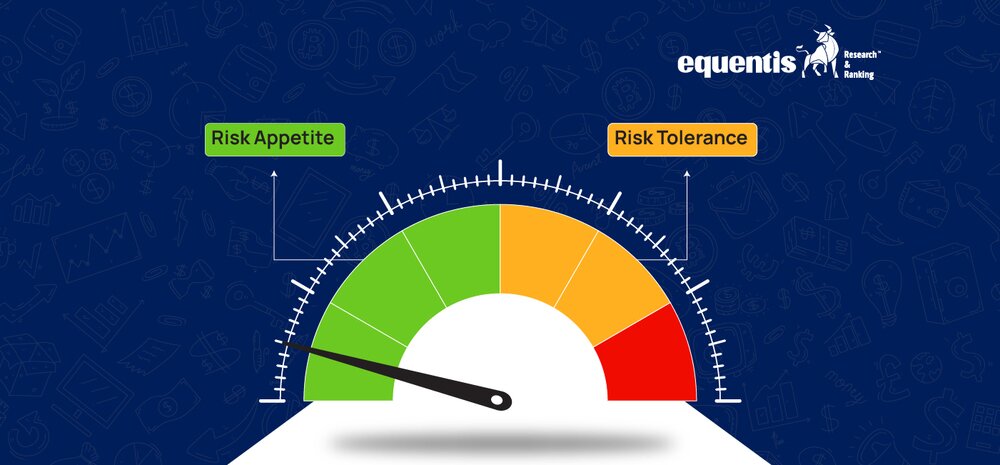

Have you ever heard “risk tolerance” and “risk appetite” interchangeably? While they may seem similar at first glance, these concepts are distinct and play crucial roles in investing. In this article, we’ll explore risk tolerance vs risk appetite, their impact on investment decisions, and the importance of aligning them to achieve your financial goals.

Let’s understand the nuances of these two key terms.

Understanding Risk Tolerance

What is Risk Tolerance?

Risk tolerance is a psychological concept that refers to an individual’s willingness to accept risk. It’s about how comfortable you are with your investments’ potential for loss or volatility. Various factors, including your personality, financial situation, and life goals, influence your risk tolerance.

Factors Influencing Risk Tolerance

- Age: Younger investors often have a higher risk tolerance as they have more time to recover from potential losses.

- Financial Situation: Your overall financial health, including income, savings, and expenses, can impact your risk tolerance.

- Personality: Some people are naturally risk-averse, while others are more comfortable taking risks.

- Life Goals: Your short-term and long-term financial goals can influence your willingness to accept risk.

Example

For instance, a young investor with a stable income and a long investment horizon may have a higher risk tolerance, allowing them to invest in more volatile assets like stocks.

On the other hand, an older investor nearing retirement may have a lower risk tolerance and prefer more conservative investments to protect their savings, which is why it’s more important to understand risk tolerance vs. risk appetite.

Understanding Risk Appetite

What is Risk Appetite?

Risk appetite is a more rational and calculated approach to risk. It’s about the risk an investor is willing to take to achieve their investment goals. Unlike risk tolerance, which is primarily psychological, risk appetite is influenced by factors such as investment goals, time horizon, and financial knowledge.

Factors Influencing Risk Appetite

- Investment Goals: Your specific financial objectives, such as retirement savings, home buying, or funding your child’s education, will determine your risk appetite.

- Time Horizon: The time you invest can influence your willingness to take on risk. Longer time horizons allow for more potential for growth, even if there are temporary setbacks.

- Financial Knowledge: A higher level of financial knowledge and understanding can increase your risk appetite as you may feel more confident in making informed investment decisions.

Example

An investor with a long-term retirement goal may have a higher risk appetite and be willing to invest in stocks or mutual funds with higher potential returns. However, an investor with a short-term goal of saving for a down payment on a house may prefer a more conservative approach with lower risk.

The Difference Between Risk Appetite and Risk Tolerance

In terms of risk tolerance vs risk appetite, they may seem similar, however, there are distinct differences between the two:

| Risk Appetite | Risk Tolerance |

| Risk appetite is a more rational and calculated assessment based on investment goals and financial knowledge. | Risk tolerance is a psychological factor influenced by personality, emotions, and personal circumstances |

| Risk appetite is more objective and is often based on data and analysis. | Risk tolerance is subjective and can vary based on personal experiences and changing circumstances. |

| Risk appetite is a more calculated decision based on logical reasoning and analysis. | Emotions, such as fear and greed, can influence risk tolerance. |

Interconnection

Although risk tolerance and risk appetite are distinct, they can influence each other. A high-risk tolerance may lead to a higher risk appetite, as individuals may feel more comfortable taking risks. However, a high-risk appetite may also be influenced by a strong belief in the potential for high returns, even if the individual’s risk tolerance is lower.

