised to create a more agile and transparent corporate structure by aligning each business unit with its core competencies and market dynamics. This move positions the individual entities for focused growth and contributes positively to the broader economic landscape.

Know More: SEBI Registered investment advisory | Stock investment advisory

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & certification from NISM in no way guarantee the performance of the intermediary or provide any assurance of returns to investors.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.

Sebi Registered Investment Advisory

Sebi Registered Investment Advisory The Phoenix Mills Ltd. (PDF)

The Phoenix Mills Ltd. (PDF) Stocks Screener

Stocks Screener Trending Sector

Trending Sector Top Losers

Top Losers Current IPOs

Current IPOs Closed IPOs

Closed IPOs IPO Performers

IPO Performers Listed IPOs

Listed IPOs Adani Ports and SEZ

Adani Ports and SEZ 5 in 5 Strategy

5 in 5 Strategy Mispriced Opportunities

Mispriced Opportunities Combo

Combo Dhanwaan

Dhanwaan