Example

Consider an investor who is naturally risk-averse (high-risk tolerance). However, this investor has a long-term investment horizon and is confident in their ability to understand financial markets. Their risk appetite may be higher than their risk tolerance, leading them to invest in more aggressive asset classes.

The Importance of Aligning when it comes to Risk Tolerance vs Risk Appetite

Aligning your risk tolerance and appetite is crucial for making sound investment decisions. When these two factors are in harmony, you’re more likely to:

- Avoid emotional decision-making: Misalignment between risk tolerance and risk appetite can lead to impulsive decisions driven by fear or greed.

- Achieve your investment goals: By investing according to your risk tolerance and appetite, you can increase your chances of achieving your financial objectives.

- Reduce stress and anxiety: When your investments align with your comfort level, you’re less likely to experience undue stress and anxiety.

If your risk tolerance vs risk appetite are not aligned, consider seeking professional advice to develop a personalized investment strategy that suits your unique circumstances.

Risk Appetite and Risk Tolerance in Stock Market Investments

Understanding risk tolerance vs risk appetite is significant when investing in the stock market. The stock market is known for its volatility, and the ability to handle fluctuations is crucial for successful investing.

- High-risk, high-reward: Investors with a high-risk tolerance and appetite may be more comfortable investing in stocks with higher potential returns but also higher volatility. This could include growth stocks, emerging market stocks, or small-cap stocks.

- Diversification: Even for investors with a high-risk tolerance, diversification is essential. Spreading your investments across different sectors and industries can help mitigate risk.

- Risk management strategies: Investors can use various risk management strategies, such as stop-loss orders and diversification, to manage their exposure to market fluctuations.

- Regular monitoring and rebalancing: It’s important to monitor your stock market investments regularly and rebalance your portfolio as needed to ensure they align with your risk tolerance and appetite.

By carefully considering your risk tolerance vs risk appetite, you can make informed investment decisions in the stock market and increase your chances of achieving your financial goals.

Conclusion

Risk tolerance vs risk appetite is two concepts that play crucial roles during hypothecation in investing. While they may sometimes overlap, understanding their differences is essential for making informed investment decisions. By aligning your “risk tolerance vs risk appetite, you can increase your chances of achieving your financial goals and reducing stress and anxiety related to investing. But it is important to consultant investment advisory services or use tools like stock screener for mastering investment risks

Disclaimer Note: The securities quoted, if any, are for illustration only and are not recommendatory. This article is for education purposes only and shall not be considered as a recommendation or investment advice by Equentis – Research & Ranking. We will not be liable for any losses that may occur. Investments in the securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL & the certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

FAQ

What is the difference between risk appetite and risk tolerance statement?

Risk tolerance is a psychological concept that reflects an individual’s willingness to accept risk. It’s influenced by personality, financial situation, and life goals. Risk appetite is a more rational and calculated assessment of the level of risk an investor is willing to take to achieve their investment goals. Factors like investment objectives, time horizons, and financial knowledge influence it. While risk tolerance and Risk appetite are related, they are not identical. Aligning both is crucial for successful investing.

What is an example of a risk appetite and risk tolerance statement?

Here’s an example of a risk appetite and tolerance statement:

“I am comfortable with moderate levels of risk and am willing to accept some short-term volatility in my investments in exchange for the potential for higher long-term returns. I am open to investing in a diversified portfolio of stocks, bonds, and mutual funds, but I prefer to avoid highly speculative investments.”What is an example of risk tolerance?

A person with a high-risk tolerance might be comfortable investing in volatile stocks or speculative investments with the potential for high returns, even if it means accepting a higher risk of loss. On the other hand, a person with a low-risk tolerance might prefer safer investments like government bonds or fixed deposits, even if they offer lower returns.

How useful was this post?

Click on a star to rate it!

Average rating 0 / 5. Vote count: 0

No votes so far! Be the first to rate this post.

waitfor delay '0:0:5'--

I’m Archana R. Chettiar, an experienced content creator with

an affinity for writing on personal finance and other financial content. I

love to write on equity investing, retirement, managing money, and more.